- USDT dominance dropped this week, confirming $62 as BTC’s new native low

- Weekend motion could be essential for BTC’s subsequent transfer because it neared key help on the charts

The market hasn’t but entered the acute greed section that usually indicators a market prime, like when Bitcoin [BTC] hit its ATH of $73k in March.

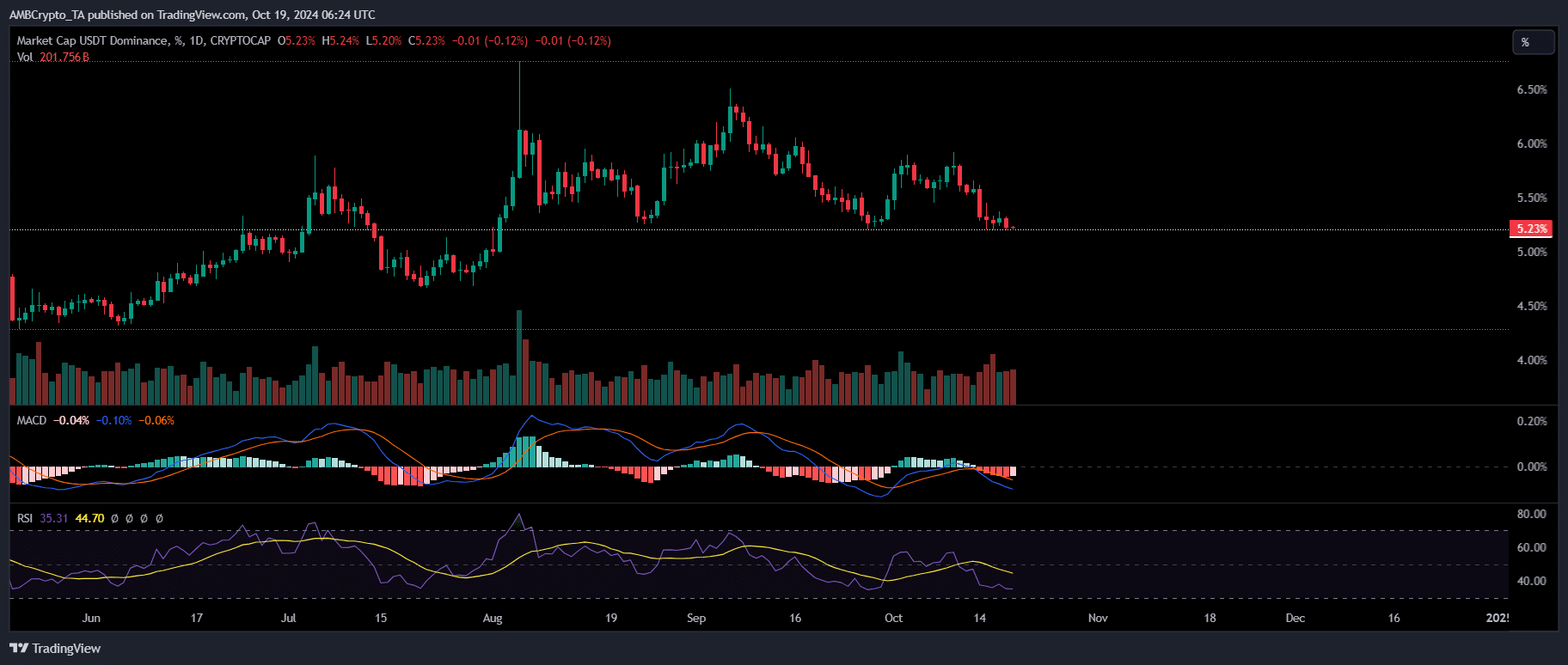

Nevertheless, over the previous seven days, a noticeable surge in liquidity has flowed into the market. This shift got here on the again of BTC breaking via key psychological ranges. A significant driver of this liquidity has been the declining dominance of Tether [USDT] – An indication that capital could also be shifting away from stablecoins into Bitcoin.

This pattern was confirmed by a bearish MACD crossover on the identical day.

