- Yr-to-date inflows went into digital asset funds reached $13.13 billion.

- Bitcoin, Solana had been excessive on demand, whereas Ethereum noticed outflows.

Digital asset funds had been again to successful methods final week, spearheaded by robust investments into the newly-launched Bitcoin [BTC] spot ETFs within the U.S.

Robust restoration

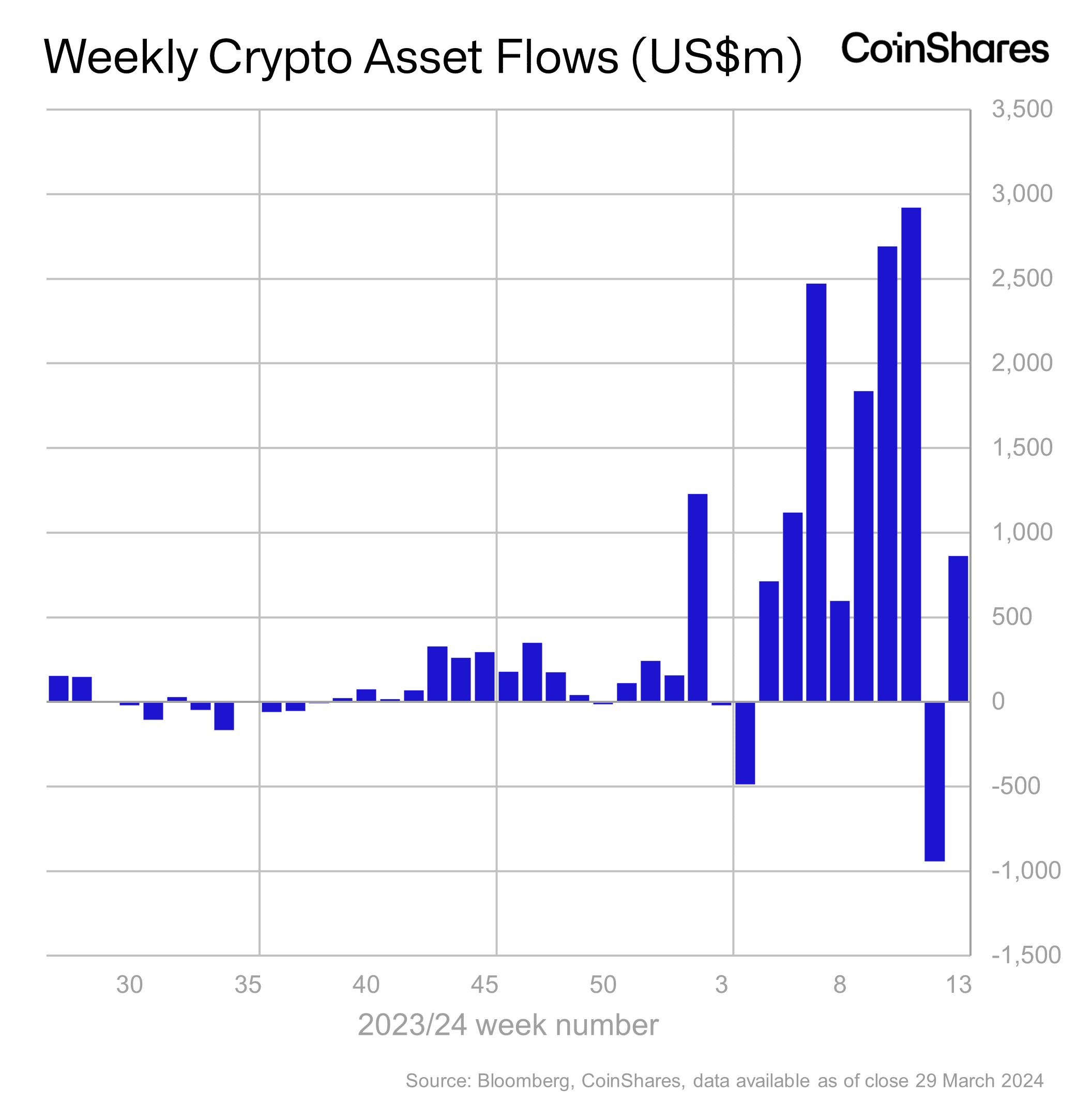

As per knowledge shared by James Butterfill, Head of Analysis at crypto asset administration agency CoinShares, about $862 million in web inflows was recorded throughout institutional crypto merchandise

This was a pointy rebound from the $942 million in outflows seen every week earlier.

The newest capital infusion propelled year-to-date (YTD) inflows to $13.13 billion. For context, this was almost 25% greater than the overall inflows recorded in 2021 — the 12 months of the crypto market’s final bull run.

In the course of the week, the overall belongings beneath administration (AuM) swelled to $98 billion, marking a rise of 11% from the week earlier than.

AUM is a crucial efficiency gradient of a fund. The upper the worth of AuM, the extra investments it tends to draw. AUM is dependent upon the inflows and the market worth of the underlying asset.

Final month, the AUM hit $100 billion for the primary time in historical past, as Bitcoin smashed to its all-time excessive (ATH) of $73,000. Nevertheless, subsequent worth correction induced the AUM to drop to present ranges.

Bitcoin stays establishments’ favourite

On anticipated traces, Bitcoin-linked funds led the cost, pocketing $865 million in inflows final week. With this, whole inflows for the reason that starting of the 12 months rose to a powerful $12.8 billion.

The surge may very well be attributed to robust demand for U.S.-based spot Bitcoin ETFs, which attracted $860 million in inflows final week.

Sturdy inflows into new ETFs led by BlackRock’s IBIT helped offset outflows from incumbent issuer Grayscale’s GBTC, which has been bleeding since transitioning to an ETF.

Ethereum loses, Solana features

Alternatively, funds tied to second-largest cryptocurrency Ethereum [ETH] noticed outflows value $19 million final week. The bearish sentiment seemingly flowed from decrease probabilities of an ETH ETF approval.

Solana-based funding merchandise witnessed inflows of $6 million final week, spurred by spectacular worth efficiency of the native asset SOL.