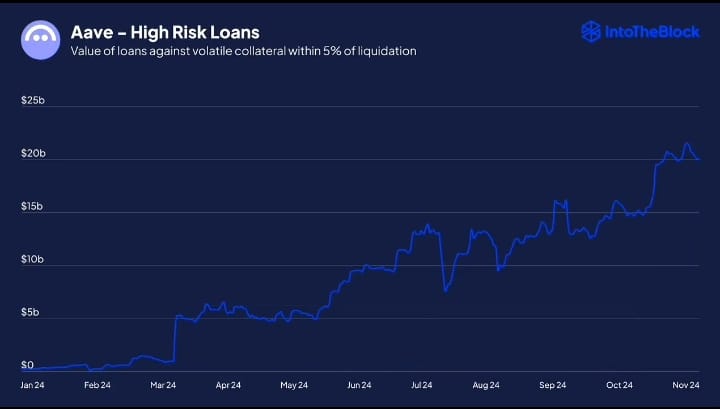

- Excessive-risk DeFi loans surged as market sentiment drove demand for leverage.

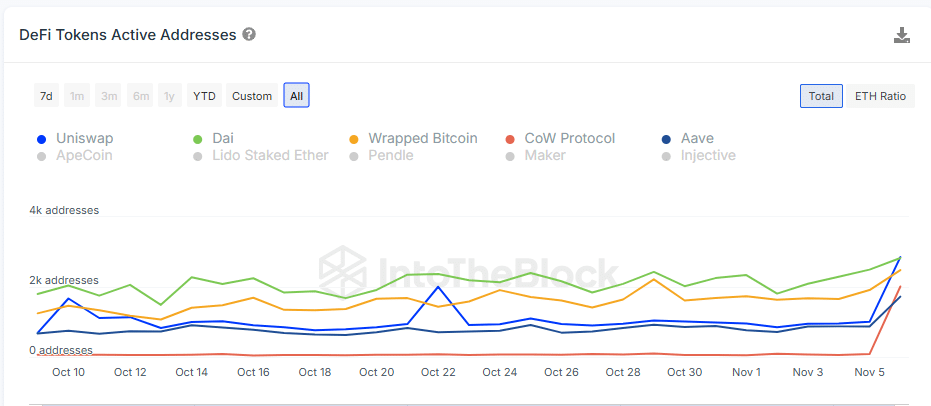

- DeFi tokens energetic addresses hitting new all-time highs.

Excessive threat loans surged as Bitcoin [BTC] hit new ATH driving demand for leverage. DeFi lending platforms Aave and Moonwell confirmed a major uptrend within the worth of high-risk loans as per IntoTheBlock, the place the collateral was inside 5% of being liquidated.

The upward development prompt an elevated urge for food for leverage throughout the crypto market as members search larger returns, particularly throughout bullish phases.

Notably, the rise in high-risk loans prompt that related behaviors have been prevalent throughout different DeFi lending platforms. This meant that broader market sentiment was inclined in the direction of aggressive funding methods.

Nonetheless, the latest conclusion of the U.S. elections launched potential volatility that would have an effect on these leveraged positions adversely.

Massive-scale political occasions typically result in unpredictable market actions, rising the danger of liquidations for these high-stake loans.

The situation illustrated the precarious steadiness DeFi members navigate between searching for excessive returns and managing important dangers in an ever-volatile market surroundings.

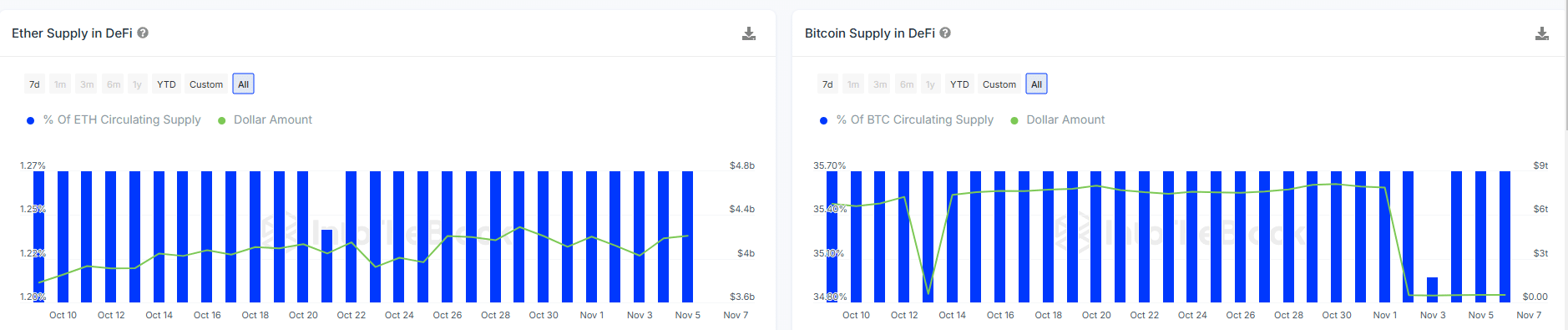

Distinction in provide of ETH and BTC in DeFi

Regardless of slight lower in complete greenback worth of Bitcoin in DeFi, it remained considerably larger than that of Ethereum. This prompt a deeper market penetration and better stake by members leveraging Bitcoin in DeFi platforms.

This indicated that Bitcoin might be extra prone to the impacts of high-risk loans, particularly as market sentiment pushes demand for leverage.

With Bitcoin’s bigger presence in DeFi, any important market corrections or volatility might result in extra pronounced results on Bitcoin’s worth and stability in comparison with Ether.

Thus, stakeholders in Bitcoin ought to keep significantly vigilant about potential market actions that these high-risk monetary actions within the DeFi area might drive.

DeFi tokens energetic addresses at ATH

The chart confirmed an enormous rise in energetic addresses for a number of DeFi tokens, doubtless as a result of extra customers speculating and searching for high-leverage alternatives in DeFi.

The notable enhance in exercise, particularly with Wrapped Bitcoin (WBTC), highlighted the market’s rising use of leverage and worry of lacking out, which might inflate asset costs.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

Traditionally, elevated exercise typically got here earlier than market peaks. A sudden consciousness of overpricing or an enormous financial occasion might rapidly drive down BTC costs.

Buyers and merchants must be cautious. The present rise in energetic addresses and leveraging reveals larger volatility threat. This might have an effect on Bitcoin’s actions quickly and will result in a neighborhood high that would ignite a correction.