- Bitcoin reveals indicators of bettering market confidence however short-term headwinds are nonetheless in play, influencing its efficiency.

- Can Bitcoin drum up sufficient momentum amid indicators of declining dominance?

The Bitcoin [BTC] funding panorama is experiencing a resurgence of confidence regardless of struggling to remain above $60,000. That is proof in retail exercise, in addition to in Bitcoin miners.

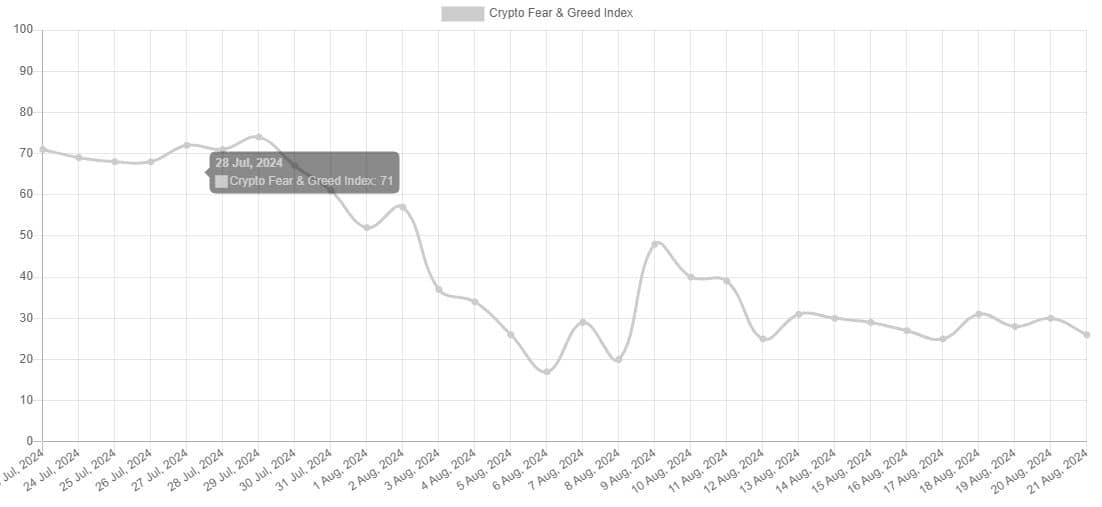

Bitcoin and the general crypto market are experiencing a confidence restoration, opposite to the state of affairs earlier within the month. The concern and greed index is presently at 26, however it peaked at 30 throughout Tuesday’s session.

The concern and greed index indicators that Bitcoin confidence is presently increased than it was in the beginning of the yr. Nonetheless, this doesn’t essentially paint an image of confidence contemplating that it dipped to 26 within the final 24 hours.

The potential cause for this the truth that BTC slipped beneath $60,000 as soon as once more. An end result that has been fairly widespread currently.

The rationale for the promote strain pushing BTC beneath $60,000 this time might be the revelation that Mt. GOX simply moved over 12,000 BTC value over $700 million.

Are miners accumulating Bitcoin?

