Market Overview: DAX 40 Futures

DAX futures pulled again once more final week after consecutive bars in an overdone bull spike. We raced previous 18000 and now got here again to go to. Bears will possible get a second leg sideways to down nevertheless it has been fairly lonely to promote on this surroundings for bears so higher to attend to see them getting cash earlier than you enter.

DAX 40 Futures

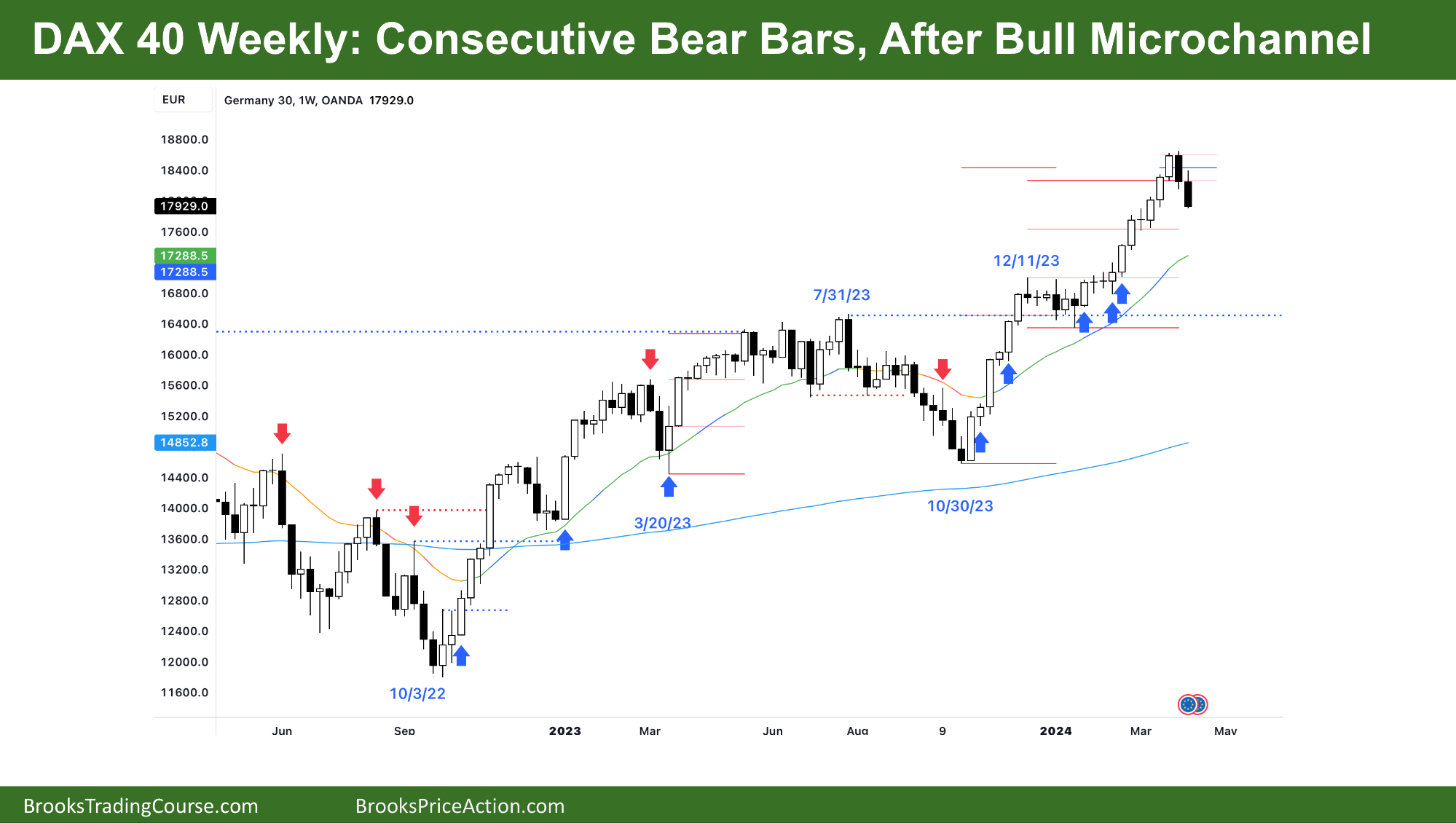

The Weekly DAX chart

- The DAX 40 futures final week was a giant bear bar closing on its low making it consecutive bear bars.

