- Bitcoin’s 2024 value motion mirrored 2020, suggesting one other parabolic rally might be imminent.

- BTC merchants search for accumulation traits as key resistance ranges sign a doable breakout forward.

Bitcoin [BTC] is exhibiting indicators of repeating its post-halving conduct from 2020, elevating the potential for a parabolic rally in 2024.

In response to crypto analyst Rekt Capital, Bitcoin’s value motion in 2024 mirrors the market dynamics noticed after the 2020 Halving.

The main focus is on the 161-day post-halving interval, which traditionally led to vital value surges.

Rekt Capital’s evaluation highlighted the similarities between Bitcoin’s post-halving value actions in 2020 and 2024.

In 2020, Bitcoin’s value surged after breaking out of its Re-Accumulation vary, which marked the start of a significant rally.

This breakout was characterised by elevated shopping for exercise and a shift in market sentiment, pushing costs to new highs.

In 2024, Bitcoin is once more positioned simply after the crucial 161-day post-halving interval, suggesting the potential for the same breakout.

As of press time, Bitcoin was buying and selling at $63,439, with a 0.60% enhance within the final 24 hours and a 7.51% achieve over the previous week.

This upward motion displays a sample much like 2020, reinforcing expectations of one other robust rally.

Key resistance and help ranges to look at

Bitcoin’s value is approaching key resistance ranges that should be cleared to verify a breakout.

BTC’s latest rise from $56,000 to $63,000 exhibits robust bullish momentum, however the resistance at these ranges stays a crucial hurdle.

Help ranges, highlighted on the chart, point out robust shopping for curiosity, much like the setup in 2020.

These help zones, marked by orange circles, present a powerful base that would assist stabilize Bitcoin’s value in case of a pullback, sustaining the general bullish outlook.

Bitcoin accumulation spikes as merchants eye breakout

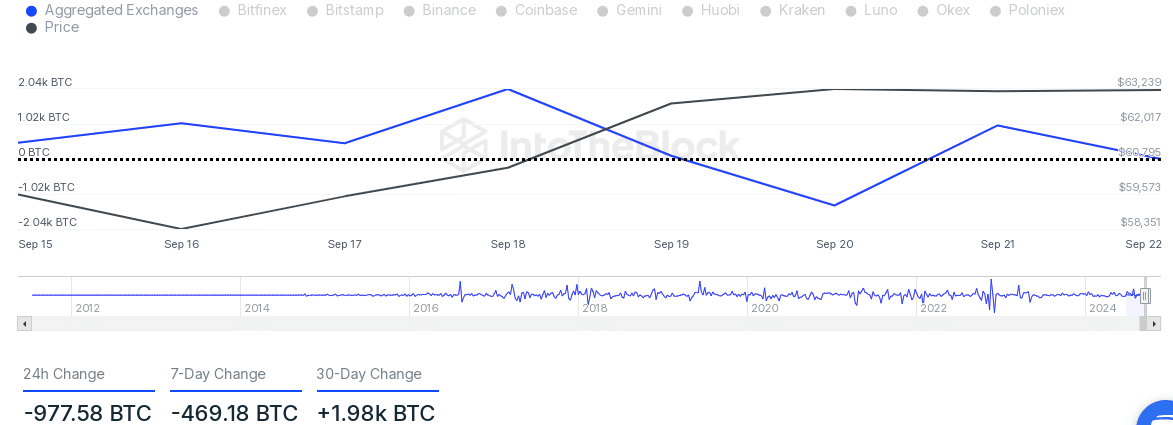

Bitcoin’s market setup signifies the potential for an imminent breakout. The value has fluctuated between $58,351 and $63,239 from the fifteenth to the twenty second of September, with a notable low on the twentieth of September at $59,573 earlier than a restoration.

On-chain knowledge additionally pointed to accumulation traits, with internet BTC outflows of -977.58 BTC within the final 24 hours and -469.18 BTC over the previous seven days, indicating lowered promoting stress.

These outflows steered that market members had been holding onto their BTC, probably positioning for additional value will increase.

In response to DefiLlama knowledge, the Whole Worth Locked (TVL) in Bitcoin-related tasks was $573.26 million, with 24-hour charges totaling $373,571 and lively addresses reaching 595,289

Learn Bitcoin (BTC) Value Prediction 2024-25

These metrics mirrored ongoing market exercise that would function a catalyst for additional value will increase, supporting the concept of a sustained upward trajectory as seen in earlier cycles.

Bitcoin’s market exercise displays ongoing investor curiosity, as indicated by latest buying and selling volumes and on-chain knowledge.