- There was a development in new demand for BTC over the previous week

- The final 12 hours have seen a decline in the identical although

The rely of Bitcoin’s [BTC] non-zero wallets has risen, regardless of the latest pullbacks within the coin’s value, in line with Santiment’s information.

In accordance with the on-chain information supplier, 370,000 new wallets holding not less than one BTC have been created within the final six days. The variety of BTC holders now totals 52.94 million, rising by 0.1% because the starting of the 12 months.

At press time, BTC was buying and selling at $67,734. Owing to negativity throughout conventional markets and the geopolitical uncertainty, the cryptocurrency fell on the charts and took the remainder of the market down with it. It was down by over 5% within the final 24 hours, in line with CoinMarketCap’s information.

Extra decline within the brief time period?

An evaluation of the coin’s efficiency on the day by day chart hinted at the opportunity of an extra value draw back within the brief time period. Key indicators noticed confirmed that bearish exercise considerably outpaced bullish traits in BTC’s market. If the crypto’s market depreciates much more, $65,000 could possibly be on the playing cards for BTC too.

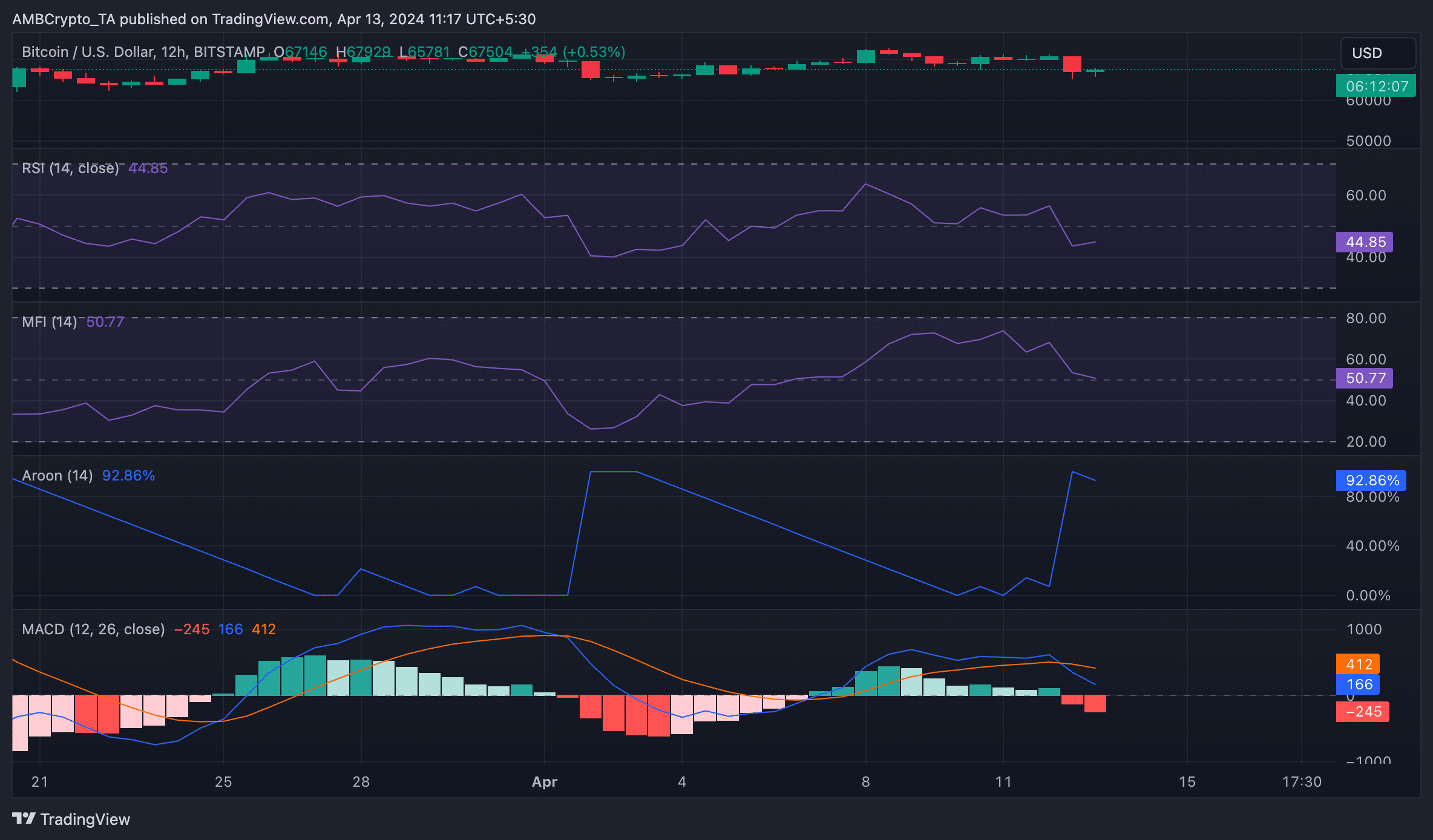

For instance, its Aroon Down Line (blue) had a studying of 92.86% at press time. An asset’s Aroon indicator measures its development energy and identifies potential reversal factors in its value motion. When the Aroon Down line is near 100, as on this case, it signifies that the downtrend is powerful and that the newest low was reached comparatively lately.

In accordance with CoinMarketCap information, BTC final traded across the $67,000-zone a month in the past.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Confirming the bearish development within the coin’s market, in the course of the intraday buying and selling session on twelfth April, the coin’s MACD crossed under its sign line.

When an asset’s MACD line intersects its sign line this manner, it signifies that the short-term development is weakening relative to the longer-term development. It has been recognized to precede a downtrend in value. Merchants usually interpret it as an indication to contemplate promoting their holdings or taking brief positions.

As anticipated, with Bitcoin’s value falling because it did, there was a pullback basically demand for the coin too. The identical was underlined by the findings of the Relative Energy Index and the Cash Movement Index, with the latter all set to cross the mid-line at press time – A really bearish signal.

The values of those indicators revealed that market contributors are favoring BTC distribution over accumulation proper now. Ergo, it’s too quickly to say whether or not the cryptocurrency will go on a sustained uptrend now, even because the Halving looms nearer.