- Bitcoin noticed a constructive response on the value charts, however social metrics underlined weak point.

- The excessive demand for Bitcoin in Could may propel costs previous the ATH quickly.

Bitcoin [BTC] noticed an fascinating week when it comes to value motion. It had a energetic breakout previous the native vary excessive at $67k on the twentieth of Could.

On the twenty third and the twenty fourth of Could, Bitcoin retested the $66.3k-$66.6k zone as help and bounced increased to commerce at $69.1k at press time.

Extra good points are more likely to observe as demand for the king of crypto continues to develop.

The CEO of the blockchain-based funds’ app Strike, Jack Mallers, asserted that “Bitcoin is the best thing you can own” in a dialog with Antony Pompliano.

The social metrics and on-chain exercise had been weakening

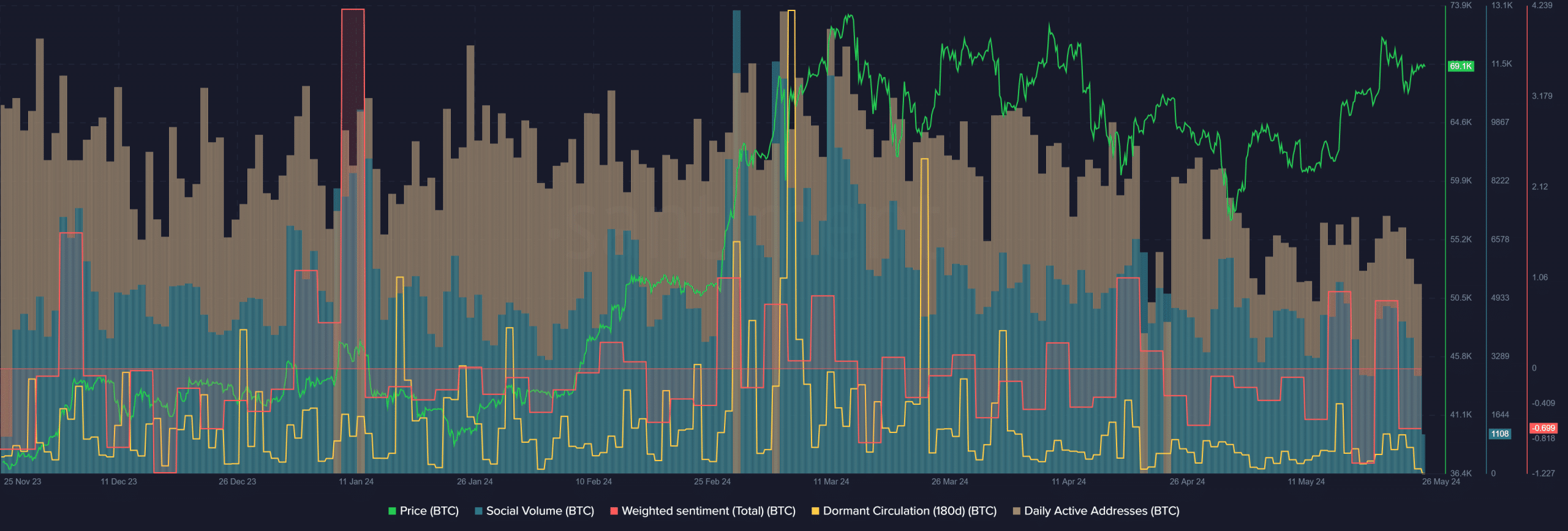

Supply: Santiment

The Social Quantity behind Bitcoin has slowly slid decrease because the eleventh of March. The Weighted Sentiment was detrimental all through Could, with two constructive surges since mid-Could.

Collectively, they pointed towards diminished social media engagement.

The every day exercise additionally trended decrease since mid-March. However, the dormant circulation final noticed noticeably giant spikes on the 18th of April and the fifteenth of Could.

Nevertheless, their measurement didn’t rival those in March or late February.

This revealed that the on-chain motion of dormant Bitcoin was absent lately, which prompt a big wave of promoting was not but upon us. This was signal because it underlines lowered promoting strain.

Is the demand for Bitcoin increased than ever earlier than?

