Market Overview: S&P 500 Emini Futures

The market fashioned a Weekly Emini inside bar closing close to its excessive, forming a pullback from across the 20-week EMA. The bulls desire a breakout above the within bull bar with sturdy follow-through shopping for subsequent week and a robust retest of the March 21 excessive. The bears need at the very least a small second leg sideways to down after a pullback.

S&P500 Emini futures

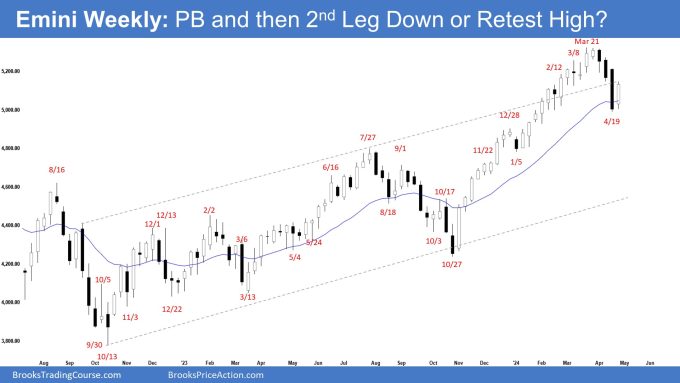

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an inside bull bar closing close to excessive and above the 20-week EMA.

- Final week, we mentioned that merchants will see if the 20-week EMA will act as short-term help even when the market quickly trades under it.

- The bulls have a robust rally within the type of a good bull channel.

- They hope that the rally will result in months of sideways to up buying and selling after a pullback.

- They hope that the 20-week EMA will act as help. So far that is the case.

- The bulls desire a breakout above the within bull bar and powerful follow-through shopping for subsequent week.

- They need a robust retest of the March 21 excessive adopted by a robust breakout above, beginning the bigger bull channel section.

- On the very least, they hope to get at the very least a small retest of the prior pattern excessive excessive (Mar 21), even when it solely results in a decrease excessive (thereby forming a decrease excessive main pattern reversal).

- The bears bought a reversal from the next excessive main pattern reversal and a big wedge sample (Feb 2, July 27, and Mar 21),

- In addition they bought a ultimate flag reversal (ioi sample in March).

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at the very least 5-to-10%. They need at the very least a check of the 20-week EMA.

- The selloff final week has retraced greater than 5% and has examined the 20-week EMA.

- The transfer down is robust sufficient to favor at the very least a small second leg sideways to down after a pullback.

- This week, the bears wanted to create follow-through promoting under the 20-week EMA however weren’t capable of accomplish that. The bears aren’t but as sturdy as they hoped to be.

- If the market trades increased, they need a reversal from a decrease excessive main pattern reversal.

- Since this week’s candlestick is an inside bar, the market is in breakout mode.

- As a result of it’s a bull bar closing close to its excessive, the percentages favor the primary breakout to be above it. The primary breakout can fail 50% of the time.

- Merchants will see if the 20-week EMA will proceed to act as help if the market retests it within the weeks forward.

- Merchants ought to be open for the potential of a pullback (bounce) adopted by a second leg sideways to down after that within the weeks forward. The pullback is at present underway.

- For now, merchants will see if the bulls can create a robust follow-through bull bar subsequent week.

- The stronger the pullback (bounce), the extra it can forged doubt on the energy of the bear’s resolve.

- If the retest of the March 21 excessive is weak (with doji(s), bear bars, and overlapping candlesticks), the percentages of one other sturdy leg down from a decrease excessive main pattern reversal will improve.

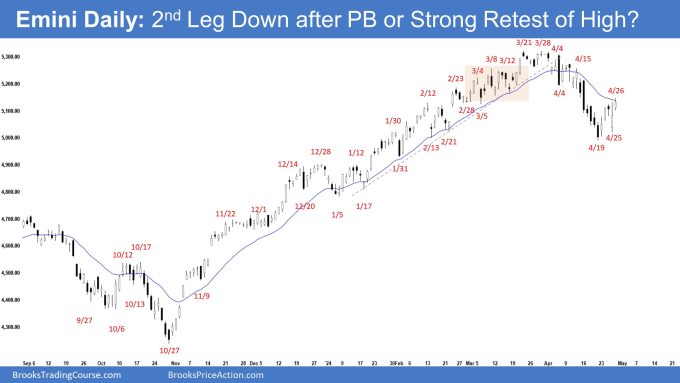

The Every day S&P 500 Emini chart

- The market traded sideways to up for the week. Thursday opened decrease however reversed into an outdoor bull bar. Friday examined the 20-day EMA.

- Final week, we mentioned that the selloff is robust sufficient for merchants to anticipate at the very least a small second leg sideways to down after a pullback.

- The bears bought a reversal from the next excessive main pattern reversal, a big wedge sample (Feb 2, July 27, and Mar 21) and a parabolic wedge (Dec 28, Feb 12, and Mar 21).

- In addition they bought a reversal from a ultimate flag (first half of March).

- The bears need the 20-day EMA to behave as resistance and need at the very least a small second leg sideways to down after the pullback.

- If the market trades increased, they need a reversal from a decrease excessive main pattern reversal or a double prime with the March 21 excessive.

- The bulls bought a robust rally which lasted over 5 months.

- They hope that the present rally will type a spike and (broader) channel which will final for a lot of months after a deeper pullback.

- They hope to get at the very least a small retest of the prior excessive (Mar 21) even if it kinds a decrease excessive.

- The bulls might want to create consecutive bull bars closing close to their highs, and buying and selling above the 20-day EMA to extend the percentages of a resumption of the pattern.

- This week, the bulls managed to create a two-legged pullback to the 20-day EMA.

- The selloff was sturdy sufficient for merchants to anticipate at the very least a small second leg sideways to down after a pullback.

- Merchants can even see if there might be at the very least a small retest of the prior excessive (Mar 21). If there may be and particularly whether it is weak (with doji(s), bear bars, overlapping candlesticks, and perhaps stalls across the 20-day EMA or round April 15 excessive space), the percentages of one other leg down from a decrease excessive main pattern reversal will improve.

- If the bulls get sturdy consecutive bull bars closing close to their highs and a robust retest of the March 21 excessive as a substitute, merchants will begin to doubt the energy of the bears and should use the (second leg sideways to down) retest of the April 19 low as a possibility to purchase.

Trading room

Al Brooks and different presenters discuss in regards to the detailed Emini worth motion real-time every day within the BrooksPriceAction.com buying and selling room. We provide a 2 day free trial.

Market evaluation reviews archive

You possibly can entry all weekend reviews on the Market Evaluation web page.