- Bitcoin’s value foundation revealed stark distinction between long-term holders and up to date consumers

- SOPR maintained 1.04 stage as whale addresses amassed by way of the $105K take a look at

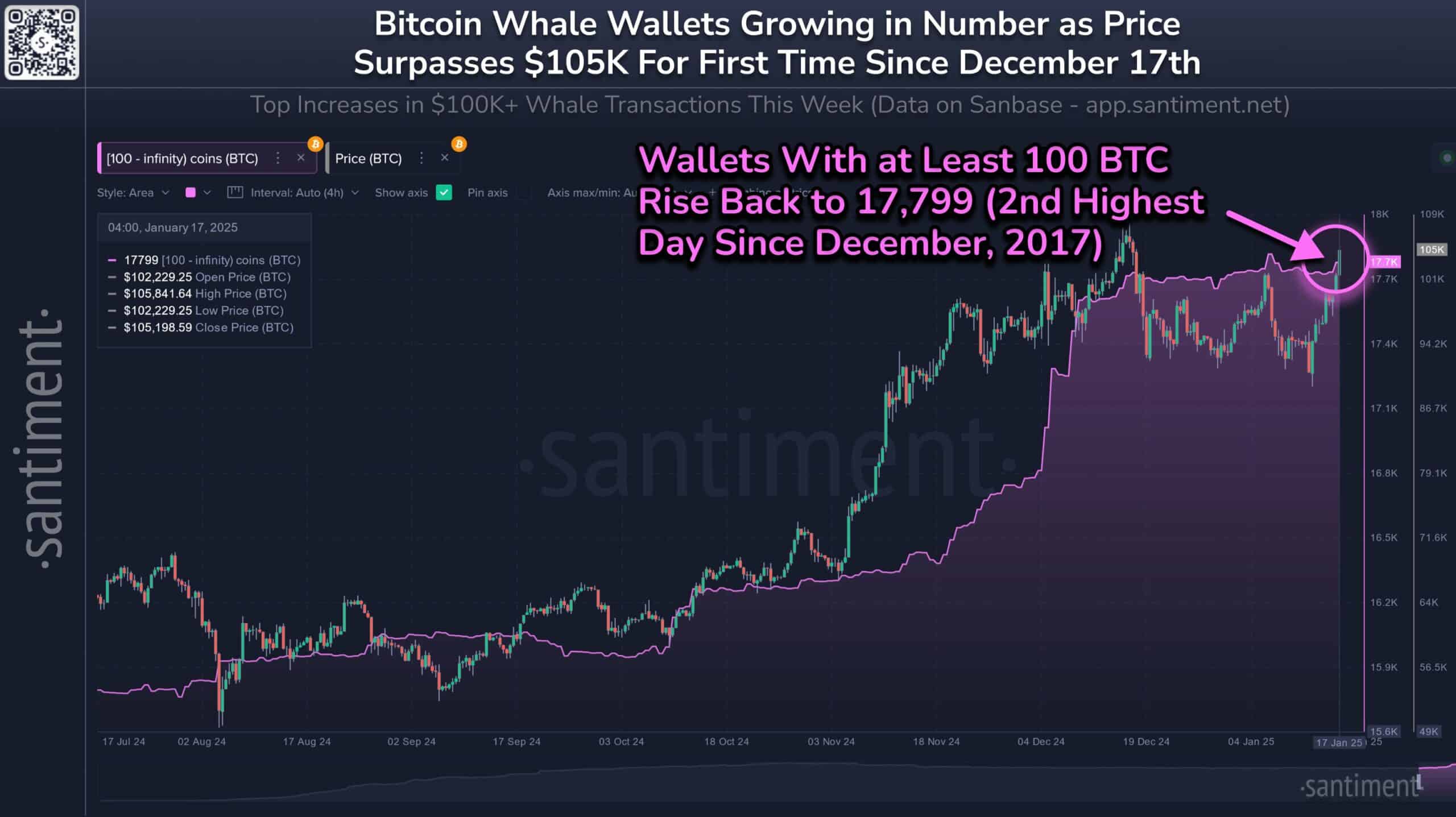

Bitcoin’s market construction has been noting a major shift after whale addresses reached ranges not seen since December 2017. The shift appears to be corresponding with the crypto’s value motion testing the essential resistance above $105,000.

This institutional positioning comes amid a transparent divergence between long-term and short-term holder conduct. The development additionally paints a compelling image of market maturity.

Strategic Bitcoin whale positioning intensifies

On the time of writing, the variety of addresses holding a minimum of 100 Bitcoin had surged to 17,799 – Marking its second-highest stage since December 2017. This milestone coincided with BTC’s newest push to $105,841.64 – An indication of strategic accumulation by institutional gamers.