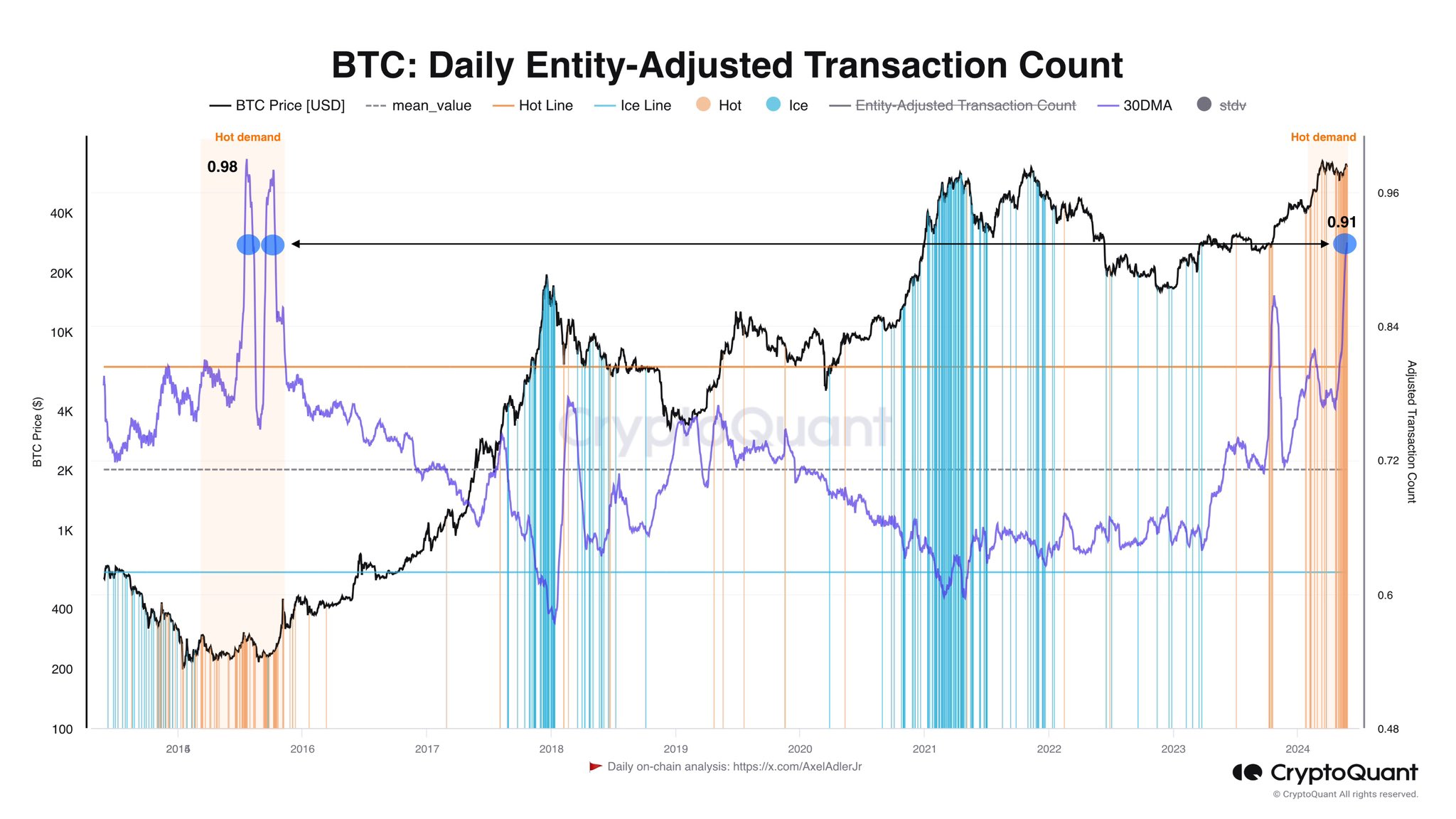

Supply: AxelAdlerJr on X

In a publish on X (previously Twitter) crypto analyst Axel Adler confirmed that the demand was red-hot. This conclusion was made based mostly on the entity-adjusted transaction rely.

Primarily based on the chart’s readings, the demand was near the degrees of the 2016 rally.

Learn Bitcoin’s [BTC] value prediction 2024-25

He additionally added that the value of Bitcoin again then was $300, in comparison with $69.1k now. Therefore, the capital concerned is vastly higher than eight years in the past.

This demand from retail and institutional traders, mixed with a diminished promoting strain from the dormant circulation metric, indicated that Bitcoin is very doubtless to interrupt out previous the $71.4k area as soon as once more.