- BlackRock’s Bitcoin ETF (IBIT) confronted fluctuating inflows; Ethereum ETF (ETHA) carried out higher.

- BlackRock’s whitepaper highlighted Bitcoin’s distinctive efficiency over the previous decade however acknowledged its excessive dangers.

BlackRock’s Bitcoin [BTC] ETF (IBIT) confronted fluctuating inflows over latest days, with the newest replace on the 18th of September, revealing zero new inflows.

In distinction, BlackRock’s Ethereum [ETH] ETF (ETHA) recorded a wholesome influx of $4.9 million throughout the identical interval as per Farside Traders.

Blackrock’s ETF efficiency analyzed

Regardless of these short-term variations, the IBIT ETF has gathered complete inflows of $20.92 billion since its inception, surpassing the cumulative inflows of $17.45 billion for all BTC ETFs mixed.

Equally, ETHA has seen complete inflows of $1.03 billion since its launch, whereas the cumulative Ethereum ETF sector has skilled a adverse web outflow of $9.8 million.

These figures counsel that the shortage of inflows for IBIT could also be a short lived fluctuation, with potential for enchancment quickly.

Blackrock on Bitcoin’s function

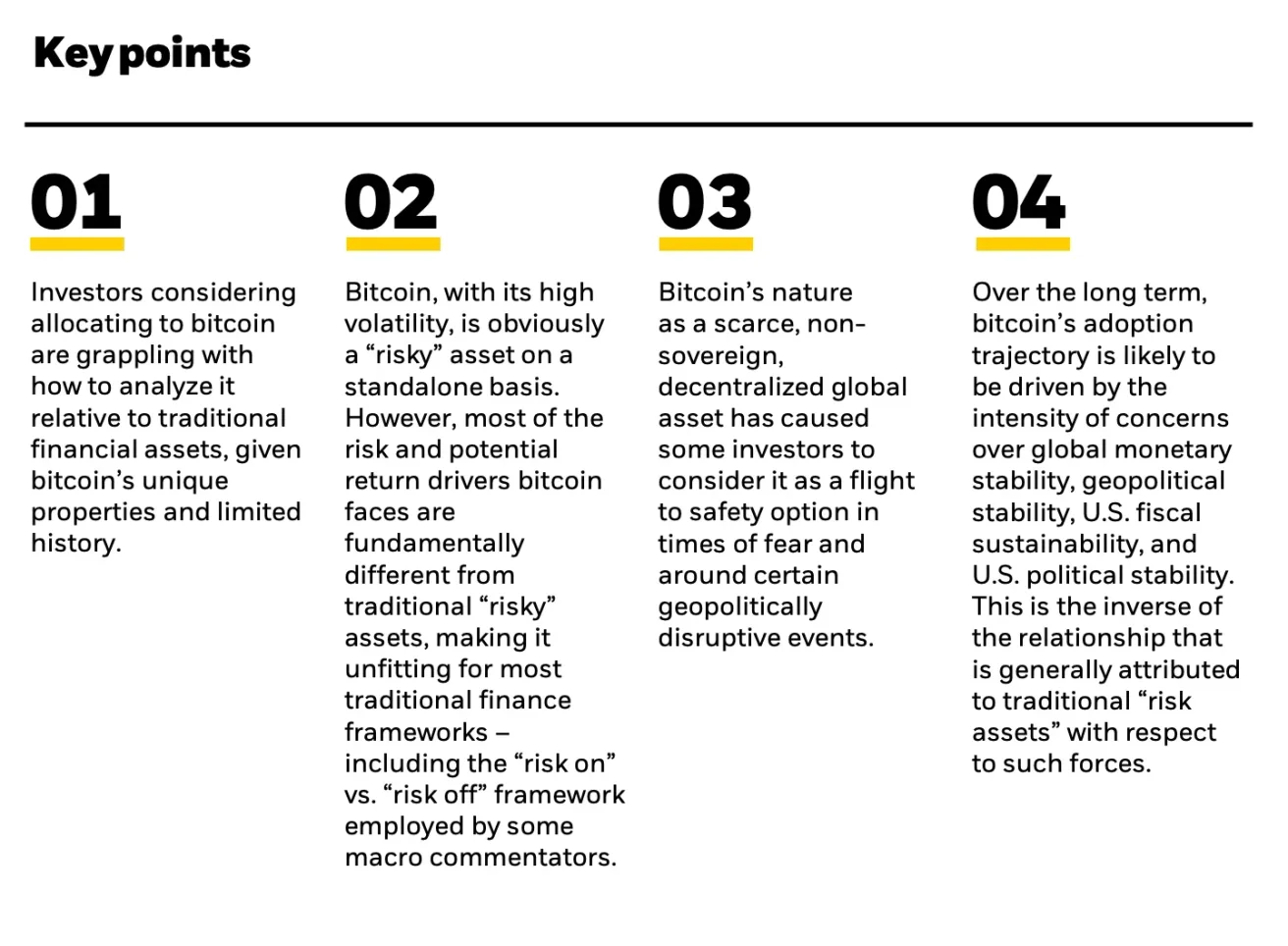

Following its historical past of profitable launches, BlackRock has unveiled a complete nine-page whitepaper that delves into Bitcoin’s distinctive function amongst main asset courses.

