- There’s a distinct correlation between Bitcoin and the S&P 500

- Bitcoin miner reserves could also be value holding an eye fixed out for too

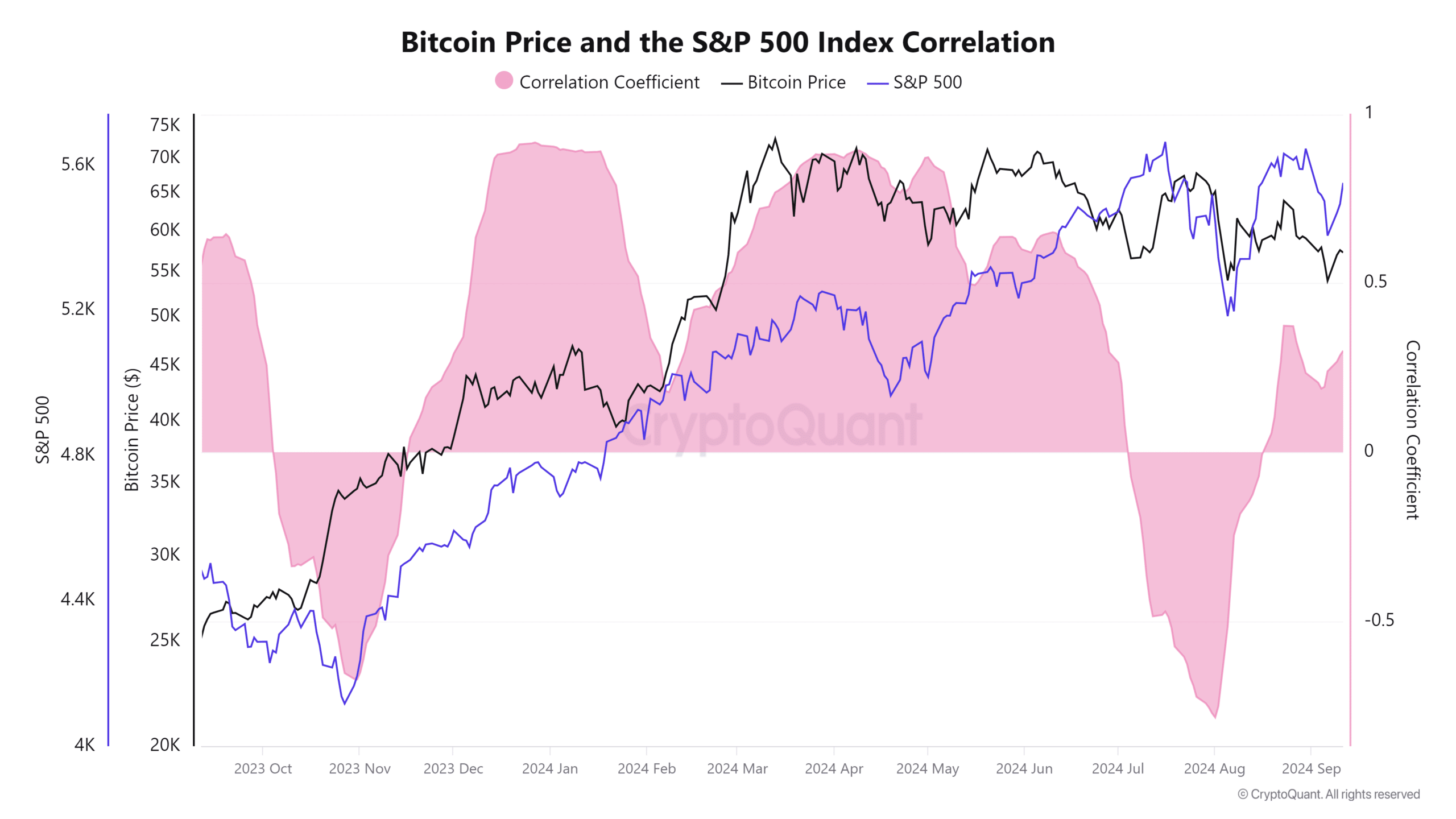

Bitcoin is commonly categorised as a risk-on asset, which is a time period strengthened by how folks put money into it. Essentially the most notable attribute of this classification is that Bitcoin has traditionally demonstrated correlation with the S&P 500.

