- Bitcoin would possibly presently be at its market backside.

- In case of a bullish breakout, BTC should first goal $61.3k earlier than it goals for $63.2k.

After per week of excessive volatility within the bears’ favor, Bitcoin’s [BTC] worth began to considerably consolidate. This gave the notion that the bearish development would possibly come to an finish.

However there was extra to the story, as a key metric hinted at a continued worth decline within the coming days.

Bitcoin nonetheless has troubles

CoinMarketCap’s knowledge revealed that the bears dominated the market final week, because the king coin’s worth declined by greater than 10%. The final 24 hours had been higher, because the coin’s worth solely dropped by over 1.7%.

On the time of writing, BTC was buying and selling at $57,523.15 with a market capitalization of over $1.14 trillion.

In the meantime, Ali, a well-liked crypto analyst, posted a tweet revealing extra troubles for the king coin. The evaluation used BTC’s Quick-Time period Holder Realized Worth, which helps gauge the conduct of current Bitcoin consumers.

Notably, for the reason that twenty second of June, BTC has struggled to interrupt above this degree, and the Quick-Time period Holder Realized Worth reached $63,250. Due to this fact, it’s essential for BTC to reclaim this degree.

Till then, BTC continues to face the hazard of promoting stress, which could push the coin’s worth down additional.

Will BTC cross $63k quickly?

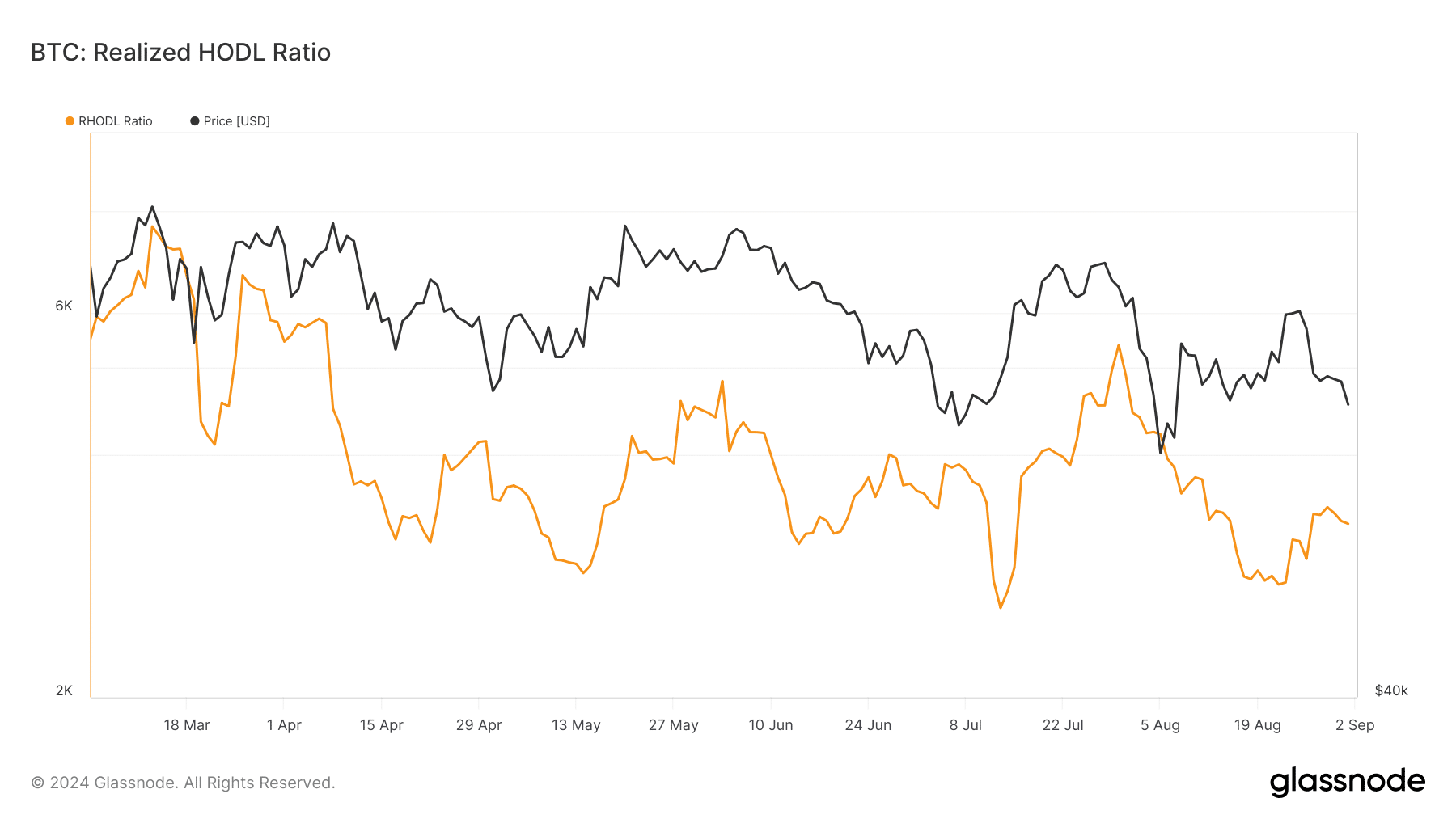

Because the hazard of a worth drop loomed round BTC, AMBCrypto deliberate to examine its metrics to seek out the percentages of BTC reclaiming $63.2k. Our evaluation of Glassnode’s knowledge revealed Bitcoin’s realized HODL ratio.

