Context of the article

The worldwide economic system is recovering from the interval of saturation, and main indices throughout the globe are booming. Although inflation has eased in most nations, policymakers warn that attaining the Central Banks’ goal of round 2% shall be fairly exhausting. Indermit S. Gill, Senior Vice President and Chief Economist of The World Financial institution Group predicts superior and growing economies—are set to develop extra slowly in 2024 and 2025 than they did within the decade earlier than COVID-19.

So, the pertinent query – 2024’s crypto growth: Is it an indication of restoration or a bubble within the making?

Let’s discover out

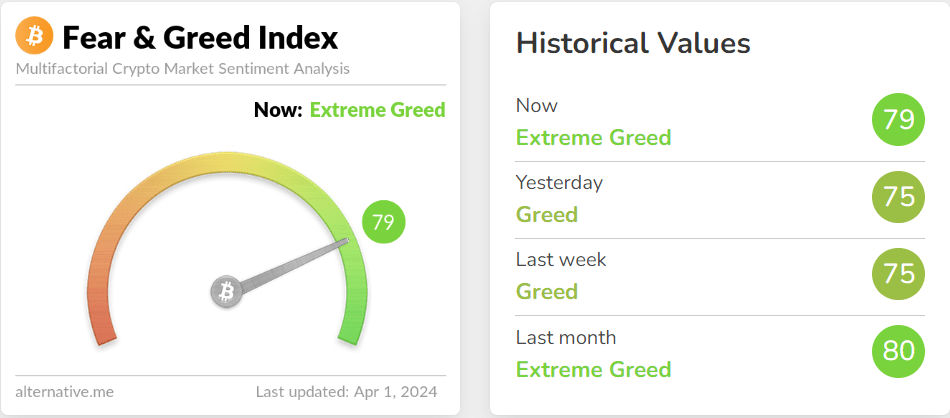

For greater than three weeks now, the Crypto Worry & Greed Index has been above the 70 mark. The index ranges from 0 (excessive worry) to 100 (excessive greed), a excessive worth is a warning of a possible market correction. Over the previous two months, there was an unprecedented stage of demand – one thing that the crypto market has by no means seen in its whole existence.

AMBCrypto’s analysis report for March 2024 reveals U.S. billionaires have been promoting their shares. Out of all of the gross sales, the much-talked-about has been that of JPMorgan Chase & Co. CEO Jamie Dimon who bought $150 million price of shares within the banking firm for the primary time in 18 years. Every billionaire has their very own causes, but it surely may need one thing to do with rising curiosity in cryptocurrencies from huge cash gamers.

What cash had been the March Market Movers?

Bitcoin

- The king coin hit a brand new All-Time-Excessive (ATH) at $73,797.35 on 14 March with its market cap surpassing that of Silver. Whereas analysts have been predicting $100k as the subsequent ATH, the AMBCrypto report argues Bitcoin hasn’t reached its ATH determine but and traders are buying and selling it with a false sense of feat in thoughts.

- Apparently, as quickly because the coin crossed the $72k stage, the Lengthy-Time period Holder cohort elevated their general distribution stress. Consequently, the market noticed over $2.6B/day in realized revenue.

- Now, if BTC manages to show the $70k stage into sturdy assist, New Yorkers will profit most from the worth surge. It’s necessary to notice the $70k psychological stage is an efficient liquidity space. It has already been examined as resistance a number of instances. Thus, strengthening the case for the bulls.

- In the meantime, the arrival of a Bitcoin spot ETF has been a serious increase for the cryptocurrency, with inflows of roughly $12.1 billion by the shut of the primary quarter.

