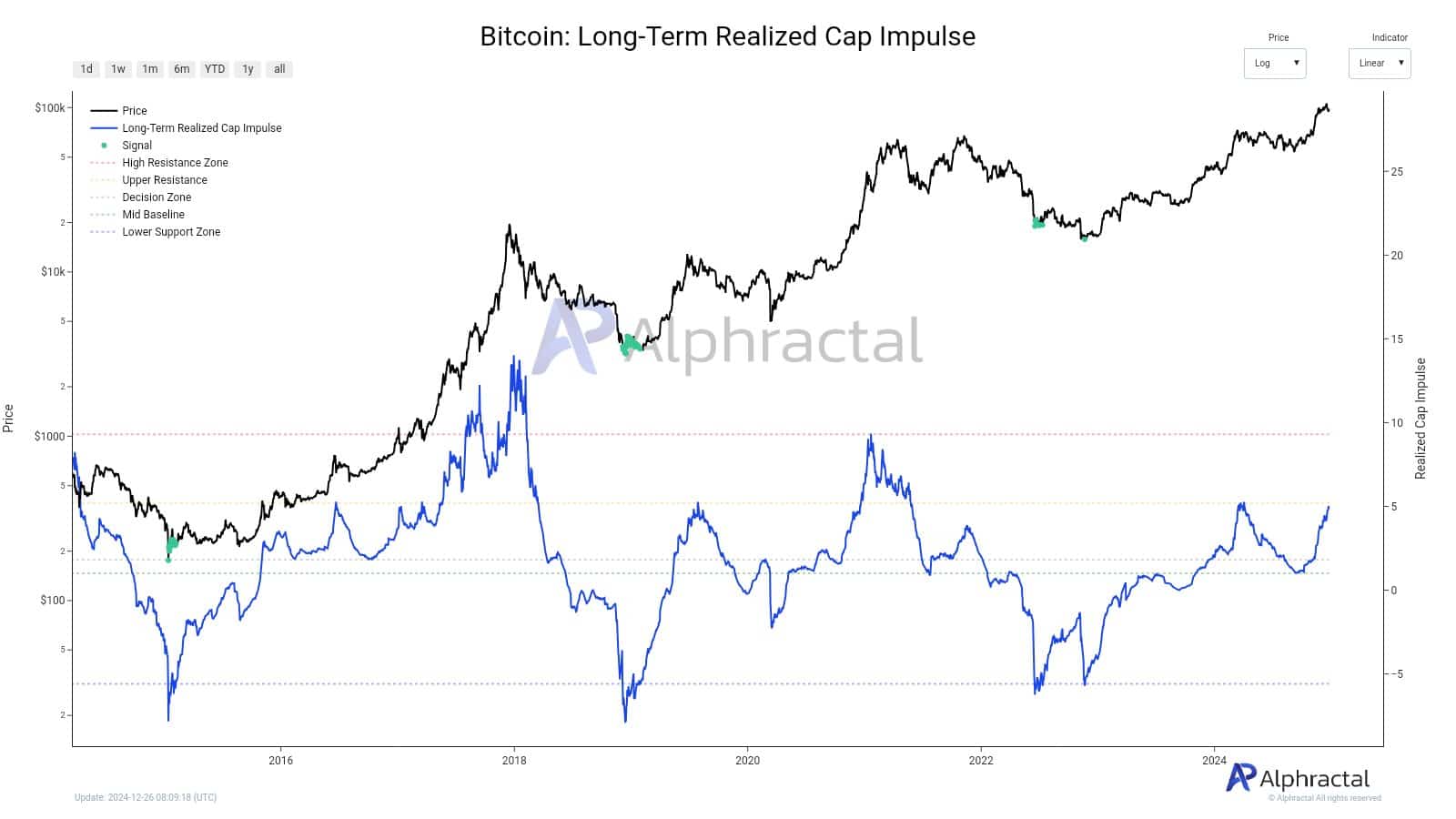

- Bitcoin’s realized cap hit its 2019 and March 2024 resistance ranges

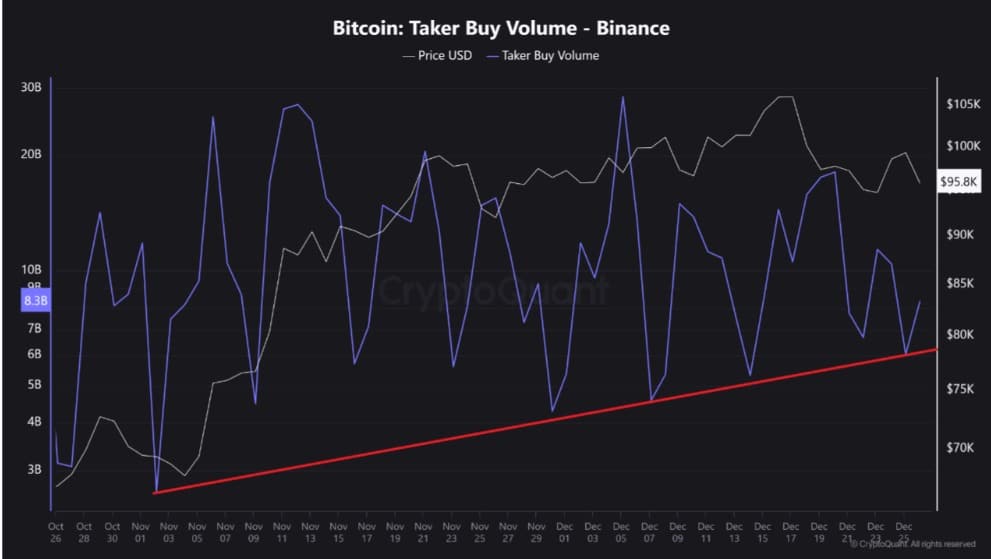

- Binance taker purchase quantity climbed to $8.3 billion too

Since hitting $102,747 every week in the past, Bitcoin [BTC] has traded inside a consolidation vary between $97k and $92k. Whereas market bears have tried to retake the market and push the value down, bulls have frequently resisted.

