- Merchants ought to watch the $61,500 resistance intently, as a break above this stage might verify a robust restoration.

- Derivates knowledge confirmed a slight bullish edge, with the lengthy/brief ratio favoring the bulls.

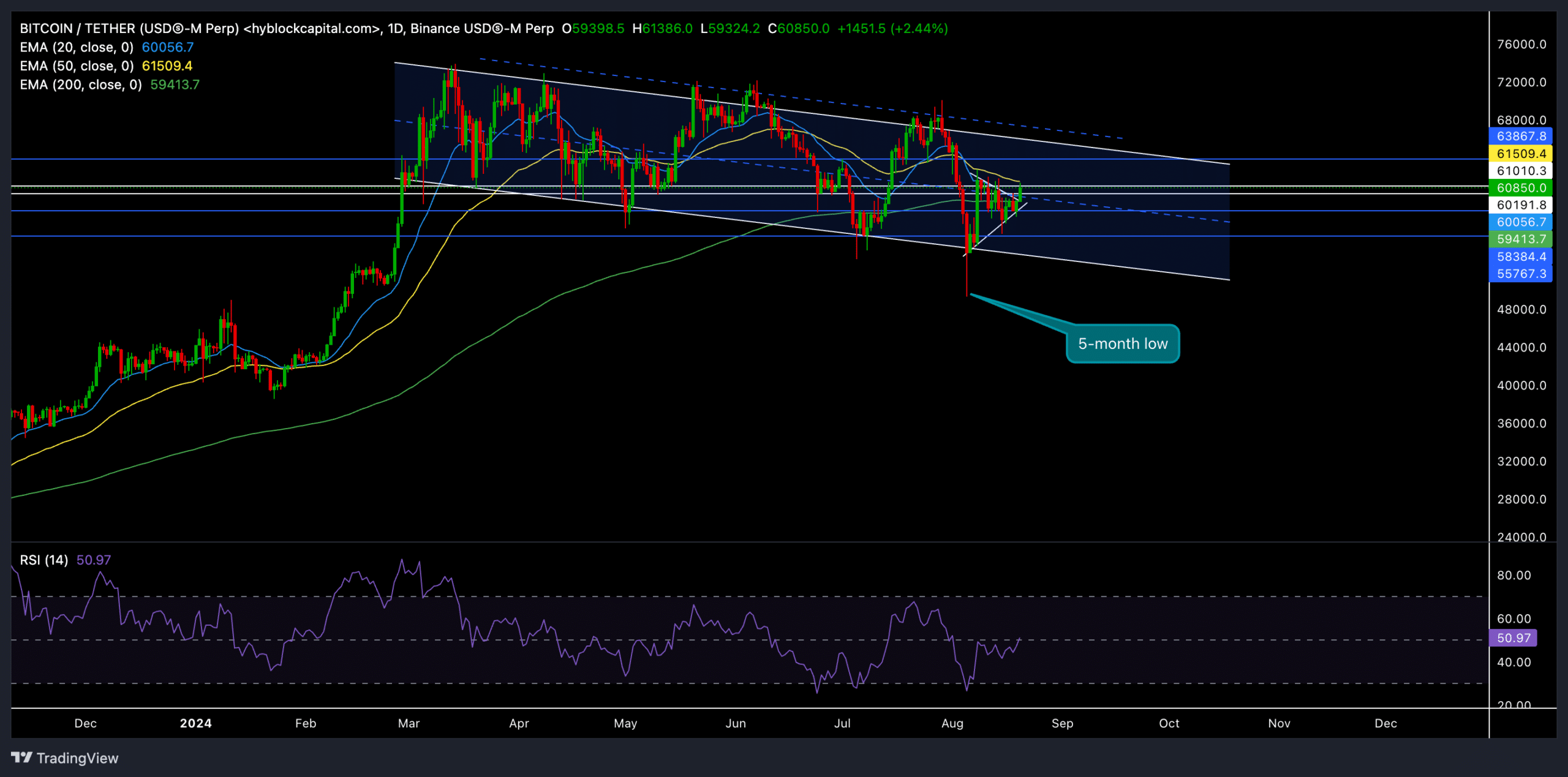

The current value motion of Bitcoin [BTC] confirmed a interval of consolidation following a dip to its 5-month low. Regardless of a spike in quantity and a moderately modest restoration, Bitcoin stays inside a vital vary that might decide its subsequent transfer.

The worth is presently buying and selling at $60,850, up by practically 2% within the final 24 hours. It just lately bounced off a 5-month low, discovering help across the $59,413 stage, which coincided with the 200-day EMA.

Bitcoin makes an attempt to rebound amid market volatility

The 50-day EMA at $61,509 is a vital stage that the bulls must reclaim for a sustained restoration.

It’s price noting that the present value is hovering round these EMAs, indicating an in depth battle between patrons and sellers.

A break above the 50-day EMA might open the door for additional positive aspects, whereas a failure to carry above the 20-day EMA may result in one other retest of decrease help ranges.

The RSI (Relative Power Index) is presently simply above the 50 mark, exhibiting a impartial stance. This implies that Bitcoin is at a important juncture the place the following transfer might decide the brief to medium-term development.

The current improve in quantity and open curiosity means that merchants are positioning for a possible transfer, however broader market sentiment will play a key position.

Key ranges to observe

On the time of writing, the speedy resistance was $61,509 (50-day EMA). If BTC can break and maintain above this stage, the following goal can be the $63,867 resistance stage, adopted by a possible check of the $66,000 area.

On the draw back, the help at $59,413 (200-day EMA) is essential. A break under this stage might result in a deeper correction, with the following help across the $54-$57K stage.

In the meantime, the derivatives knowledge confirmed a bullish tilt, with quantity up by 21% to $54.88B and open curiosity growing by practically 3% to $30.89B.

The lengthy/brief ratio for the final 24 hours stood at 1.0358, barely favoring the longs.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

On Binance, the BTC/USDT lengthy/brief ratio was 1.3223—exhibiting that many merchants have been nonetheless betting on a continuation of the current bounce.

Buyers also needs to monitor exterior elements comparable to macroeconomic developments and broader market sentiment, as these will seemingly affect BTC’s value motion within the close to time period.