- Bitcoin’s value has risen by over 6% in 24 hours

- If the bulls maintain on to market management, a rally previous $65,000 is likely to be potential

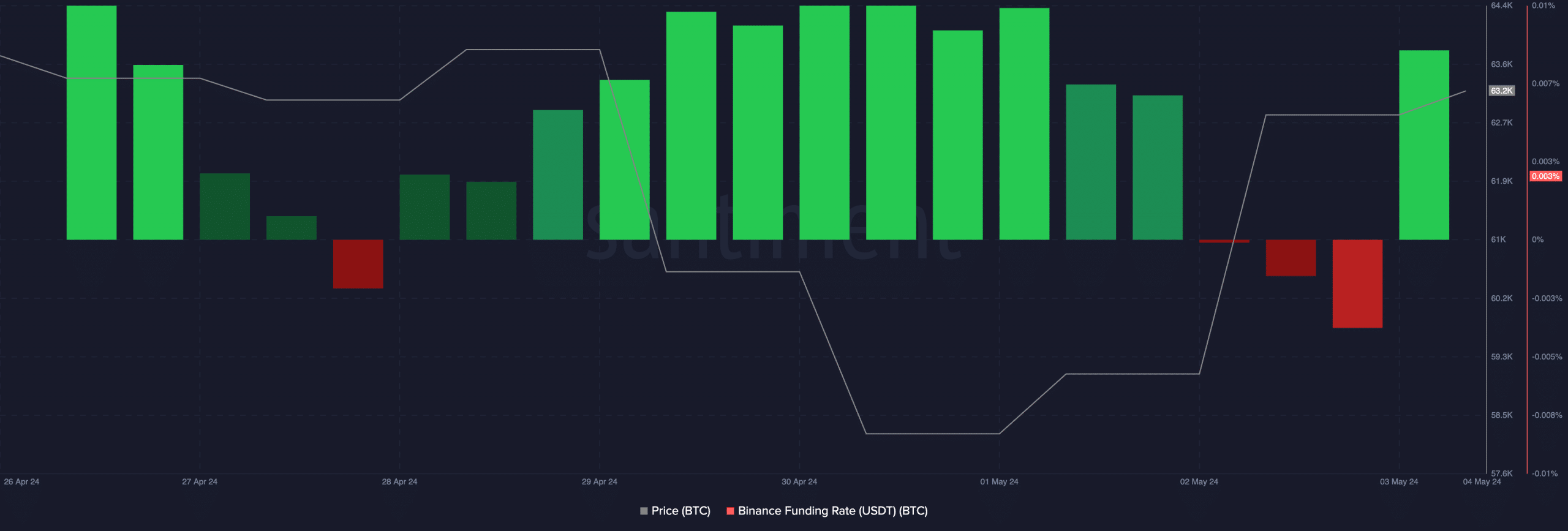

In keeping with Santiment, the 6% hike in Bitcoin’s [BTC] value over the past 24 hours has led to a notable change in its funding price, from detrimental to constructive on Binance.

📈 #Bitcoin has bounced on a #bullish Friday with its market cap rising +5.4% in 24 hours. The gang has utterly #flipflopped on their #Binance trades, going from liquidated #shorts to #longs after this bounce. For the rally to proceed, we do not need to see #FOMO rising too… pic.twitter.com/fY3lEX3REb

— Santiment (@santimentfeed) Might 3, 2024

Funding charges are a mechanism utilized in perpetual futures contracts to make sure that the contract value stays near the spot value. When an asset’s contract value is greater than its spot value, merchants who maintain lengthy positions pay a price to merchants shorting the asset. Funding charges return constructive values when this occurs.

Conversely, detrimental funding charges are recorded when the asset’s contract value is decrease than the spot value. Right here, quick merchants pay a price to merchants holding lengthy positions,

When an asset witnesses a sudden shift from detrimental to constructive funding charges, it suggests that there’s a sturdy demand for lengthy positions. It’s thought-about a bullish sign and a precursor to an asset’s continued value development.

In keeping with Santiment, Bitcoins funding price on Binance closed on 3 Might at a year-to-date low of -0.008%. Nevertheless, after the worth initiated an uptrend to climb by over 6% in 24 hours, its funding price on the main change modified to constructive.

At press time, this had a studying of 0.0027%, indicating that there have been extra lengthy than quick positions within the coin’s derivatives market.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

What do you have to look out for?

Bitcoin’s value surge within the final 24 hours has led to a rally in buying and selling exercise in its derivatives market. In keeping with Coinglass, as an illustration, buying and selling quantity in that market had a cumulative determine of $78.05 billion over that interval, with the identical climbing by 30%.

