- Bitcoin Coinbase Premium Index is now constructive.

- This alerts a spike in coin accumulation by US-based buyers.

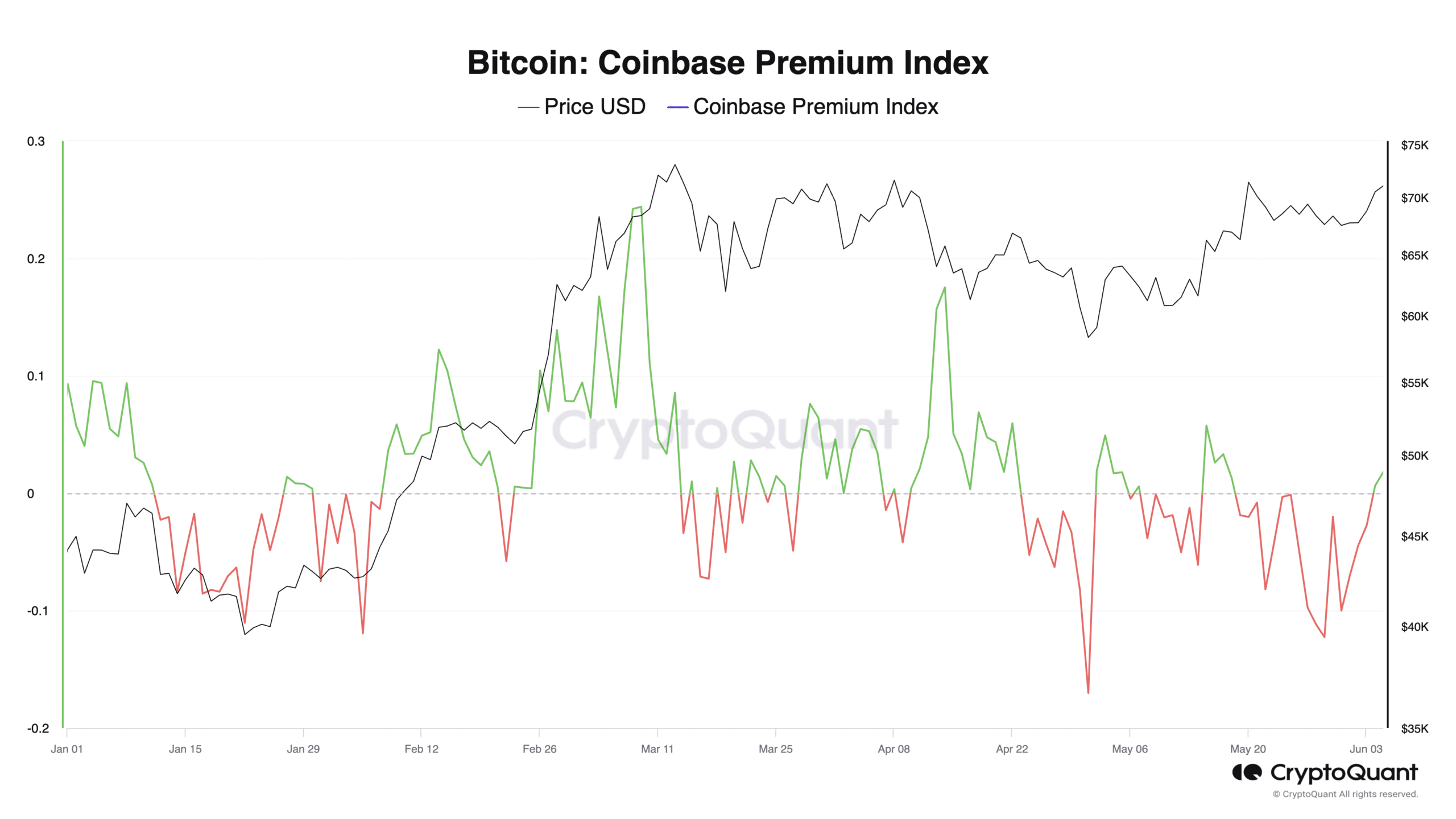

Bitcoin’s [BTC] Coinbase Premium Index (CPI) has turned constructive after returning unfavorable values for about ten days, pseudonymous CryptoQuant analyst BQYoutube has present in a brand new report.

