- Fierce lengthy positions and a big OI counsel that shorts are in danger.

- Indicators introduced a bullish bias that would drive Bitcoin towards $77,000.

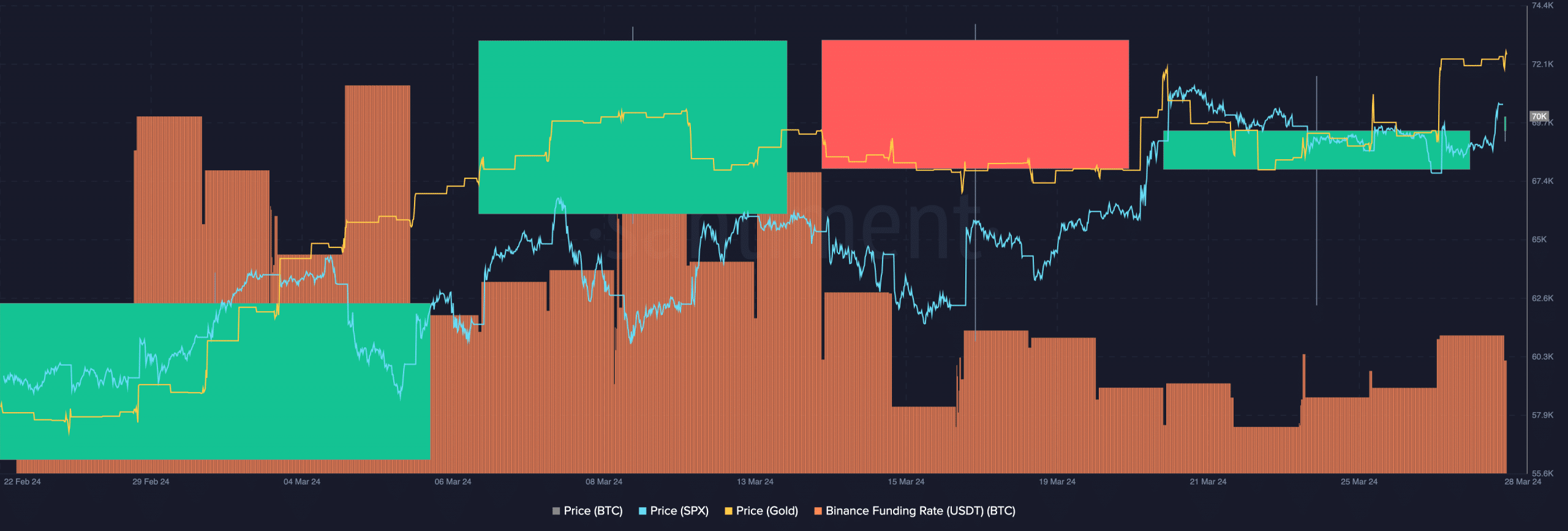

Bitcoin [BTC] merchants are at it once more. However this time, they don’t seem to be wagering huge cash, and predicting a nosedive for the coin. As a substitute, AMBCrypto’s evaluation of the Funding Fee confirmed that many merchants had been lengthy.

Being in an extended place implies that a dealer is anticipating to make good points from a cryptocurrency’s value improve. Additionally, Funding Fee tells if longs are paying shorts in any other case.

A divergence brought about the doubling down

At press time, Bitcoin’s Funding Fee was at its highest level because the 18th of March, Santiment confirmed. At press time, BTC had elevated to $70,368.

When funding turns into extra optimistic as value will increase, it means perp longs are aggressive, and are getting their rewards. Within the context of the worth, that is doubtlessly bullish. If this continues, the worth of the coin would possibly rally increased than the predicted $75,000.

In the meantime, merchants appeared to have their causes for betting huge on Bitcoin. Curiously, it was one thing exterior of the crypto ecosystem.

From AMBCrypto’s scrutiny of the scenario, conventional belongings just like the SPX and gold retested their respective all-time highs. This occurred at a time when Bitcoin was struggling to climb again to $73,000.

Traditionally, a divergence like this when the halving is shut means that BTC was not executed with its pre-having rally. Due to this fact, the distribution skilled over the previous couple of weeks would possibly grind to a halt.