- It’s the second consecutive bear bar excessive after a powerful bull micro-channel.

- We mentioned final week that the microchannel had 3 pushes up and wanted a few legs sideways to all the way down to right.

- Bulls purchased beneath the low of the final sturdy bar, and can possible purchase beneath the low of the second final one as effectively.

- The bulls see two clear legs up and maybe will get yet another after two corrective legs sideways.

- The bears bought good observe by after the bear outdoors bar final week. It was a low likelihood promote beneath that bar, so for those who took it, it’s for a swing. You’ll scalp out disillusioned if the reversal is powerful.

- Bears are focusing on the doji just a few weeks again which is the final leg of the parabolic wedge prime.

- Often when you’ve got these excellent dojos in a spike, the spike continues and comes again to check them.

- They act like a weak purchase or promote sign. Reverse merchants fade them and scale in again to them in late stage developments / spikes.

- Bulls need a reversal bar subsequent week and can most likely get it.

- We touched the magic 18000 quantity once more so I wouldn’t be stunned if we get an inside bar subsequent week.

- It’s sturdy sufficient to anticipate a second piece sideways to down. That may generally be straight down, however I anticipate to come back again and contact the massive spherical quantity once more subsequent week maybe.

- Most all the time in bulls would have exited beneath final week. Some others will now exit beneath the low of this weeks bar.

- Different bulls will fade sturdy adversarial setups on this surroundings betting that the bears will get disillusioned.

- The bulls within the closing week didn’t get an opportunity to exit breakeven, which make me consider we have to get again there. However we may go down very far earlier than coming again!

- I’d argue not all the time in lengthy, so buying and selling vary, and I anticipate patrons someplace beneath.

- For bears after a powerful bull spike it’s higher to be promoting above one thing AFTER a bear breakout of a previous bar. So that may be above final week.

- However they’ll argue a powerful bar closing on its low so they are going to promote and promote larger.

- Anticipate sideways subsequent week.

