- After consolidating, Bitcoin as soon as once more jumped above the $91k mark.

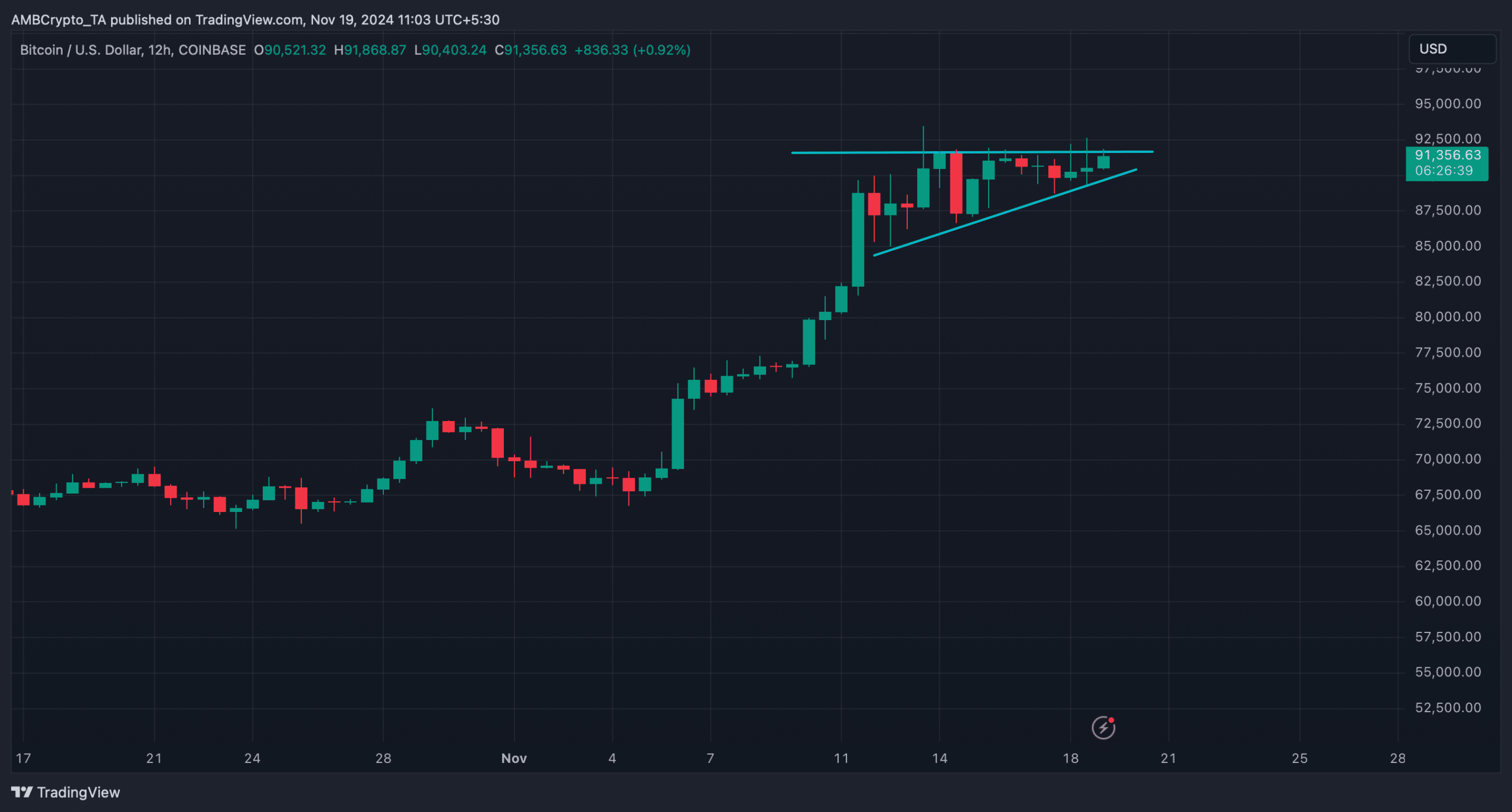

- BTC was testing the resistance of a bullish ascending triangle sample.

Not like the final time, Bitcoin [BTC] took just a few days to lastly go above the $91k mark achieve. However this simply is likely to be the start of a recent rally. This appeared to be the case as BTC was mirroring its previous pattern, which instructed that the king coin would possibly hit $100k prior to anticipated.

Bitcoin turns bullish once more

After touching an all-time excessive, BTC witnessed a pullback, however it managed to commerce above the $90k mark because it began to consolidate. AMBCrypto reported earlier {that a} doable motive behind this could possibly be the three,000 BTC sell-off by miners.

Bitcoin’s capability to keep up above $90,000 indicated important market confidence, although miner profit-taking resulted in a rise in provide.

