- Bitcoin outflows from exchanges peaked at $148 billion when it hit $88K, establishing a robust help base.

- Now, an much more sturdy base has emerged, a sign it is best to strategy with warning.

With a capped provide of 21 million, Bitcoin’s [BTC] market cap has soared previous $2 trillion, with every BTC valued at $102,383 on the time of writing. Clearly. the stakes have by no means been larger.

Whereas Bitcoin nonetheless trails conventional Twentieth-century belongings with $450 trillion tied up in bonds and actual property, the king coin’s speedy bounce from $67K to $102K in simply 40 days alerts a future that’s laborious to disregard.

However, as is usually the case with quick positive aspects, the short-term outlook for Bitcoin is way from sure.

With $148 billion in stablecoins flooding the market on the $88K mark, these traders have already bagged a 15% revenue, making this value level seem like a golden entry.

As historical past exhibits, the temptation to money out at a major achieve may very well be too sturdy to withstand. This creates a high-stakes scenario, placing traders’ danger urge for food to the take a look at because the market braces for potential sell-offs.

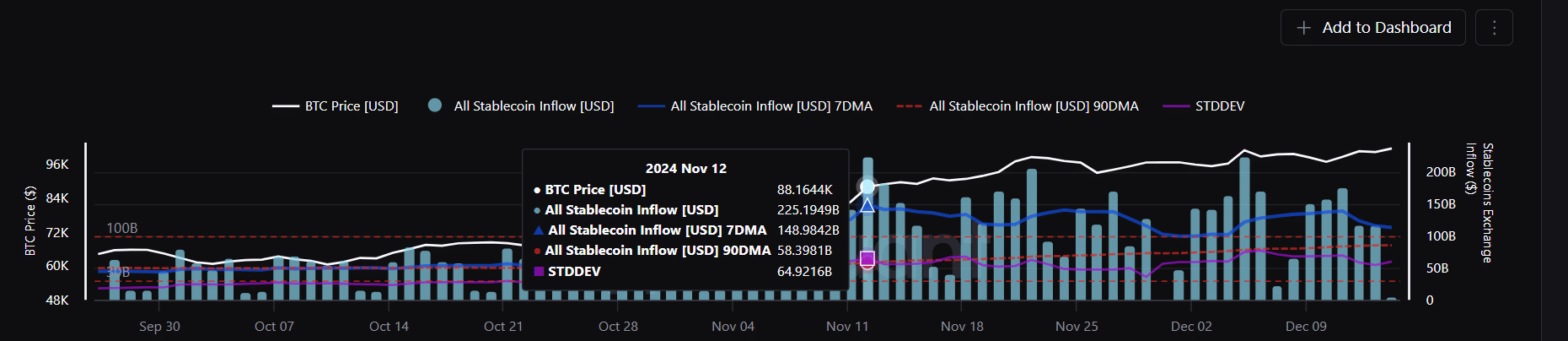

Huge stablecoin inflow may very well be a warning sign

Sometimes, when stablecoins flood into exchanges, it alerts a bullish outlook. Buyers are positioning themselves to purchase Bitcoin as soon as market volatility settles.

This development turned notably clear through the election, when the “Trump pump” introduced in huge liquidity, with $2 billion value of USDT minted.

Economically, the inflow of stablecoins was immediately tied to a surge in Bitcoin demand, pushing its value to $88K in underneath every week.

The demand for BTC peaked at this value level, with $148 billion in stablecoins, particularly ERC-20 tokens, flooding into exchanges.

Clearly, traders had been assured that BTC would breach $100K, a minimum of earlier than the election pump runs its course.

This brings us to some compelling insights: First, these traders are comfortably “in-the-money,” poised to both HODL or money out at a revenue.

Second, with the election pump shedding steam, the market desperately wants a recent catalyst to maintain these holders from hitting the promote button.

And third, if promoting does kick off, the large query is whether or not the market has the energy to soak up the stress.

Regardless of December being properly underway, BTC has but to submit a brand new all-time excessive, a milestone briefly reached over every week in the past when it hit $104K.

Since then, it’s been in a holding sample, leaving market watchers divided on its subsequent transfer.

Are Bitcoin traders shedding their danger urge for food?

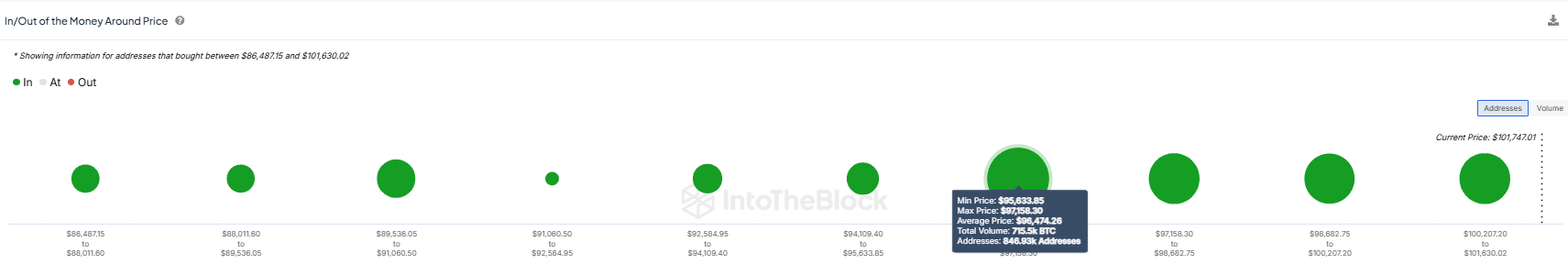

The $88K mark has clearly confirmed to be a lovely entry level. This was additionally demonstrated when Bitcoin dropped simply over 5% to $90K, 4 days after testing the $99K stage for the primary time.

However earlier than it might dip additional, a 4% rebound the following day rapidly introduced it again into the inexperienced. Since then, bears have tried twice to push Bitcoin again to that stage, however every try has failed.

In consequence, a brand new backside has shaped between $94K and $96K.

Why is that this vital? The chart above exhibits a major surge in stablecoin inflows, with $131 billion flowing into exchanges at this value level.

Much more telling, over 840K addresses – marking the best variety of holders at this stage – acquired a complete of 715.5K BTC.

This creates a robust help base between $94K and $96K, making it vital for BTC to carry above this vary should you’re “long” on it.

On the one hand, the knowledge means that institutional gamers are stepping in to soak up the promoting stress.

Nonetheless, there’s a shift occurring: investor greed is on the decline. As BTC’s value climbs, many have gotten extra cautious, seeing the worth as too excessive to leap in.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

This hesitation alerts that retail traders could also be ready for a dip earlier than deciding to enter the market. Curiously, the stablecoin market factors to the $96K stage as a lovely entry level.

This may very well be one thing to keep watch over within the coming days.