- US Treasury Secretary Janet Yellen has stated that the US financial system is wholesome and there are not any indicators of a recession.

- The crypto market has recovered barely, with Bitcoin reclaiming $54,000.

The crypto market has made slight features, with all of the top-ten cryptos buying and selling within the inexperienced at press time although they fell wanting reaching their weekly highs.

Bitcoin [BTC] has bounced again above $54,000 after a slight 0.6% achieve in 24 hours. Ethereum [ETH] has adopted go well with, with a 1.3% achieve to commerce at $2,290 on the time of writing.

The main gainer among the many prime ten largest cryptos by market cap is Dogecoin [DOGE] with a 2.6% achieve.

The latest rebound comes after US Treasury Secretary, Janet Yellen, stated the US financial system was wholesome and “deep into a recovery.”

Yellen was talking on the Texas Tribune Competition on Saturday the place she addressed considerations in regards to the weak jobs report launched final week after nonfarm payrolls fell beneath expectations.

Yellen stated that she didn’t see “red lights flashing” and that the roles information was an indication of a gentle touchdown, not a recession.

Her remarks have drawn reactions from the crypto group. In accordance with BitMEX co-founder, Arthur Hayes, Yellen will possible resort to cash printing to stimulate the financial system.

“Bad Gurl Yellen is watching, if markets go down more she will definitely pump up the jam by printing more money,” Hayes said.

Such exercise may see folks flip in the direction of threat belongings like crypto as cash printing will increase inflation threat.

Bitcoin isn’t out of the woods… but

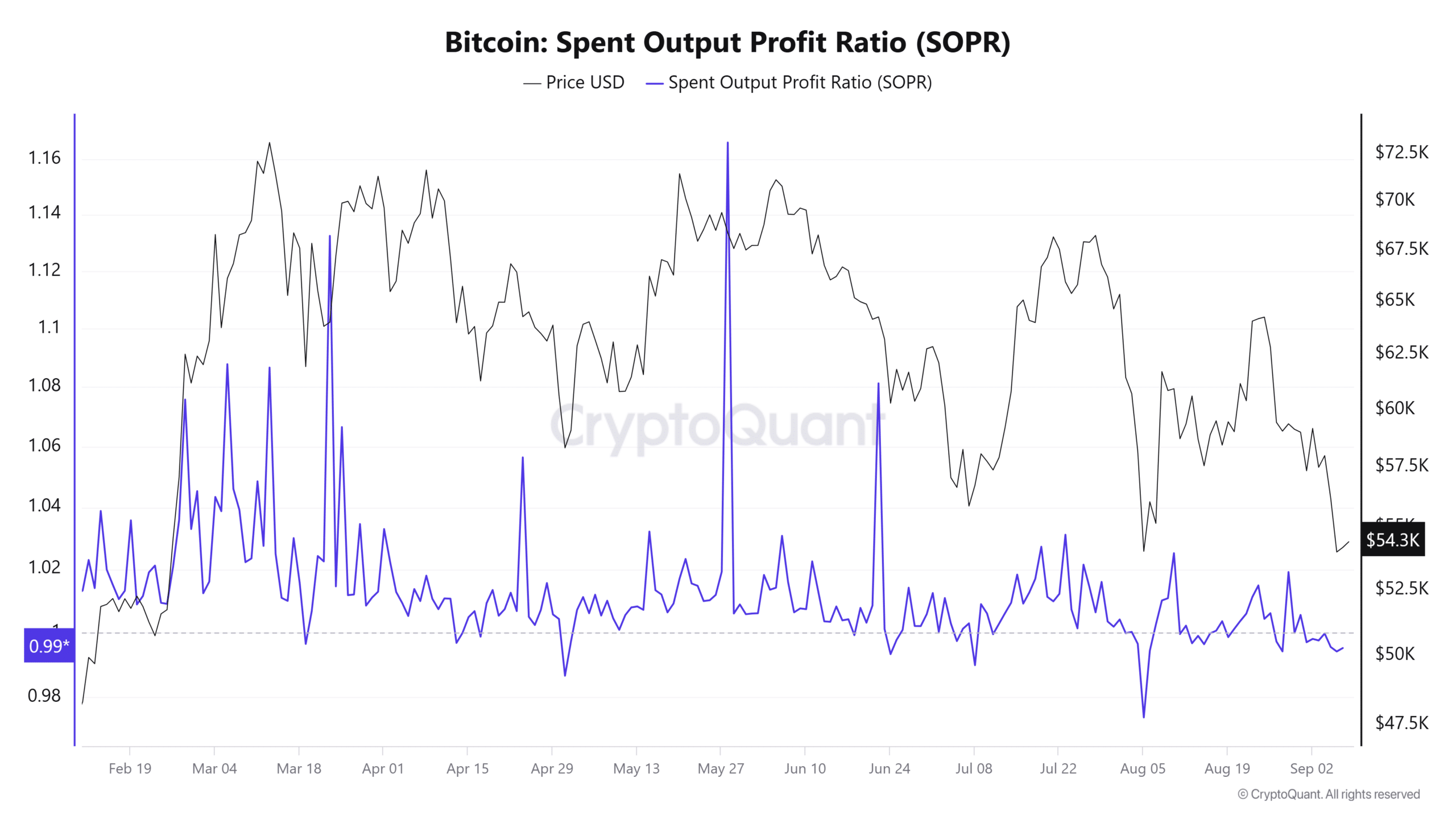

Regardless of the latest features, the BTC worth nonetheless exhibits indicators of struggling. For the reason that begin of the month, the Bitcoin Spent Output Revenue Ratio (SOPR) has did not shift above 1.