The correlation between Bitcoin and the S&P 500 often underscores investor diversification within the risk-on class. Nevertheless, there are situations the place Bitcoin has misplaced its correlation with the inventory market. This was evident in June and July, phases which had been characterised by differing components equivalent to Bitcoin’s involvement in politics.

In response to newest information, nevertheless, Bitcoin is as soon as once more shifting in tandem with the inventory market. The correlation coefficient bounced from its lowest level at first of August and turned constructive in mid-August.

Price cuts expectations are the frequent denominator for this correlation. The U.S Federal Reserve is slated to carry its subsequent FOMC assembly within the subsequent 4 days. Expectations have been overwhelmingly leaning in the direction of a sizeable fee lower. Such an end result can be favorable for the risk-on section, one which encompasses each shares and crypto.

Each Bitcoin and the inventory market are anticipated to answer the announcement. Actually, most analysts maintain the consensus {that a} bullish end result is very doubtless if the Fed decides to embark on aggressive fee cuts. Right here, it’s. value noting that the correlation could also be misplaced additional down the road, particularly if Bitcoin takes off aggressively.

All eyes on Bitcoin miner provide

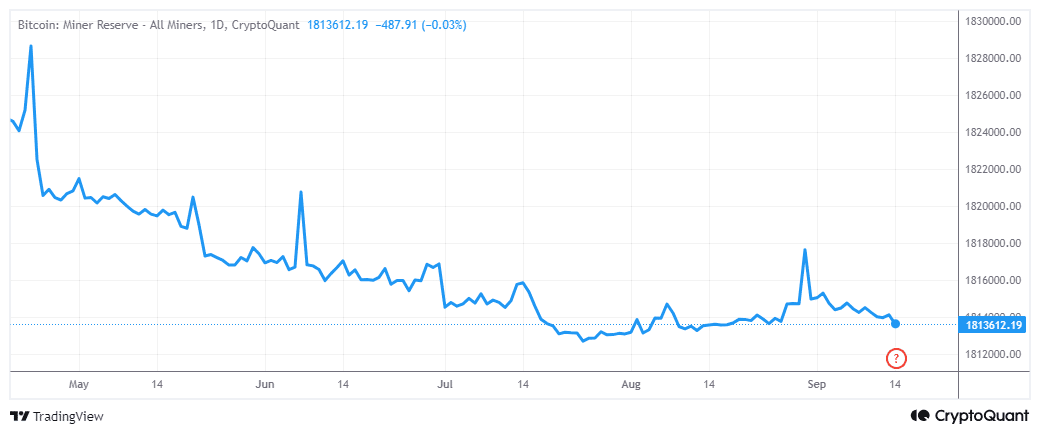

Talking of bullish expectations, the market is at the moment in search of indicators of a serious rally. Actually, a latest Santiment submit identified that mining pockets balances might provide a robust sign when the subsequent main rally commences.

“Bitcoin and Ethereum mining wallets have seen declining supply held since the first half of 2024. With this latest mild rebound, look for a jump in their combined supplies as a strong signal the next bull run is approaching.”

Traders ought to thus hold an in depth eye on miner reserves primarily based on this evaluation. The miner reserves metric revealed that Bitcoin miner balances have been declining since April. It demonstrated some uptick in July, nevertheless it quickly retraced in favor of outflows.

We will see primarily based on the aforementioned evaluation that miner flows had been inside their 2024 backside vary. This implies there’s a vital likelihood of a pivot from this degree, particularly now that This fall is simply across the nook.

A mixture of fee cuts and the U.S elections might present the appropriate mix of catalysts to set off one other main market transfer. A shift in guard in Bitcoin miner reserves, particularly in favor of a pointy uptick, could also be seen as ample affirmation of when the subsequent bull run kicks off.