- Bitcoin has reclaimed a key resistance of $65K, producing enthusiasm available in the market.

- Nonetheless, this will not but affirm a bull market.

At current, Bitcoin [BTC] has certainly reclaimed the $65K resistance, which is a optimistic signal, however it’s not but a full affirmation of a bull market.

In previous bull markets, ranges like this usually characterize psychological limitations. Breaking $65K is important, because it marks the reclaiming of a key historic resistance.

Nonetheless, merely breaking it isn’t sufficient. Additional steps are required to verify a bull run to $74K.

Why is $65K a psychological barrier for Bitcoin

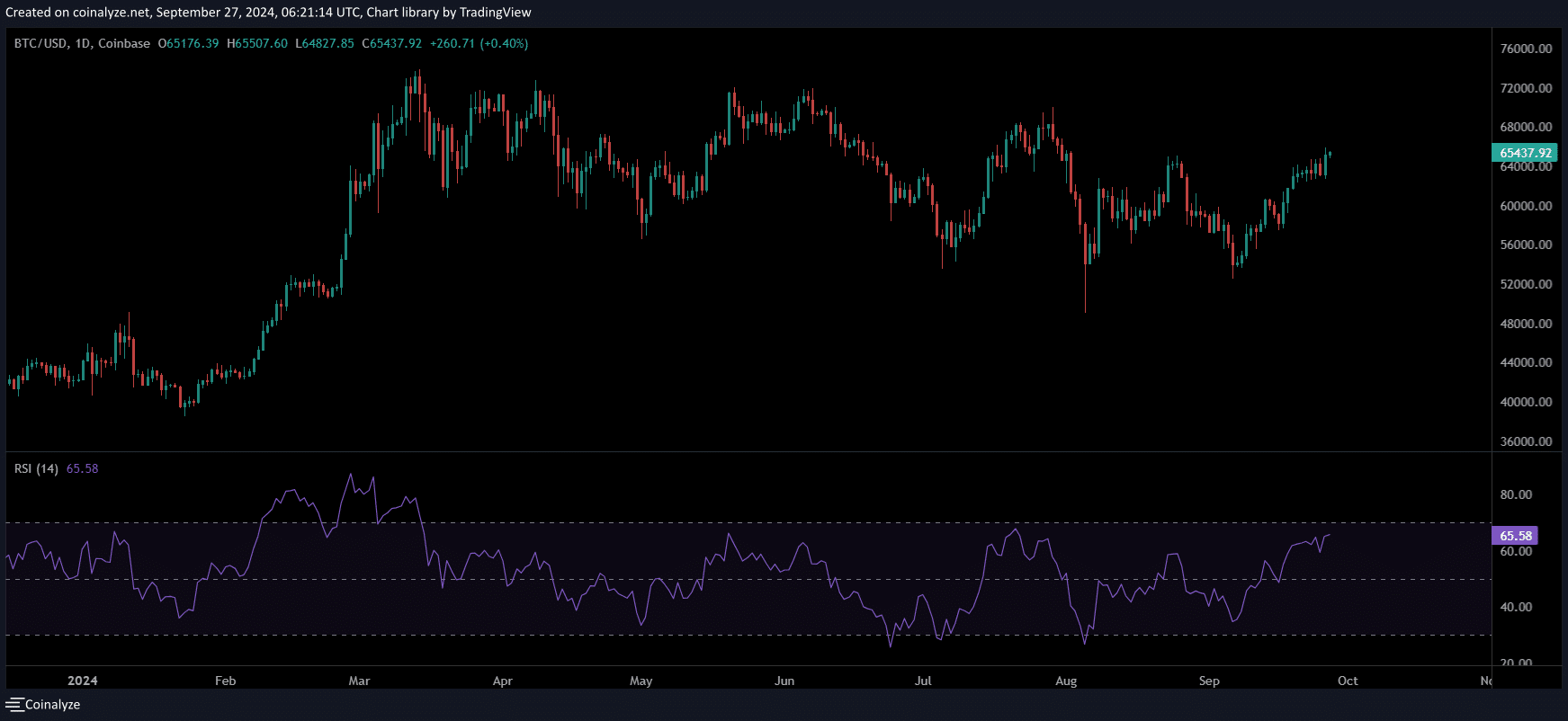

Traditionally, at any time when a key resistance is examined, it signifies sturdy shopping for stress, usually represented by the RSI reaching overbought situations.

Psychologically, this will make merchants cautious. A fast transfer to $66K may elevate issues about overextension, rising the chance of a sharper correction later.

As an example, when BTC hit its ATH of $73K in March, the RSI remained above 70 for over a month, signaling an impending pullback, which ultimately triggered BTC to retrace again to $61K.

In accordance with AMBCrypto, to keep up a constant bull run, Bitcoin should maintain above $66K and ideally proceed upward or pull again to $61K for a wholesome retest.

