- Whale exercise round Bitcoin has remained excessive during the last seven days

- Technical indicators hinted at a number of low volatility days forward

After a substantial hike in worth on 19 April, Bitcoin [BTC] as soon as once more flashed crimson inside hours of its much-awaited 4th halving. Within the meantime, nevertheless, whales made their transfer as they elevated their accumulation and constructed on their current holdings.

Bitcoin whales are energetic

Hours earlier than the halving, the crypto’s value motion turned bullish as its worth surged previous $65k. Nevertheless, the situation modified quickly after the episode had transpired.

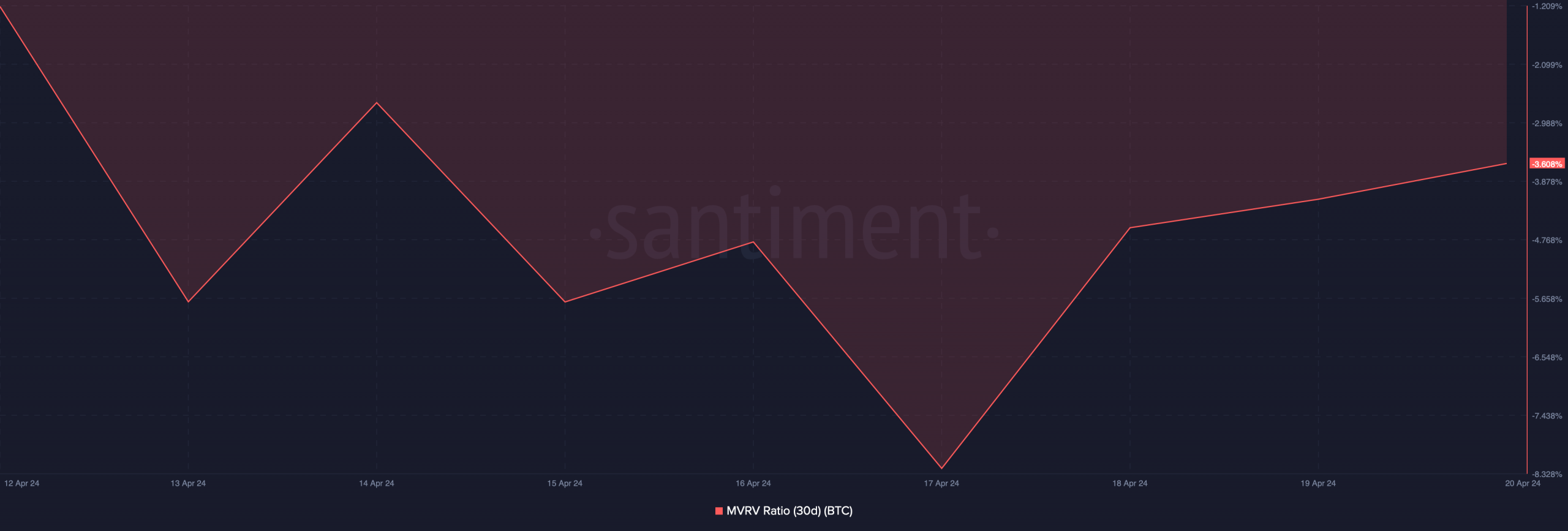

At press time, Bitcoin was buying and selling at $63,777 with a market capitalization of over $1.2 trillion. Right here, it’s attention-grabbing to notice that BTC’s MVRV ratio climbed over the previous couple of days, that means that extra traders are actually in revenue.

Whereas the worth remained unstable, the highest gamers within the crypto-space tapped up the chance to purchase. In truth, as per a latest tweet from IntoTheBlock, the largest Bitcoin holders, holding over 0.1% of the full provide, collectively added 19,760 Bitcoins to their holdings at a mean value of $62.5k.

