- Fed retains charges regular, drawing criticism from analysts.

- Bitcoin worth sees declines however BTC ETFs present inflows.

Assembly expectations and aligning with 0.6% projections likelihood from the CME FedWatch Instrument, the US Federal Reserve introduced on twelfth June that the benchmark rates of interest will stay unchanged.

After a two-day Federal Open Market Committee (FOMC) assembly, members determined to keep up the charges at 5.25% – 5.50% for the seventh consecutive time. Notably, this determination was additionally according to Wall Avenue predictions.

Remarking on this with a contact of criticism Anthony Pompliano, in a latest stream stated,

“It is arrogant for the central bank to believe that they can set an interest rate… the market is the true setter of interest rates.”

Following the announcement, the crypto market witnessed a big downturn. As of thirteenth June, Bitcoin [BTC] dropped by 2.35% over the previous 24 hours, whereas Ethereum declined by 3.66% on the time of writing.

Just one fee lower by the top of 2024

The FOMC members have revised their particular person projections for the variety of fee cuts anticipated this 12 months. Initially, in March, the FOMC projected three fee cuts by the top of 2024. Now, they’ve lowered this expectation to only one fee lower.

The revised forecast implies that the FOMC now anticipates just one 0.25 proportion level fee lower earlier than the top of the 12 months.

This announcement stunned some analysts who anticipated extra aggressive fee cuts. Some analysts imagine the Fed may have to rethink and doubtlessly modify this forecast within the coming months if financial circumstances change.

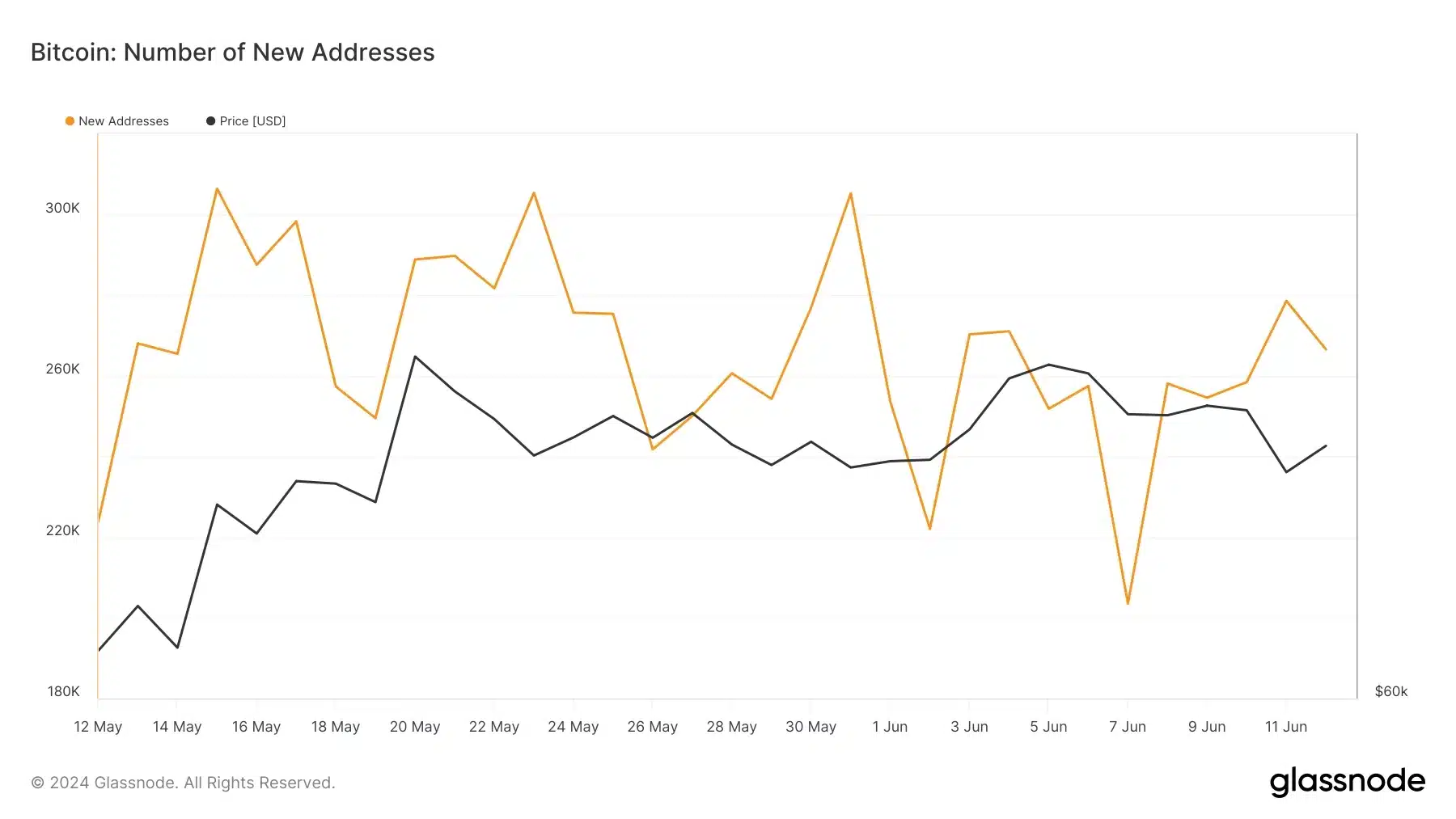

Amidst all this, Bitcoin was experiencing a drop in new addresses as per AMBCrypto’s evaluation of Galssnode.

