- BTC has declined by 10.85% on month-to-month charts.

- An analysts cites 2019 consolidation cycle as an indication for upcoming uptrend.

Over the previous month, Bitcoin [BTC] has defied all market predictions. In truth, it has continued to say no regardless of, market expectations for a rebound.

As of this writing, BTC was buying and selling at $54,439 after dropping by 6.5% over the past seven days. Equally, the king crypto has declined by 10.85% over the past 30 days. This decline has seen Bitcoin’s buying and selling quantity plummet by 65.23% to $16.1 billion on every day charts.

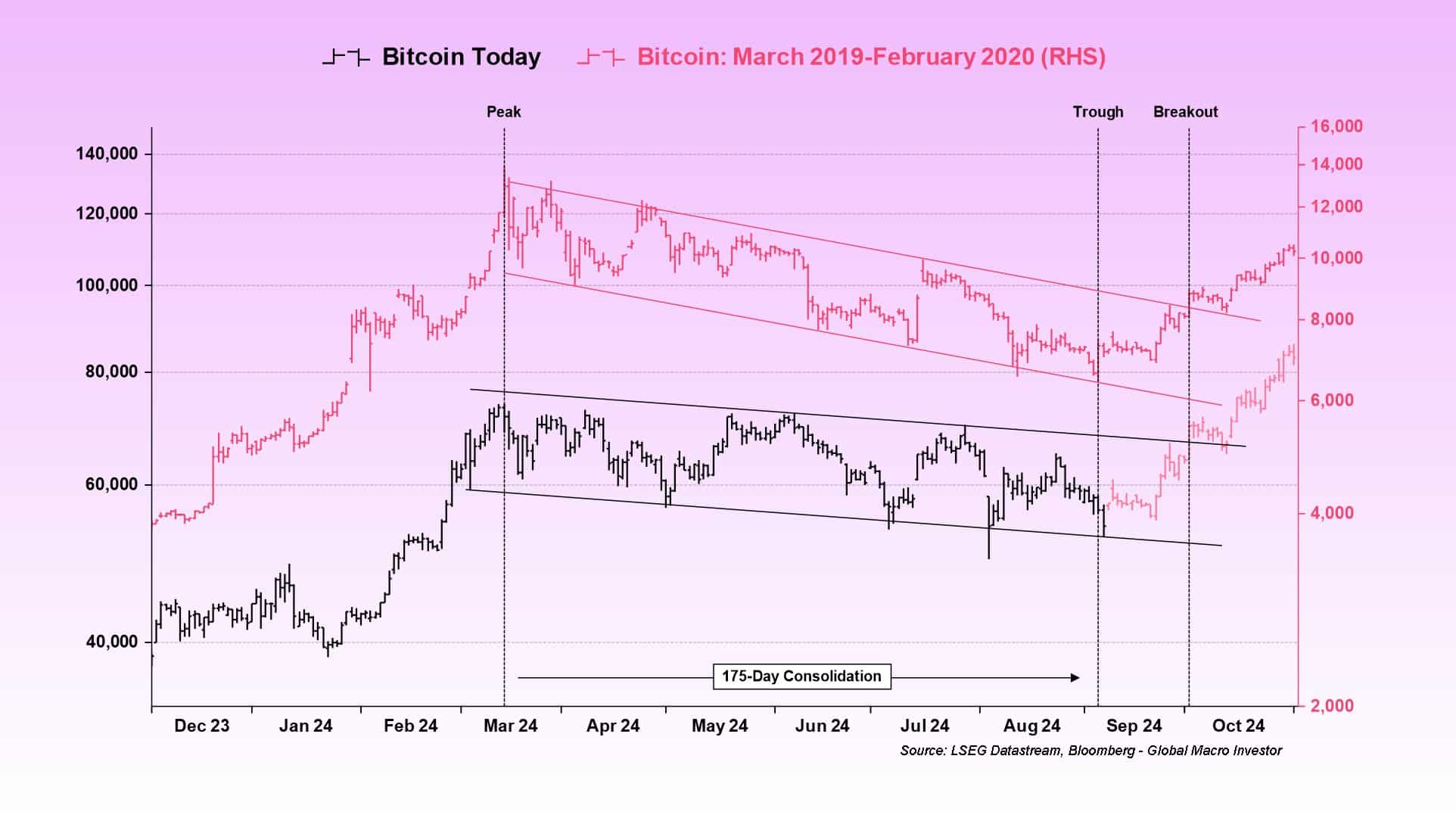

Regardless of this decline, the prevailing market sentiment stays optimistic. Inasmuch as analysts frequently eye a rebound. As an illustration, standard crypto analyst Bittel Julien suggested an upcoming rally citing the 2019 cycle.