At present, the RSI is mirroring historic retracement factors when BTC reclaimed key resistance ranges. Merchants might turn into cautious and begin taking income, anticipating a possible correction.

Briefly, and not using a pullback, Bitcoin’s worth may shortly turn into overextended. Subsequently,

Retracement is likely to be wanted subsequent

Per AMBCrypto, a retracement to $61K would assist affirm that the earlier resistance at $65K has efficiently flipped to help.

In easy phrases, this may give bulls an opportunity to display their power by defending this help degree.

If this pattern holds, it’d entice extra consumers seeking to enter the market at a cheaper price, making it simpler for Bitcoin to push previous $70K.

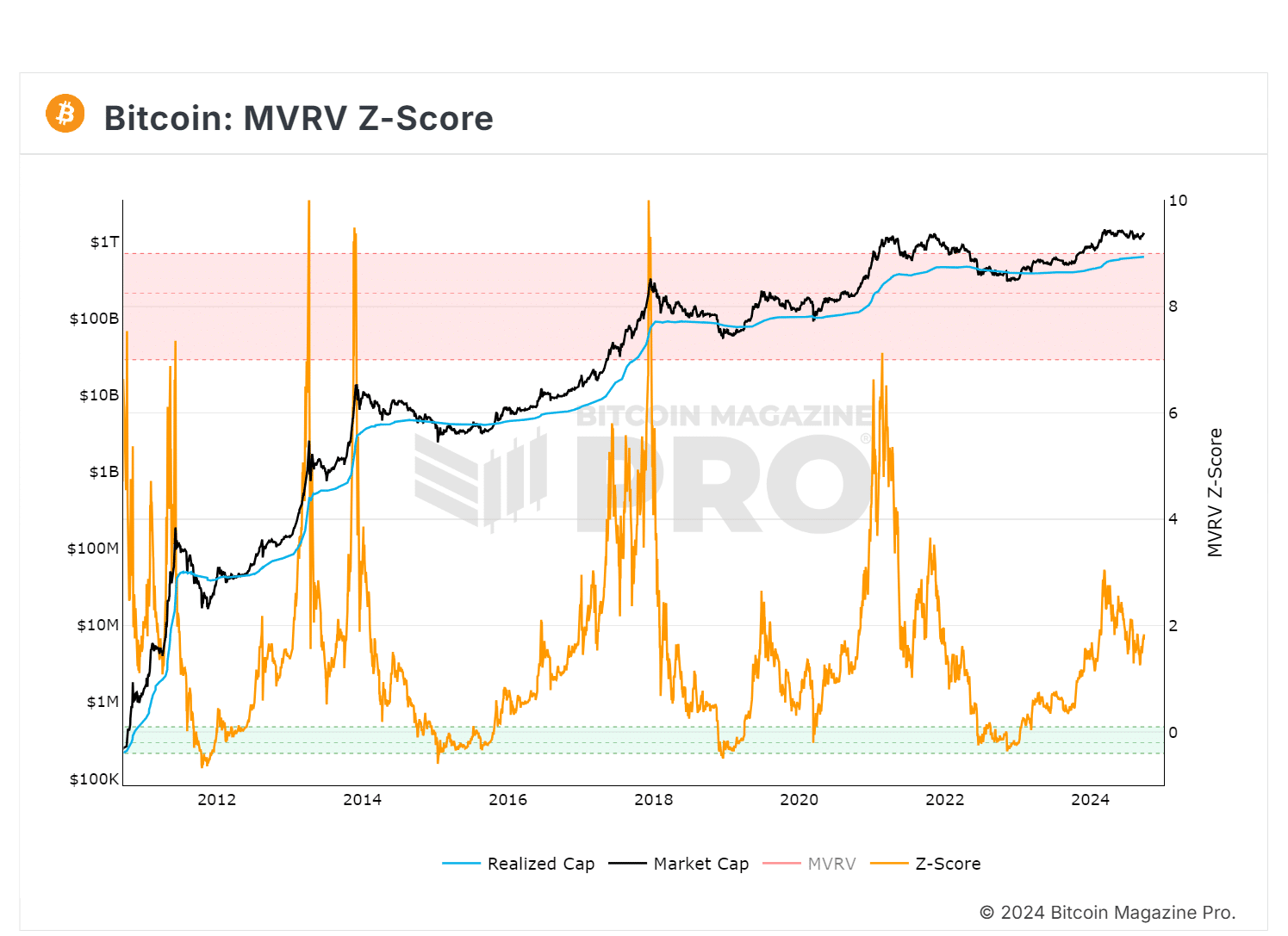

Usually, the Z-score coming into the inexperienced field has led to a bull rally afterward, indicated by the height testing the crimson band, which highlights an overheated market.

Subsequently, a wholesome retracement to $61K can set the stage for extra aggressive shopping for, paving the best way for BTC to retest its authentic ATH.