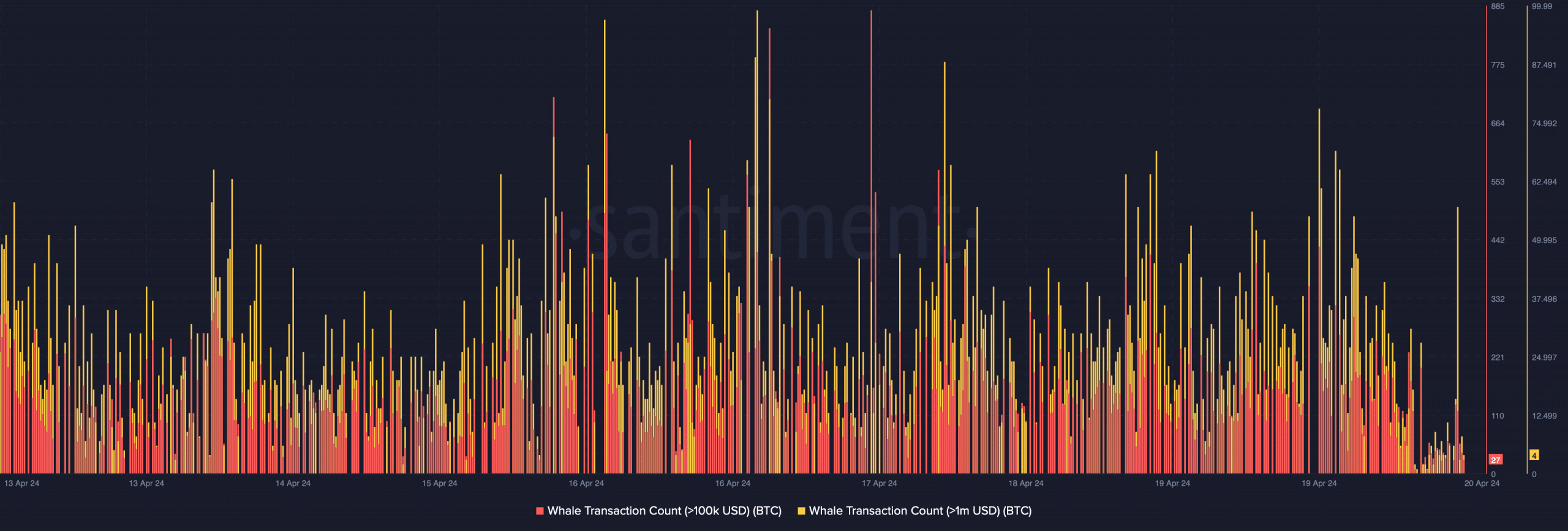

AMBCrypto’s evaluation of Santiment’s knowledge additionally revealed that whale exercise round BTC surged, as is evidenced by the rise in its whale transaction rely.

Will shopping for strain assist BTC flip bullish?

