- A bearish divergence appeared on BTC’s dominance chart

- If SOL turns bullish, then it’d goal $187 within the coming weeks

Bitcoin’s [BTC] dominance has been rising for a number of weeks now, suggesting that altcoins may need to attend longer for a rally. Nonetheless, the scenario can change quickly as a bullish divergence appeared to seem on the charts. This would possibly permit altcoins like Solana [SOL] to achieve bullish momentum quickly.

Therefore, it’s value having a look on the odds of an altcoin summer season.

Bitcoin dominance to fall quickly?

BTC dominance has constantly remained effectively above the 50% mark. Every time this metric rises, it signifies that the probabilities of altcoins gaining upward momentum are low. At press time, BTC’s dominance stood at 54%, as per CoinStats.

Moreover, AMBCrypto’s evaluation of the Altcoin Season Index revealed that the indicator had a studying of 20. Typically, a worth underneath 25 hints at a Bitcoin season.

Nonetheless, the scenario would possibly change quickly. CryptoBullet, a well-liked crypto analyst, not too long ago shared a tweet highlighting a bullish and bearish divergence on BTC’s dominance chart. As per the identical, whereas BTC’s dominance elevated, a bearish divergence appeared on the Relative Power Index (RSI) chart.

This would possibly point out a potential dip within the cryptocurrency’s dominance going ahead.

Curiously, the other occurred in late 2021, with the identical leading to a hike in BTC dominance in subsequent months. If the bearish divergence sample is examined, then traders would possibly quickly seen altcoins flourish throughout the board.

Will Solana profit from this?