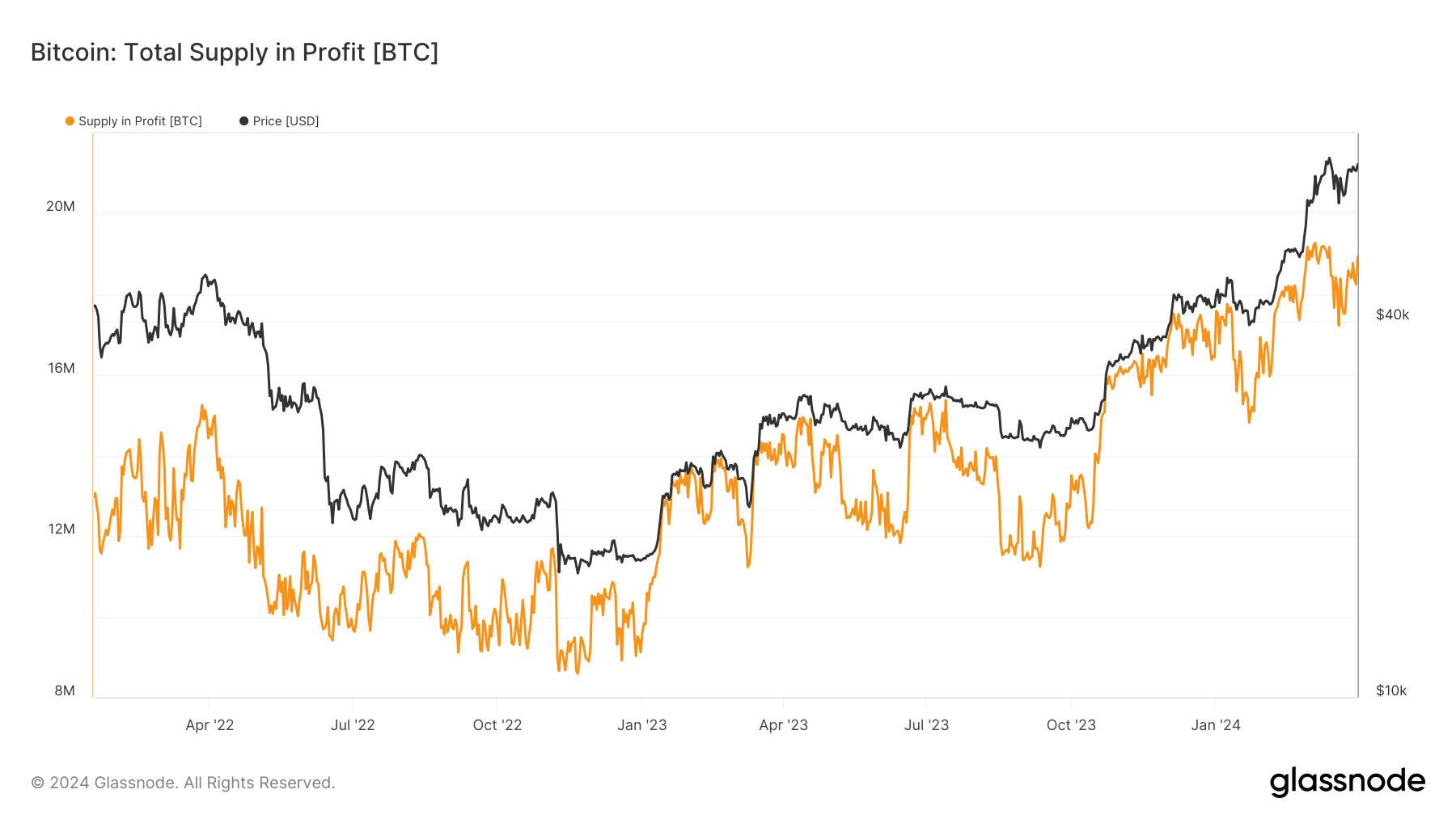

- The excellent news is a lot of the traders holding BTC of their portfolios are worthwhile, in the intervening time. As per the Provide in Revenue metric, on 1 April, 18M addresses had been in revenue, this was a rise of 3M from its cycle-low of 15M.