Significantly noteworthy is the steep accumulation sample that started in October 2024, when whale addresses numbered round 16,200 – Representing a virtually 10% hike in large-holder focus over simply three months.

The acceleration in whale accumulation throughout the November-December interval notably corresponded with Bitcoin’s sustained break above the $90,000-level.

Bitcoin’s market construction indicators maturity

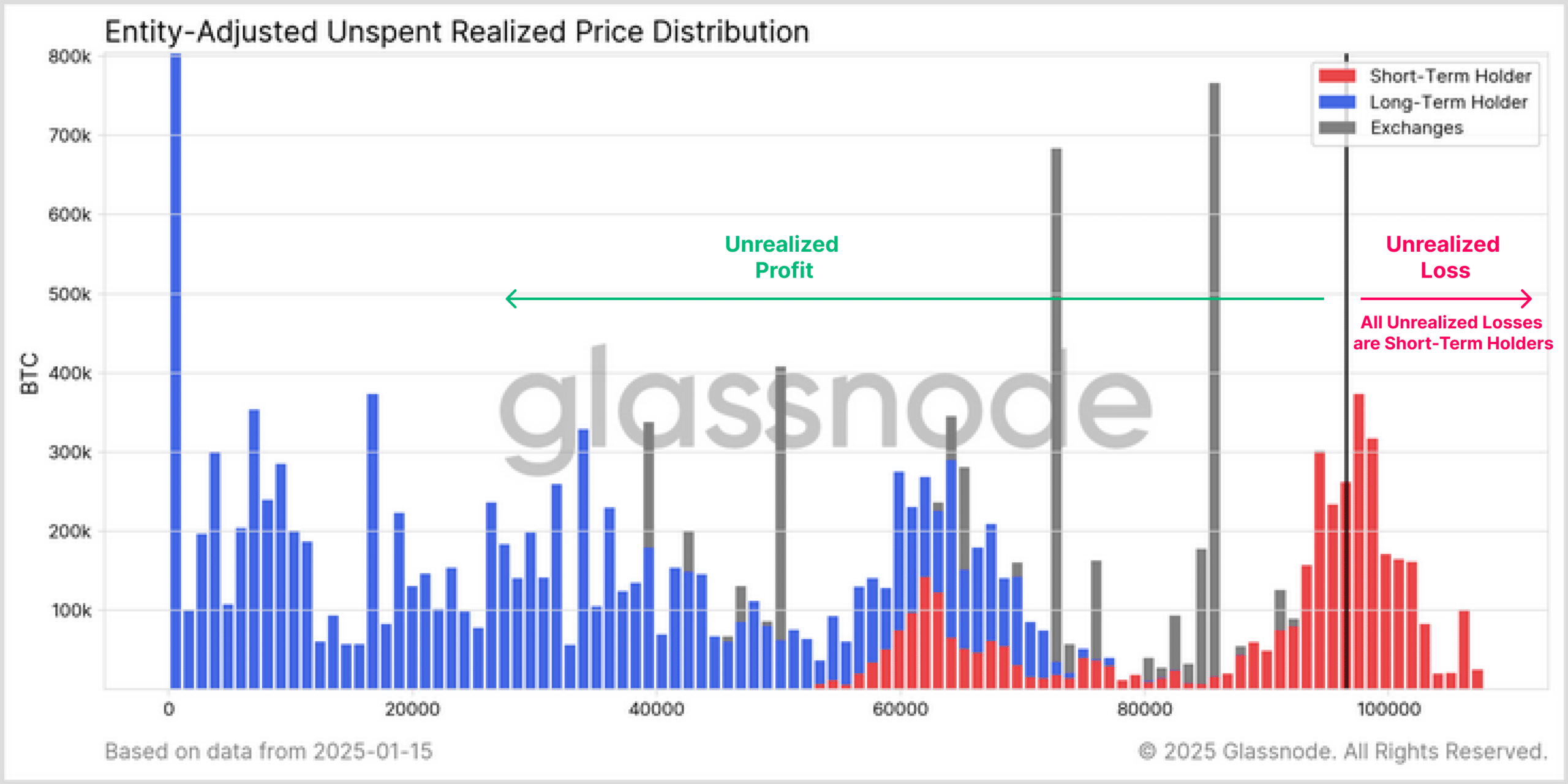

Additional strengthening this bullish narrative, Bitcoin’s value foundation distribution highlighted a telling market dynamic.

The information confirmed unrealized losses completely concentrated amongst short-term holders who entered positions inside the final 155 days. Lengthy-term holders keep vital unrealized earnings, with substantial accumulation zones seen within the 20,000-40,000 BTC vary.