The important thing will likely be to carry

Conversely, as an alternative of pulling again to $61K, Bitcoin jumps on to $66K. This fast rise exhibits sturdy shopping for stress, as buyers are desirous to enter the market with out ready for a greater worth.

Whereas it appears unlikely, this is usually a bullish sign, exhibiting that there’s sufficient demand to maintain larger costs. Subsequently, to keep up a bull market, Bitcoin should maintain above $66K and ideally proceed upwards.

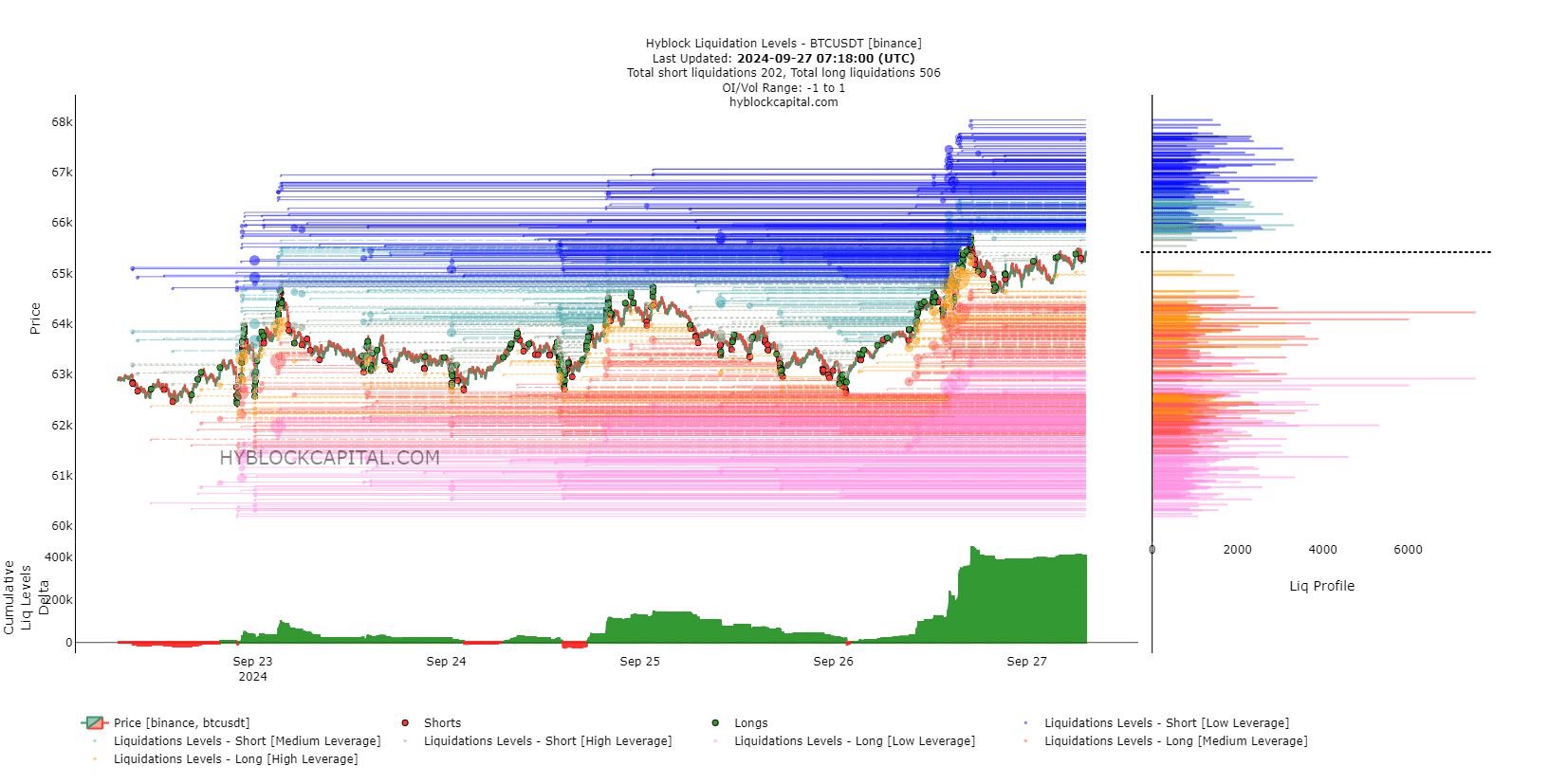

Up to now three days, as Bitcoin examined the $65K resistance, many lengthy positions entered, anticipating bulls to carry the extent.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nonetheless, with brief sellers resurfacing, lengthy liquidation may set off a retracement to $61K, reinforcing AMBCrypto’s speculation. Total, the bull rally previous $70K hinges on bulls holding the $66K resistance.

In any other case, a retracement to $61K is important for confirming help, lowering volatility, attracting consumers, and organising for a sustained bull run to $74K.