For starters, the RHODL Ratio takes the ratio between the 1 week and the 1-2 yr RCap HODL bands. At press time, it registered a downtick, which might presumably point out a market backside.

Other than this, a number of different metrics additionally seemed optimistic. Our evaluation of CryptoQuant’s knowledge identified that BTC’s aSORP was inexperienced, which means that extra traders had been promoting at a loss.

In the midst of a bear market, it may point out a market backside.

The Binary CDD was additionally inexperienced, suggesting that long-term holders’ motion within the final seven days was decrease than common. So, they’ve a motive to carry their cash.

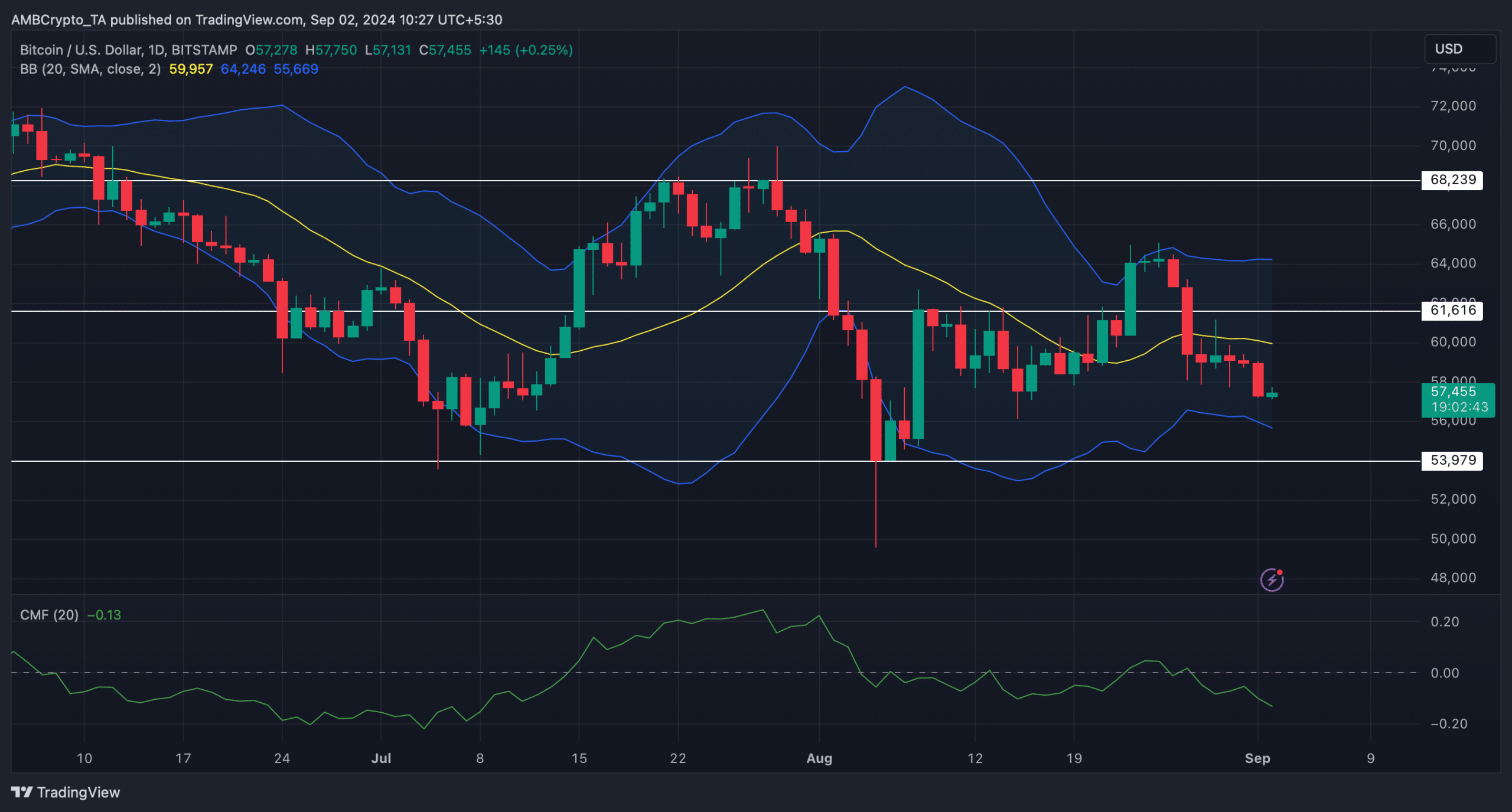

We then checked Bitcoin’s each day chart to see whether or not technical indicators hinted at a worth rise in the direction of $63.2k.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Bitcoin’s worth was about to the touch the decrease restrict of the Bollinger Bands, which regularly ends in worth rebounds. If that occurs, then it could be essential for BTC to go above $61.6 earlier than it eyes $63.2k.

Nonetheless, the Chaikin Cash Stream (CMF) moved southwards, indicating that there have been possibilities of BTC’s worth dropping additional.