- Bitcoin may rally as much as the $62,000 stage, primarily based on historic value momentum.

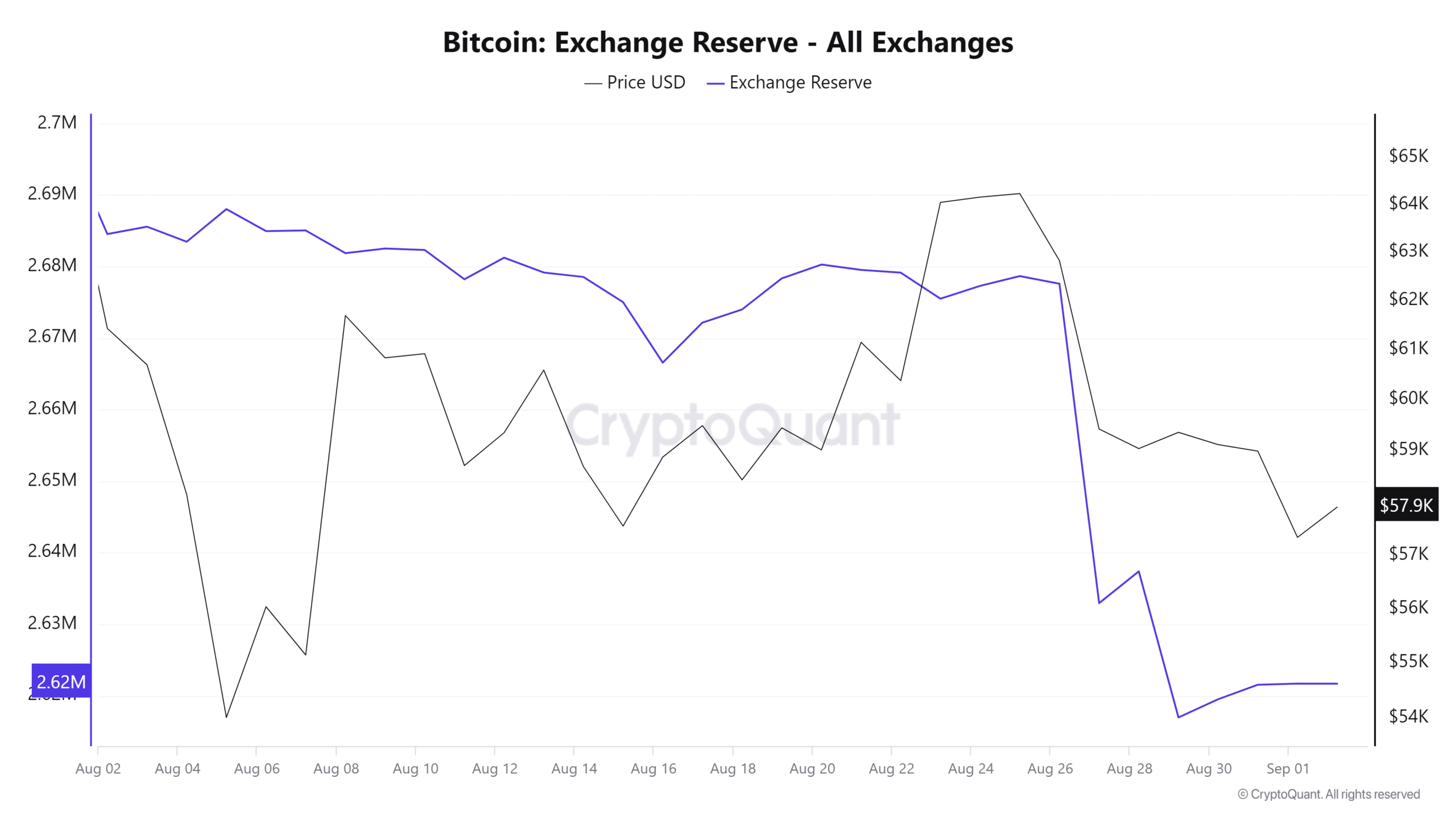

- BTC change reserve information confirmed potential shopping for strain from buyers, because it has considerably fallen in latest days.

On this bearish market sentiment, crypto whales had been aggressively shopping for the dip as main cryptocurrencies, together with Bitcoin [BTC] and Ethereum [ETH], noticed vital value declines.