The paper emphasizes BTC’s distinctive place as a “diversifier,” contrasting it with conventional belongings by highlighting its fleeting correlations with U.S. equities and USD rates of interest.

In line with BlackRock, Bitcoin’s unconventional traits current each alternatives and challenges for buyers accustomed to analyzing conventional asset courses.

Bitcoin’s journey to date

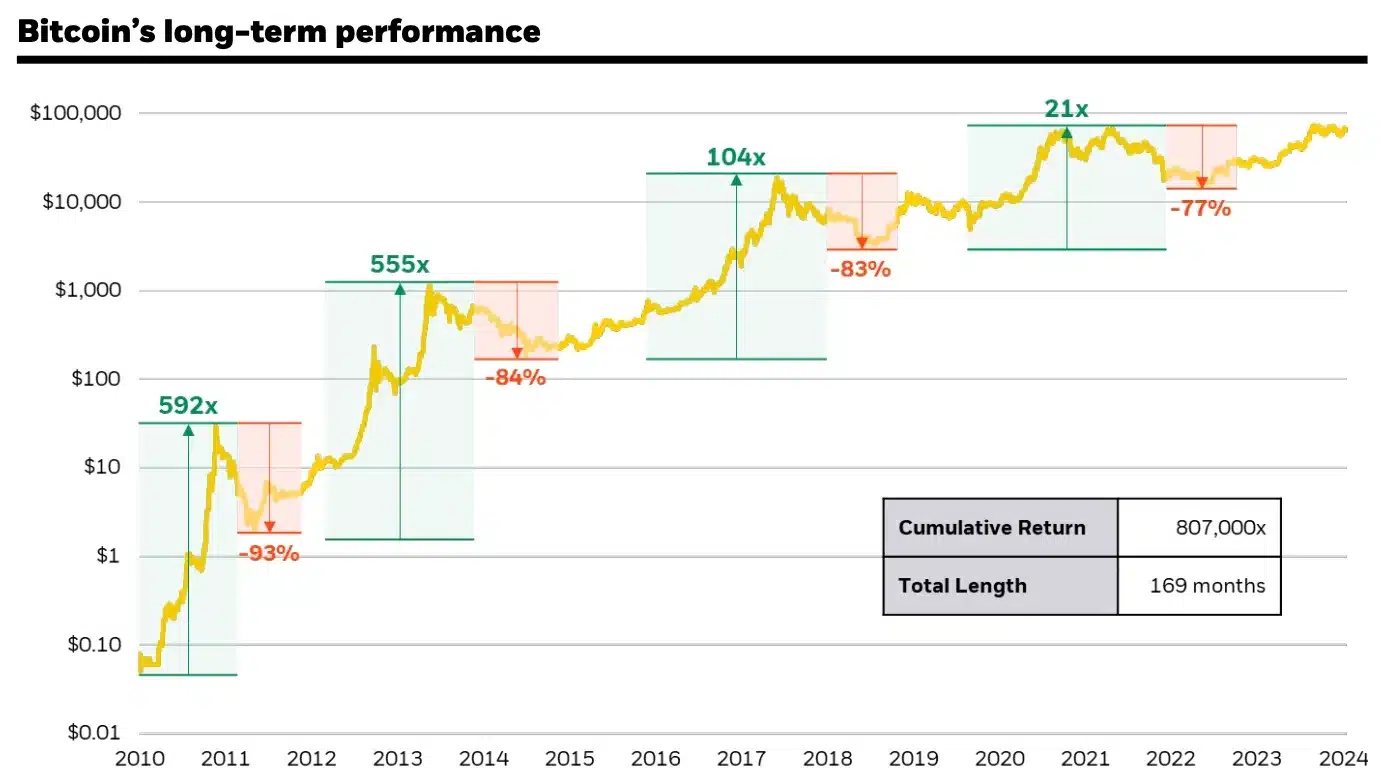

The whitepaper offers an in-depth evaluation of Bitcoin’s journey to a $1 trillion market capitalization, showcasing its distinctive efficiency over the previous decade.

It reveals that BTC outpaced all main asset courses in seven of the final ten years, delivering a powerful annualized return of over 100%.

This outstanding development occurred regardless of Bitcoin being the poorest performer in three of these years, marked by 4 important drawdowns exceeding 50%.

“These movements in bitcoin’s price continue to reflect, in part, its evolving prospects through time of becoming adopted on a widespread basis as a global monetary alternative.”

