- Whale cohorts have tried to soak up aggressive promoting, seizing the “dip”.

- Nonetheless, they might not have established a market backside, but.

Bitcoin [BTC] is at a vital crossroads as bulls wrestle to interrupt resistance after a September rally introduced costs near $65K.

Priced at $60,480 at press time, the anticipated repetition of the late July cycle hasn’t materialized, with bears retreating and bulls concentrating on the following resistance at $68K.

Bearish strain stays, elevating fears of a deeper pullback; if bulls falter, BTC may retrace to round $55K. Nonetheless, a big occasion has sparked optimism, fueling hypothesis that this inflow of demand may catalyze a short-squeeze.

Bitcoin whale confidence rises

Whale cohorts holding 1K to 10K BTC have displayed confidence in Bitcoin’s future positive factors, buying over 50K BTC within the final 10 days, valued at roughly $3.14B.

Curiously, this shopping for surge coincided with a interval when Bitcoin confronted strain from short-sellers after rising near $63K. These purchases have prevented a big pullback, aiding Bitcoin’s ascent towards the $65K resistance.

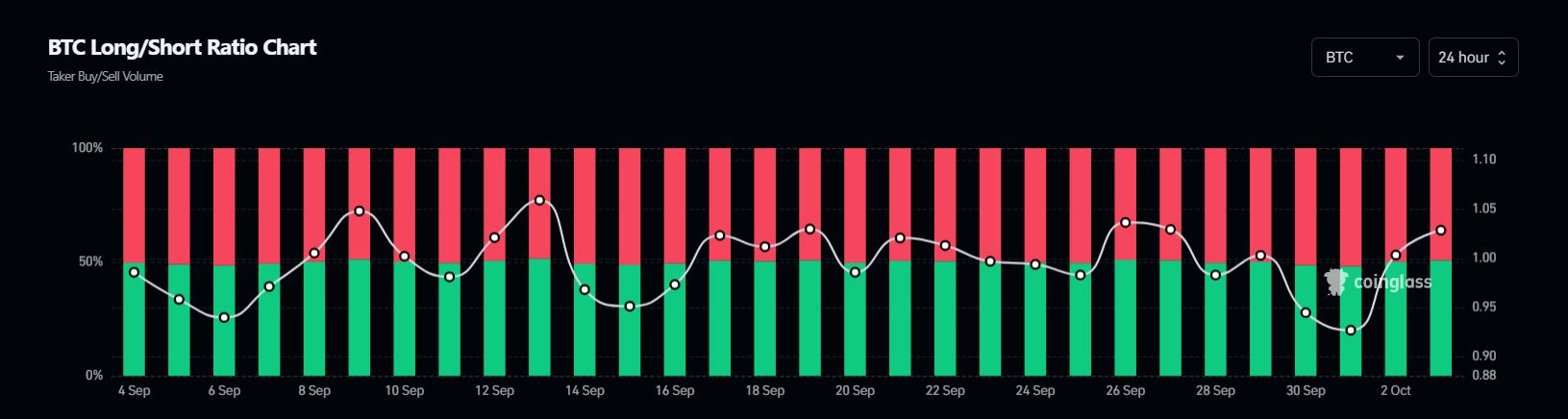

Put merely, shorts regained management within the derivatives market in the course of the mid-September rally, exerting strain on BTC for a pullback. Nonetheless, whale accumulation absorbed this strain, making a scenario ripe for a short-squeeze.

If the same pattern unfolds, brief liquidations might be triggered, doubtlessly changing into a catalyst for a big rebound.