Ethereum

- With the Dencun improve going stay in March, Ethereum unlocked a brand new stage for builders’ development because the scalability-related challenges and gasoline charges situation had been addressed.

- Ethereum’s worth has efficiently maintained its $3500 assist. It reached $4000 just lately, the very best level in practically two years. This may very well be attributed to numerous elements, together with elevated DeFi exercise and anticipation of the Dencun improve.

- AMBCrypto’s analysis report reveals that the outlook forward for Ethereum is constructive and the anticipation of a spot ETH ETF may form its future rally.

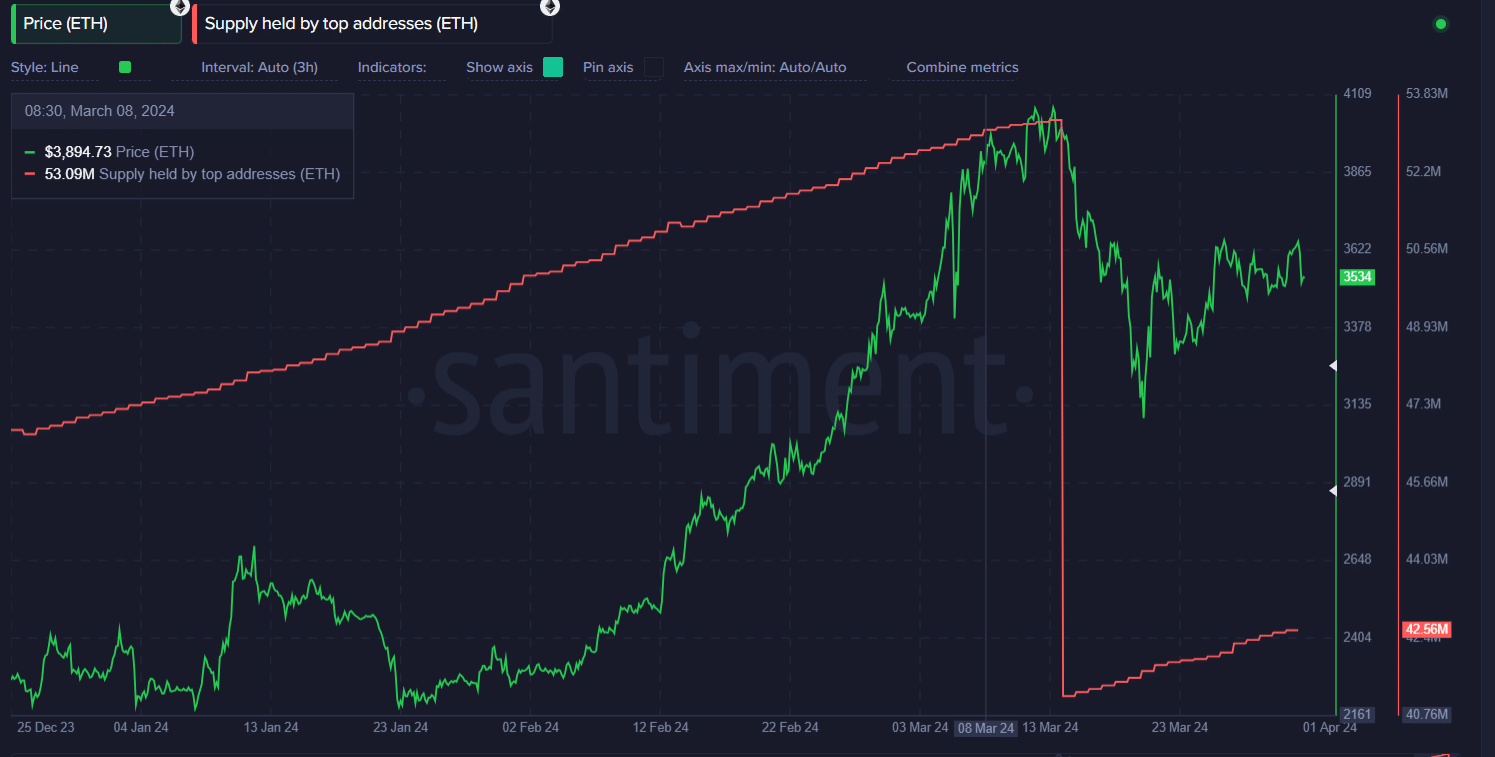

- Notably, after a giant sell-off on 14 March, the highest 10,000 richest wallets purchased 42.56 million ETH. This shopping for spree is anticipated to assist Ethereum have an excellent begin in April 2024 for 2 important causes. First, these huge traders have a whole lot of energy over the worth of Ethereum and might have an effect on how common folks make investments too. Second, these wallets often plan to maintain their holdings for a very long time, which may imply April may not see a whole lot of promote stress.

Memecoins and DePIN sector

- Previously month, meme cash like WIF, PEPE, and FLOKI noticed a giant surge of their costs, doing even higher than standard ones like DOGE and SHIB. Many merchants noticed their investments surge by triple digits. The buying and selling exercise, consequently, reached a peak final seen in November 2021. In line with AMBCrypto’s report, many of those merchants had been hoping to make sufficient cash from meme cash to purchase Bitcoin afterward.