A hedge towards U.S. greenback weak point

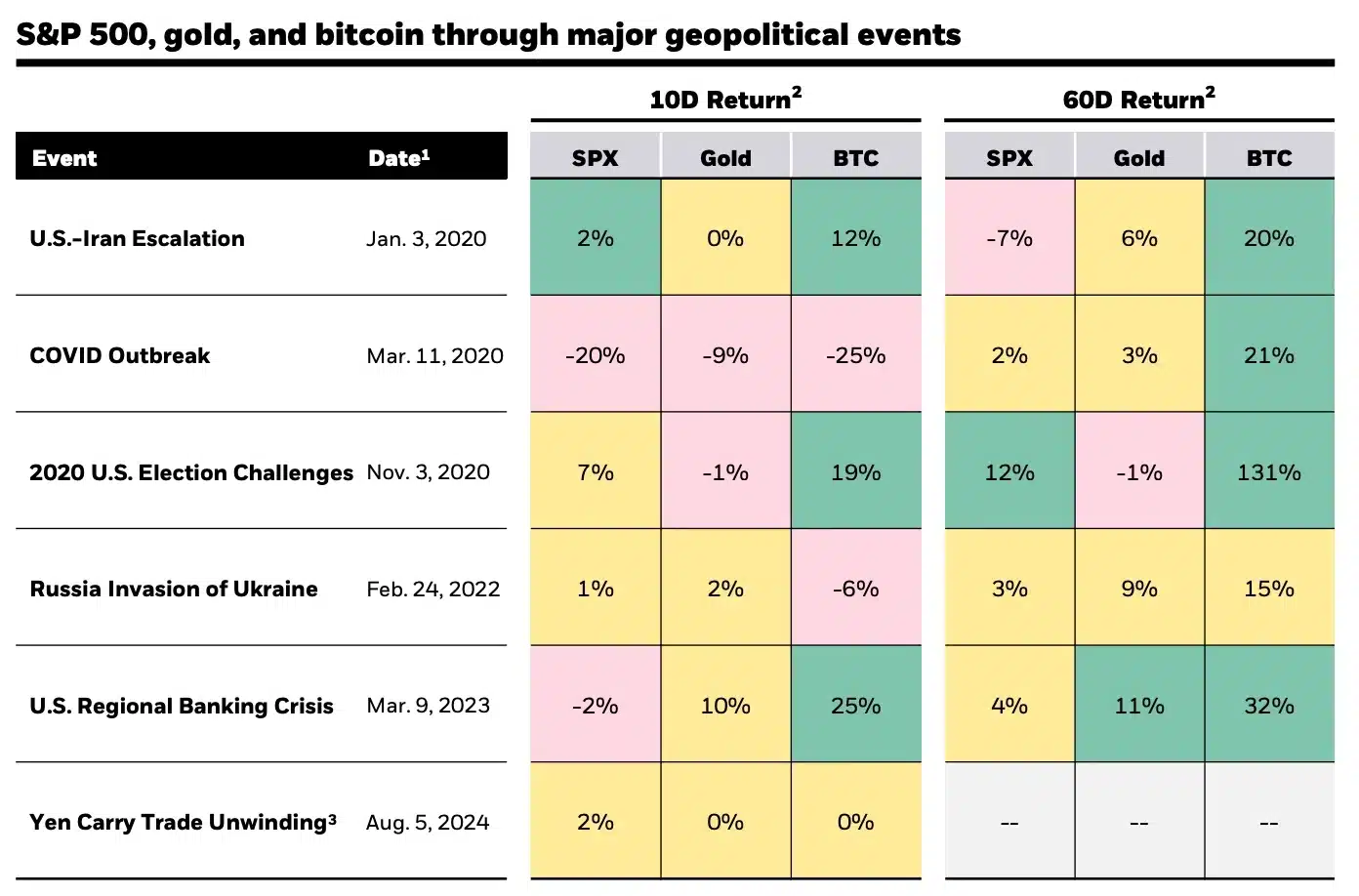

The paper additionally emphasizes BTC’s perceived insulation from international macroeconomic elements, suggesting that, for some buyers, it has emerged as a “flight to safety” throughout instances of geopolitical uncertainty.

Moreover, BlackRock argued that Bitcoin affords a hedge towards potential U.S. greenback weak point, which might come up from the rising federal deficit.

The whitepaper additional contrasts Bitcoin with U.S. equities by emphasizing Bitcoin’s steady buying and selling and near-instantaneous money settlement, which reinforces its liquidity throughout market stress.

Not like conventional equities which can be confined to plain buying and selling hours, Bitcoin operates 24/7, making it significantly precious during times of liquidity pressure, akin to over weekends when conventional markets are closed.

This distinctive attribute positions Bitcoin as a extremely saleable asset in instances of monetary uncertainty, providing a bonus over conventional belongings which can be much less accessible throughout such intervals.

Bitcoin, a risk-on asset — Why?

That being stated, the whitepaper concluded that Bitcoin stays a high-risk asset, and famous:

“None of the prior analysis negates the fact that bitcoin, on a standalone basis, is still very much a risky asset. Bitcoin has also been volatile and subject to myriad risks that include regulatory challenges, uncertainty over the path of adoption, and a still- immature ecosystem.”

Which means BTC’s dangers are distinct from these of conventional funding belongings.

Not like different belongings, Bitcoin’s habits and danger elements can’t be simply categorized inside easy “risk on” (investing in belongings perceived as increased danger for increased returns) versus “risk off” (avoiding riskier belongings in favor of safer ones) frameworks.

All in all, BTC’s distinctive traits make it a particular case, exhibiting that these conventional danger evaluation fashions might not absolutely seize its complexities.