- Shopping for stress on Bitcoin remained excessive.

- Market indicators urged a value correction within the coming days.

After a cruise, Bitcoin [BTC] has witnessed a correction in the previous couple of hours. A contemporary report additionally identified a growth that hinted at a value correction.

AMBCrypto deliberate to examine BTC’s on-chain knowledge to search out out whether or not this correction will final or the development will change once more.

How is Bitcoin doing?

Bitcoin has misplaced its bullish momentum. In keeping with CoinMarketCap, the king coin’s value elevated by greater than 8% within the final seven days.

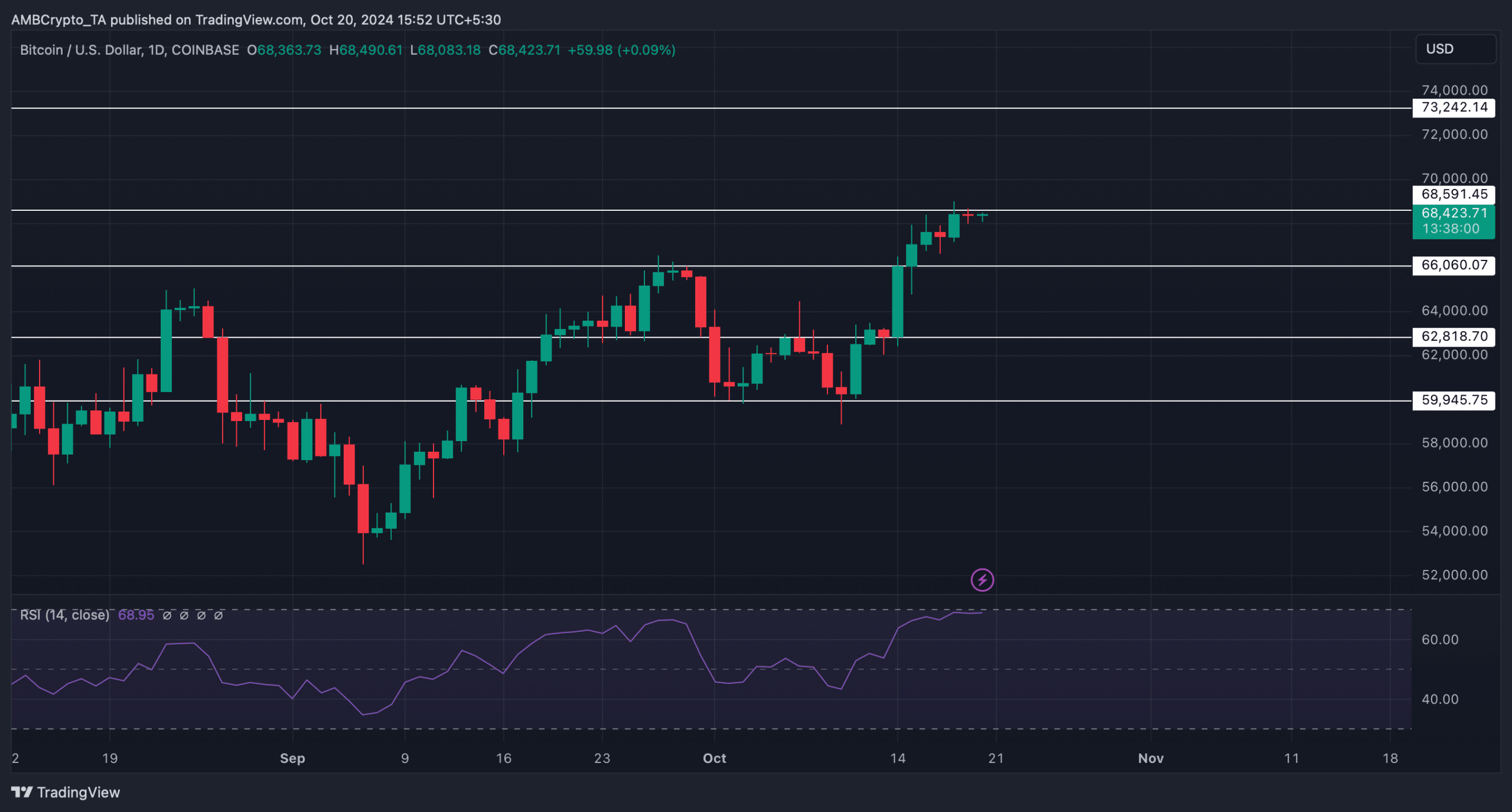

Nonetheless, the development modified within the final 24 hours, because the coin’s value solely moved marginally. On the time of writing, the coin was buying and selling at $68,423.71 with a market capitalization of over $1.35 trillion.

Within the meantime, Ali, a preferred crypto analyst, not too long ago posted a tweet revealing an vital growth. As per the tweet, Bitcoin’s key indicator, the TD sequential flagged a promote sign.

This indicated that traders would possibly begin promoting the coin. Each time promoting stress on an asset will increase, it hints at a value decline.