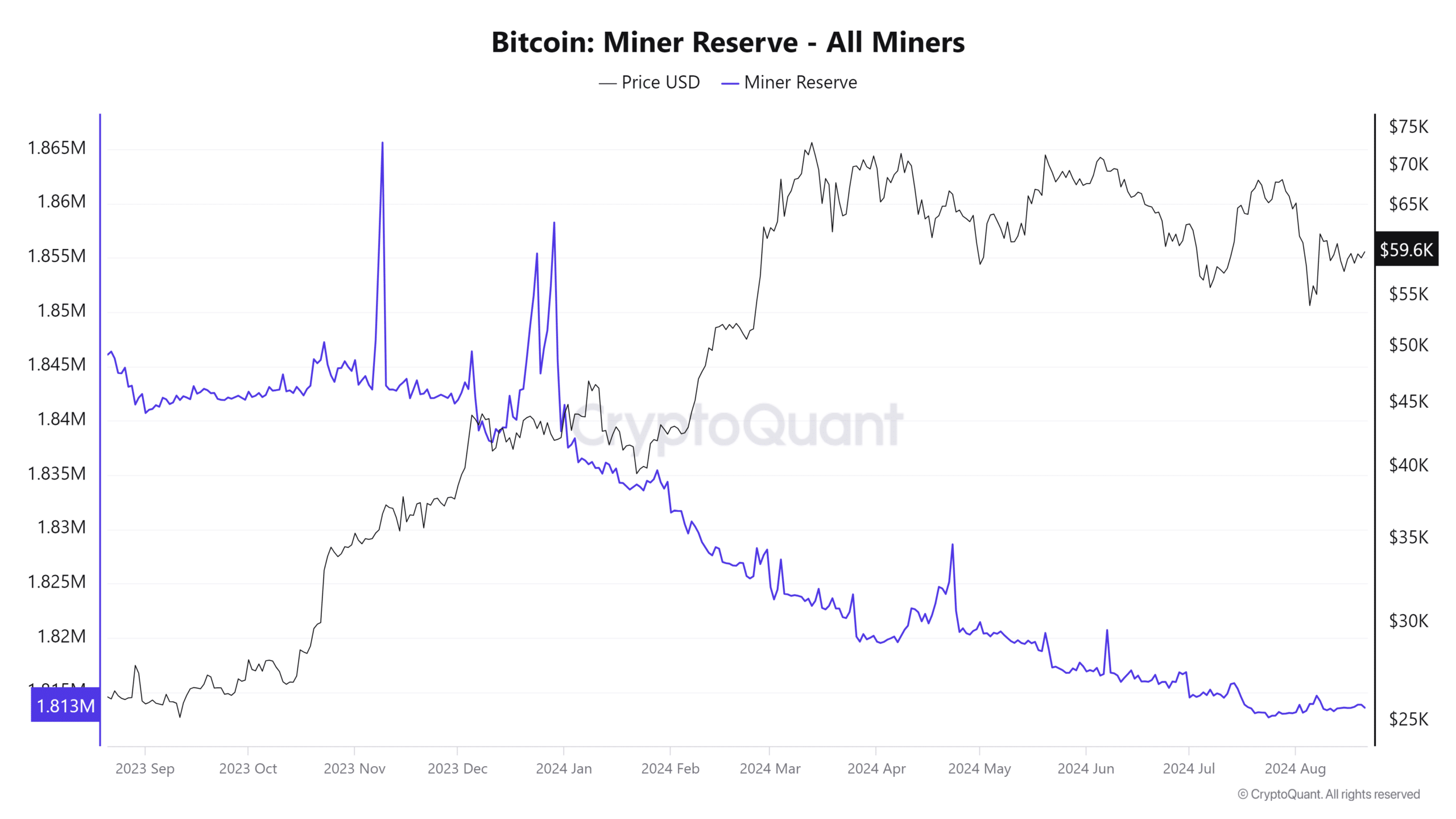

Bitcoin miner reserves have been on an total downward trajectory within the final 12 months. Reflecting the state of promote strain as bars grew to become the dominant power.

Nonetheless, miner reserve information signifies an inversion within the curve thus far this month from July lows. This implies that the variety of miners HODLing their BTC has been rising.

Supply: Cryptoquant

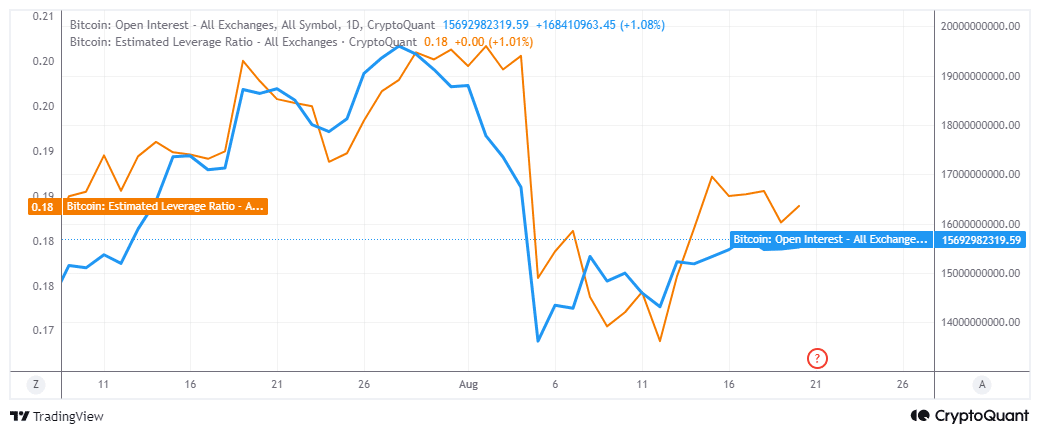

Demand for Bitcoin within the derivatives section can be recovering. This was evident within the rising open curiosity after a tough begin earlier this month. Equally, we additionally noticed rising urge for food for leverage, resurgence.

Supply: CryptoQuant

Regardless of the resurgence in open curiosity and leverage, it’s clear that the market continues to be in a cautious temper. Latest liquidations have many merchants on edge particularly with the prevailing directional uncertainty.

Whereas the present market circumstances counsel an enchancment within the degree of market confidence, Bitcoin continues to be uncovered to sure and unsure dangers. Mt. Gox-induced promote strain is considered one of them.

Nonetheless, there’s one other threat that’s much less pronounced. BTC dominance has been declining since 10 August.

A small retracement is completely regular contemplating that Bitcoin dominance achieved a powerful rally since 13 July. However, this might be the beginning of a stronger downtrend to come back.

If so, then liquidity might begin flowing in favor of the altcoins, consequently limiting BTC’s potential upside.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In the meantime, Bitcoin demand from main establishments signifies rising competitors. For instance, Microstrategy has been the main institutional investor however not anymore.

Latest information reveals that Blackrock has been aggressively shopping for Bitcoin. Its BTC holdings are actually nearly twice the quantity owned by Microstrategy.