This metric measures the distinction between BTC’s costs on Coinbase and Binance. When its worth is constructive, it means that the coin is priced greater on Coinbase in comparison with Binance. It’s interpreted to imply sturdy shopping for curiosity from US-based buyers.

Conversely, when it declines, and its worth is unfavorable, it alerts much less buying and selling exercise on the US-based alternate.

At press time, BTC’s CPI was 0.006.

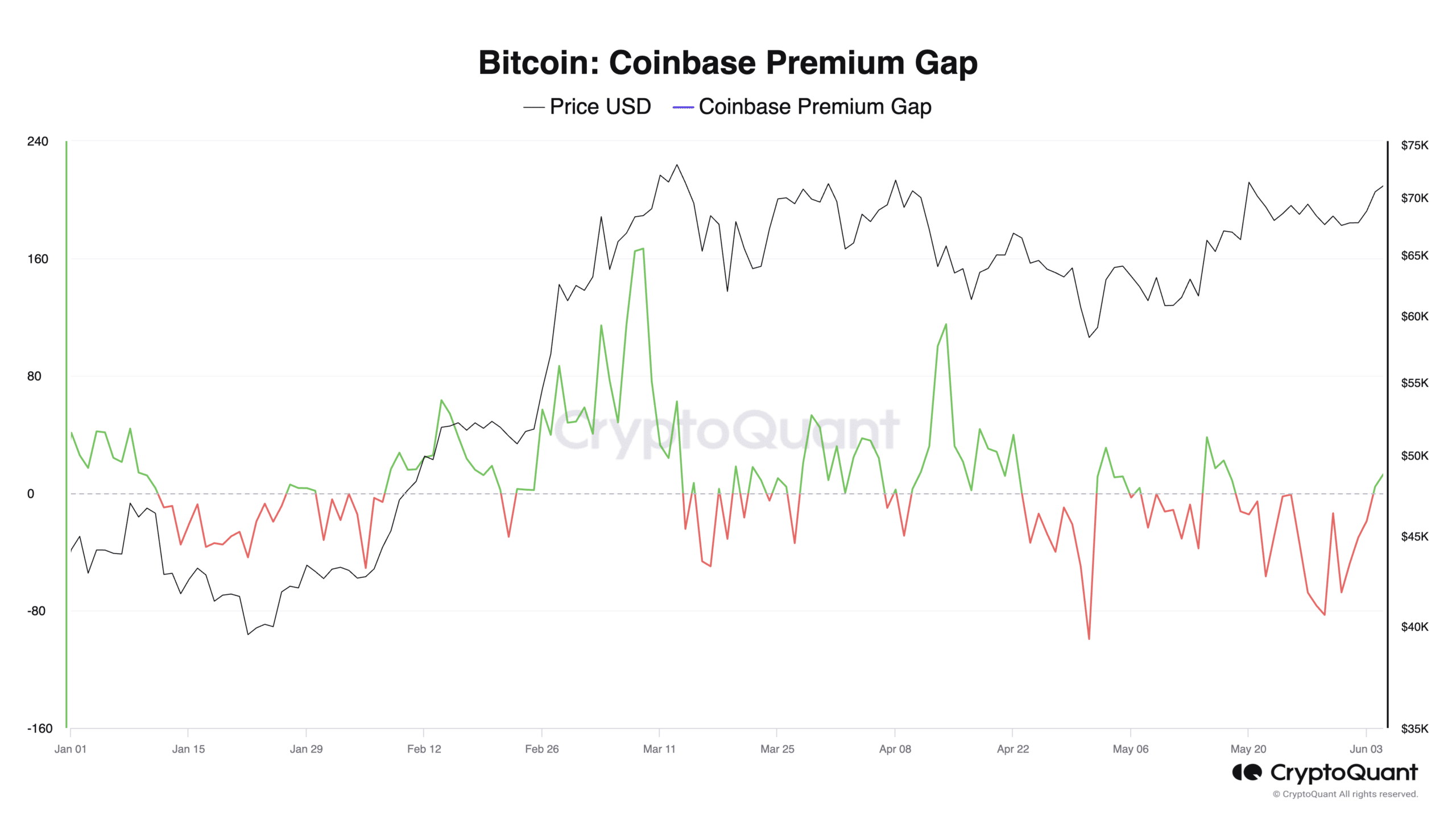

Confirming the resurgence in exercise from US-based BTC holders, BTC’s Coinbase Premium Hole was 4.48 at press time.

In line with CryptoQuant information, this was the primary time the metric had returned a constructive worth since 18th Might.

