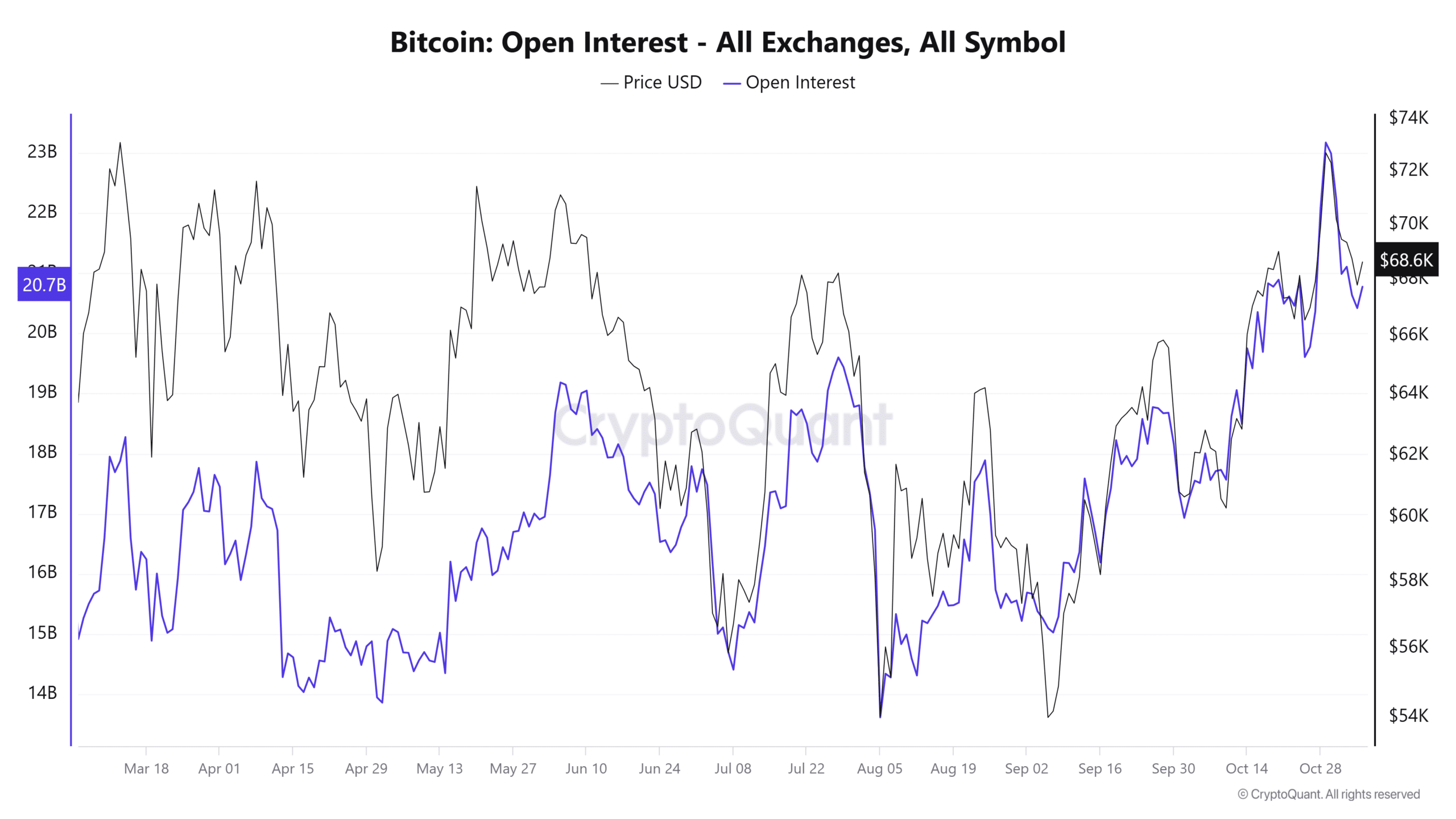

- Bitcoin open curiosity just lately declined from $23 billion to $20.7 billion.

- Regardless of the drop in open curiosity, BTC’s worth stays above $68,000.

The Bitcoin [BTC] open curiosity and worth motion are seeing notable shifts as market volatility will increase forward of the U.S. election week. Information signifies a pointy drop in BTC’s open curiosity on all exchanges, suggesting that merchants have gotten extra cautious amidst unsure market situations.

