Market Overview: DAX 40 Futures

DAX futures went down final week with some profit-taking after a decent bull channel. We’re nonetheless at all times in lengthy, however we raced previous 18000, and we would have to cease there for bulls to recuperate from the transfer up. It’s an outdoor down bar, so a weak promote sign, however some bears will search for a follow-through and fade a breakout of that. Most merchants ought to be lengthy or flat and ready for cease entry according to the always-in course.

DAX 40 Futures

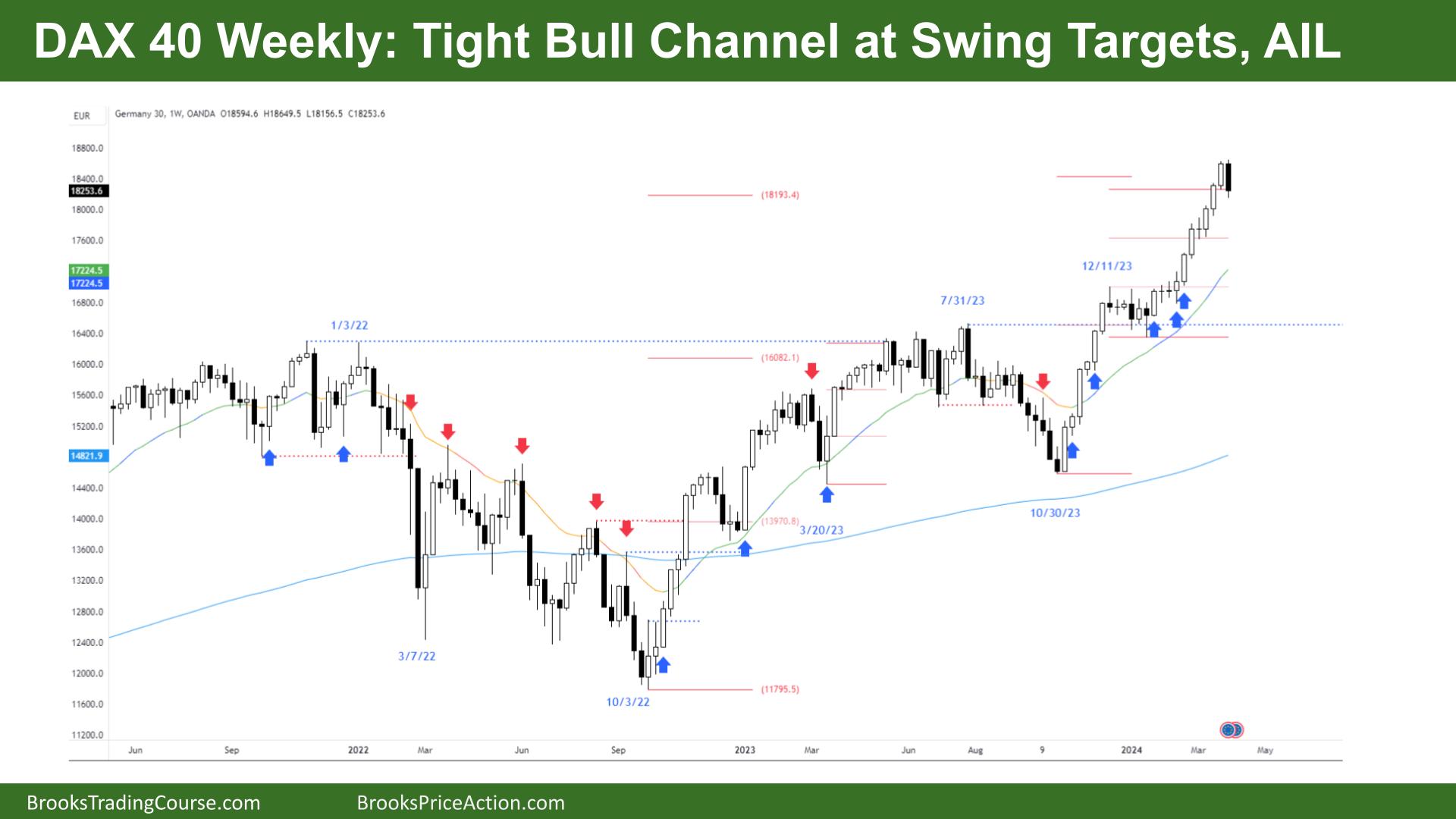

The Weekly DAX chart

- The DAX 40 futures went decrease final week with profit-taking in a decent bull channel.

- We reached swing targets from the wedge backside and the upper low breakout of the prior buying and selling vary.

- It was a 7-bar bull microchannel earlier than final week, and we stated increased chance is a pullback quite than extra up.

- Low 1 in a decent bull channel, so most likely bull scalpers beneath.

- As a result of we raced by way of the targets bulls will probably get one other likelihood to hit that measured-move goal.

- It’s an outside-down bear bar, so there’s a weak quick beneath. That’s as a result of there may be additionally a bull breakout above the bar.

- Bears want follow-through, however not for a promote beneath. The follow-through will probably result in a second try at a brief scalp. The entry would expect the Excessive 1 to fail.

- Bear targets can be the bull doji again a number of weeks.

- We then stated to anticipate a buying and selling vary inside 3 – 5 bars. We acquired the beginning of it in 3.

- There are extra measured transfer targets above, however its climactic and sure an overshoot of different targets.

- The pullback is more likely to be stronger as a result of there have been no restrict order trades on the way in which up – shopping for beneath bars.

- Decrease chance is to have one other tight buying and selling vary like in November. However it’s 2 legs.

- Normally, after the second leg, a deeper two-legged correction happens. The bears need it right down to the shifting common.

