On-chain knowledge exhibits that the Ethereum change netflow just lately spiked considerably, an indication that might be bearish for the cryptocurrency’s worth.

Ethereum Change Netflow Registered A Giant Constructive Spike Not too long ago

In a brand new publish on X, the market intelligence platform IntoTheBlock has mentioned in regards to the newest pattern that has been occurring within the change netflow metric for Ethereum.

The “exchange netflow” right here refers to an on-chain indicator that tracks the online quantity of any given cryptocurrency getting into into or exiting the wallets related to centralized exchanges.

Associated Studying

When this metric’s worth is optimistic, it signifies that traders are depositing a web variety of tokens on these platforms proper now. Typically, one of many major causes holders could switch to the exchanges is for selling-related functions, so this pattern can have bearish implications for the asset’s worth.

Alternatively, the unfavourable indicator implies the exchanges are at present bleeding provide as outflows are outpacing the inflows. Such a pattern could also be an indication that the traders are accumulating, which may naturally be bullish for the coin.

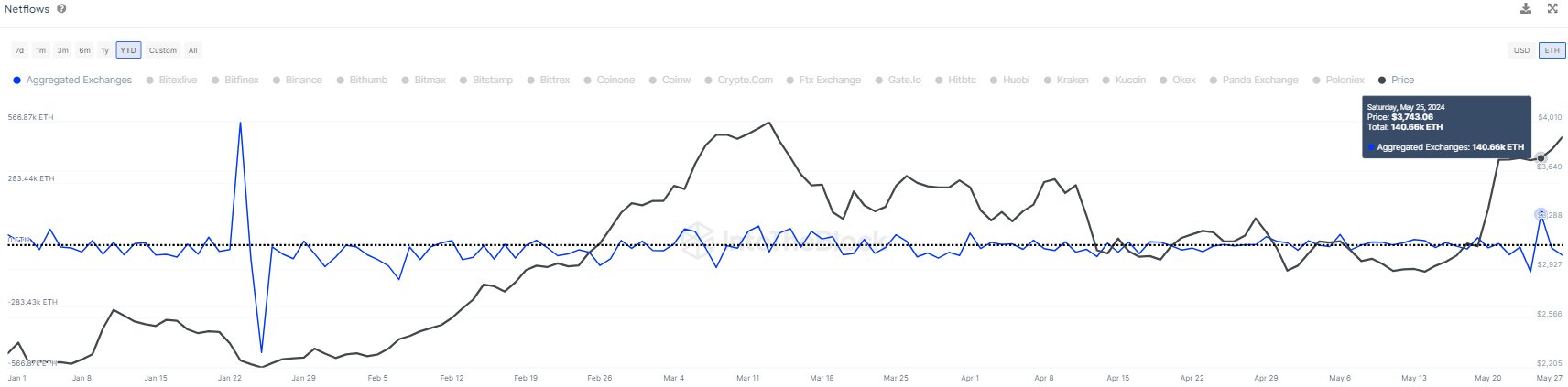

Now, here’s a chart that exhibits the pattern within the Ethereum change netflow for the reason that begin of the yr 2024:

The graph exhibits that the Ethereum change netflow has registered a optimistic spike just lately. On the peak of this spike, the exchanges acquired 140,660 ETH in web deposits.

On the present worth of the cryptocurrency, this quantity is equal to virtually $547 million. It is a large quantity and the biggest web deposit spree these central entities have witnessed since January.

“High inflows to exchanges are typically a sign of selling behavior, as people either try to claim profits or succumb to FUD,” notes the analytics agency. Apparently, although, since these deposits have come, the asset’s worth has elevated.

This might counsel that both the whales making the inflows haven’t pulled the set off on promoting these cash but, or they by no means deliberate to promote to start with. After all, it’s additionally potential that the market demand has been capable of soak up the promoting if the whales have certainly offered.

Within the situation the place the whales made the deposits with the intention of promoting however haven’t made the commerce but, Ethereum might really feel a bearish impact.

Associated Studying

It now stays to be seen how the cryptocurrency’s worth will develop within the coming days and if these massive deposits will play any seen function in any respect.

ETH Worth

Ethereum had seen a pullback earlier, however the asset has managed to make a restoration, as its worth is now as soon as once more floating above the $3,900 mark.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com