- As per the most recent evaluation, the profit-taking development would possibly proceed additional.

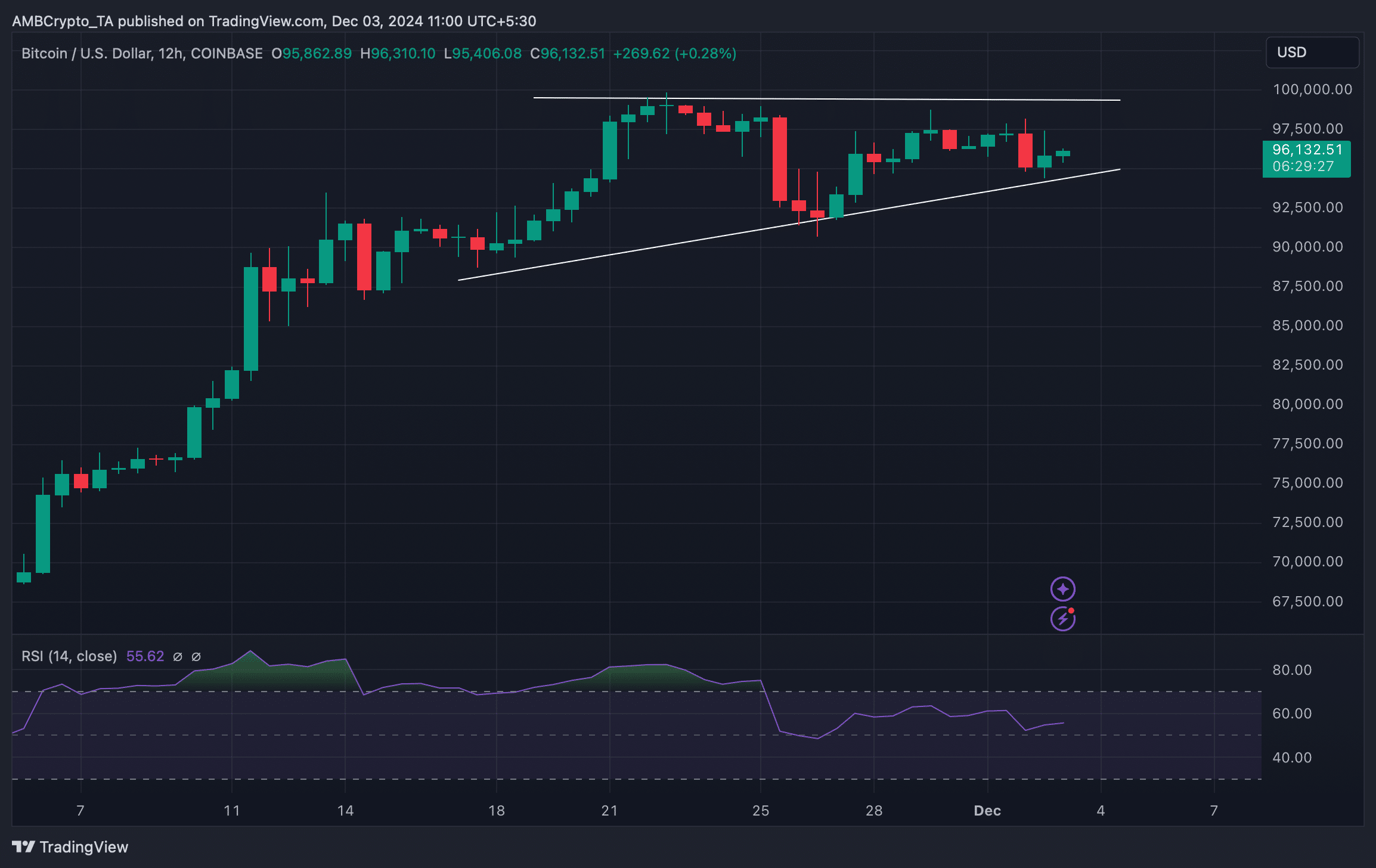

- Nonetheless, a bullish sample appeared on BTC’s 12-hour chart.

Bitcoin [BTC] momentum remained low because it continued to consolidate close to the $96k mark. The newest evaluation revealed a doable motive behind this development. The truth is, the evaluation additionally revealed that the continuing development would possibly proceed additional.

Bitcoin long-term holders’ plan

After touching $97k on the 2nd of December, Bitcoin’s worth plummeted to $94k. Nonetheless, the king coin gained slight bullish momentum because it as soon as once more crossed $96k.

This worth motion indicated a consolidation section inside this vary, because it was failing to fulfill buyers’ expectation of reaching $100k.

In the meantime, Alphractal, a knowledge analytics platform, posted a tweet stating how long-term holders’ actions is likely to be influencing BTC’s worth.

As per the tweet, LTHs have distributed a big quantity of BTC at a revenue, rising short-term promoting strain. This development is clearly mirrored within the Lengthy Time period Holders SOPR indicator.

Moreover, since late 2023, the addresses of those holders have continued to be at extraordinarily worthwhile ranges, in line with the Lengthy Time period Holders NUPL Heatmap.

This indicated that LTHs would possibly take extra revenue, presumably inflicting an additional rise in promoting strain. If that’s true, then this issue might be inflicting BTC’s worth to consolidate. The truth is, an identical development was seen throughout BTC’s earlier cycles.

