- Bitcoin volumes in U.S surged and reached 2022 ranges.

- The profitability of holders grew together with the rate of BTC.

Bitcoin [BTC] witnessed a large surge in value over the previous couple of days, inflicting a spike in optimism for BTC throughout this era. As a consequence of this surge in value, there was a large spike when it comes to quantity for BTC as properly.

Volumes on the rise

In line with new information, BTC commerce quantity throughout US hours had returned to 2022 ranges. The excessive quantity of BTC transactions in America indicated that the U.S market was exhibiting large curiosity in BTC and should have even reached saturation.

Nonetheless, on APAC (Asia Pacific) entrance, it wasn’t the case. The quantity throughout APAC buying and selling hours had been considerably decrease. This meant that there was a big cohort of people who had nonetheless not interacted with BTC.

As the recognition of BTC grows, merchants working throughout APAC hours might quickly make investments and commerce BTC which can drive the value of BTC to new heights.

As BTC started to succeed in its beforehand established all time highs, many aged holders had been noticed to be shifting their holdings. Not too long ago, an on-chain motion of over 10-year-old Bitcoin was recorded.

A transaction involving 2,000 BTC was despatched in block 844625, marking a big shift in long-held belongings.

Whales make strikes

This whale behaviour might trigger an increase in FUD amongst holders and merchants alike, and should trigger a damaging affect on BTC’s value.

At press time, BTC was buying and selling at $69,750.53 and its value had grown by 0.04% within the final 24 hours.

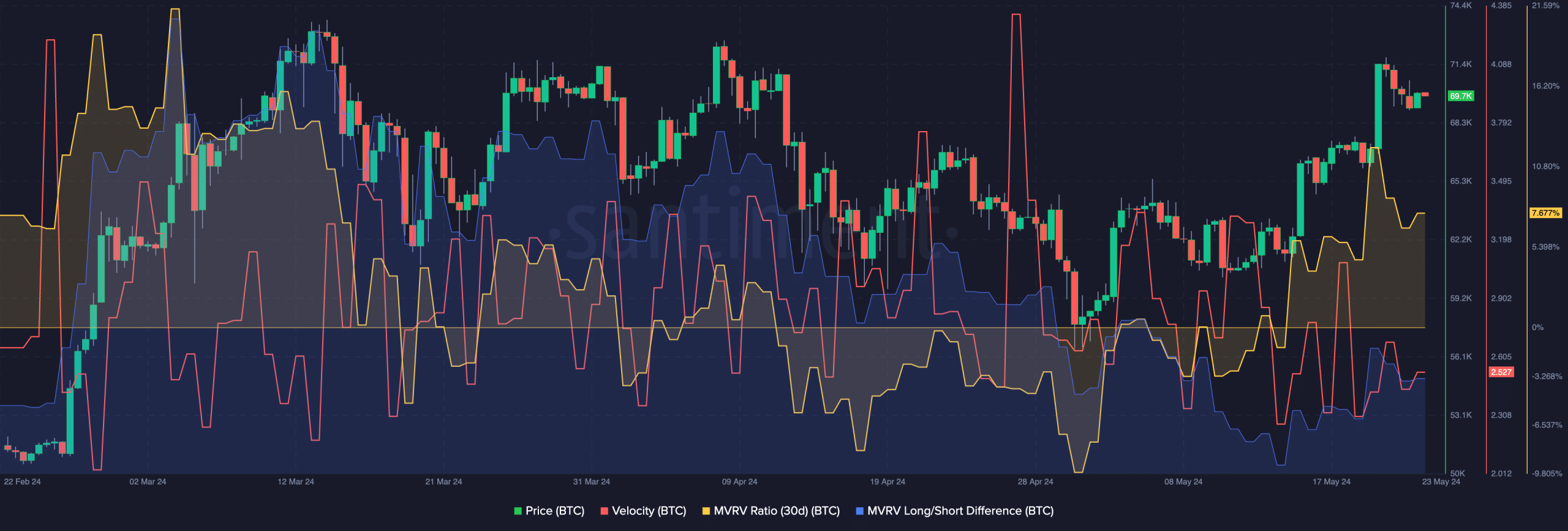

Furthermore, the rate at which it was buying and selling at had grown, implying the frequency at which BTC was buying and selling at had additionally elevated.

Coupled with that, the MVRV ratio for BTC had additionally considerably grown, implying that almost all addresses had been worthwhile on the time of writing. Despite the fact that that is optimistic for the holders, it might imply hassle for BTC’s value.

As profitability rises, so does the inducement to promote. If holders start to bask in profit-taking, BTC’s value may be negatively impacted. An element that may decide the chance of an deal with promoting their BTC is the Lengthy/Quick ratio.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The Lengthy/Quick ratio showcases the variety of long run holders in comparison with short-term holders on the community.

At press time, this ratio was declining, indicating a prevalence of quick time period holders who usually tend to promote their holdings.