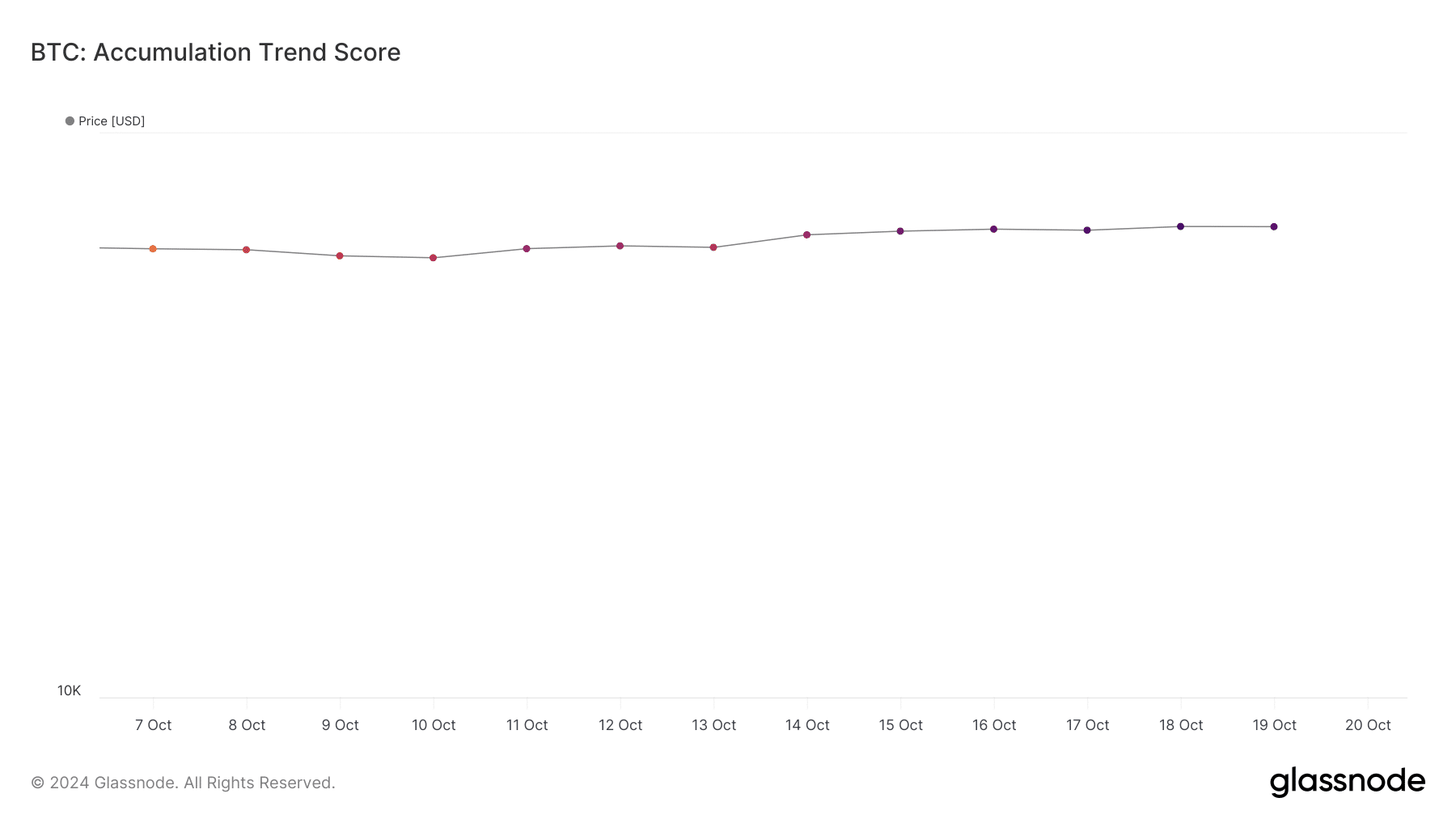

Nonetheless, as per our evaluation of Glassnode’s knowledge, traders have been beginning to purchase extra BTC. It revealed that BTC’s accumulation development rating elevated from 0.5 to 0.7 final week.

For starters, the Accumulation Development Rating is an indicator that displays the relative dimension of entities which can be actively accumulating cash on-chain when it comes to their BTC holdings.

A quantity nearer to 1 represents an increase in shopping for stress.

Is BTC poised for a correction?.

AMBCrypto dug deeper to search out out what to anticipate from the king coin within the coming days. As per our evaluation, Bitcoin’s NVT ratio elevated over the previous couple of days.

Each time the metric rises, it signifies that an asset is overvalued, hinting at a value drop within the coming days.

Nonetheless, BTC’s alternate reserve was dropping, that means that promoting stress was dripping. The truth that traders have been nonetheless shopping for BTC was additional confirmed by its web deposit on exchanges.

To be exact, Bitcoin’s web deposit on exchanges was low in comparison with the final seven-day common. Each of those metrics have been bullish, as excessive shopping for stress leads to value upticks.

Learn Bitcoin (BTC) Worth Prediction 2024-25

AMBCrypto then checked Bitcoin’s each day chart to search out out what to anticipate from it. We discovered that BTC was getting rejected at its resistance. Notably, its Relative Energy Index (RSI) was coming into the overbought zone.

If that occurs, then Bitcoin would possibly witness a value correction, inflicting BTC to drop to $66k once more. In case of a continued bull run, BTC would possibly contact $73k.