This resilience has pushed BTC to stay above $90k over the past 39 days. This market resilience could be attributed to a hike in shopping for exercise throughout the board.

Bitcoin’s Realized Cap hits 2019, March 2024 ranges

In line with Alphractal’s evaluation, Bitcoin’s realized capitalization reached the identical resistance ranges noticed in 2019 and March 2024. A hike to this stage could be interpreted to be an indication of sustained shopping for exercise, particularly as buyers’ demand rises.

In March 2024, Bitcoin’s realized cap recorded a powerful upswing whereas BTC’s worth soared to the primary ATH seen in 2024 and BTC closed the month at a excessive of $71k. Equally, because the market recovered from 2018’s bear market, BTC surged from $3k to $13k in 2019 between February and April. After hitting this resistance stage in 2019, the costs dipped to $7k whereas in March, it dropped to $56k via April.

These 2 earlier cycles revealed {that a} rise in realized cap straight correlates with BTC’s worth trajectory. When it rises, it signifies an increase in shopping for stress, even when the value rises greater.

We will see this shopping for stress via the latest surge in Bitcoin’s Binance taker purchase quantity, with the identical climbing to $8.3 billion. Often, a excessive taker quantity factors to excessive demand, which finally pushes the value up.

As an example, over the past 30 days, it has made greater lows suggesting better investor curiosity and strengthening shopping for stress.

Based mostly on rising patrons’ curiosity, we are able to see that the demand stays excessive and Bitcoin realized cap will most probably breach its earlier resistance ranges.

Due to this fact, if Bitcoin’s realized cap manages to interrupt out from these resistance ranges seen in 2019 and 2024, BTC will rise additional. If it fails to take action, it would finally decline – An indication that Bitcoin’s yearly development has already been important.

What do BTC’s charts counsel?

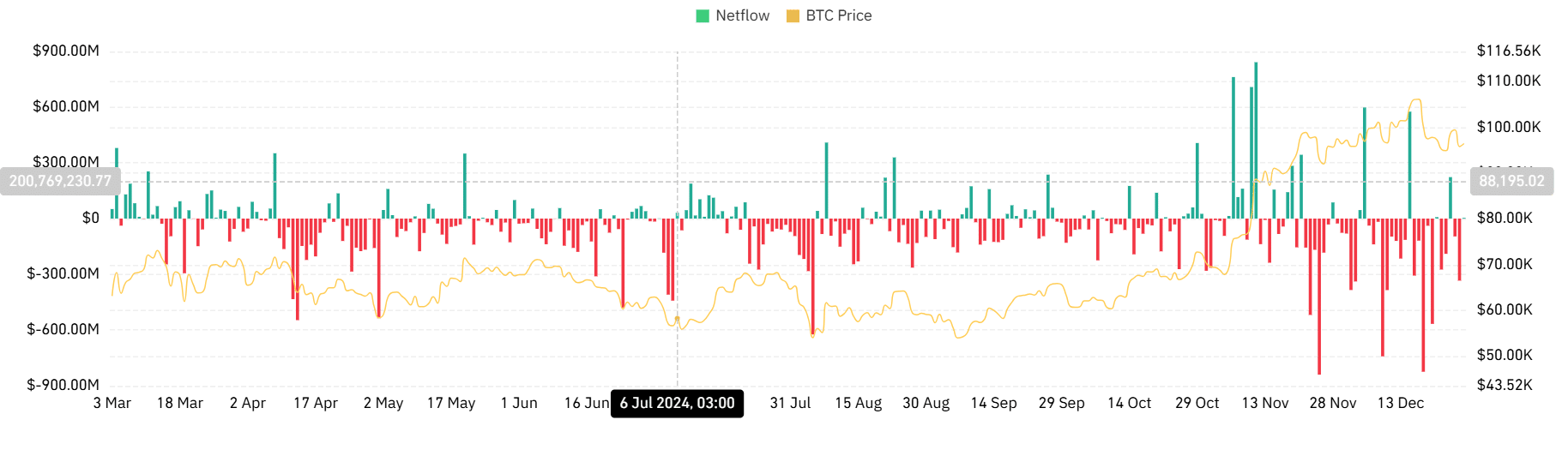

Whereas the evaluation offered appeared to supply a constructive outlook, it’s important to look at and decide what different market indicators say.

In line with AMBCrypto’s evaluation, Bitcoin is at the moment noting sturdy market demand.

For starters, we are able to see this demand via the sustained decline in spot netflows. Over the previous month, figures for a similar declined from $597 million to $-334.1 million. This steered that demand could also be outpacing provide, with buyers frequently accumulating.

Moreover, we are able to see greater shopping for stress via a constructive Chaikin cash move (CMF). This has remained constructive from November – An indication of sturdy demand for the crypto as buyers proceed to enter the market.

Merely put, though Bitcoin’s realized cap has reached its earlier resistance stage, BTC’s demand stays important. Which means that Bitcoin has extra room for development. If this demand stays and shopping for stress pushes the value greater, BTC will try $98,900 within the brief time period.

Nevertheless, if the yearly development is already carried out, Bitcoin may begin declining to $92,200.