The tweet talked about,

“It’s important to note that this distribution phase by Long-Term Holders can extend over several months, as observed in all previous cycles. This underscores their strategy of capitalizing on bullish cycles to move and realize profits from BTC held inactive for over 155 days.”

Will BTC proceed to consolidate?

Because the aforementioned evaluation instructed the opportunity of continued revenue taking, AMBCrypto checked different datasets to seek out whether or not additionally they recommend an identical future, which might prohibit BTC from shifting up.

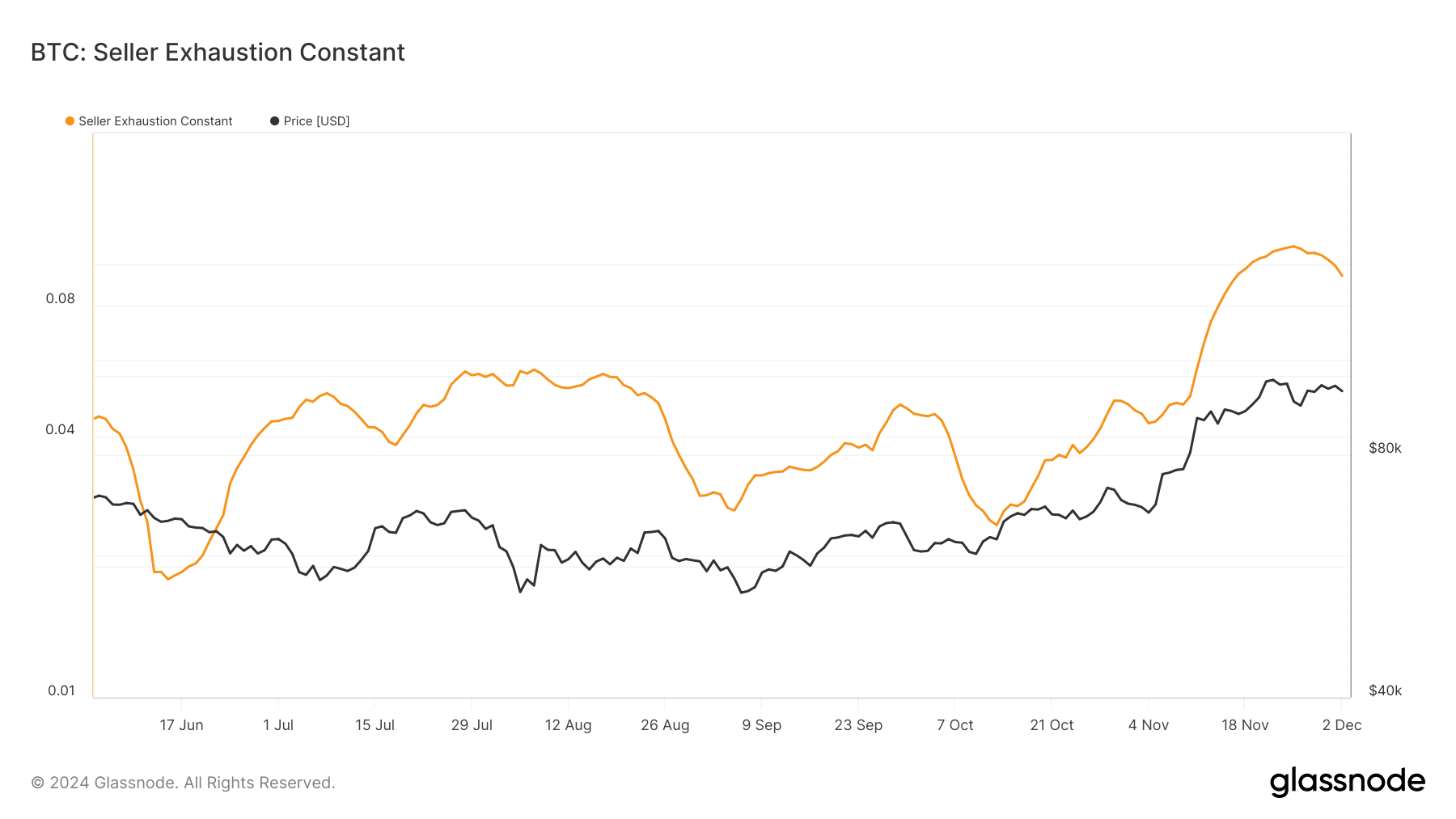

Glassnode’s knowledge revealed that BTC’s vendor exhaustion fixed began to say no after reaching a peak. On fairly a couple of events, when the metric dropped, it was adopted by slight worth upticks.

The Pi Cycle High indicator identified that BTC has a market high of over $124k. Subsequently, if revenue taking declines and shopping for strain rises, then it received’t be too formidable to count on BTC touching $100k within the coming weeks.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Moreover, we discovered that BTC’s worth was shifting inside a bullish ascending triangle sample. A profitable breakout above that mark might set off a contemporary bull rally.

The percentages of that occuring had been respectable, because the Relative Energy Index (RSI) registered an uptick. This meant that purchasing strain was rising, which has the potential to push BTC’s worth up.