All issues are working collectively in BTC’s favor

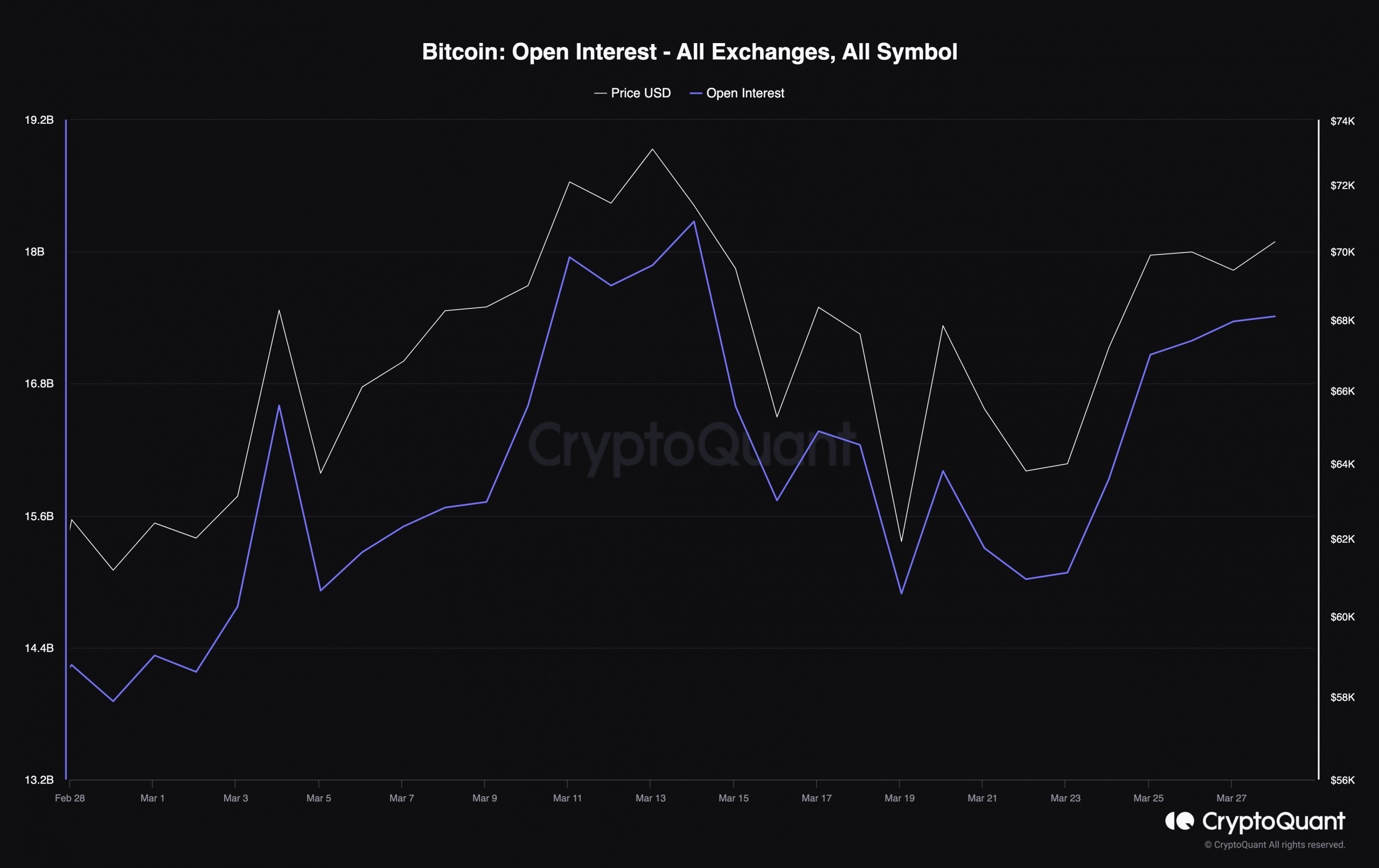

Whatever the Funding Fee indications, you will need to assess Bitcoin’s Open Curiosity (OI). OI is the worth of open positions within the derivatives market.

An rising OI suggests extra liquidity, consideration, and volatility coming into the market. Nonetheless, if the OI decreases, it means merchants are more and more closing their positions.

Utilizing information from CryptoQuant, AMBCrypto noticed the hike in Open Curiosity. At press time, Bitcoin’s OI was a mind-blogging $17.41 billion.

Alongside the worth motion, the rising OI was an indication of energy for Bitcoin. Ought to the OI proceed to extend as BTC does the identical, one other all-time excessive earlier than the halving would possibly seem.