This metric exhibits that the common investor has been promoting BTC at a loss over the previous week. Such loss-taking exercise signifies a bearish sentiment and market misery as buyers panic and trim losses.

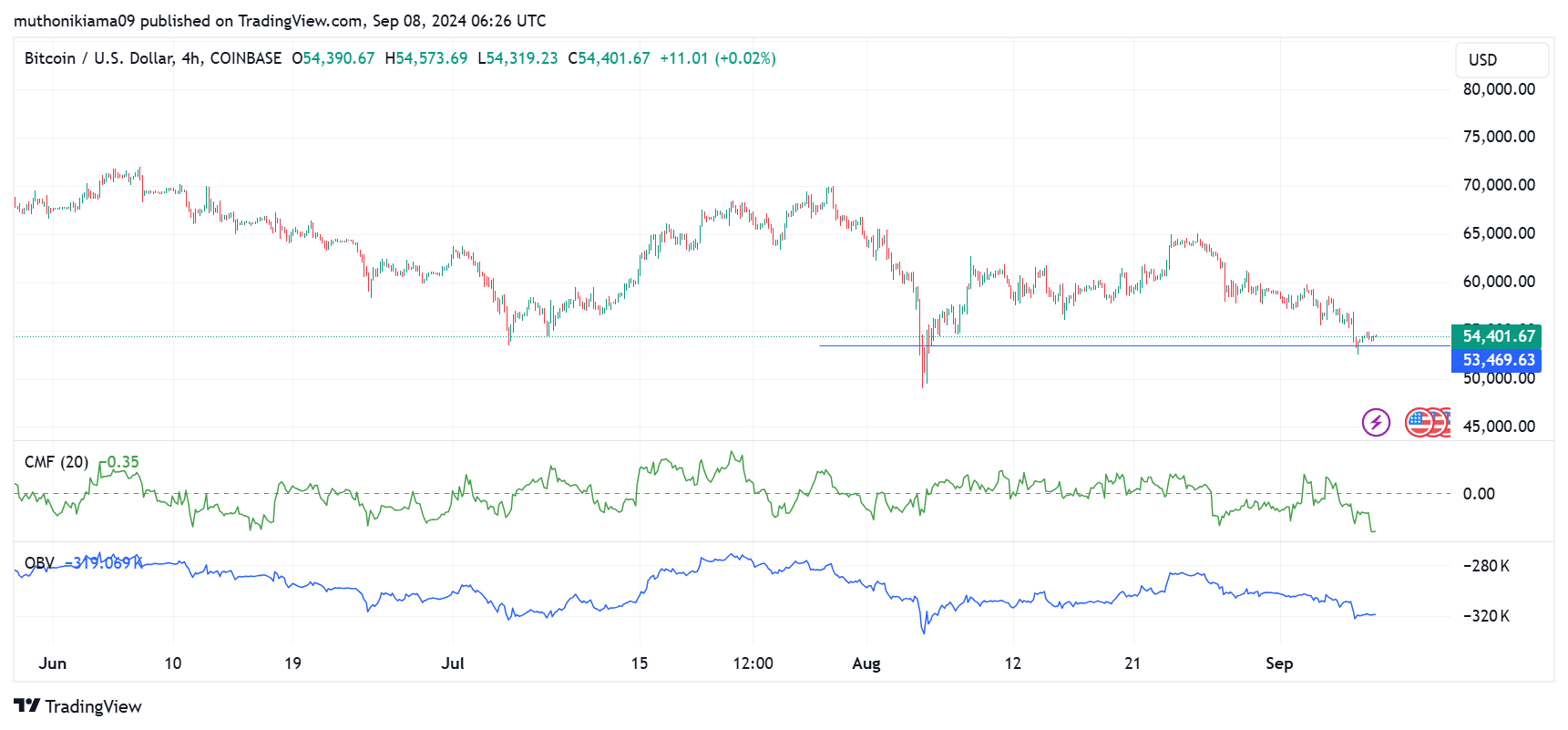

Shopping for strain additionally stays low as seen within the Chaikin Cash Stream (CMF) indicator, which was detrimental at press time. This index continues to create decrease lows and it’s at present on the lowest degree since June on the four-hour chart.

The prevailing bearish sentiment was additionally seen within the On Steadiness Quantity (OBV), which stays predominantly detrimental. This development exhibits market weak spot as promoting volumes dominate, exerting downward strain on BTC costs.

Nonetheless, BTC may need fashioned a really perfect entry level after testing the assist at $53,469. The final time BTC examined this assist, it registered an 8% achieve.

It’s essential to notice that consumers may stay hesitant as they await the discharge of the US Shopper Worth Index (CPI) information on eleventh September.

The market forecast for the August inflation is 2.6%. If the CPI falls inside or beneath expectations, the crypto market may very well be set for a rebound. Conversely, if the information nonetheless depicts a weakening US financial system, crypto costs may tank additional.