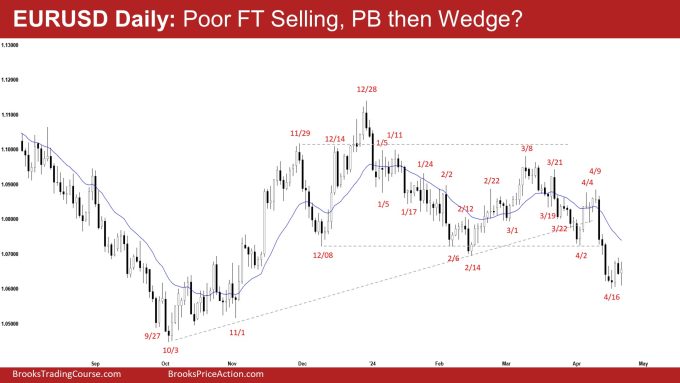

Market Overview: EURUSD Foreign exchange

The bears received a disappointing EURUSD follow-through promoting on the weekly chart. They hope that this week was merely a pullback and hope to get a minimum of a small second leg sideways to down. The bulls desire a reversal from the next low main development reversal, a bigger wedge bull flag (Mar 15, Oct 3, and Apr 16) and a wedge within the third leg down (Dec 8, Feb 14, and Apr 16).

EURUSD Foreign exchange market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Foreign exchange chart was a small bull doji with tails above and beneath.

- Final week, we mentioned that the chances barely favor the market to commerce a minimum of just a little decrease. Merchants will see if the bears can create a follow-through bear bar. In the event that they do, it’ll improve the chances of a retest of the October 2023 low.

- The market traded barely decrease earlier within the week however reversed to shut with a small bull physique.

- The bears received a breakout beneath the triangle sample and the smaller 22-week buying and selling vary final week.

- Nonetheless, they weren’t capable of get a follow-through bear bar this week.

- They hope that this week was merely a pullback and hope to get a minimum of a small second leg sideways to down. They need a retest of the big buying and selling vary low (Oct low).

- If the market trades increased, the bears need the market to stall across the breakout level or the 20-week EMA.

- They need one other leg down, finishing the wedge sample with the primary two legs being February 14 and April 16.

- The bulls see the present transfer merely as a two-legged pullback (which began on Dec 28) and a bear leg inside a buying and selling vary.

- They need a reversal from across the decrease third of the big buying and selling vary.

- They need a reversal from the next low main development reversal, a bigger wedge bull flag (Mar 15, Oct 3, and Apr 16) and a wedge within the third leg down (Dec 8, Feb 14, and Apr 16).

- Since this week’s candlestick is a small bull doji, it’s not a powerful sign bar for subsequent week.

- Whereas the bears weren’t capable of create robust follow-through promoting, the small bull doji will not be sufficient to reverse the large bear breakout bar.

- Merchants could wish to see a minimum of a small micro double backside earlier than they might be extra keen to purchase aggressively.

- For now, the market should be within the sideways to down bear leg.

- Merchants will see if the bears can get one other leg decrease or will the market proceed to stall across the present ranges (decrease third of the big buying and selling vary).

- The EURUSD is in a 74-week buying and selling vary. (Trading vary excessive: July 2023, Trading vary low: Oct 2023).

- The decrease third space of the big buying and selling vary which could possibly be a purchase zone for buying and selling vary merchants.

- Merchants will proceed to BLSH (Purchase Low, Promote Excessive) inside a buying and selling vary till there’s a breakout with follow-through promoting/shopping for.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

The Every day EURUSD chart

- The EURUSD traded barely decrease earlier within the week however stalled and pulled again just a little increased. Friday shaped a small retest of the April 16 low closing as a bull doji with a protracted tail beneath.

- Final week, we mentioned that odds barely favor the market to commerce a minimum of just a little decrease and favor a minimum of a small second leg sideways to down after a small pullback.

- The bulls hope that the breakout from the triangle and the smaller buying and selling vary will fail.

- They hope that the present transfer will kind the next low main development reversal and a wedge bull flag (Dec 8, Feb 14, and Apr 16).

- They need a reversal from across the decrease third of the big buying and selling vary.

- They might want to create a number of robust consecutive bull bars buying and selling again above the 20-day EMA to point that they’re again in management.

- The bears received a breakout beneath the smaller buying and selling vary and the triangle sample.

- Nonetheless, the follow-through promoting will not be as robust because the bears hope it will be.

- They see this week merely as a pullback and wish one other robust leg down.

- If the market trades increased, they need the pullback to stall across the 20-day EMA space and kind one other leg down, finishing the wedge sample with the primary two legs being April 2 and April 16.

- For now, merchants will see if the bears can create one other leg down after the present pullback (bounce).

- The market is presently buying and selling across the decrease third of the big buying and selling vary which could possibly be the purchase zone of buying and selling vary merchants.

- Merchants will proceed to BLSH (Purchase Low, Promote Excessive) inside a buying and selling vary till there’s a breakout with follow-through promoting/shopping for.

- Poor follow-through and reversals are hallmarks of a buying and selling vary.

Market evaluation experiences archive

You’ll be able to entry all weekend experiences on the Market Evaluation web page.