- Shopping for stress on BTC was rising, which urged a continued value hike.

- Nevertheless, a couple of technical indicators hinted at a correction.

Bitcoin [BTC] traders loved a lot revenue final week because the coin’s value surged by double digits. Due to the value rise, bullish sentiment across the coin elevated, inflicting a file drop within the provide of BTC on exchanges. Will this propel additional value rises?

Buyers are shopping for Bitcoin

CoinMarketCap’s information revealed that Bitcoin witnessed an over 11% value hike within the final seven days. At press time, the king coin was buying and selling at $67,866.54 with a market capitalization of over $1.34 trillion.

In truth, AMBCrypto reported earlier that there have been probabilities of BTC transferring above $67k. Due to the most recent value enhance, over 50 million BTC addresses have been in revenue, which accounted for greater than 94% of the whole variety of BTC addresses.

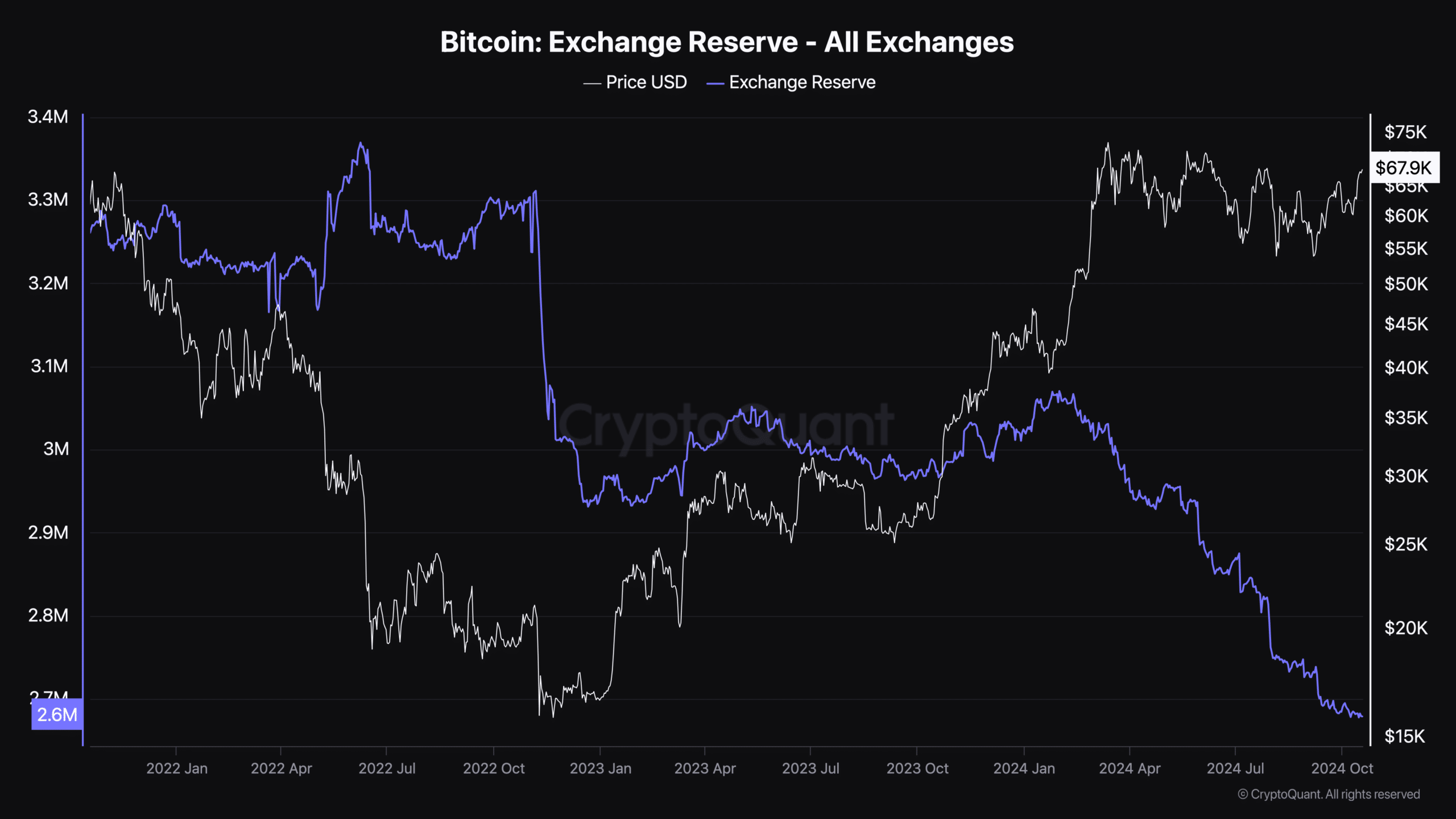

Whereas all this occurred, a key BTC metric reached a file low. To be exact, Bitcoin’s provide on exchanges dropped to the bottom within the final 5 years. A drop on this metric signifies that traders have been shopping for BTC in anticipation of an additional value rise.

Due to this fact, AMBCrypto checked different datasets to search out out whether or not shopping for stress was excessive.

The place is BTC headed?