On the 2nd of September, on-chain analytic agency Spot On Chain made a put up on X (previously Twitter) {that a} Bitcoin whale had bought almost 1,000 BTC price $57.4 million from Binance [BNB].

Bitcoin whales purchase the dip

Moreover, the identical whale had bought almost 2,000 BTC price $117 million, from Binance within the final 4 days at a mean value of $58,525.

With the latest buy, the whales’ Bitcoin holding elevated to eight,559 BTC price $494 million.

Beforehand, the whale had dumped an enormous 7,790 BTC price $467 million of BTC in July 2024, earlier than the market sentiment turned bearish.

Upcoming ranges

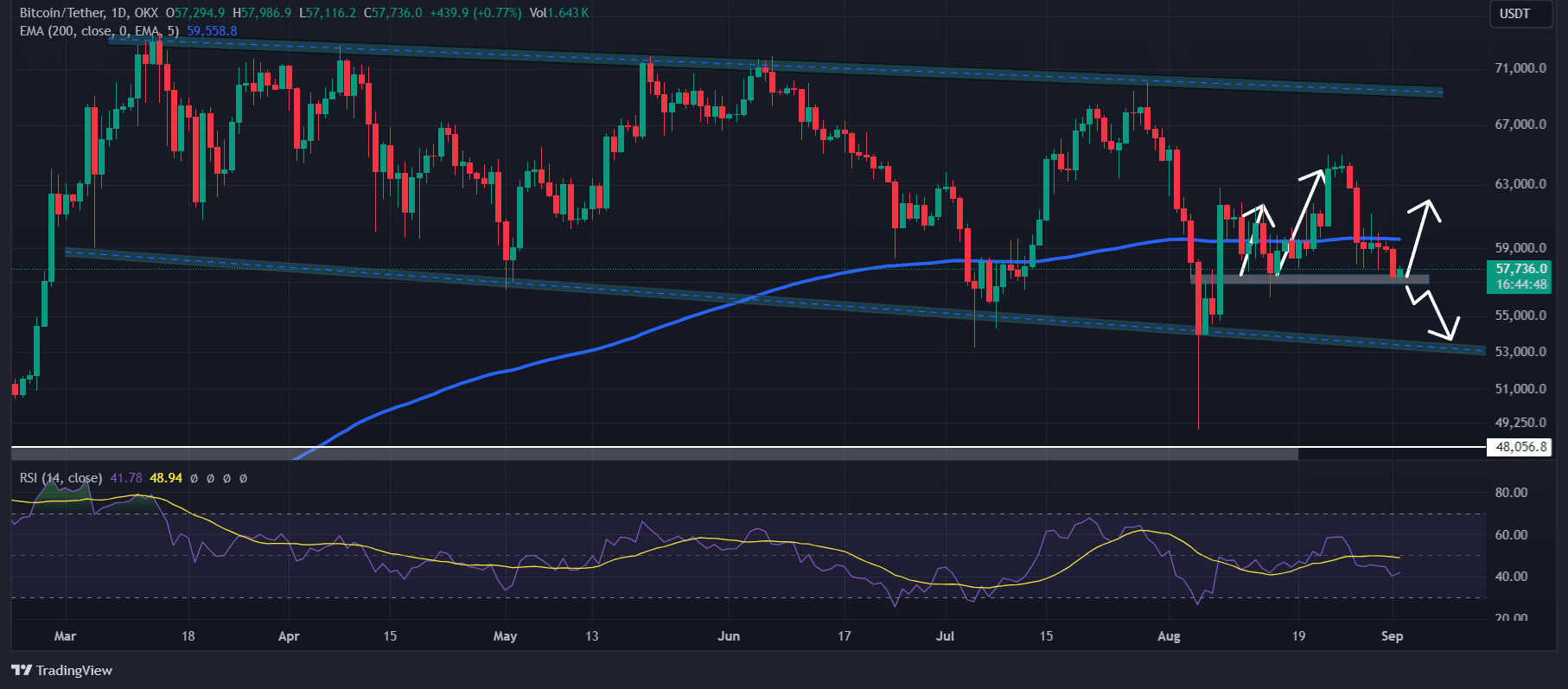

AMBCrypto’s take a look at TradingView’s information revealed that the king coin was at a vital help stage of $57,300 at press time. On a every day time-frame, it was buying and selling beneath the 200 Exponential Shifting Common (EMA).

The worth beneath the 200 EMA indicated that it was in a downtrend right now.