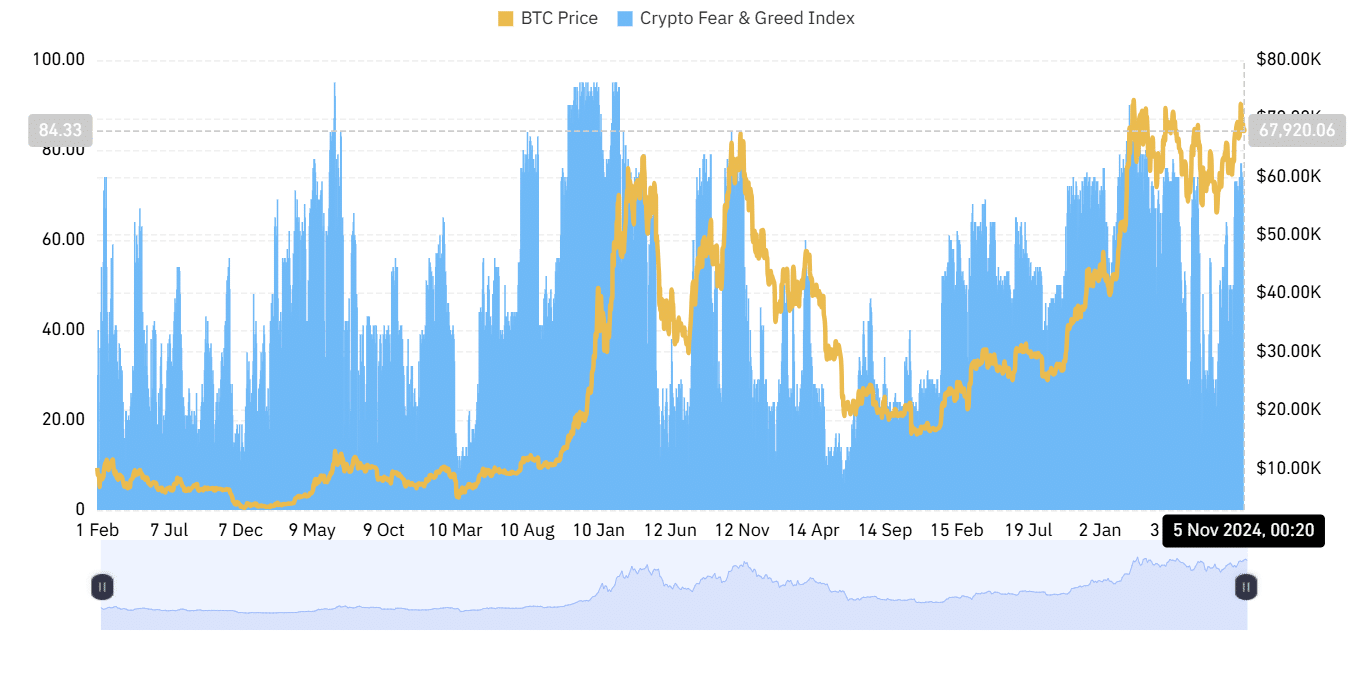

The present panorama displays a cautious but speculative setting, coupled with rising volatility within the S&P 500 (tracked by the VIX index) and the excessive readings on the Crypto Concern & Greed Index.

Bitcoin open curiosity decline: An indication of warning or a chance?

Bitcoin open curiosity has just lately dipped from over $23 billion to $20.7 billion, reflecting a shift as merchants unwind leveraged positions.

Traditionally, diminished open curiosity signifies much less market leverage, hinting that merchants could also be pulling again from riskier bets. This development may very well be influenced by the approaching U.S. election, as political occasions typically carry added uncertainty and volatility to monetary markets.

Apparently, regardless of the drop in open curiosity, Bitcoin’s worth has remained regular above $68,000, suggesting underlying power. This resilience could point out that whereas leveraged positions have decreased, spot shopping for stays robust, doubtlessly pushed by long-term holders.

For merchants, the discount in open curiosity might sign a pause in speculative exercise, however for long-term buyers, it reinforces confidence in Bitcoin’s upward potential.

U.S. election’s impression on Bitcoin Open curiosity and market volatility

The VIX, or Volatility Index, for the S&P 500 has risen to about 21.97, signaling heightened concern in conventional markets. Traditionally, excessive VIX ranges align with elevated warning in riskier property like cryptocurrencies.

Buyers seem like getting ready for broader market fluctuations because the U.S. election approaches, influencing each equities and digital property like Bitcoin.

The Relative Volatility Index (RVI) for Bitcoin, at the moment round 47.7, signifies potential worth swings with out a robust directional development.

With the RVI near 50, Bitcoin might expertise additional fluctuations, aligning with the cautious sentiment because the election nears. A regulatory shift following the election, notably concerning digital property, might add to Bitcoin’s volatility.

Bitcoin Open curiosity and sentiment indicators: Optimism amid warning

Regardless of the elevated warning, the Crypto Concern & Greed Index sits at 70 (Greed), indicating that whereas warning exists, general sentiment stays constructive. This hole between excessive sentiment and cautious buying and selling habits suggests the market could also be ready for extra certainty following the election.

Traditionally, Bitcoin has proven consolidation patterns or slight pullbacks earlier than resuming developments in response to election outcomes.

The mix of excessive sentiment and declining Bitcoin Open curiosity might indicate that merchants are hesitant to extend leverage but anticipate BTC’s worth resilience.

This sample of elevated sentiment with decrease leverage typically results in a consolidation part, the place optimistic buyers watch for volatility to settle earlier than absolutely re-entering the market.

Outlook for Bitcoin’s worth and Open curiosity post-election

With the U.S. election as a possible catalyst, Bitcoin’s futures actions could depend upon each political and macroeconomic developments.

Merchants will doubtless look ahead to a breakout above $70,000 or a steady consolidation above key assist ranges to verify a post-election upward development. Conversely, any surprising election consequence or new regulatory insurance policies might briefly disrupt Bitcoin’s path.

Learn Bitcoin (BTC) Worth Prediction 2024-25

Because the election approaches, Bitcoin seems poised in a holding sample, supported by long-term confidence but tempered by short-term warning.

Metrics equivalent to Bitcoin Open curiosity and the Concern & Greed Index might be essential for gauging market sentiment. Relying on the election’s consequence, Bitcoin might both consolidate or set its sights on new highs within the months forward.