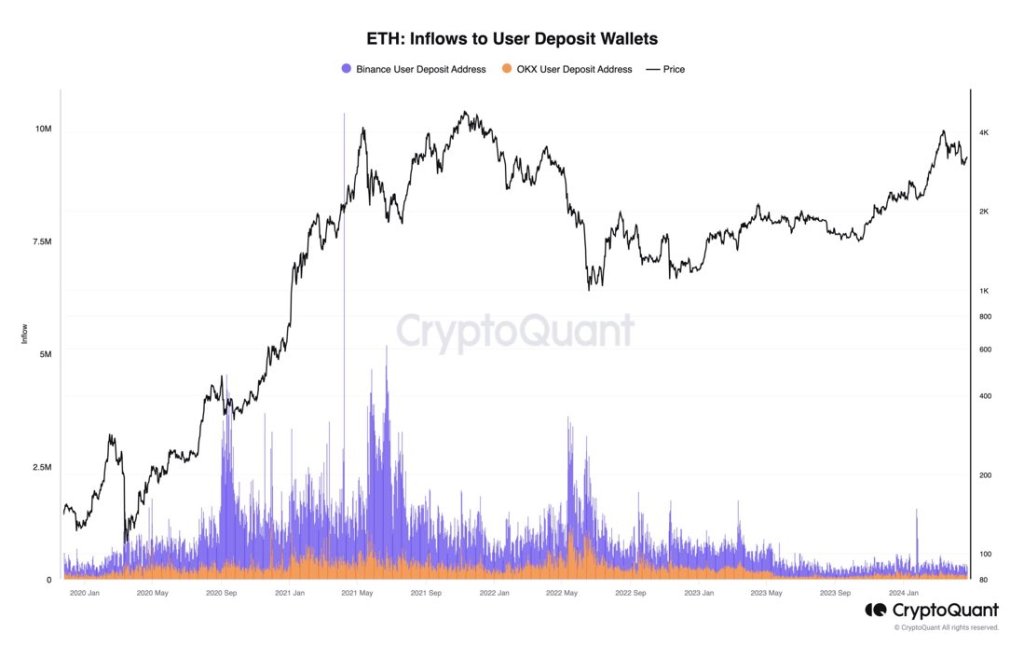

Taking to X on April 26, one analyst notes that there’s a excessive chance of Ethereum spiking within the classes forward due to thinning sell-side liquidity throughout main centralized exchanges like Binance and Coinbase.

Skinny Promote-Facet, Huge Potential Transfer For ETH

Thinning sell-side liquidity, as seen on order books throughout CEXes, signifies that few sellers are keen to liquidate. With few sellers in the marketplace, a small upsurge in demand may theoretically see costs skyrocket.

Even so, market makers may fill this imbalance by contemplating how the market works. On the similar time, costs should not assured to rally even when they continue to be as they’re.

Not like new meme cash, for example, Ethereum is extraordinarily liquid; it’s the second largest coin by market cap, solely trailing Bitcoin. Which means billions will probably be wanted to push costs above the quick resistance ranges at $3,300 and $3,700, as clearly proven within the every day chart.

Ethereum has been underneath stress for the higher a part of April following a drop from its all-time excessive of $4,090. Trying on the improvement within the every day chart, the coin is down 23% from all-time highs, discovering sturdy rejection from the center BB–or the 20-day transferring common.

Analysts anticipate consumers to take over and reverse mid-April losses if a complete breakout above $3,300 is marked by increasing quantity. If not, ETH dangers falling under $2,800, aligning with the April 12 and 13 sell-off.

Spot Ethereum ETF Launch In Hong Kong, Adoption Gasoline Optimism

Nevertheless, merchants are usually bullish, anticipating a worth rebound within the months forward. A number of components may propel ETH costs upwards. A serious catalyst is the extremely anticipated launch of spot Ethereum exchange-traded funds (ETFs) in Hong Kong. Just like the affect of spot Bitcoin ETFs on BTC costs, this product for ETH might prop up the coin, permitting conventional buyers to realize publicity to the second world’s most useful coin.

In the US, the most important impediment stopping the Securities and Change Fee (SEC) from approving the same product is the uncertainty of ETH’s classification. On April 25, ConsenSys sued the regulator, urgent the regulator to categorise the coin as a commodity.

Past the launch of this product by the top of the month, Ethereum’s core strengths stay. The continued adoption of Ethereum and Layer 2 scaling options continues. As extra protocols select to deploy on the sensible contracts platform, it fosters optimism for Ethereum’s long-term viability and development.

Function picture from Canva, chart from TradingView