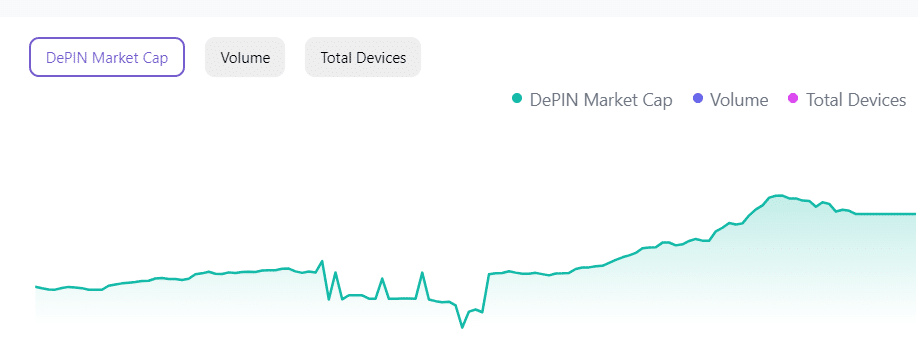

- Throughout each huge surge within the crypto market, there are standard tales that catch everybody’s consideration. For instance, in 2017, folks had been enthusiastic about ICO cash and privateness cash. Then, in 2021, DeFi, NFTs, and layer 1s turned the massive issues. Now, analysts predict that in 2024-25, DePIN shall be a very powerful pattern within the crypto world.

- For the reason that begin of 1 January 2024, DePIN Market Cap has grown by $35,370.826 million. Solana noticed probably the most vital rise in buying and selling quantity amongst main DePIN tasks, with a notable improve of 52% over the previous 30 days.

The most important loser

In line with Alex Casassovici, founding father of Web3 streaming mission Azarus, we’re witnessing the primary actual bear marketplace for NFTs. Certainly, the NFT Gross sales Quantity within the final 30 days has fallen by 8.50% whereas the NFT transactions have declined by 45.79%. NFT sellers, alternatively, have elevated by 45.25%. Thus, portray a really bleak image for the general market.

Apparently, AMBCrypto’s report reveals a stunning outperformance by Bitcoin NFTs in comparison with their Ethereum counterparts.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

About Crypto Market Report – March 2024

AMBCrypto’s newest report is a complete evaluation of March’s market traits and it gives worthwhile insights for predicting market actions in April.

The report dives into key matters like –

- Bitcoin vs. inflation

- BTC’s subsequent ATH projection

- Ethereumization of Bitcoin

- ETH’s worth potential

- NFT market dynamics

- Market forecast for April

You may obtain the complete report right here.