AMBCrypto’s evaluation of CryptoQuant’s information established the aforementioned reality. Bitcoin’s change reserve dropped sharply over the past months, indicating a transparent motive of traders to purchase the king coin.

Lengthy-term holders have been keen to carry their cash, which was evident from the coin’s inexperienced binary CDD. Issues within the derivatives market additionally regarded fairly optimistic.

The coin’s funding price was rising, which means that lengthy place merchants have been dominant and have been keen to pay quick merchants. Moreover, Bitcoin’s taker purchase/promote ratio indicated that purchasing sentiment was dominant within the derivatives market.

Nevertheless, US traders have been considering in any other case. This was evident from the low Coinbase premium, which means that promoting sentiment amongst US traders was dominant. Rising promoting stress might put an finish to BTC’s bull rally.

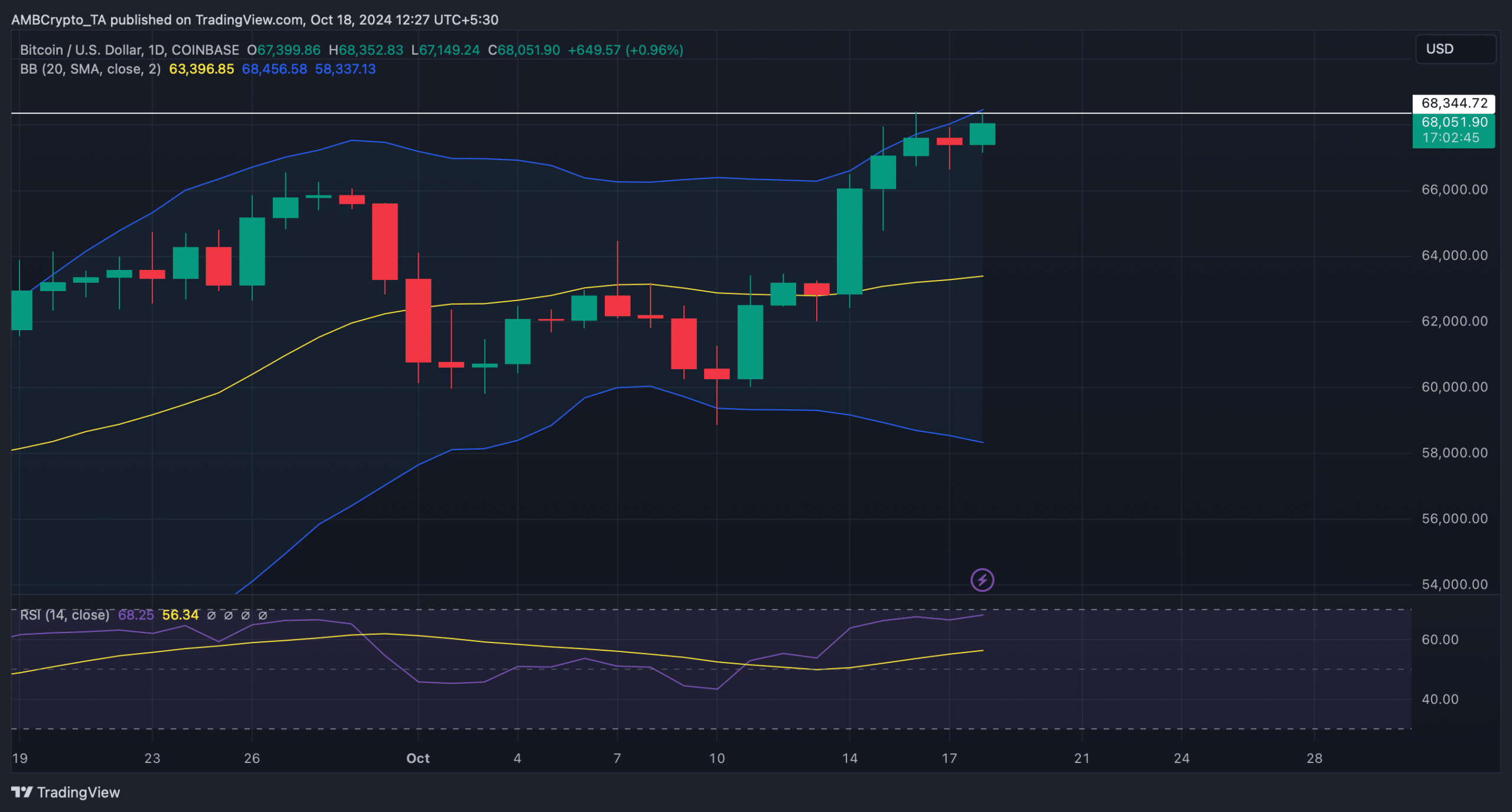

Due to this fact, AMBCrypto deliberate to try Bitcoin’s every day chart to higher perceive which manner the king coin was headed. As per our evaluation, Bitcoin was testing its resistance on the $68k mark. Nevertheless, the market indicators urged a rejection.

Learn Bitcoin’s [BTC] Value Prediction 2024–2025

For example, BTC’s value touched the higher restrict of the Bollinger Bands, which regularly causes value corrections.

Moreover, the Relative Power Index (RSI) was additionally about to enter the overbought zone. If that occurs, promoting stress may rise, which could lead to a value drop within the coming days.