Most putting appeared to be the distinction between long-term holder conduct, as highlighted by the blue bars clustering round cheaper price ranges, and short-term positions marked in crimson at greater costs.

Trade holdings, represented by grey bars, underlined periodic spikes above 600,000 BTC. This, once more, hinted at strategic institutional positioning moderately than panic promoting.

Sturdy technical basis helps BTC’s uptrend

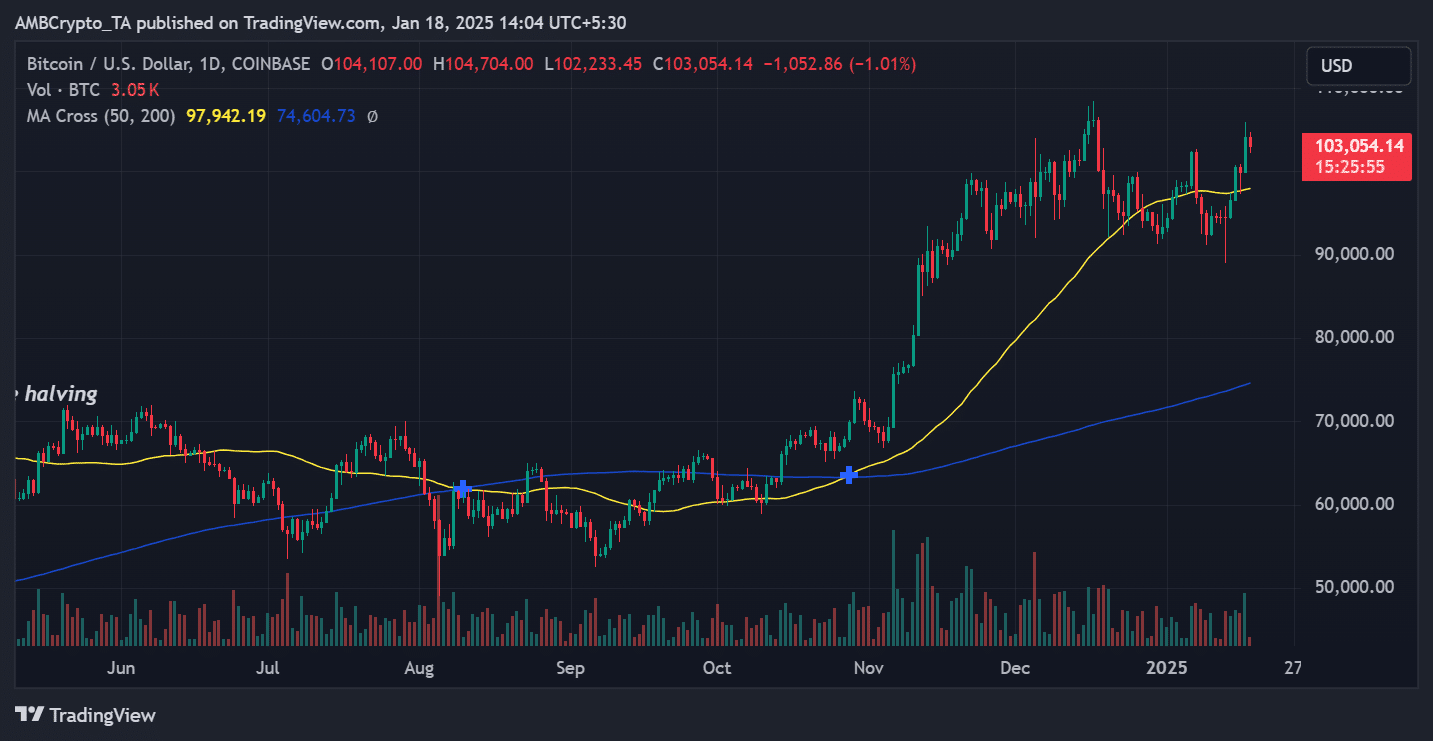

Supporting these on-chain metrics, Bitcoin’s value motion maintained its bullish momentum on the charts, with the 50-day shifting common at $97,942.19 offering dynamic help properly above the 200-day MA at $74,604.73.

This vital hole between shifting averages, over $23,000, highlighted robust upward momentum.

The latest buying and selling quantity of three.05K BTC at $103,054.14 demonstrated sustained institutional curiosity, whereas the sequence of upper lows since November fashioned a strong technical basis.

The latest pullback from $105,841.64 to its press time ranges represented a wholesome consolidation, moderately than a development reversal.