Prevailing market sentiment

In his evaluation, Julien highlighted the present sustained consolidation section. In accordance with the analyst, the present consolidation section has lasted 175 days.

Similar to the 2019 cycle, Bitcoin is caught in the same consolidation section. Due to this fact, if BTC follows the identical script, it’ll end in upward motion.

Based mostly on this evaluation, BTC shifted from $7,200 to $10,000 in 2020 after the lengthy consolidation. Though it declined after, this was attributed to the pandemic. Thus, the analysts see an upcoming rebound after the lengthy consolidation.

Due to this fact, If historical past was any indicator, we could be on the point of both a considerable breakout or a continuation of the consolidation sample.

What BTC charts counsel

Whereas Julien highlighted one key indicator suggesting a possible reversal, the query is, do the opposite metrics agree?

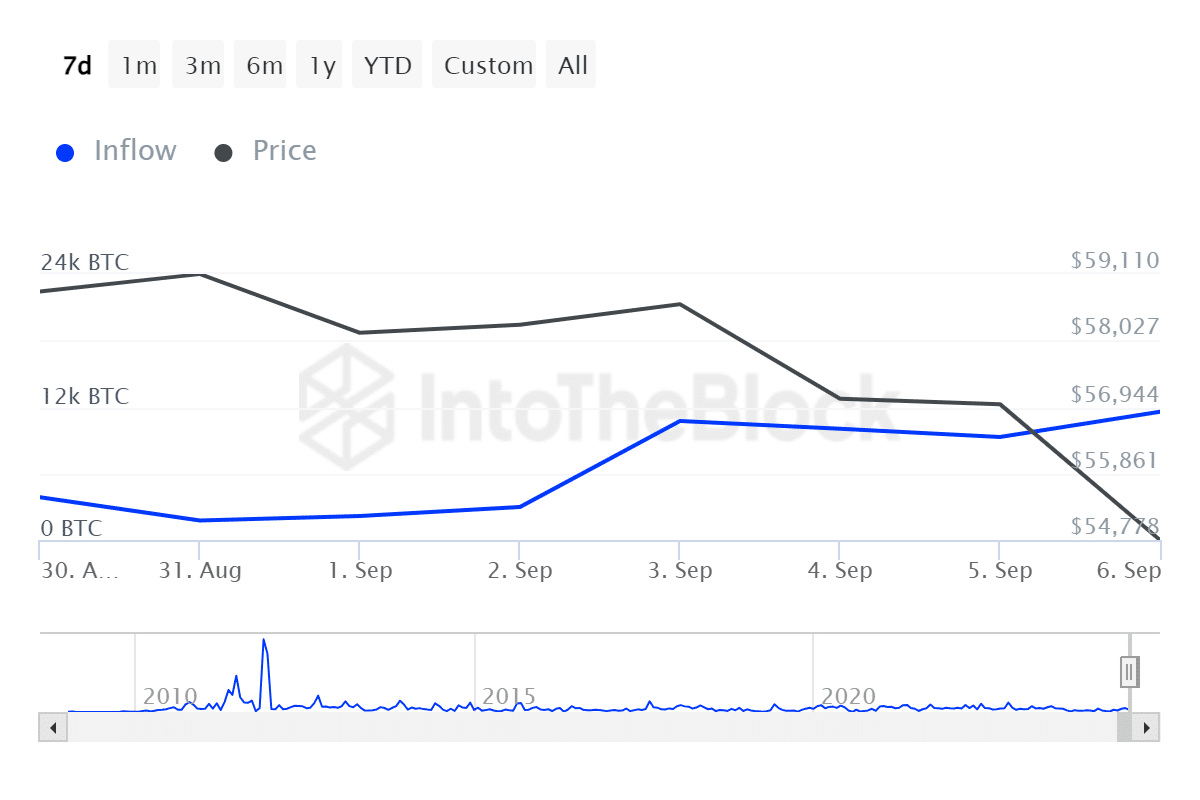

Supply: IntoTheBlock

Firstly, over the previous week, giant holders influx has skilled sustained development from a low of 1.76k to 11.57k at press time. Since traders are shopping for through the market downturn, it suggests they’re dying the dip.

