- BTC might outperform gold by an additional 122%.

- The market’s expectation of a US BTC reserve jumped by 10 factors.

Bitcoin [BTC] has outperformed gold since November as an analyst expects an additional 122% rally in opposition to the worldwide reserve asset.

Based on famend technical chartist and dealer, Peter Brandt, one would possibly quickly want 89 ounces of gold to purchase 1 single BTC coin.

Brandt’s projection was primarily based on the bullish cup and deal with formation on the BTC/gold ratio chart.

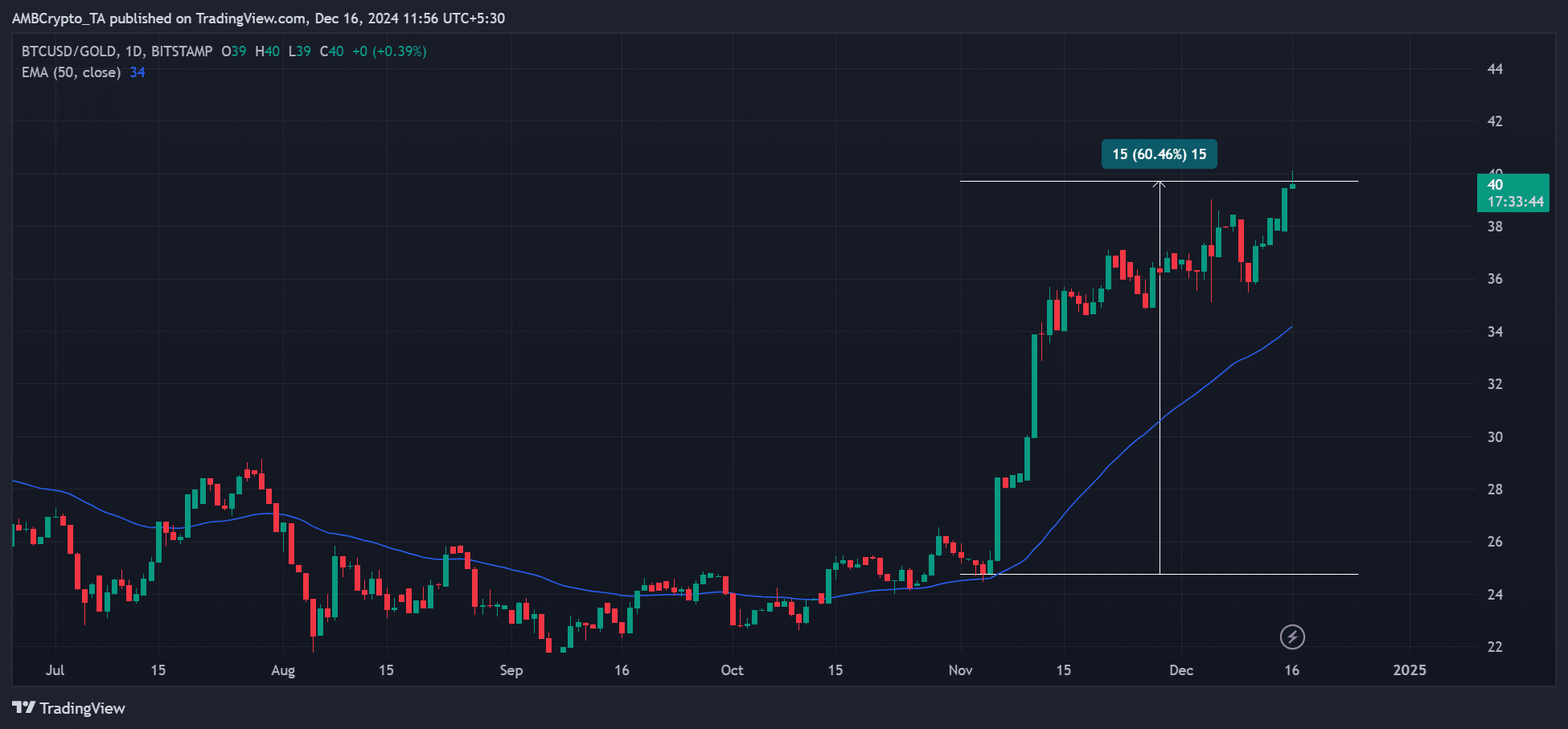

For context, the BTC/gold ratio tracks the relative efficiency of BTC in opposition to gold. It not too long ago hit a brand new excessive of 39 and broke above resistance, which might make the bullish 89 goal attainable.