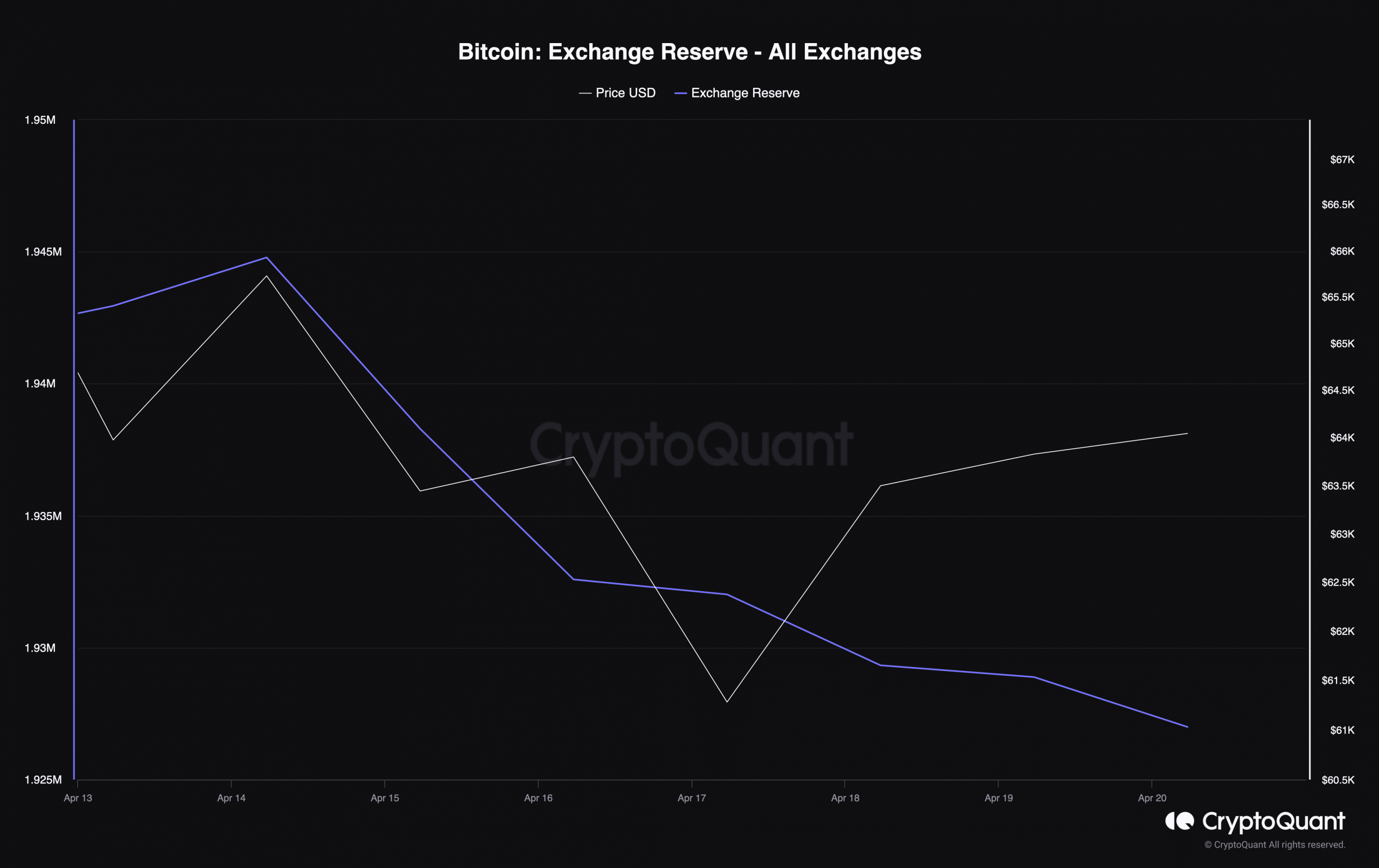

AMBCrypto then took a take a look at CryptoQuant’s knowledge to seek out out whether or not shopping for strain on BTC has been excessive or not. We discovered that Bitcoin’s change reserves dropped sharply during the last seven days.

At press time, Bitcoin’s change reserves stood at 1.92 million BTC.

Moreover, each BTC’s Coinbase Premium and Funds Premium have been inexperienced, that means that purchasing sentiment was dominant amongst U.S and institutional traders. Nevertheless, the rising demand may take a while to translate right into a bull rally, as a number of different metrics appeared bearish.

For instance – BTC’s Web Unrealized Revenue and Loss (NUPL) prompt that traders are in a “belief” part the place they’re in a state of excessive unrealized income. Furthermore, its aSORP was crimson at press time. This implied that extra traders have been promoting at a revenue.