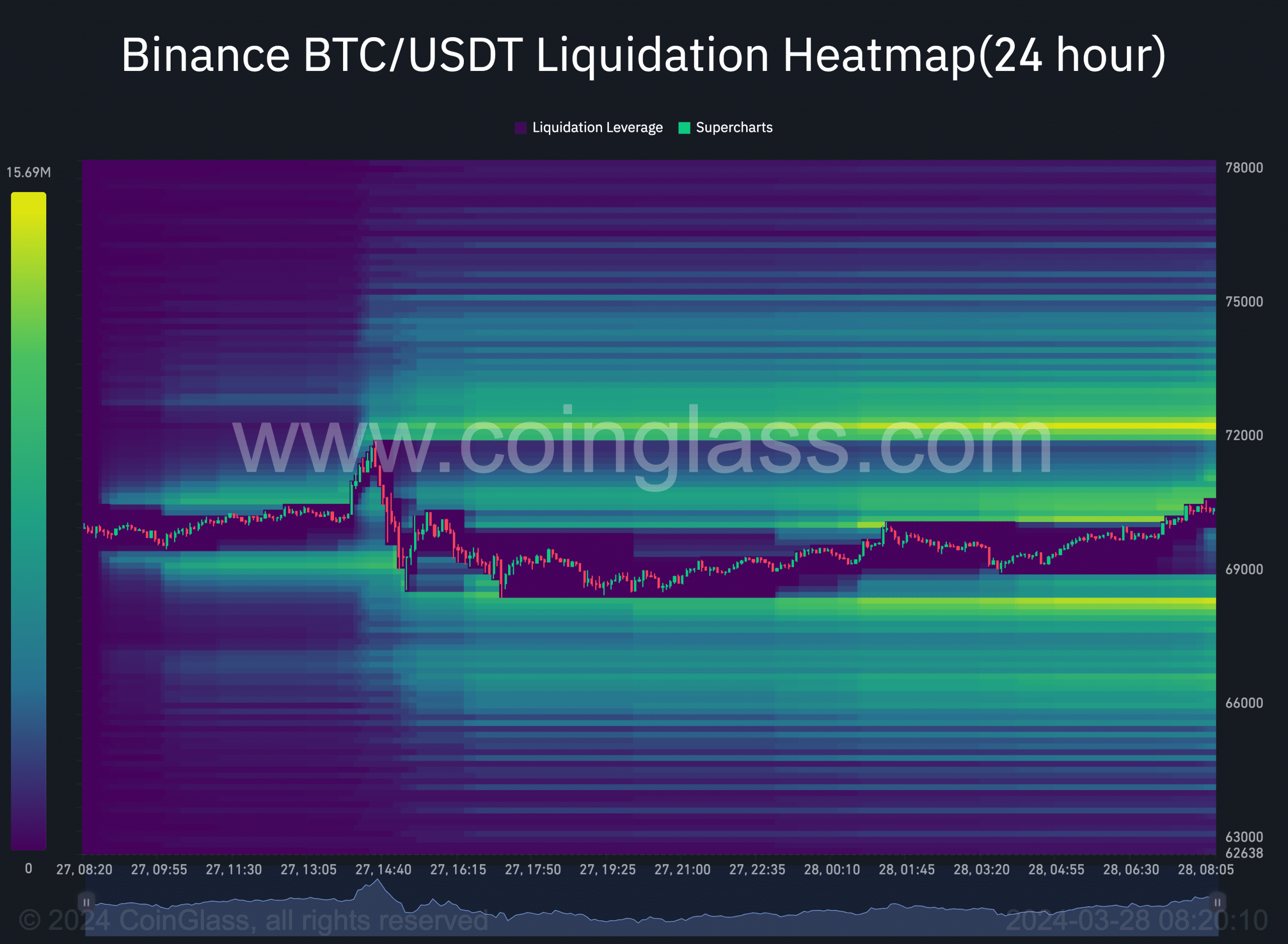

On one other finish, we appeared on the liquidation information. As of this writing, many shorts have seen their positions worn out throughout the final hour.

In line with Coinglass, the liquidation heatmap confirmed that BTC would possibly strategy $73,311 quickly. If the coin hits this value, open contracts price about $6.31 million could be liquidated.

Supply: Coinglass

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

As well as, a big a part of the casualty is likely to be shorts who used medium to excessive leverage.

From a buying and selling perspective, a big Open Curiosity plus brief liquidations would possibly result in a breakout. Whereas Bitcoin won’t hit $80,000, a potential rise towards $77,000 is one prediction that would come to cross.