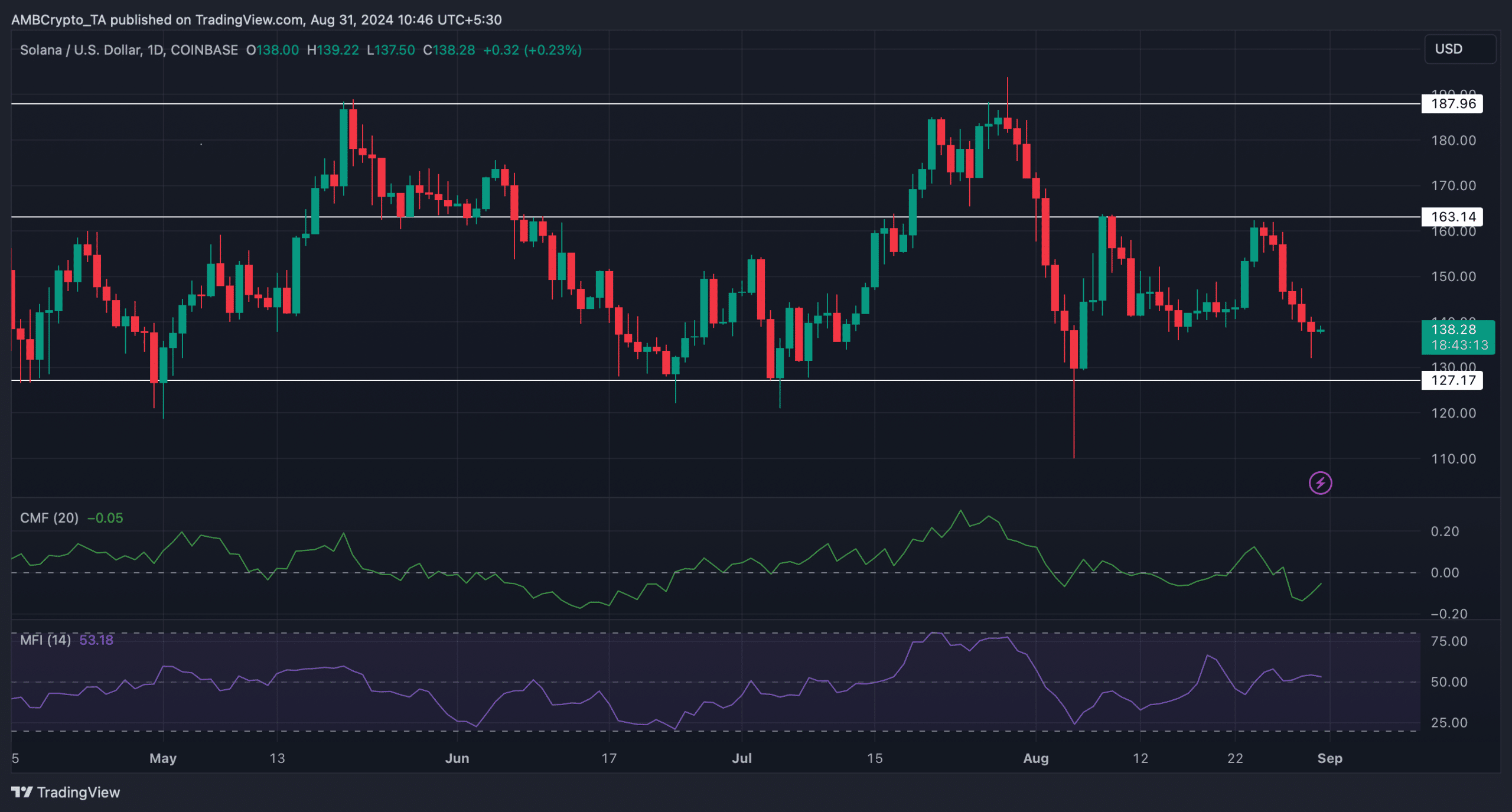

Since a drop in BTC dominance would possibly end in an altcoin rally, AMBCrypto deliberate to examine Solana’s state to see whether or not it confirmed any indicators of a bull rally. In line with CoinMarketCap, SOL’s worth dropped by over 10% within the final seven days.

At press time, it was buying and selling at $138.57 with a market capitalization of over $64 billion.

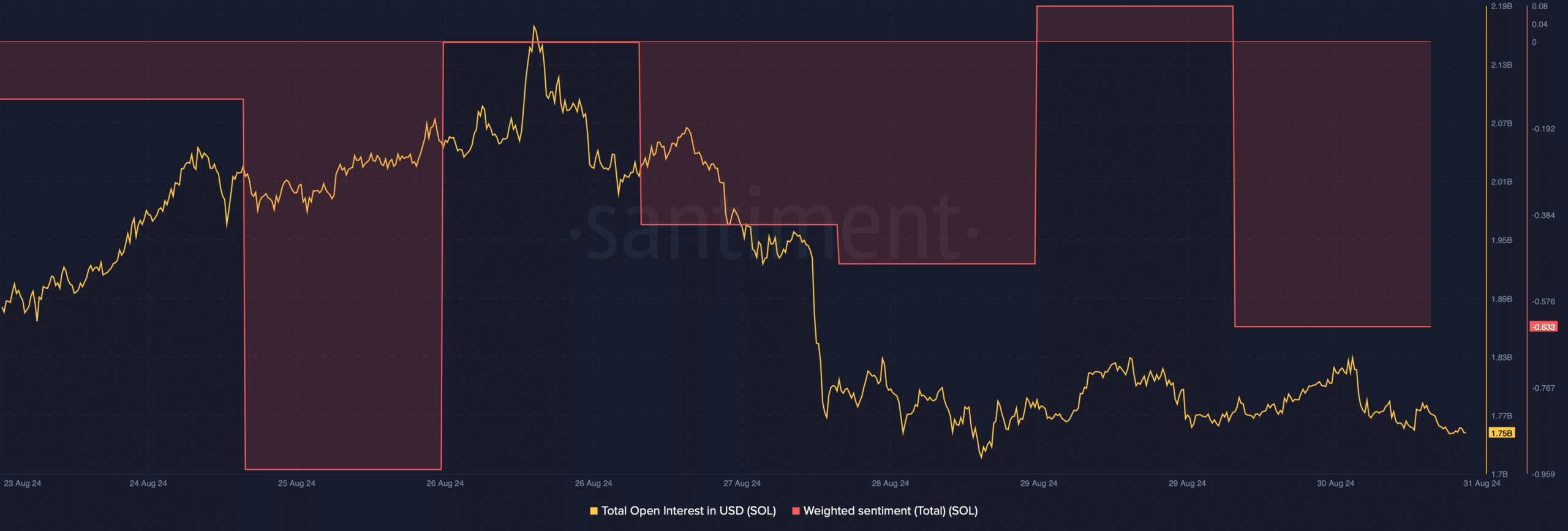

The dangerous information was that SOL’s buying and selling quantity spiked whereas its value dropped, which legitimized the downtrend. The token’s weighted sentiment additionally plummeted sharply, which means that bearish sentiment round SOL was dominant.

Nonetheless, SOL’s Open Curiosity dipped. Normally, a drop on this metric signifies that there are probabilities of the continuing value development altering. Due to this fact, AMBCrypto checked SOL’s every day chart to seek out out what the technical indicators advised.

The Cash Circulation Index (MFI) registered a downtick, hinting at a sustained value drop. If that occurs, then traders would possibly seen SOL dropping to $127.

Is your portfolio inexperienced? Try the SOL Revenue Calculator

Quite the opposite, the Chaikin Cash Circulation (CMF) went north. Moreover, if BTC dominance falls, then SOL would possibly as effectively flip bullish. Within the occasion of a bullish takeover, SOL would possibly goal $163 earlier than it begins its journey in direction of $187.