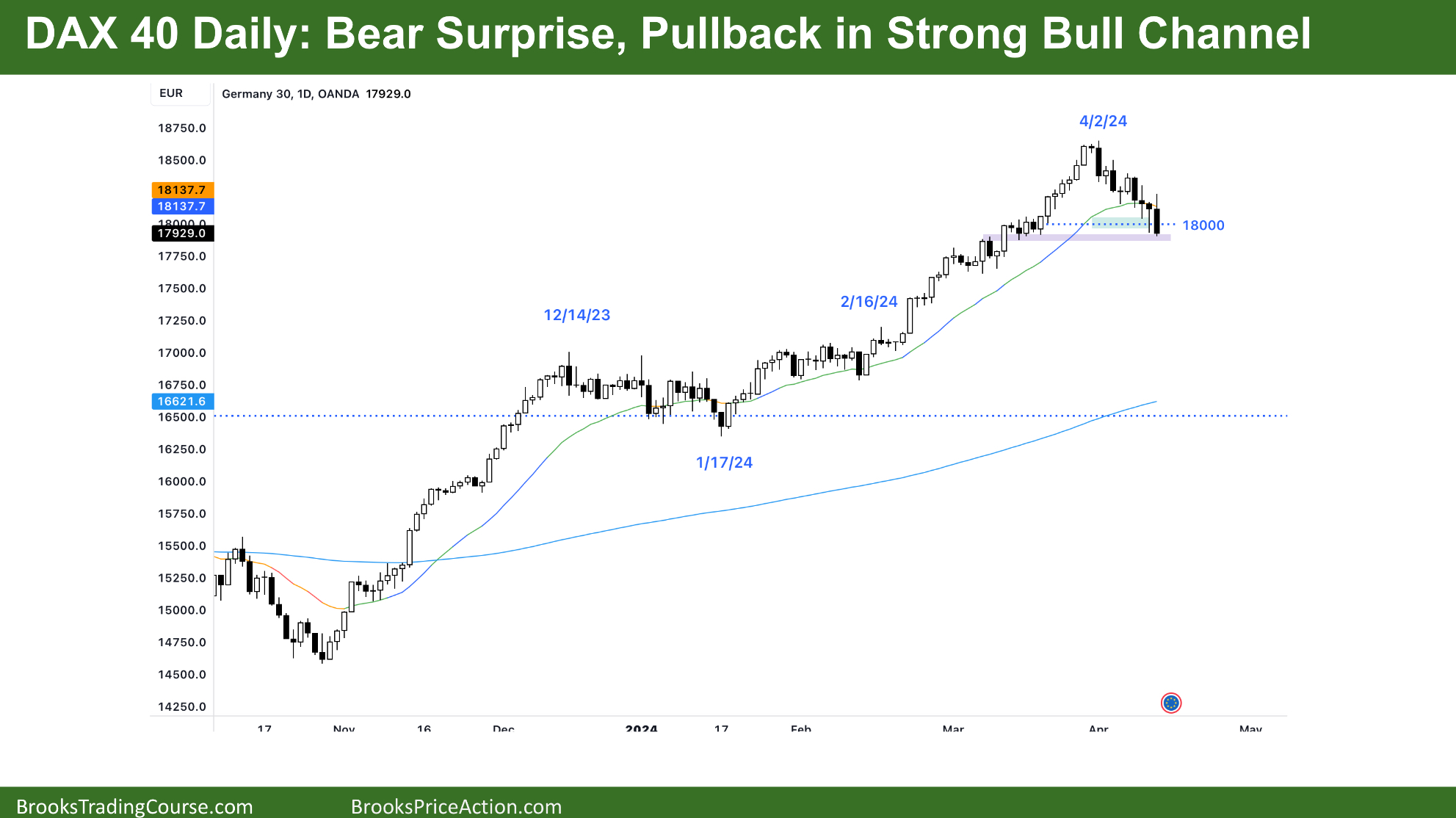

The Day by day DAX chart

- The DAX 40 futures on Friday was a giant bear bar closing close to its low.

- Additionally it is an outdoor bar – outdoors down bar.

- Bulls can argue two legs down after a spike – every leg has itself two elements.

- The Excessive 2 failed close to the MA and we broke beneath, so that they most likely want a Excessive 4 to get lengthy.

- Nothing to purchase right here for them.

- Bears see we retraced the final leg of the parabolic wedge on the weekly and are again to the tight buying and selling vary – the ultimate flag.

- So what to do?

- Bulls are shopping for beneath this bull spike and likelihood says they are going to most likely earn a living. They purchased the final breakout level Thursday and can purchase beneath the low for a scalp.

- Bears will argue we ran their stops, so will look to promote a measured transfer down from right here to 17200 space.

- However first break of a powerful trendline makes that unlikely proper now.

- Bulls see the surface bar as a powerful spike on a LTF from Thursday low, and a attainable wedge backside. However they don’t have a purchase sign.

- At all times briefly on this timeframe so merchants ought to anticipate sideways to down subsequent week.

- In case you bought above Thursday you made cash on Friday. So restrict order merchants are getting cash on reverse days. Anticipate this to proceed subsequent week.

- Though we are going to see on Monday / Tuesday the place bears are exiting beneath or not.

Market evaluation studies archive

You’ll be able to entry all weekend studies on the Market Evaluation web page.