- Ethereum has recorded low capital inflows since January in comparison with Bitcoin.

- ETH’s long-term holders proceed to attend for a brand new all-time excessive.

Main altcoin Ethereum [ETH] has underperformed in comparison with Bitcoin [BTC] since January, Glassnode present in a brand new report.

Based on the on-chain knowledge supplier, whereas BTC, aided partly by the US spot exchange-traded funds (ETF), has seen vital capital inflows for the reason that starting of the yr, ETH has recorded a decline in buying and selling exercise.

ETH stays in BTC’s shadows

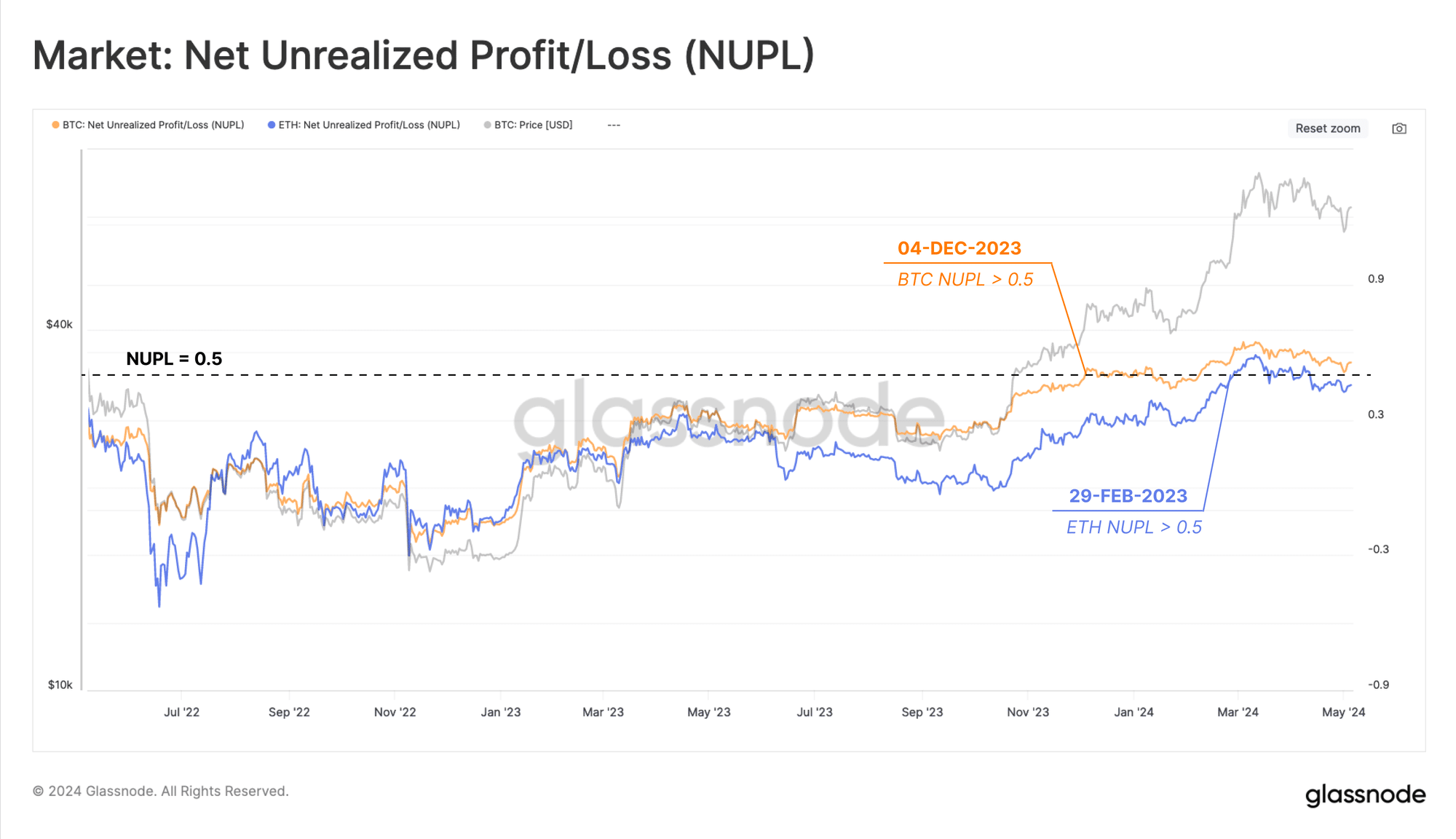

Following the approval of spot Bitcoin ETFs on the tenth of January, Glassnode knowledge exhibits a major divergence in Internet Unrealized Revenue/Loss (NUPL) between BTC and ETH.

In its report, the on-chain analytics agency famous that this means that BTC’s traders have captured a bigger share of income in comparison with their ETH counterparts since then.

The NUPL metric determines whether or not an asset’s holders are experiencing unrealized beneficial properties or losses. It compares the common buy value of all tokens held by traders to the present market value.

If the market value is greater, there’s a net-unrealized revenue, whereas whether it is decrease, there’s a net-unrealized loss.

Based on Glassnode, a major threshold for the NUPL is when the worth exceeds 0.5. It’s because it alerts that an asset’s unrealized revenue is larger than 50% of its whole market capitalization.

Glassnode stated,

“Amidst the hype and market rally surrounding (the) approval of the spot Bitcoin ETFs, the unrealized profit of Bitcoin holders expanded considerably faster than that of Ethereum investors. As a result, the Bitcoin NUPL metric crossed 0.5 and entered the euphoria phase three months before than equivalent metric for Ethereum.”

Additional, ETH has but to see a powerful influx of recent capital as BTC has since spot ETFs grew to become tradeable within the US.

Glassnode assessed the Brief-Time period Holders’ Realized Cap for each cash and located that ETH’s stays low.

This implies lowered exercise from the coin’s short-term traders, whose actions are recognized to considerably affect an asset’s value efficiency.

The report additional acknowledged,

“In many ways, this lack of new capital inflows is a reflection of the under-performance of ETH relative to BTC. This is likely in part due to the attention and access brought about by the spot Bitcoin ETFs.”

On why this is perhaps taking place, Glassnode added:

“The market is still awaiting the SEC’s decision for approval of a suite of ETH ETFs expected towards the end of May.”

Is your portfolio inexperienced? Take a look at the ETH Revenue Calculator

Because of the distinction within the efficiency of the cash, BTC and ETH’s long-term holders (LTHs) have adopted completely different methods.

Whereas BTC’s LTHs have let go of a few of their holdings to e-book income following the coin’s rally to a brand new all-time excessive, ETH’s LTHs –

“Appear to still be waiting for better profit-taking opportunities.”