- Spot Bitcoin ETFs recorded a historic $3.13 billion weekly influx, showcasing rising investor confidence.

- Altcoins like Solana, XRP, and Litecoin witnessed important institutional inflows amid Bitcoin’s dominance.

The ripple results of Donald Trump’s presidential election victory proceed to make waves within the cryptocurrency market, fueling a sustained interval of development and exercise.

Final week, the market reached a pivotal milestone as international funding merchandise noticed internet inflows of roughly $3.13 billion.

This surge was largely attributed to heightened curiosity in U.S. spot Bitcoin [BTC] exchange-traded funds (ETFs), underscoring the market’s evolving dynamics.

Crypto inflows break file

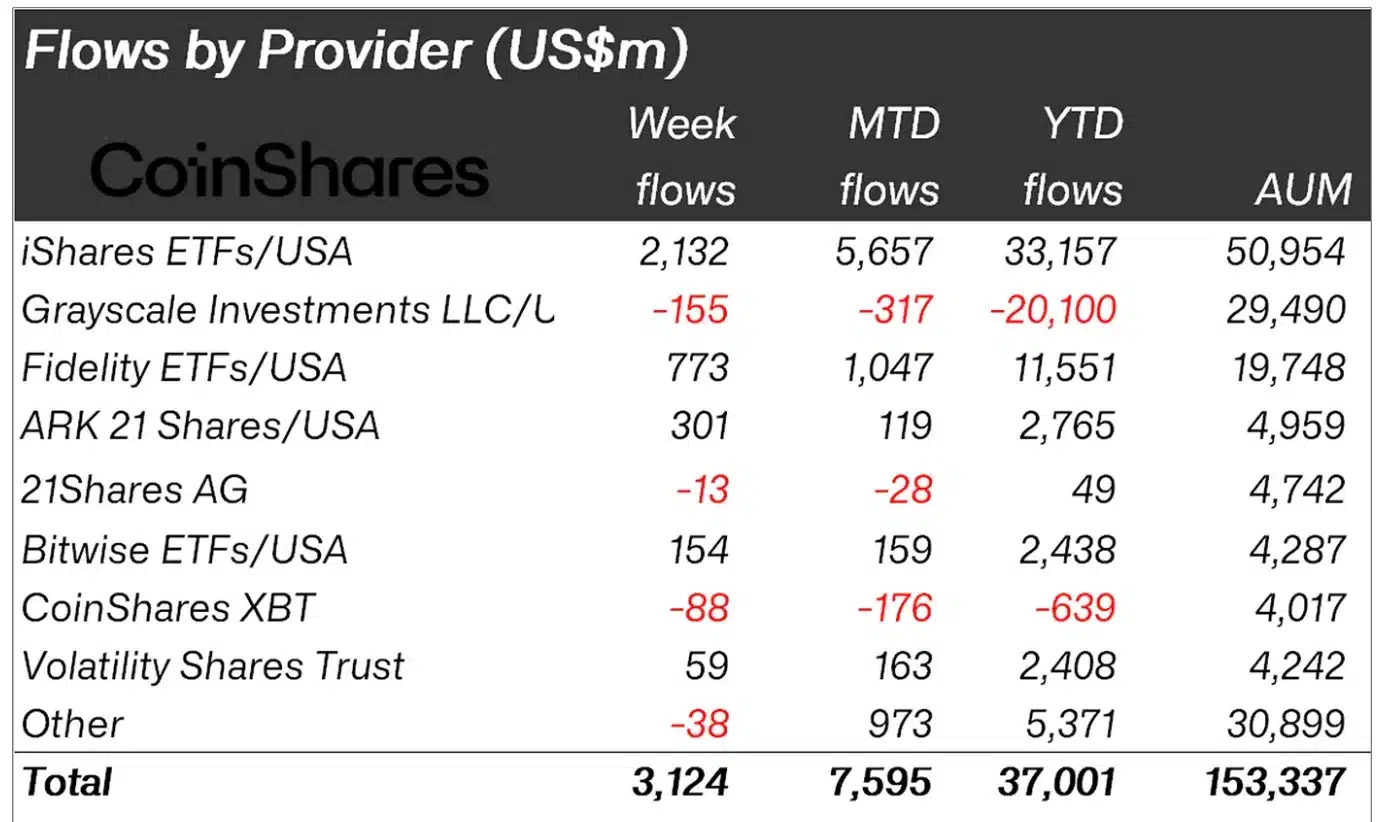

Based on CoinShares information, this improvement highlighted the rising investor confidence and the transformative influence of political and financial shifts on the crypto house.

As per the report,

“Digital asset investment products saw the largest weekly inflows on record, totalling US$3.13bn, bringing total year-to-date inflows to a record $37bn.”

This was for the week of the 18th–twenty second of November, the place spot Bitcoin ETFs garnered a powerful 102% enhance from the earlier week’s $1.67 billion, as reported by SoSoValue.

These positive aspects additionally marked the seventh consecutive week of constructive inflows, showcasing sustained momentum and rising investor enthusiasm. Moreover, the entire belongings underneath administration (AUM) surged to an all-time excessive of $153 billion.

Amidst this rise, BlackRock’s IBIT continued to dominate the market, boasting $48.95 billion in internet belongings as of the twenty second of November, with cumulative inflows reaching $31.33 billion.

In distinction, Grayscale’s GBTC accounted for $21.61 billion in internet belongings however has confronted outflows exceeding $20 billion since its inception.