Placing brief positions in danger

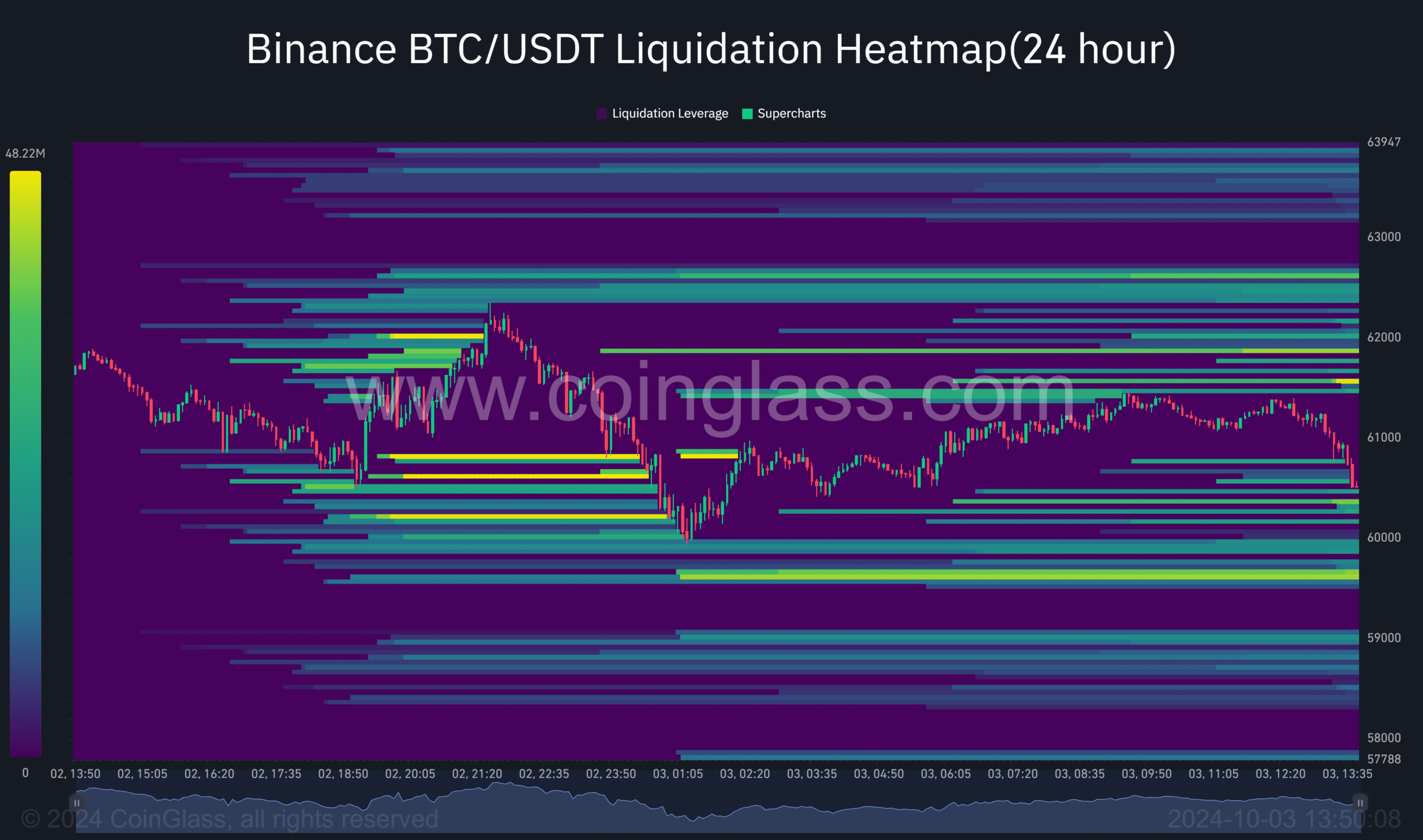

At current, a rebound to $61K presents a robust liquidity pocket, holding roughly $40M in leverage. An in depth close to that vary would jeopardize brief sellers, forcing their positions to shut and swinging BTC upwards.

A “flip” would sign a market backside

Sometimes, whale accumulation patterns usually align with Bitcoin testing a market backside.

In response to AMBCrypto, a retreat again to $60K was important to shake off weak arms – those that acquired BTC at an earlier help of $55K – prompting them to money in on their positive factors and exit the cycle.

Now, the bottom line is to flip the $60K resistance into help, encouraging new consumers to enter the market. This shift would allow whales to focus on the market backside and push BTC nearer to $66K.

