- Bitcoin’s post-halving surge, fueled by supply-demand imbalances, continues to drive its value greater.

- Anthony Scaramucci supported Bitcoin’s long-term potential, whereas Peter Schiff remained skeptical.

Bitcoin [BTC], as soon as struggling to interrupt the $60,000 mark simply weeks in the past, was making headlines with its spectacular bull run.

As of the most recent replace from CoinMarketCap, BTC had surged to $88,683, reflecting a big 8.81% rise in simply 24 hours.

The cryptocurrency’s efficiency over the previous week and month is equally astounding, with good points of 28.72% and 41.21%, respectively.

Is Trump behind the crypto market surge?

This exceptional rally has propelled Bitcoin previous the $89,000 threshold, contributing to a surge within the total crypto market, which has now surpassed its pandemic-era peak.

A lot of this development was fueled by market optimism, with merchants betting on a continued growth beneath the now President Donald Trump.

In actual fact, Anthony Scaramucci, CEO of SkyBridge Capital and beforehand a vocal critic of Trump throughout the election cycle, had acknowledged the affect of the Republican victory on BTC’s latest bull rally.

Scaramucci expressed rising confidence within the potential for the U.S. to create a Strategic Bitcoin Reserve, which might drive elevated institutional allocations and additional propel the worth of the main cryptocurrency.

He stated,

Bitcoin’s surge on Trump’s win just isn’t the primary story

Nonetheless not everybody appears to share the identical thought as Jesse Myers, co-founder of OnrampBitcoin famous,

“Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…But, that’s not the main story here.”

He claimed,

“The main story here is that we are 6+ months post-halving.”

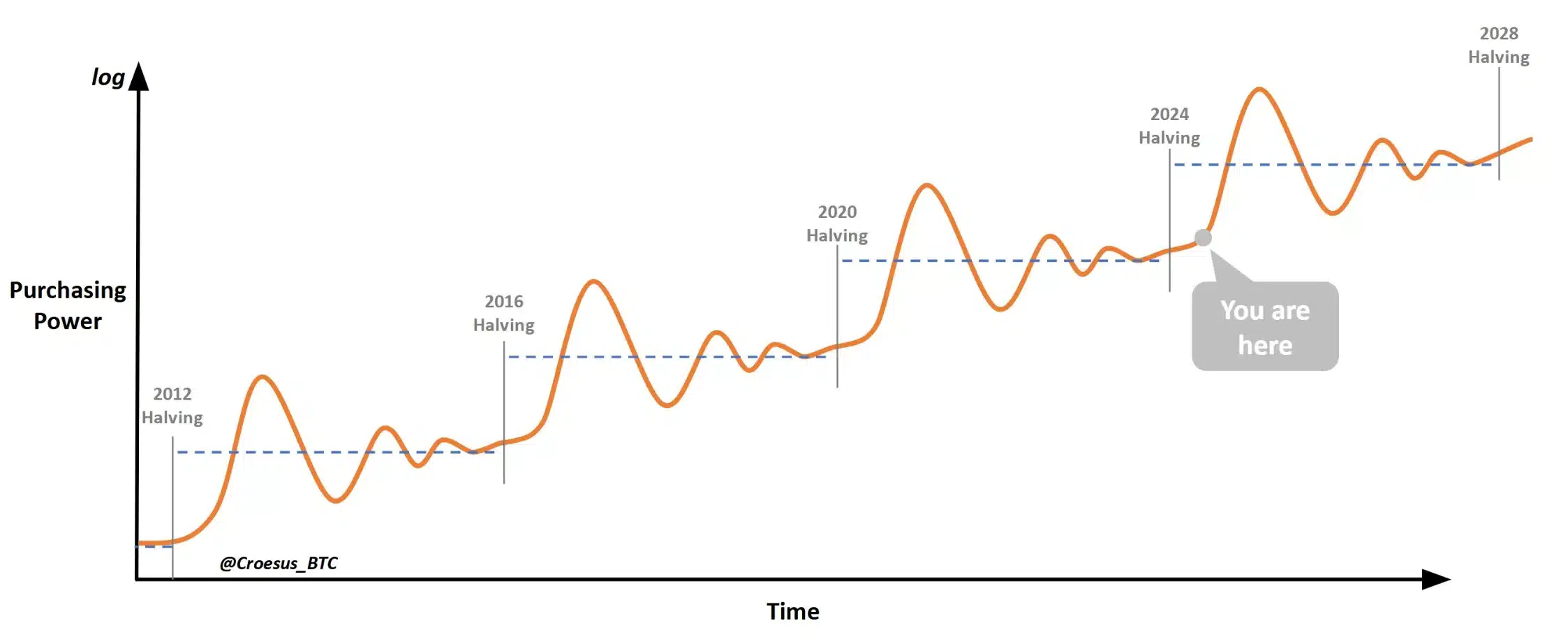

Myers identified that Bitcoin’s halving occasion has created a supply-demand imbalance, the place the obtainable provide was inadequate to fulfill the rising demand at present value ranges.

His imbalance has pushed a surge in costs to revive equilibrium, a phenomenon sometimes seen after every halving occasion.

Drawing from historic tendencies following the halvings of 2012, 2016, and 2020, Myers predicts an identical consequence after the 2024 halving, with the market coming into a bull run that may proceed to push BTC’s value greater.

Thus, as per Myers, the post-halving surge is anticipated to gas the subsequent main upward trajectory for the cryptocurrency.

Whereas Myers acknowledged that Trump is probably not the only real driver behind Bitcoin’s surge, he shares confidence in Bitcoin’s long-term viability.

Regardless of Bitcoin making information Schiff stays unaffected

In distinction, Peter Schiff, a vocal critic of Bitcoin, expressed his skepticism on X.

Schiff dismissed the present rally, reiterating his long-held perception that Bitcoin’s rise was speculative and unsustainable, warning traders of potential dangers in the long term.

He stated,

“Over the years, Bitcoin promoters have corrupted many.”

Thus, as Bitcoin approached the $90K mark with the RSI within the overbought territory, the subsequent section for the cryptocurrency stays extremely anticipated.