In actual fact, traders’ confidence did repay as BTC’s worth elevated by practically 2% up to now 24 hours, permitting it to leap above $91k.

In the meantime, Ali, a well-liked crypto analyst, just lately posted a tweet highlighting a notable growth.

As per the tweet, Bitcoin was mimicking a previous pattern. In 2020, after Bitcoin broke its earlier all-time excessive of $19,700, it surged 26%, consolidated for every week, then jumped to $40,000.

An identical pattern was seen this time. To be exact, BTC has risen 28% after surpassing its earlier ATH and has been consolidating for the previous six days. As historical past was repeating itself, BTC subsequent to focus on $100k isn’t a too bold expectation.

Is BTC concentrating on $100k subsequent?

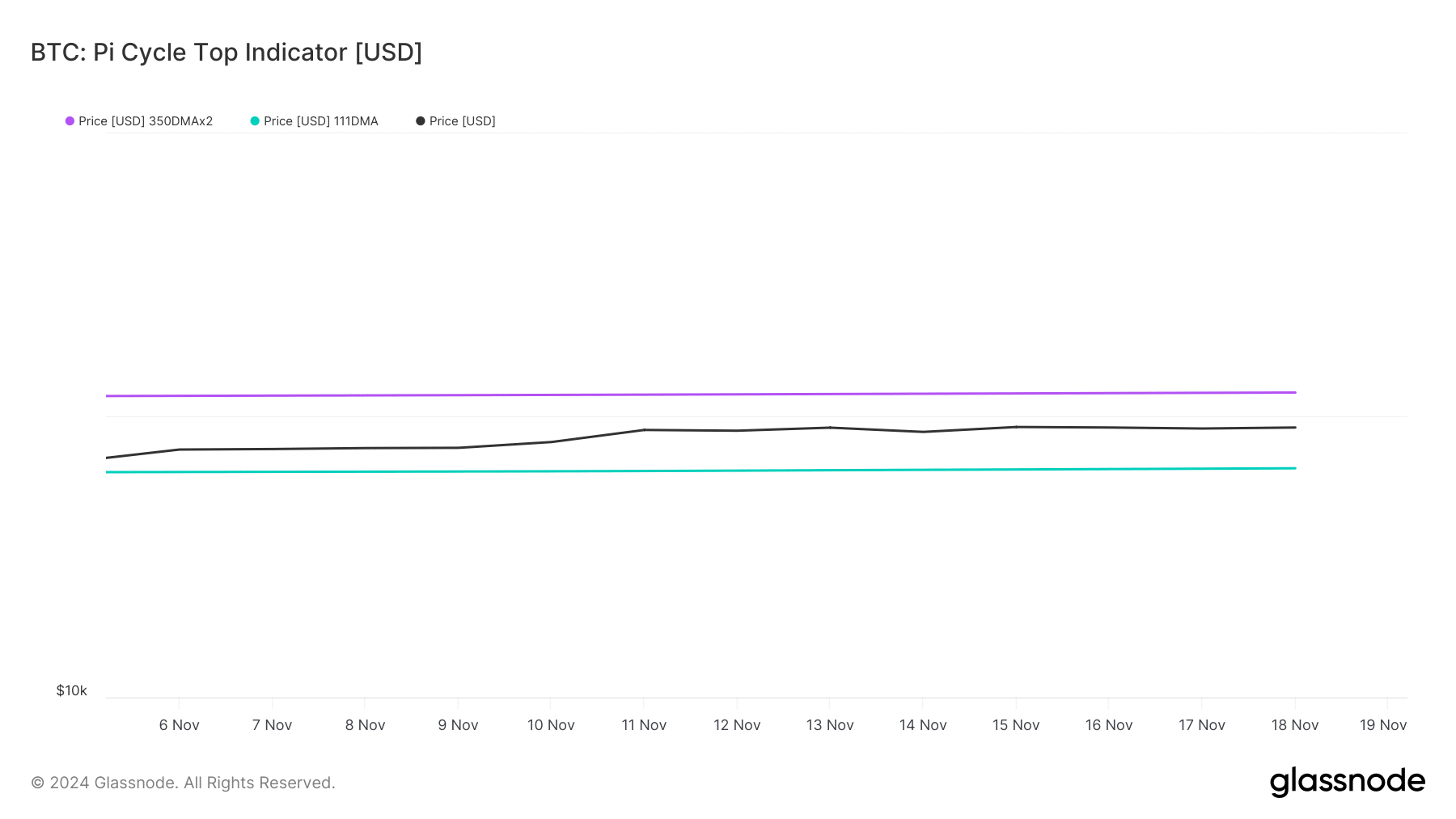

The Pi Cycle High indicator identified that Bitcoin was buying and selling properly above its supposed market backside of $64.9k. If the indicator is to be believed, then BTC’s doable market prime was at $120k.