BTC merchants in Korea look away

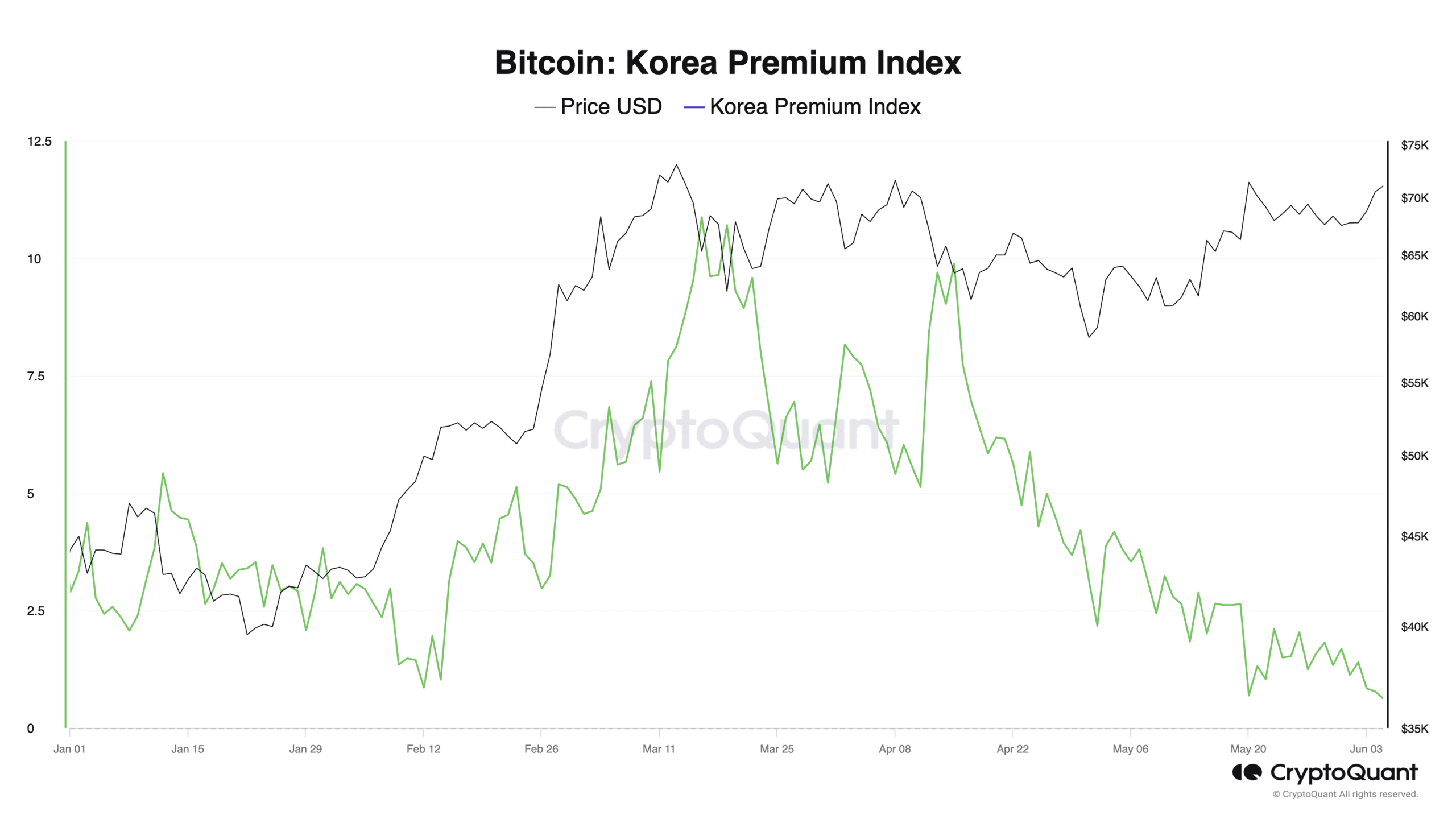

Though BTC’s Korean Premium Index (KPI) has trended downward since fifteenth April, it stays above the zero line. Additionally known as the Kimchi Premium, this index measures the hole between BTC costs on South Korean exchanges and different exchanges.

At 0.78 at press time, BTC’s Kimchi Premium was at its year-to-date low, signaling that regional demand for the coin by Korean buyers is at its lowest because the starting of the 12 months.

Detrimental sentiment follows the coin

At press time, BTC exchanged arms at $71,148. Its worth has risen by 10% prior to now 30 days. Throughout that interval, the coin traded briefly at $71,315 on twenty first Might earlier than witnessing a pull again.