Signaling that market contributors are opening new buying and selling positions, BTC’s futures open curiosity registered a 7% uptick in 24 hours too. At press time, the coin’s futures open curiosity was $30 billion, whereas the crypto was valued at simply over $63,000 on the charts.

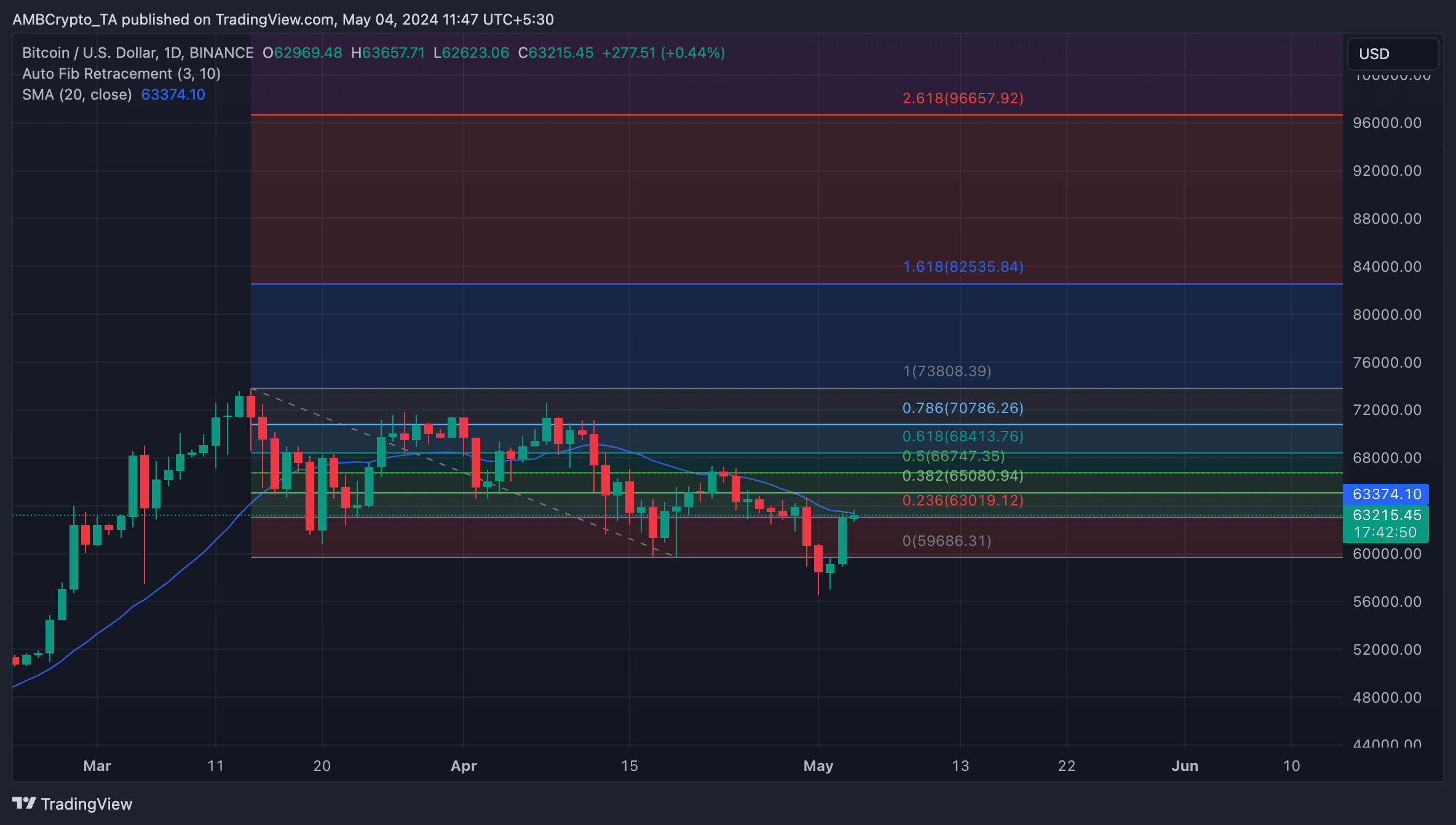

Moreover, readings from BTC’s Fibonacci retracement ranges on the 1-day chart revealed that if this bullish momentum is sustained, the coin’s subsequent value level will likely be $65,050.

Nevertheless, if the bears re-emerge and put strain on its value, the bullish projection will likely be invalidated. If that occurs, BTC’s value will fall underneath $60,000 to change fingers at $59,700.