- Bitcoin’s open curiosity has reached an all-time excessive, with a notable improve in shorting exercise.

- Whereas “cautious optimism” has stored BTC close to $100K, the rally to $130K stays elusive.

Two weeks in the past, market speculators set their sights on Bitcoin [BTC] hitting $100K by the tip of This autumn. In simply 14 days, BTC has practically reached that concentrate on, closing close to $99K and setting a brand new ATH.

Because the election, over $4 billion has flowed into US-listed Bitcoin exchange-traded funds. This week, BlackRock’s ETF choices noticed a robust debut, with name choices—bets on worth will increase—outpacing places.

Regardless of these large inflows, BTC has but to completely lock in its goal. Every new ATH because the election has confronted resistance, signaling potential overextension.

With present momentum, $100K seems inside attain. Nevertheless, with Bitcoin open curiosity at a brand new ATH, RSI in overbought territory, and weak fingers shaking out, there are nonetheless essential elements to observe earlier than BTC could make its option to $130K.

Excessive Bitcoin open curiosity underscores robust demand

Within the final 10 buying and selling days, Bitcoin’s each day appreciation has slowed to round 3%, a noticeable decline from the primary week post-election when each day highs surpassed 10%. This discount in momentum could point out a cooling-off interval.

Nevertheless, there’s a silver lining. Not like earlier cycles, the place traders usually exited as BTC entered a ‘high-risk’ zone, fearing an imminent correction, the present sentiment suggests a extra cautious optimism.

This optimism is pushed by bulls focusing on $100K as the subsequent key milestone for Bitcoin, motivating traders to leap in and capitalize on the rally. Consequently, the variety of new addresses holding BTC has doubled within the final 30 days.

The spinoff market has adopted swimsuit. Information from Coinglass reveals that Bitcoin’s open curiosity has surged to a brand new all-time excessive of $57 billion, with extra merchants betting on the long run route of BTC’s worth.

In brief, these elements underline robust demand at present worth ranges. FOMO is fueling steady curiosity, conserving BTC resilient regardless of indicators of overextension.

Nevertheless, whereas this momentum could also be ample to maintain BTC close to $100K, its subsequent upward goal hinges on the sustained energy of this pattern, supported by a positive macroeconomic backdrop.

Conversely, if short-sellers within the spinoff house regain traction, and FOMO fades, a long-squeeze might push BTC right down to $89K earlier than a transfer to $130K is viable – except the present vary flips into strong assist.

Odds of $100K changing into agency assist

Taking a look at this chart, many altcoins are approaching key areas of curiosity, whereas BTC seems to be on the verge of one other potential fakeout above the native vary highs.

This indicators warning, as Bitcoin’s upward transfer may very well be short-lived or misleading. In the meantime, altcoins are nearing essential worth ranges the place important worth motion is probably going.

Usually, when BTC hits a goal worth, capital shifts towards altcoins, with traders aiming to scale back danger and redistribute income throughout the broader market. This usually acts as a significant resistance to BTC’s rally.

Due to this fact, changing this resistance into assist – by seeing substantial capital move ‘into’ relatively than ‘out’ of Bitcoin – will probably be essential in figuring out whether or not the $100K vary can maintain in the long run.