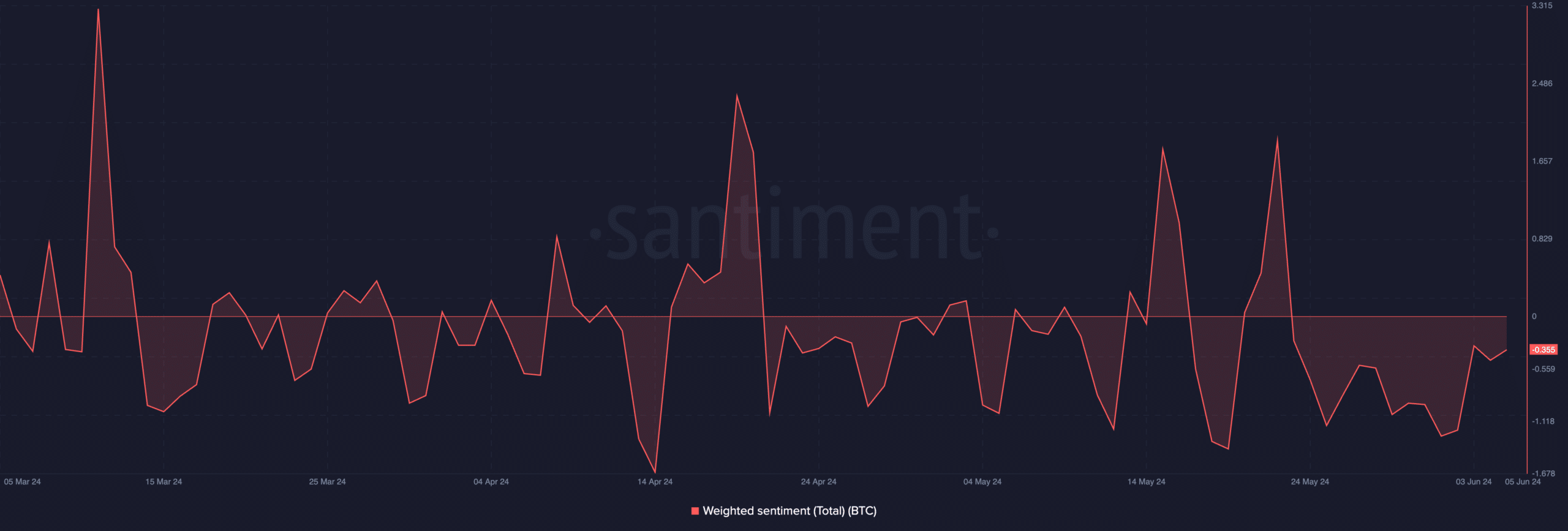

Nonetheless, regardless of BTC’s current worth rally, unfavorable sentiment trails the coin. At press time, its weighted sentiment was -0.355. Actually, the worth of this metric has been unfavorable since twenty fourth Might.

This means that regardless of its worth rally prior to now few weeks, there may be nonetheless a bearish bias towards the main coin amongst market individuals.