Blackrock’s IBIT outshines

Actually, a deeper evaluation revealed that a good portion of final week’s inflows, roughly $2.05 billion, got here from IBIT.

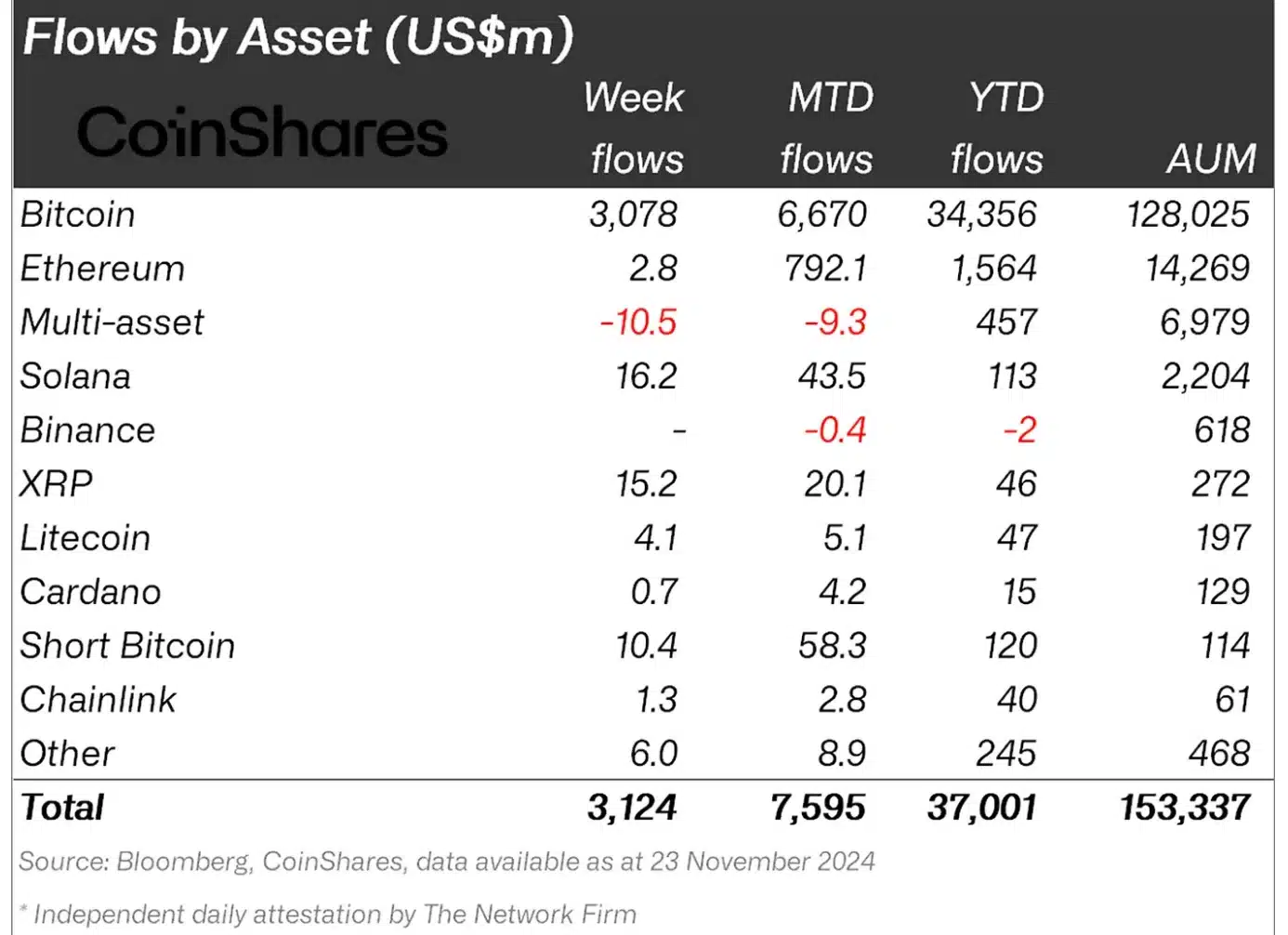

These Bitcoin funds led the cost, contributing $3 billion to the weekly whole—a stark distinction to the modest $309 million first-year inflows for U.S. gold ETFs.

Thus, whereas Bitcoin’s value rally continued to draw curiosity from institutional and retail buyers alike, it has additionally spurred $10 million in inflows into short-Bitcoin merchandise.

This pushed the month-to-month determine for these merchandise to $58 million—the very best degree since August 2022.

Bitcoin is just not alone

That being mentioned, whereas Bitcoin dominated the influx charts, altcoins too demonstrated their rising attraction amongst institutional buyers.

As an example, Solana [SOL] led the altcoin pack with a powerful $16 million in internet weekly inflows, outpacing Ethereum [ETH], which recorded $2.8 million.

Different notable performers included Ripple [XRP], Litecoin [LTC], and Chainlink [LINK], which garnered $15 million, $4.1 million, and $1.3 million, respectively.

These figures mirror growing confidence within the altcoin sector, fueled by sturdy value momentum and the increasing adoption of those digital belongings throughout numerous use instances.

Evidently, these developments clearly underscored the profound influence of the election on the crypto market.

Nevertheless, it’s essential to know that different components might have additionally influenced the traits. James Butterfill, Head of Analysis at CoinShares famous,

“This recent surge in activity appears to be driven by a combination of looser monetary policy and the Republican party’s clean sweep in the recent US elections.”