On this market downturn, each time BTC reaches this stage, it experiences shopping for strain and an upward rally. There may be excessive hypothesis of an upside rally as much as the $62,000 stage this time.

Moreover, the technical indicator Relative Power Index (RSI) was in an oversold space, indicating potential value reversal, which is a constructive signal for buyers and merchants.

Bullish outlook emerges

Different on-chain information additionally supported this bullish outlook. CryptoQuant’s BTC change reserve information confirmed potential shopping for strain from buyers, because the change reserve has considerably fallen in latest days.

In the meantime, CoinGlass’s BTC Lengthy/Brief Ratio chart stood at 1.0043 at press time, the best stage for the reason that twenty sixth of August, indicating bullish market sentiment.

BTC was buying and selling close to the $57,730 stage right now, having skilled a modest value drop of a decline of 0.8% within the final 24 hours. In the meantime, its Open Curiosity dropped by 1% throughout the identical interval.

Key liquidation ranges

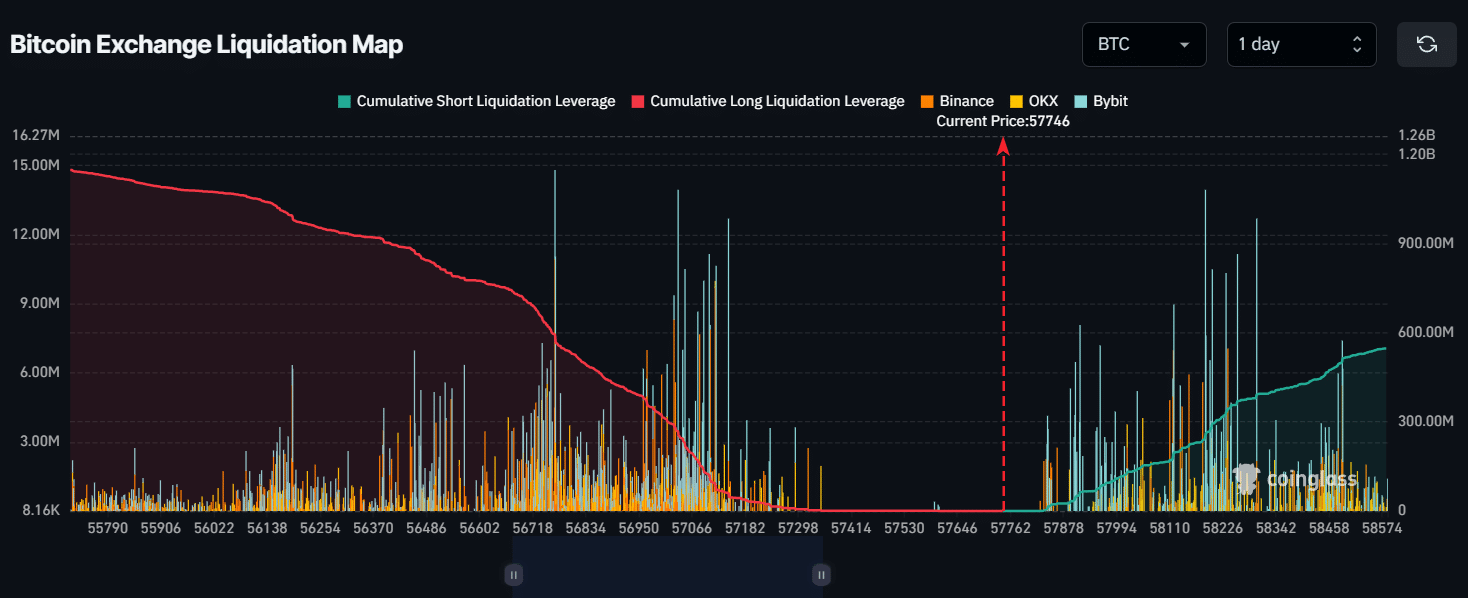

AMBCrypto’s take a look at CoinGlass’ Bitcoin change liquidation map signaled that bulls had been dominating and probably liquidating brief positions at press time.

Main liquidation ranges had been close to the $56,760 stage on the decrease facet and the $58,300 stage on the higher facet, as merchants are over-leveraged at these ranges.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

If the sentiment stays bearish and the BTC value falls to the $56,760 stage, almost $600 million price of lengthy positions will likely be liquidated.

Conversely, if the sentiment shifts and the value rises to the $58,300 stage, roughly $390 million briefly positions will likely be liquidated.