- Common analyst believes BTC’s potential to succeed in a brand new peak relies on historic knowledge

- Anticipated rally hinges on how effectively the crypto holds the $54,000 help degree

Over the previous week, Bitcoin’s market efficiency has been sluggish, with a 4.53% decline on the charts. On the time of writing, it was priced at $58,371.56, with its market cap dropping marginally too. That being stated, its valuation was nonetheless above a trillion {dollars}.

Even so, cautious sentiment nonetheless reigns supreme in BTC’s market, with many nonetheless hesitant about wanting to purchase in.

Is Bitcoin going to succeed in a brand new all-time excessive?

Crypto analyst Moustache asserts that Bitcoin is at a key turning level proper now, doubtlessly resulting in a breakthrough above the $70,000 threshold.

His evaluation relies on a comparability of BTC’s present value motion put up Japan’s inventory market crash, which triggered a crypto downturn in August, to the COVID-19-induced crash.

In keeping with his chart, the COVID-19-induced crash led BTC to rally considerably, reaching highs of round $11,892.92. This might posisbly be duplicated on this case.

The analysts claimed that based mostly on BTC’s historic tendencies, the present value consolidation could also be non permanent and will set the stage for potential upward motion.

“If $BTC continues to repeat 2020, the present vary is the second finest probability as a result of it’s solely a retest in the meanwhile.“

That being stated, he cautioned that the soundness of the $54,000 degree is required for this upward trajectory to materialize. He added,

“$54,000 should maintain for this [rally to a new high] to occur.“

What this implies is {that a} dip under $54,000 may tilt the market in the direction of bearishness, dominated by promoting stress.

Now, with the highlight on the $54,000 degree now, AMBCrypto dug additional to establish if this degree is more likely to maintain and what the sentiment round BTC truly is.

Market sentiment – Will the $54,000 degree maintain?

Knowledge from IntoTheBlock revealed that 80% of BTC holders are presently worthwhile. This advised that the general market sentiment stays optimistic.

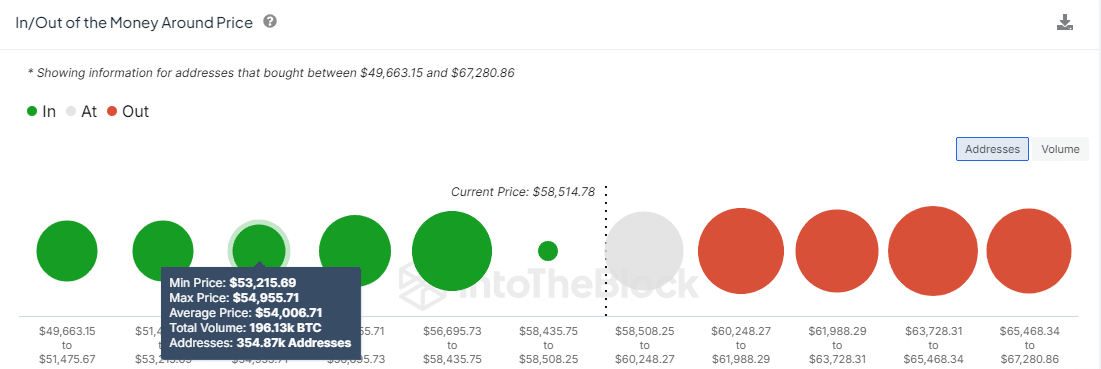

Upon evaluation of the In/Out of the Cash Round Value (IOMAP) metric, AMBCrypto found that $54,018.30 is a powerful help degree, with over 355,000 addresses with a collective buying and selling quantity exceeding $1 billion.

The IOMAP software illustrates help ranges the place a majority of holders are worthwhile (“in the money”), and which may stop costs from falling additional. Conversely, it additionally identifies resistance ranges the place many are unprofitable (“out of the money”), doubtlessly triggering sell-offs as costs climb, thus capping additional hikes.

With Bitcoin priced the place it’s proper now — A determine near the analyst-highlighted $54,000 mark — It seems well-positioned to behave as a buffer towards additional declines. This discovering may catalyze one other surge on the worth charts.

Lastly, Coinglass reported important adverse netflows of $738.06 million from three main exchanges, Binance, OKX, and Bybit, over the past week – An indication that extra BTC is being withdrawn than deposited.

This development sometimes implies market contributors have a choice for holding or securing their belongings offline. This can doubtlessly scale back the availability on exchanges and drive up BTC’s value if demand stays the identical or grows.