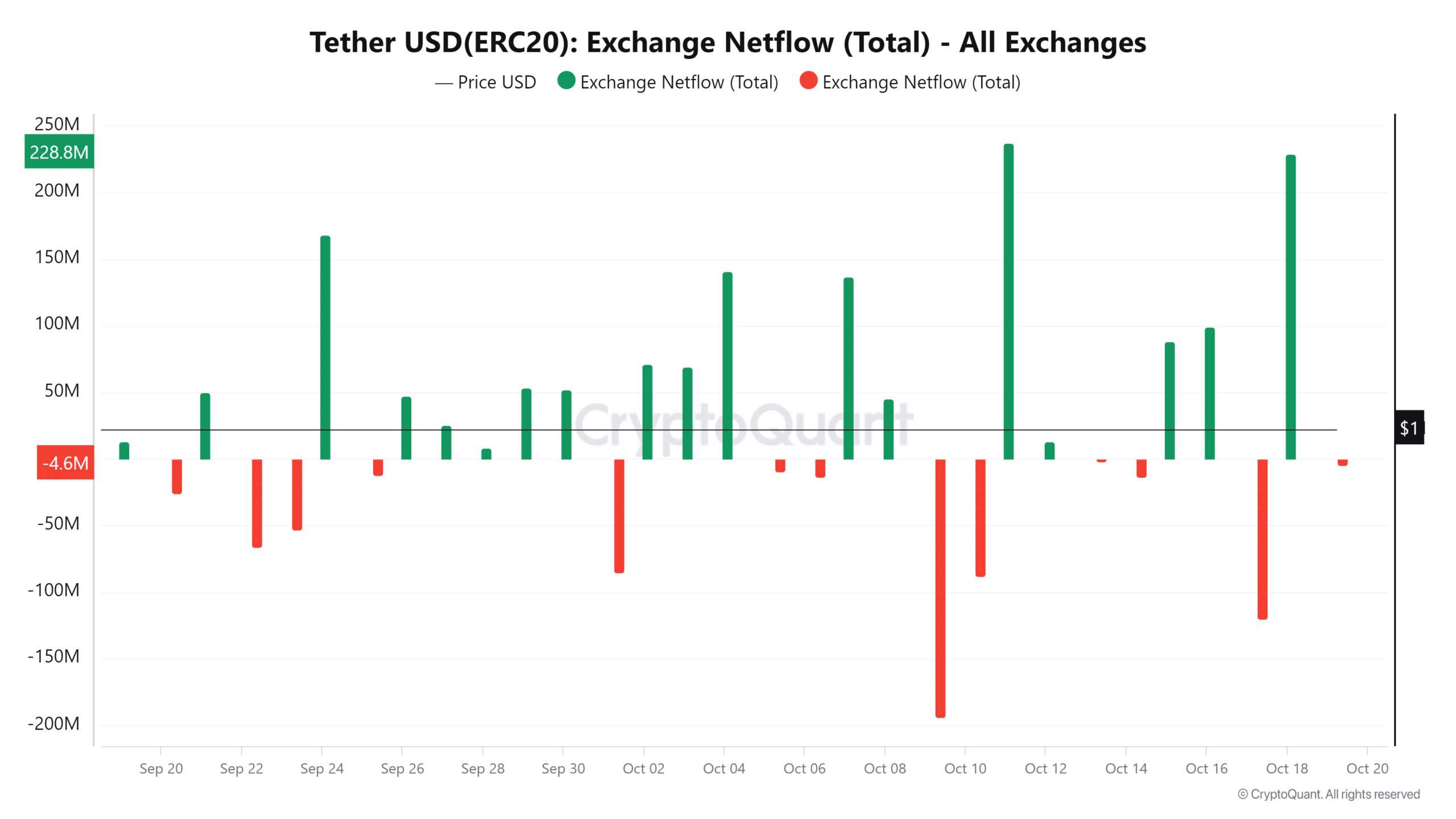

In easy phrases, a big quantity of liquidity has flowed into BTC as buyers seen $62k as a brand new low and purchased the dip.Moreover, one other historic milestone highlighted the rising significance of USDT and USDC. This additional deepened their influence on BTC’s value motion.

At present, USDT and USDC make up virtually 50% of the whole transaction quantity in main crypto belongings. This merely reinforces their standing as secure havens when Bitcoin nears a market prime.

On the time of writing, USDT gave the impression to be nearing a key help degree – One which it has examined twice since July. Every time, Bitcoin confronted robust resistance round $65k, leading to important pullbacks.

With BTC buying and selling at $68,346, a hike in USDT dominance may set off a correction. This is able to point out market panic as sellers take income earlier than the rally wanes.

Monitoring USDT dominance is essential

Alongside a bearish MACD crossover, a number of key indicators, together with a falling RSI, prompt that USDT dominance could proceed to say no, probably revisiting early July ranges when BTC was round $68k.

If this pattern persists, Bitcoin may take pleasure in a bullish weekend, fueled by robust sentiment as excessive liquidity flows into BTC from USDT.

Nevertheless, warning is warranted. Whereas USDT outflows have been gaining momentum, they might set off a short-term correction. Nonetheless, this doesn’t assure an outright pullback except this habits continues for the subsequent few days.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Subsequently, carefully monitoring the USDT dominance chart is crucial. A slight divergence from the prevailing downtrend would possibly sign the top of this bullish cycle.

If historical past is any information, it may push BTC again under $62k – The established native low.