The market conduct signifies accumulation signaling the investor’s confidence in potential future worth features. This can be a bullish sign and elevated accumulation leads to shopping for strain which pushes costs up.

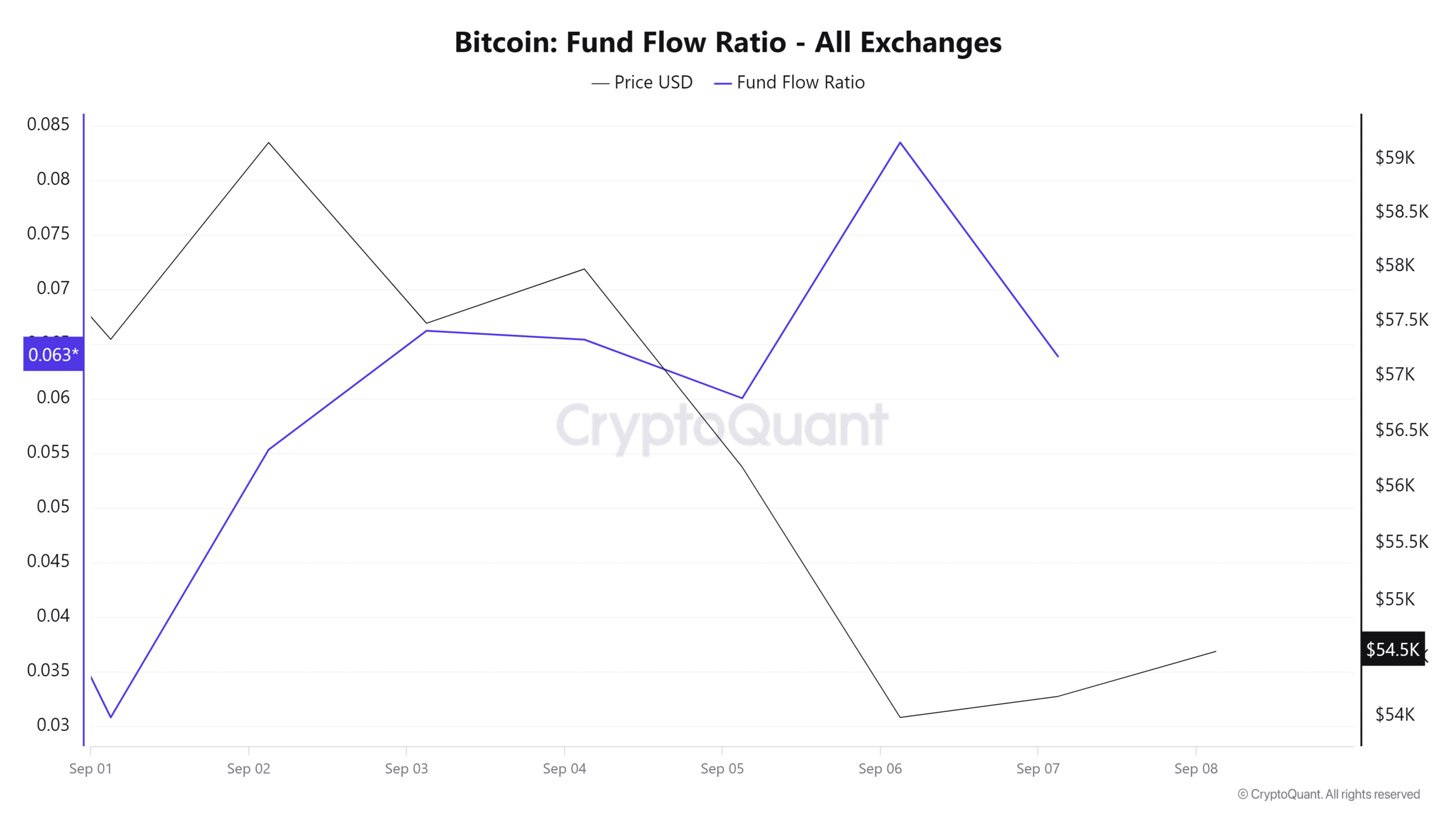

Moreover, the fund move ratio has elevated over the previous week. A rise in fund move signifies capital influx is larger than outflow. Such a market behavior suggests elevated shopping for exercise which results in upward worth motion.