This has been the case even with the every day earnings made by coin holders.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

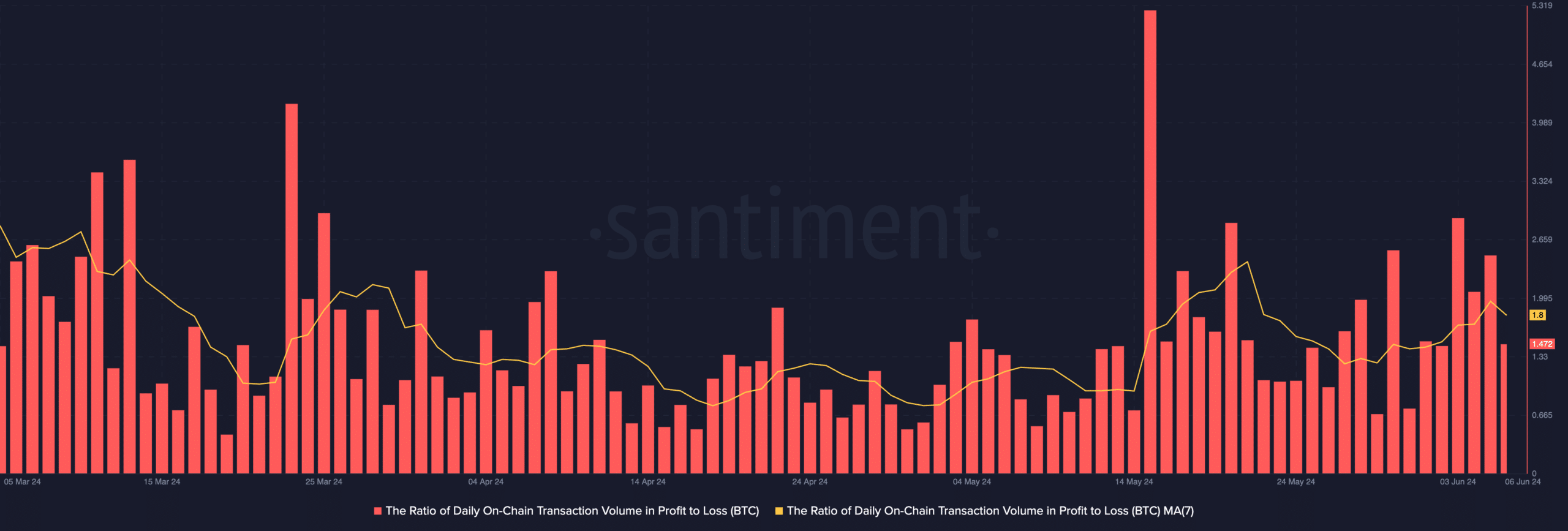

AMBCrypto assessed the every day ratio of BTC transaction quantity in revenue to loss (utilizing a seven-day) transferring common and returned a worth of 1.8.

This confirmed that for each BTC transaction that led to a loss prior to now few weeks, 1.8 transactions have returned a revenue.