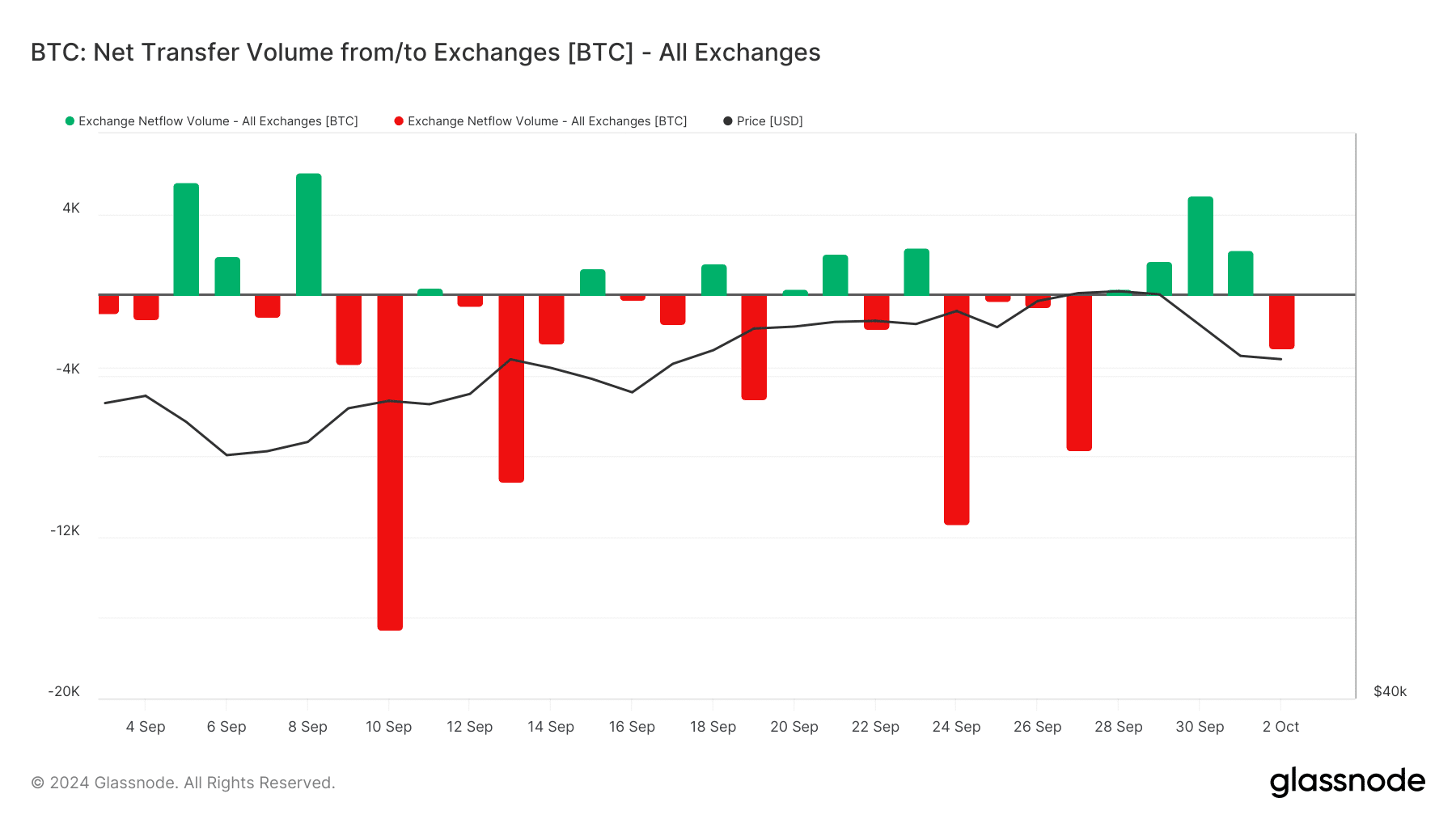

Whereas internet outflows have regained management after three days of rising BTC provide, suggesting that $60K presents a robust buy-the-dip alternative, a extra strong push is required to substantiate a bull rally.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In brief, if bulls capitalize on this worth level with aggressive shopping for and flip $60K into help, a rebound may drive BTC again to $66K.

In any other case, if bearish sentiment prevails with none occasion to soak up strain, worry may set off panic promoting, permitting shorts to take care of management and doubtlessly pushing BTC all the way down to round $55K – setting the stage for the following market backside.