This often displays rising optimism amongst traders as they anticipate additional features.

Supply: CryptoQuant

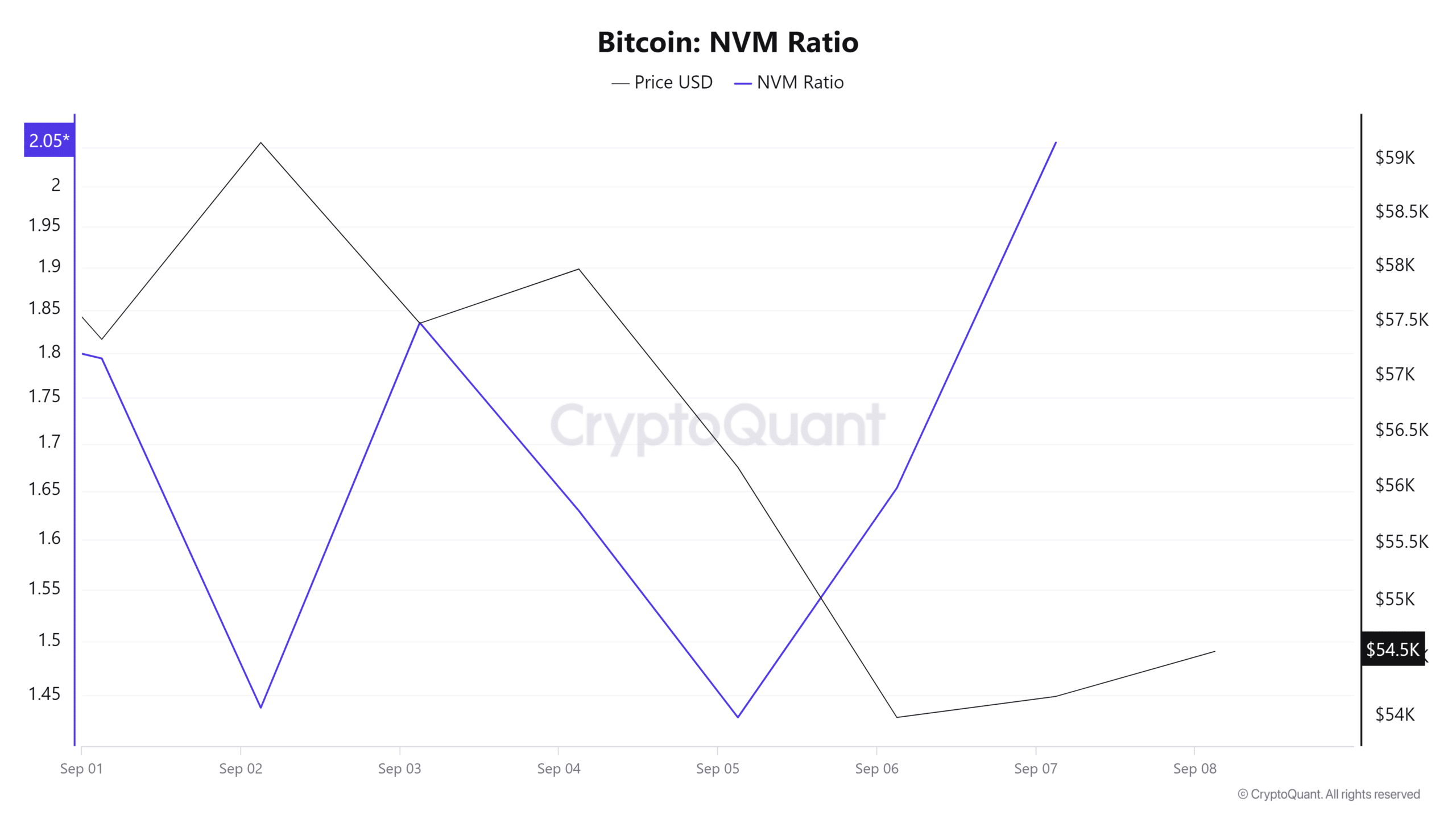

Lastly, the NVM ratio has elevated from 1.4 to 2.05 over the previous 7 days. This exhibits long-term holders are nonetheless holding regardless of the worth decline.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Such market conduct suggests confidence amongst long-term traders.

Coupled with present market favorability, BTC is effectively positioned for a reversal above the $56K resistance degree.