On-chain metrics verify Bitcoin’s energy

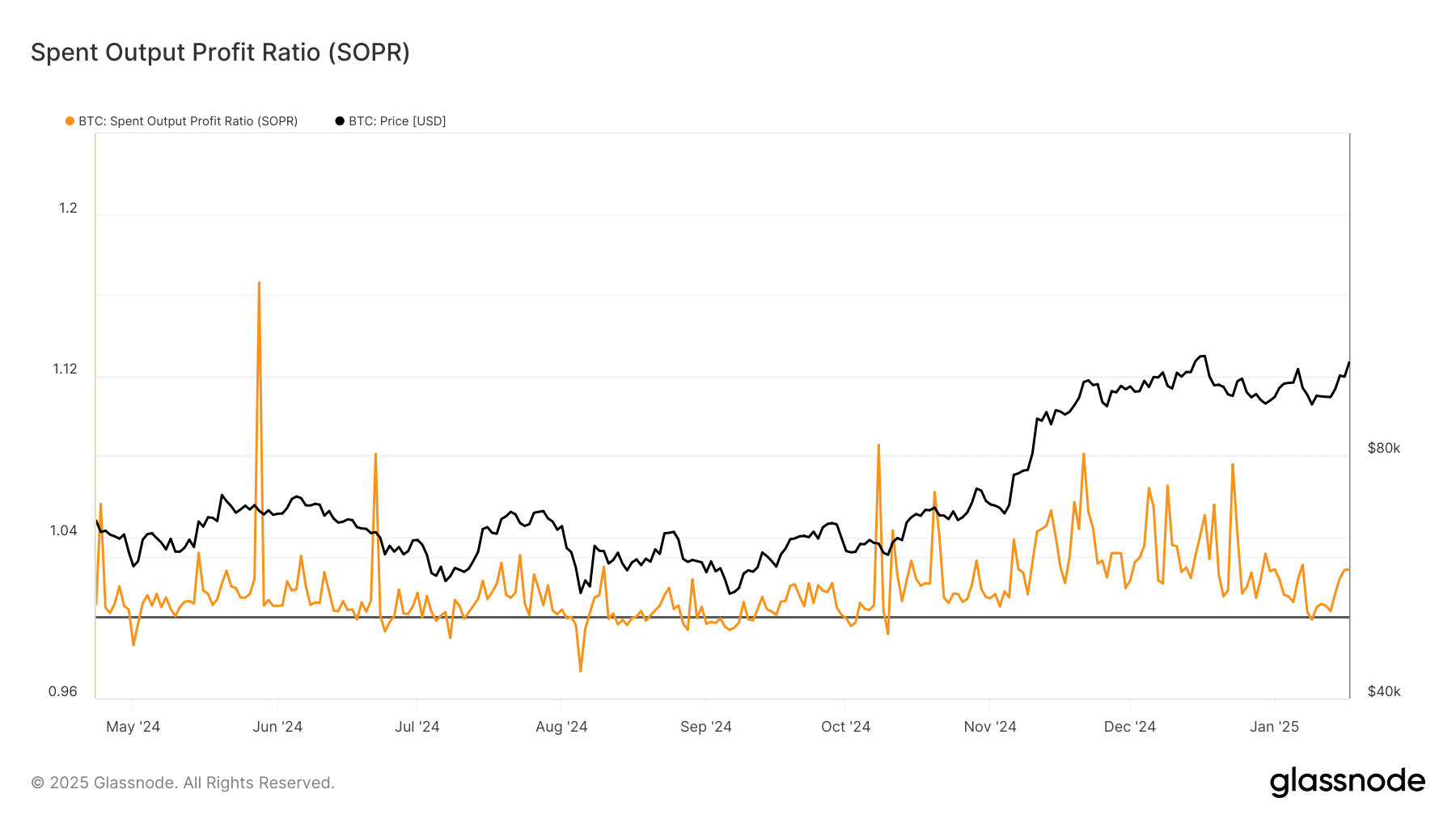

The Spent Output Revenue Ratio (SOPR) added one other layer of confidence, sustaining ranges constantly above 1.0 since November’s surge. This metric, hovering round 1.04, indicated that almost all Bitcoin transactions have been realizing modest earnings, with out triggering mass promoting.

Lastly, trade netflow patterns confirmed a calculated distribution method, with constructive inflows of 308.7 BTC suggesting managed accumulation moderately than distribution.

Historic netflow spikes, notably these seen in December, have preceded vital value actions, indicating strategic positioning by massive gamers.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Wanting forward, Bitcoin’s capability to carry above the psychological $100,000-level whereas institutional wallets proceed rising may sign strengthening market fundamentals. The convergence of a number of constructive indicators – report whale addresses, wholesome SOPR ranges, robust shifting common help, and strategic trade flows – suggests BTC’s market construction stays sturdy.

Nonetheless, merchants ought to carefully monitor the $105,000 resistance stage. A decisive break above this threshold may set off the subsequent vital transfer.