- Bulls can exit beneath this week.

- At all times in lengthy, so anticipate sideways to up. Bears need good follow-through for the correction to begin, nevertheless it’s unlikely.

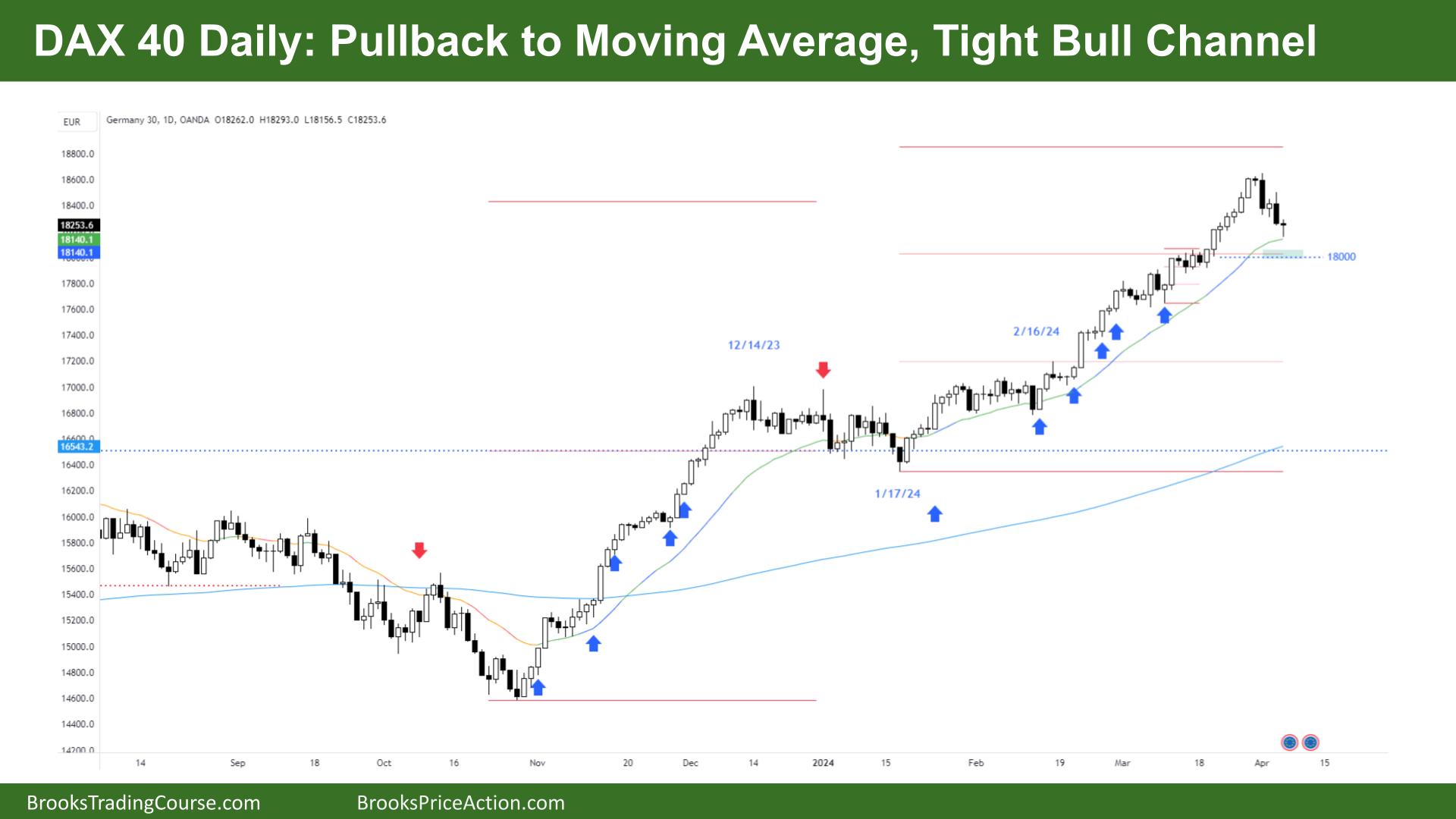

The Each day DAX chart

- The DAX 40 futures went decrease on Friday with a bear doji above the shifting common.

- The bulls see a pullback to the shifting common after a powerful bull spike.

- However the spike comes proper on the finish of a bull transfer.

- So, each bulls and bears will most likely see a climax and anticipate a two-legged correction.

- Small pullback bull development traits, so probably patrons on the shifting common.

- There was a doable last flag at 18000, I stated earlier that I believed we might come again and we’re inside scalping distance on the weekly chart from it.

- I’m not recommending quick for many merchants, however I definitely don’t need to promote beneath something on this chart but.

- It was a cheeky Excessive 1 fade above Wednesday, a commerce I wish to take late in a development.

- Bulls desire a second entry purchase sign close to the MA, however most merchants ought to anticipate it to cease taking place and begin to flatten out.

- 18000 is the place the final clear increased low broke by way of the buying and selling vary.

- Bulls may also argue a parabolic wedge high, three pushes up in that final spike, so two legs after which a transfer up.

- The PWT is 7 bars, so we would want the identical once more to right.

- Can we break 18000 and go down? There’s decrease portability at this stage simply because the upper time frames are so bullish. I feel most bears need to promote into the bar, midpoint, or above.

- You possibly can see with the tail on Friday entrance working bulls, or bear scalpers are shopping for, so watch out promoting right here.

- Anticipate sideways to right down to the shifting common subsequent week.

Market evaluation reviews archive

You possibly can entry all weekend reviews on the Market Evaluation web page.