- Crypto speculators stay cautious of profit-taking and value correction issues

- There haven’t been consecutive ETH/BTC inexperienced weekly candles since April 2024

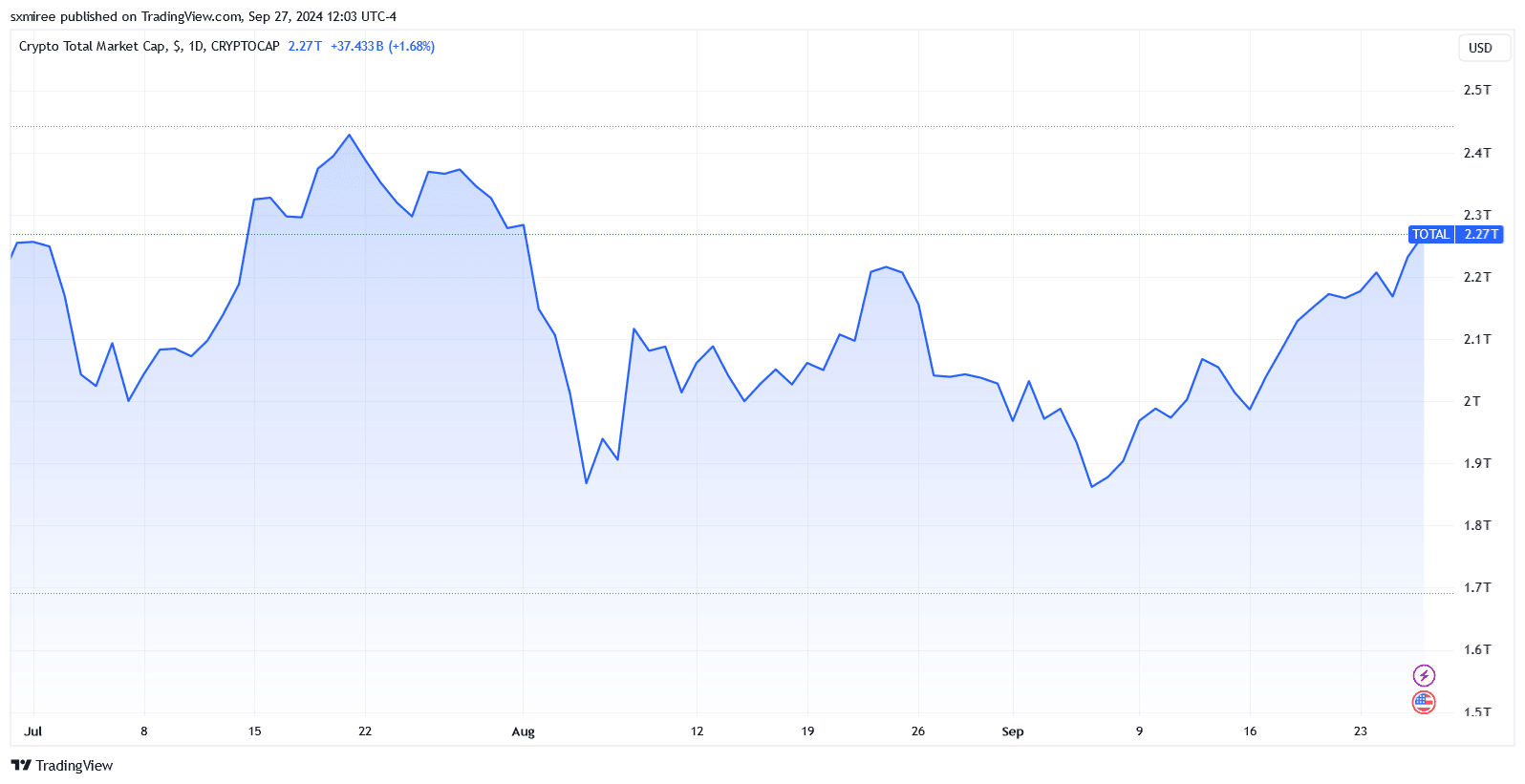

Most cryptocurrencies had been buying and selling within the inexperienced on Friday after making respectable advances between Wednesday and Thursday. In reality, the market-wide positive aspects reversed an early midweek dip, one which ensued after a sluggish begin to the week.

Ethereum (ETH), which has seen renewed its energy in latest weeks, was buying and selling at $2,689 at press time, with bulls focusing on an in depth above $2,770 for the primary time since August 24.

Right here, it’s value mentioning that ETH has been pushing previous Bitcoin within the second half of the month, racking up positive aspects of 16.34% since 15 September.

That’s not all although. Coinglass knowledge revealed that ETH’s value moved up 11.26% final week, whereas BTC registered a 7.38% uptick. Whereas each cryptocurrencies have slowed this week, they continue to be on target for third consecutive weekly positive aspects.

Bitcoin bulls goal double-digit month-to-month positive aspects

Overlooking its not too long ago rejuvenated motion although, Ethereum has fallen by 20.75% over the past three months. This decline is very pronounced given the expectations of a rally after the 23 July launch of a U.S spot Ethereum exchange-traded fund (ETF). The institution-focused providing has didn’t dwell as much as the hype, posting combined outcomes thus far.

With three extra days to go, Bitcoin leads the flagship altcoin in month-to-month returns. In reality, BTC value’s trajectory has put it on monitor to lock in double-digit month-to-month earnings if it maintains a value above $65K. Quite the opposite, Ether is positioned for a 5.70% positive aspects throughout September at its press time value.

BTC and ETH value targets forward of This autumn

Heading into the weekend, speculators have their eyes on month-to-month closes for the respective cryptocurrencies. At press time, Bitcoin was buying and selling in no-man’s land close to $66,000, with help established round $62,800. In the meantime, Ethereum was holding regular above $2,600.

Analysts have set a short-term value goal within the $68k to $70k vary for BTC and within the $2,760 to $2,820 vary for ETH. Nonetheless, a potential pullback, particularly if the momentum wanes, requires warning on lengthy positions. Momentum exhaustion would pave the best way for bears to grab the weekend and drag costs down, as was the case in July.

Bitcoin retracement targets to the draw back embrace a return under $62,000, with a risk of a stoop as deep as $57,400. Ether, for its half, noticed rejection at $2,770 on 24 August, pulling its value again to $2,430 three days later.

ETH value’s upside potential additionally confronted stress from higher Ether issuance, which may weigh on the spot motion. In reality, knowledge from Ultrasound Cash revealed {that a} whole of 54,098.4 ETH has been added to the availability over the past 30 days, translating to a 0.547% annualized inflation fee.