- U.S CPI information rose to 0.3%, barely beneath the anticipated 0.4% in April.

- Market noticed some aid after April’s sluggish inflation studying, with BTC leaping by +5%

Danger-on markets, together with Bitcoin [BTC], noticed some aid after United States’ CPI information revealed that inflation didn’t get a lot worse in April.

In line with the U.S Bureau of Labor Statistics (BLS), CPI (Client Worth Index) rose 0.3% in April, barely decrease than the anticipated 0.4%. CPI is a key information level for Fed fee selections and tracks what customers pay for items and companies to gauge inflation.

The truth is, the studying steered that inflation cooled barely in April, giving the markets a much-needed breather after a whole lot of muted worth motion.

Bitcoin swings, eyes the short-term provide at $65K

AMBCrypto lately coated how this week’s Fed calendar and bigger macro occasions may have an effect on BTC worth motion. The decrease studying from the CPI boosted risk-on markets, with BTC main the fray.

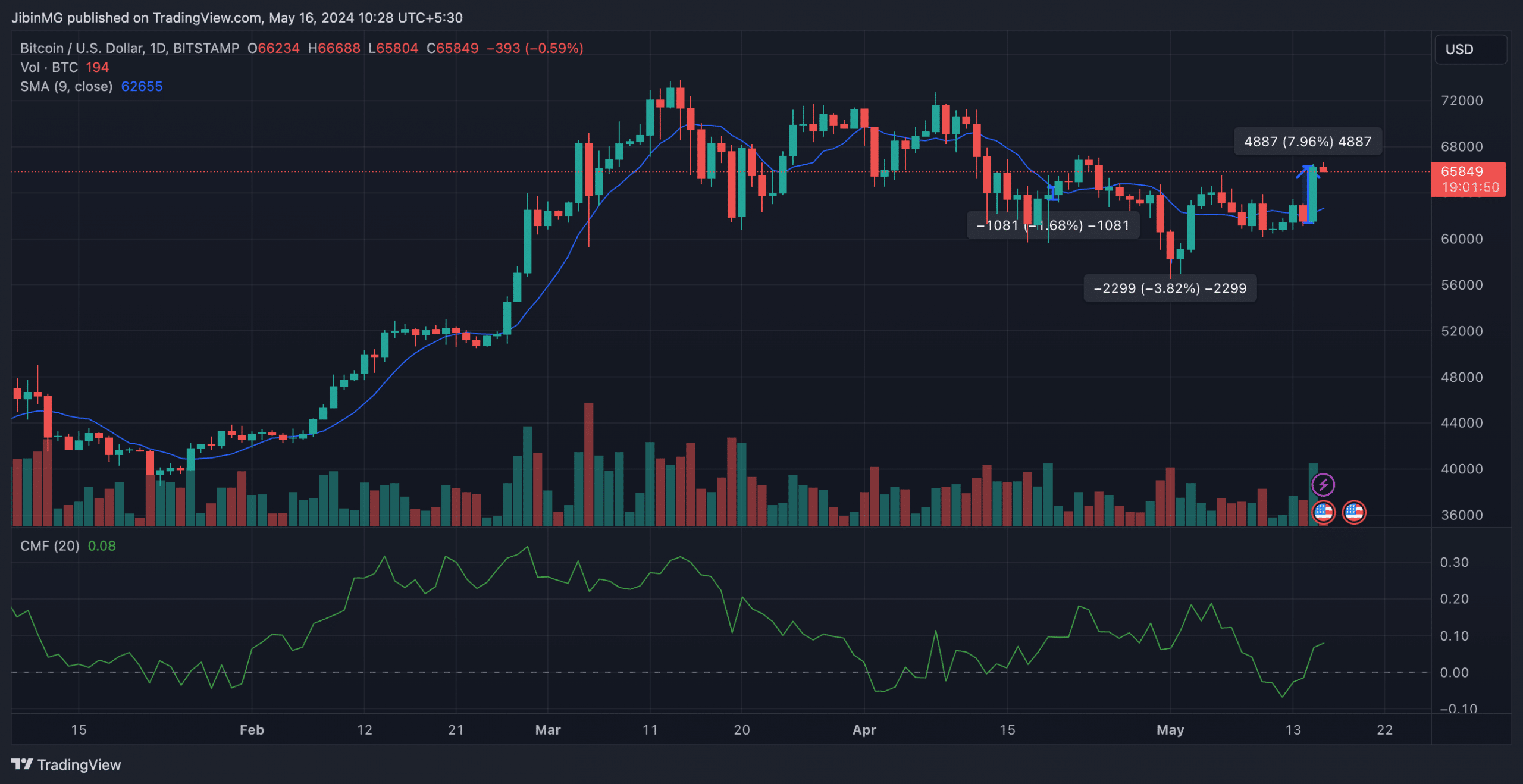

On the worth chart, the king coin rallied by over 5% and cleared its short-term spot provide (resistance) stage at $63k. On the time of writing, it was buying and selling at a worth effectively previous $65,000.

The aforementioned transfer may flip BTC’s market construction to bullish on the decrease timeframes (LTF), particularly on the 4H chart, if the candlestick closes above it. It’s price noting, nonetheless, that the market construction on greater timeframes stays bearish except BTC decisively closes above $66k.

Pseudonymous crypto-trader and analyst, Skew, shared an analogous projection after the CPI information was launched. After Bitcoin appreciated previous $63,000, the dealer famous,

“Spot supply around $65K now. Thin spot books, so spot taker flow will be vital in order to trend with bullish pricing so far in risk assets”

Moreover, the dealer marked $63k and $63.5k as key worth ranges for a draw back transfer.

Wait and watch

Regardless of the marginally decrease CPI studying, the Fed may look forward to a affirmation of sluggish inflation earlier than reducing rates of interest although.

Since BTC’s worth motion is fixated on Fed fee expectations, a transparent worth course could be picked after June’s Fed assembly. Within the meantime, BTC may lengthen its choppiness inside the $60K—$70K vary till the following Fed fee resolution.