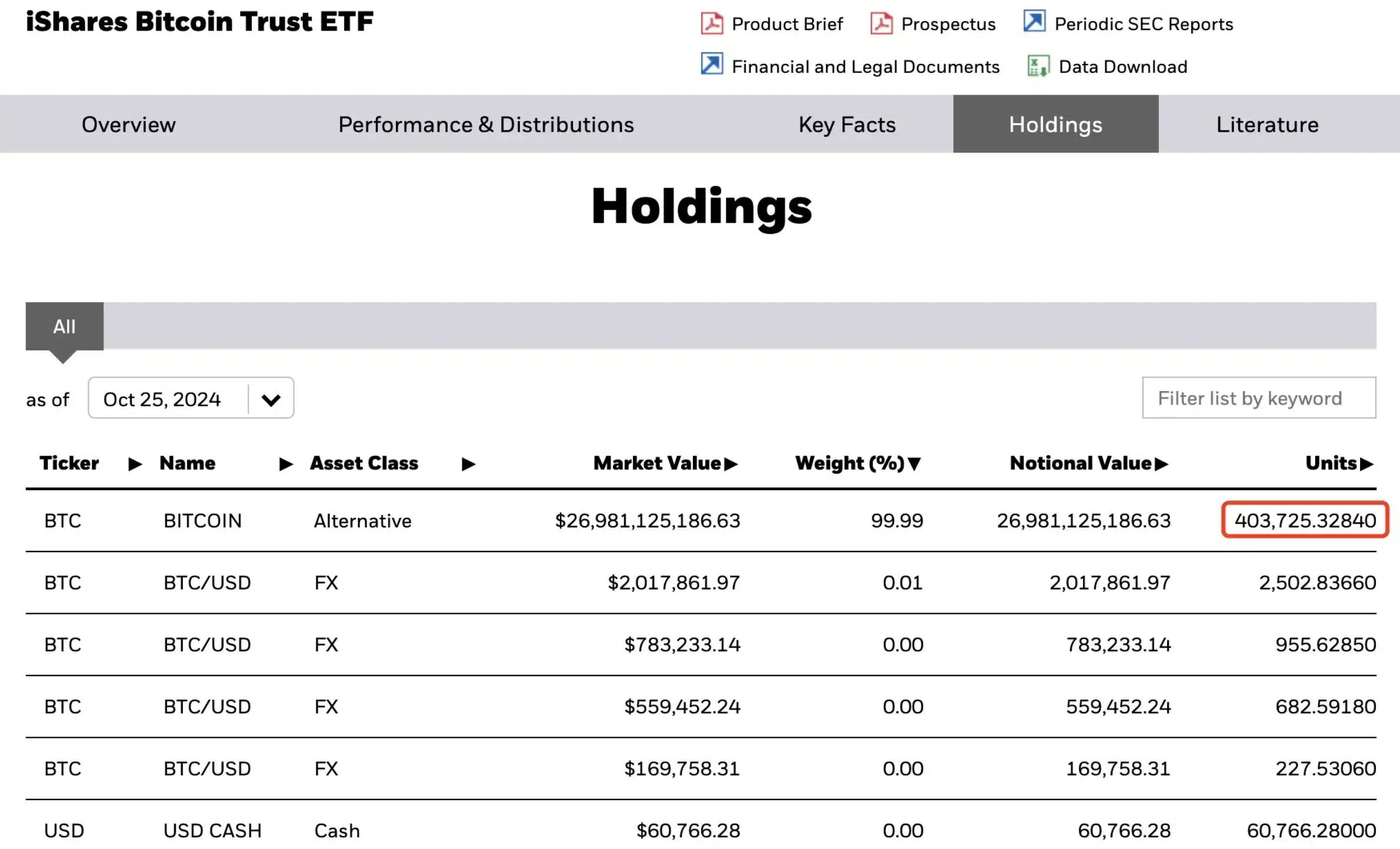

- BlackRock’s Bitcoin holdings exceed 400,000 BTC, valued at $26.98 billion.

- BlackRock’s Bitcoin ETF sees constant inflows, surpassing $23 billion in complete worth.

Amid rising hypothesis that Bitcoin [BTC] ETFs might quickly surpass the holdings of Satoshi Nakamoto, BlackRock has hit a big milestone in its BTC accumulation.

Blackrock’s Bitcoin accumulation

In keeping with a current replace from Lookonchain, the asset administration large now holds over 400,000 Bitcoin. At press time, it was valued at roughly $26.98 billion.

