Market Overview: Bitcoin

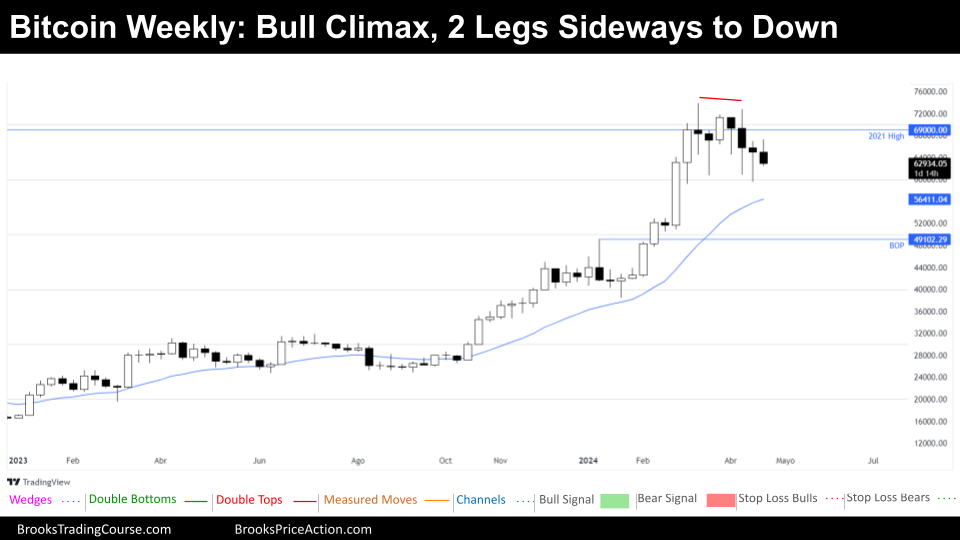

Bitcoin painted an image of a market in transition. Whereas a Excessive 3 purchase setup emerged, it was adopted by bearish indicators and hints of a possible purchase climax. This means the potential of evolving right into a buying and selling vary, particularly after a robust bull development. Whereas uncertainty stays, each bulls and bears are keenly observing worth motion for clues in regards to the market’s subsequent main transfer.

This week takes on added significance as we strategy the month-to-month shut. The present month-to-month bar presents a robust bearish sign, closing close to its low. If a brand new low doesn’t materialize, April might change into the seventh bar inside a bullish micro-channel. This potential setup bears watching, as historical past exhibits that sturdy bull breakouts typically expertise shopping for stress on bearish retracements, at the least sufficient for an additional check of the breakout excessive.

How will this pressure between the weekly and month-to-month timeframes resolved? Will the bulls discover renewed power to push costs increased, or will the bears solidify their short-term dominance? The approaching days and weeks will present the solutions.

Bitcoin

The Weekly chart of Bitcoin

The Bitcoin market skilled a reversal down this week, after buying and selling above the earlier week’s excessive, a Excessive 3 purchase setup. Nonetheless, this setup was a bearish doji candlestick, indicating indecision. Whereas the market is technically At all times In Lengthy, we’re observing a transition from the current tight bull channel to, at the least, a weaker section of the bull channel.

The present market habits hints at a possible purchase climax. The market’s forceful purchase vacuum check of resistance (2021 all-time excessive) helps the purchase climax speculation. If this state of affairs holds true, we anticipate a shift right into a buying and selling vary as a substitute of a continuation of the Bull Channel.

Nonetheless, it’s necessary to notice that this might additionally signify a short lived pause inside a unbroken bull channel. If costs set up a brand new increased excessive adopted by one other pause, the present exercise might merely be interpreted as a minor pullback inside a bigger uptrend.

What’s attention-grabbing is that even in a doubtlessly climatic setting, bulls have been in a position to revenue from “scalping” trades – shopping for the preliminary pullback after a 7-period bull micro-channel.

Bulls might try extra scalping alternatives if costs check the 20-week EMA. The dearth of considerable bearish momentum reinforces this risk. Bears who offered throughout the purchase climax might shut at the least a portion of their positions when worth encounters that first clear assist stage – the 20-week EMA. Further assist ranges exist at $50,000 and a earlier breakout level, lessening the draw back danger.

Will probably be attention-grabbing to watch whether or not the market reaches the EMA earlier than a definitive At all times In Quick sign emerges. An At all times in Quick market will change Bulls’ confidence.

From the bears’ perspective, this week’s worth motion might kind a positive bearish setup if it closes close to its present low. Nonetheless, the bears face challenges because of the sturdy assist ranges and the market’s common anticipation of a buying and selling vary reasonably than a steep decline.

Bulls, alternatively, will search a robust bullish shut. Ideally, this bullish surge would originate from the EMA or the $55,000 spherical quantity assist. If this week concludes with a bearish bar closing close to its low, the likelihood of additional worth declines subsequent week will increase.

The Each day chart of Bitcoin

Bitcoin’s each day chart presently presents a state of uncertainty. Bears interpret the current worth motion as a failed bull breakout from a triangle formation, signaling potential weak point. Bulls, alternatively, anticipate a better low following the decrease low, hoping for a continuation of the prior uptrend. In the interim, nonetheless, the market seems confined inside a buying and selling vary.

Markets inherently search equilibrium, resulting in intervals of consolidation the place each bulls and bears understand worth. This creates a buying and selling vary marked by uncertainty, with frequent rallies and selloffs that in the end keep contained. Sometimes, a decisive breakout happens, signaling newfound consensus on worth course and resulting in a brand new buying and selling vary.

Importantly, each buying and selling vary accommodates the potential for the subsequent main development to emerge. For now, essentially the most prudent technique inside this vary is to “Buy Low, Sell High, and Scalp” (BLSHS). This includes maximizing income from shorts and longs taken on the vary boundaries. It is very important keep away from trades inside the center third of the vary, the place worth motion is much less predictable.

It’s additionally essential to acknowledge that almost all breakout makes an attempt from buying and selling ranges in the end fail. Sturdy rallies or selloffs may be misleading, main much less skilled merchants to make impulsive choices based mostly on the hope of a sustained development. These typically show to be purchase vacuums or promote vacuums testing the vary’s extremes with out vital follow-through.

The Bitcoin market is incessantly pulled in direction of each the highest and backside of its buying and selling vary. Seasoned merchants perceive this dynamic and resist the temptation to chase huge bullish or bearish strikes close to the vary’s limits. Market inertia dictates {that a} excessive share of breakouts on this setting will show unsuccessful.

Let’s spark a dialogue! What are your ideas on the present Bitcoin buying and selling vary? Do you agree with the evaluation? Please haven’t any hesitation to remark, supply your insights, and share this report with different merchants.

Market evaluation reviews archive

You possibly can entry all of the weekend reviews on the Market Evaluation web page.