Subsequently, anticipating BTC concentrating on $100k subsequent, in case of an increase in volatility, wouldn’t be a protracted shot.

Glassnode’s knowledge additionally identified whales’ confidence within the king coin elevated over the previous few weeks. This was evident from the rise within the variety of BTC addresses holding greater than $1 billion, which might gas a worth rise.

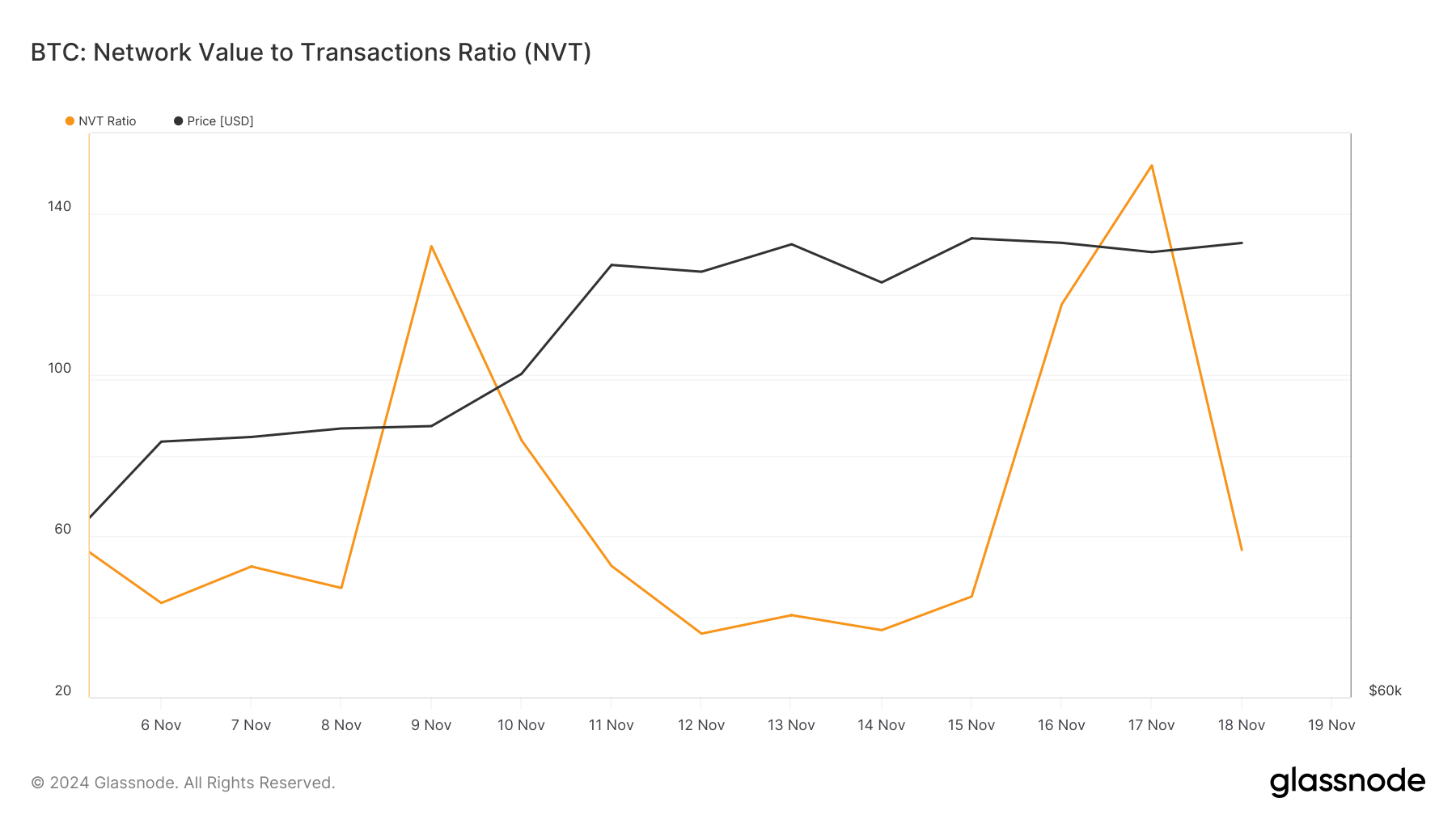

Moreover, after a pointy rise, BTC’s NVT ratio dipped. A decline within the metric implies that an asset is undervalued, suggesting a worth hike quickly.

AMBCrypto’s evaluation revealed {that a} bullish ascending triangle sample fashioned on BTC’s 12-hour chart. At press time, the king coin was testing the resistance of the sample.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

If Bitcoin manages to interrupt above that degree, then it received’t be stunning to see a recent bull run, pushing the coin to $100k.