Bitcoin stands robust

Regardless of Bitcoin’s latest bearish momentum, not all metrics level to a adverse outlook. Based on AMBCrypto’s evaluation of Santiment knowledge, there was a notable spike in Social Dominance metrics.

Moreover, the Relative Energy Index (RSI) has not indicated clear indicators of both shopping for or promoting strain.

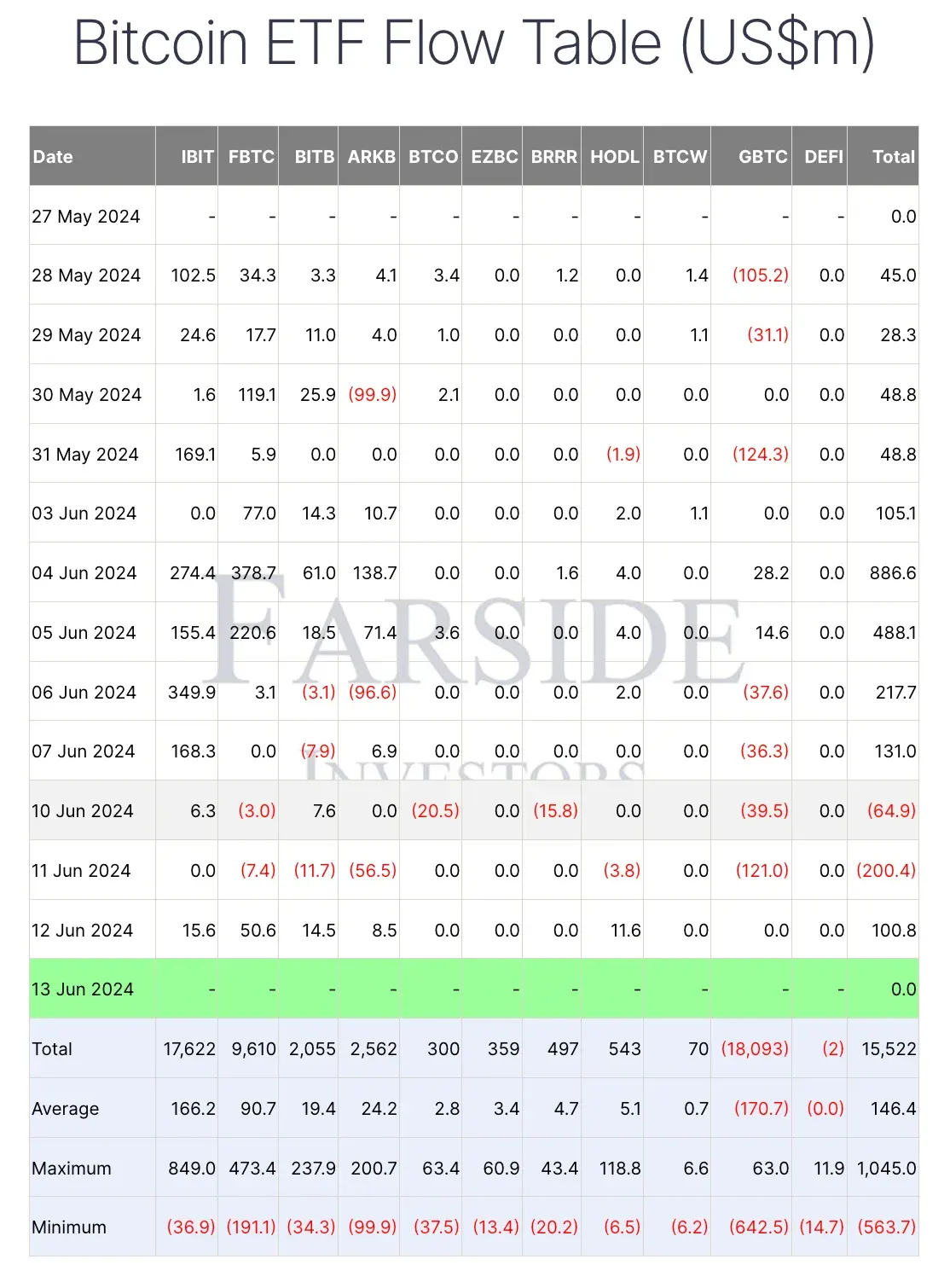

Moreover, Bitcoin’s spot Trade Traded Funds (ETFs) skilled inflows of $100.8 million, marking a turnaround after two consecutive days of outflows.

Pompliano, greatest put it when he stated,

“Bitcoin is the only asset that I’m aware of that is an asset class to itself which has outperformed inflation.”