Over the previous two weeks alone, BlackRock has added 34,085 BTC to its portfolio, value roughly $2.3 billion. This newest acquisition highlighted BlackRock’s dominance within the cryptocurrency area because it continues to develop its Bitcoin holdings.

On the flip aspect, BlackRock’s BTC ETF (IBIT) has seen exceptional progress, surpassing the $23 billion mark, based on Farside Traders. Notably, IBIT has been on a constant influx streak because the 14th of October.

Between the 14th and twenty fifth October, IBIT recorded inflows nearing $400 million on some days, reflecting robust investor curiosity and confidence in BlackRock’s BTC technique. This underscored BlackRock’s strategic method to Bitcoin amid its rising adoption.

Neighborhood response and impression on Bitcoin

Seeing this the crypto neighborhood has responded with optimism.

As of the newest replace, Bitcoin was buying and selling at $67,773.35, marking an increase of over 1% inside the previous 24 hours as per CoinMarketCap.

Additioanlly, the Relative Energy Index (RSI) was additionally mendacity above the impartial threshold, signaling that bullish momentum was overtaking bearish forces.

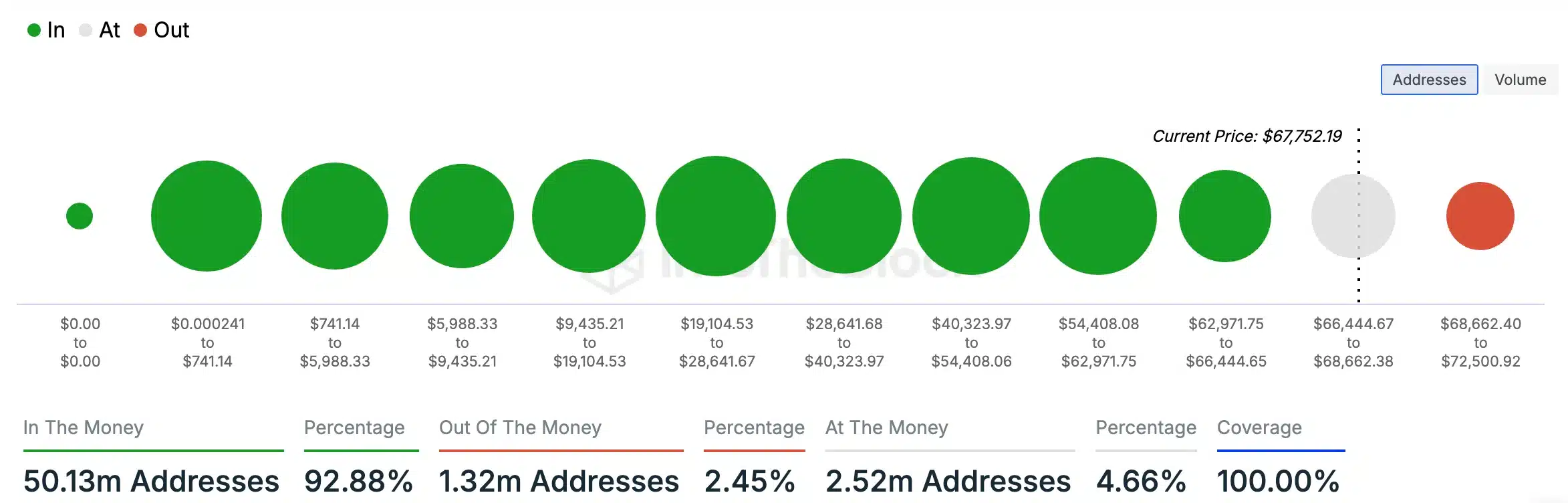

For Bitcoin’s roadmap forward, an evaluation by IntoTheBlock, cited by AMBCrypto, revealed that roughly 92.88% of BTC holders had been “in the money,” that means their holdings had been valued increased than their preliminary buy worth.

In the meantime, solely 2.45% of holders had been “out of the money,” reflecting a sturdy market sentiment and suggesting potential for additional worth positive aspects.

Is that this the beginning of the “Bitcoin war”?

Hypothesis about future “Bitcoin wars” is already circulating, with some predicting that giants like BlackRock may finally search to fork the unique Bitcoin chain and promote their very own model because the reputable one.

Whereas such a situation might at present seem to be a conspiracy idea, the speedy accumulation of BTC by BlackRock has raised issues about its rising affect over the market.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Nevertheless, they aren’t alone—different main gamers resembling MicroStrategy, led by Michael Saylor, in addition to Tesla, Binance, and SpaceX, have additionally been steadily amassing Bitcoin.

Due to this fact, whether or not MicroStrategy and different establishments will have the ability to problem BlackRock’s dominance stays an open query.