BTC: Subsequent international reserve?

Since November, BTC has outperformed gold by 60%, with the BTC/GLD ratio hovering from 25 to 40. The outstanding BTC efficiency was accelerated by pro-crypto Donald Trump’s win within the US presidential elections.

One of many upcoming administration pledges was to arrange a nationwide BTC reserve and most market insiders imagine this might occur on day 1.

Based on Strike CEO Jack Mallers, the president-elect was exploring a ‘day 1 executive order for a BTC reserve.’

This might speed up Brandt’s breakout projection of 89 for the BTC/gold. This implied about 230K per BTC if hit.

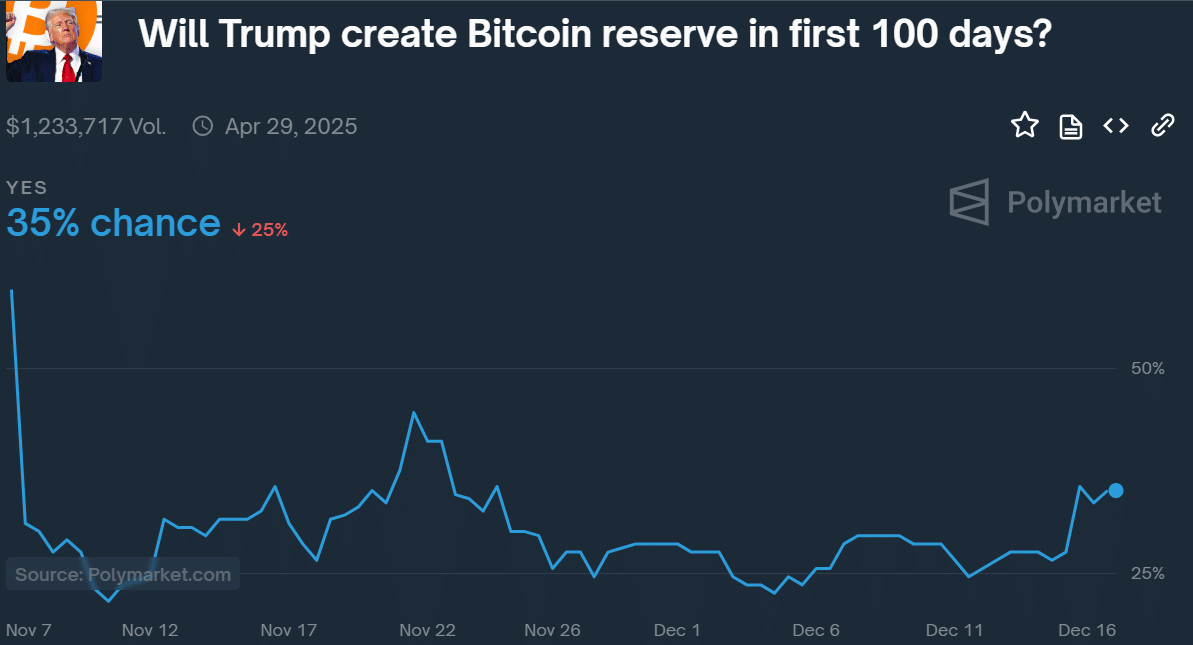

At press time, prediction markets have been pricing a 35% likelihood of Donald Trump making a BTC reserve throughout the first 100 days of his administration.

This was a ten% leap from final week’s odds, suggesting the market was more and more optimistic of such an consequence. If created, BTC might aggressively compete with gold as a worldwide reserve asset.

Whether or not Brandt’s $230K per BTC goal might be hit this cycle stays to be seen. However most asset managers had a $150K-$200K worth goal for this cycle.

Within the meantime, BTC hit a brand new all-time excessive of $106.6K and was valued at $105K forward of the Fed fee choice on the 18th of December.