In the course of a bull market, it could point out a market prime.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

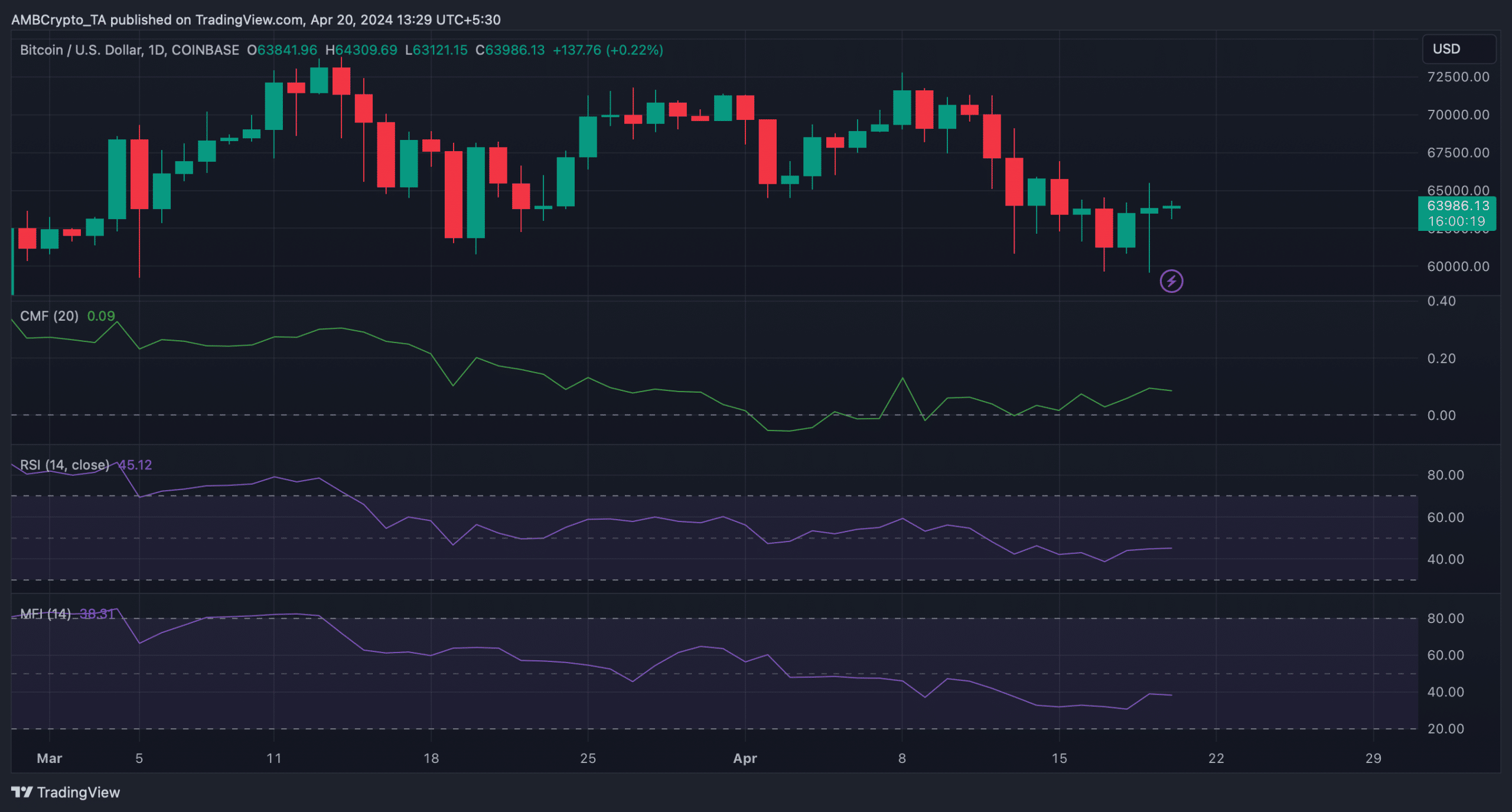

AMBCrypto then analyzed BTC’s day by day chart to see whether or not the cryptocurrency will flash inexperienced indicators anytime quickly. We discovered that each the Relative Energy Index (RSI) and the Cash Movement Index (MFI) have been trending sideways under their ranges of equilibrium.

Moreover, the Chaikin Cash Movement (CMF) registered a slight downtick as properly.

All these indicators hinted that traders may see a number of slow-moving days earlier than Bitcoin’s value turns unstable once more.