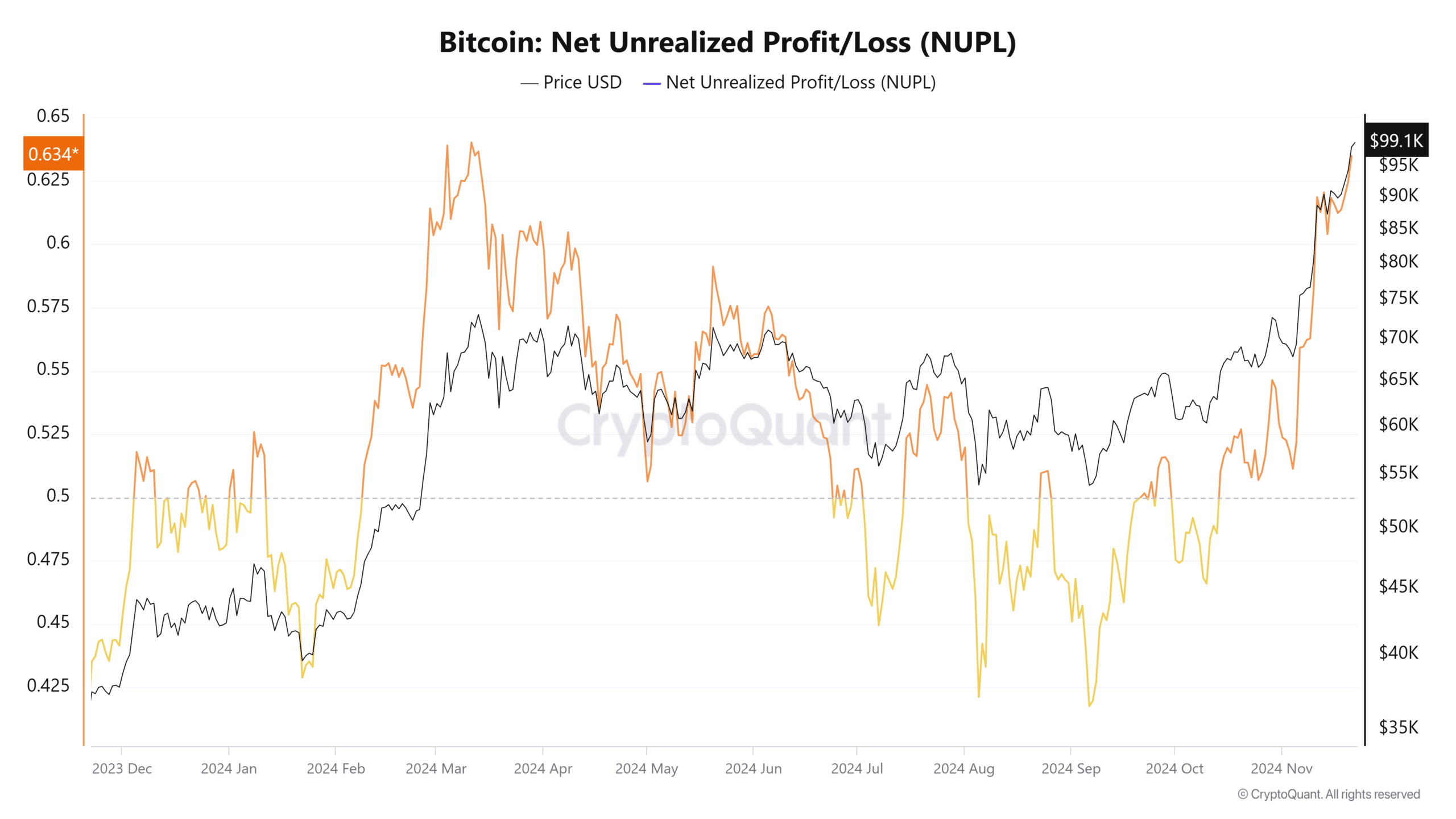

Apparently, the NUPL indicator is reflecting a sample just like the March pattern, the place many “weak hands” began cashing out on income, fearing the rally was nearing its peak.

As talked about earlier, demand has remained robust, absorbing promoting strain regardless of the market overheating. Nevertheless, a possible high might nonetheless be close to, particularly if main altcoins proceed to outperform Bitcoin.

Solana, particularly, is positioning itself for important strikes forward of its extremely anticipated ETF itemizing, which might shift market dynamics within the coming days.

In abstract, whereas BTC is on monitor to hit $100K, with Bitcoin open curiosity reaching new ATHs, excessive FOMO sustaining new curiosity, and powerful demand counteracting indicators of overextension, different elements might nonetheless affect its trajectory.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The efficiency of altcoins, market sentiment, and exterior occasions could also be essential in figuring out whether or not Bitcoin can maintain its momentum or face a correction earlier than advancing towards $130K.

This situation appears possible, particularly contemplating the notable shorting exercise inside Bitcoin’s open curiosity and the rising curiosity from traders looking for extra inexpensive belongings, which is comprehensible contemplating the excessive stakes surrounding Bitcoin at these elevated worth ranges.