- Proportion of miner income derived from charges hit an ATH on the halving day.

- Miners have been promoting their holdings publish halving after HODLing for greater than a month.

Bitcoin’s [BTC] halving occasions have been to the crypto house what Olympics means for the sports activities fraternity, and Academy Awards for film aficionados. A keenly awaited and celebrated occasion, halving tends to spice up the financial worth of the most important digital asset on the planet by squeezing the provision.

Nevertheless, whatever the perceived bullishness, these occasions have had an adversarial impression on the economics of Bitcoin mining, forcing miners to undertake new strategies to enhance their revenue margins.

Halvings – A ache for Bitcoin miners

As is well-known, miners validate and add transactions on the Bitcoin ledger, thus performing as a significant cog within the on a regular basis operations of the chain. On their half, miners make enormous investments in organising mining infrastructure to hold out this process.

In return, they’re compensated with a hard and fast subsidy from each block they mine together with transaction charges from customers.

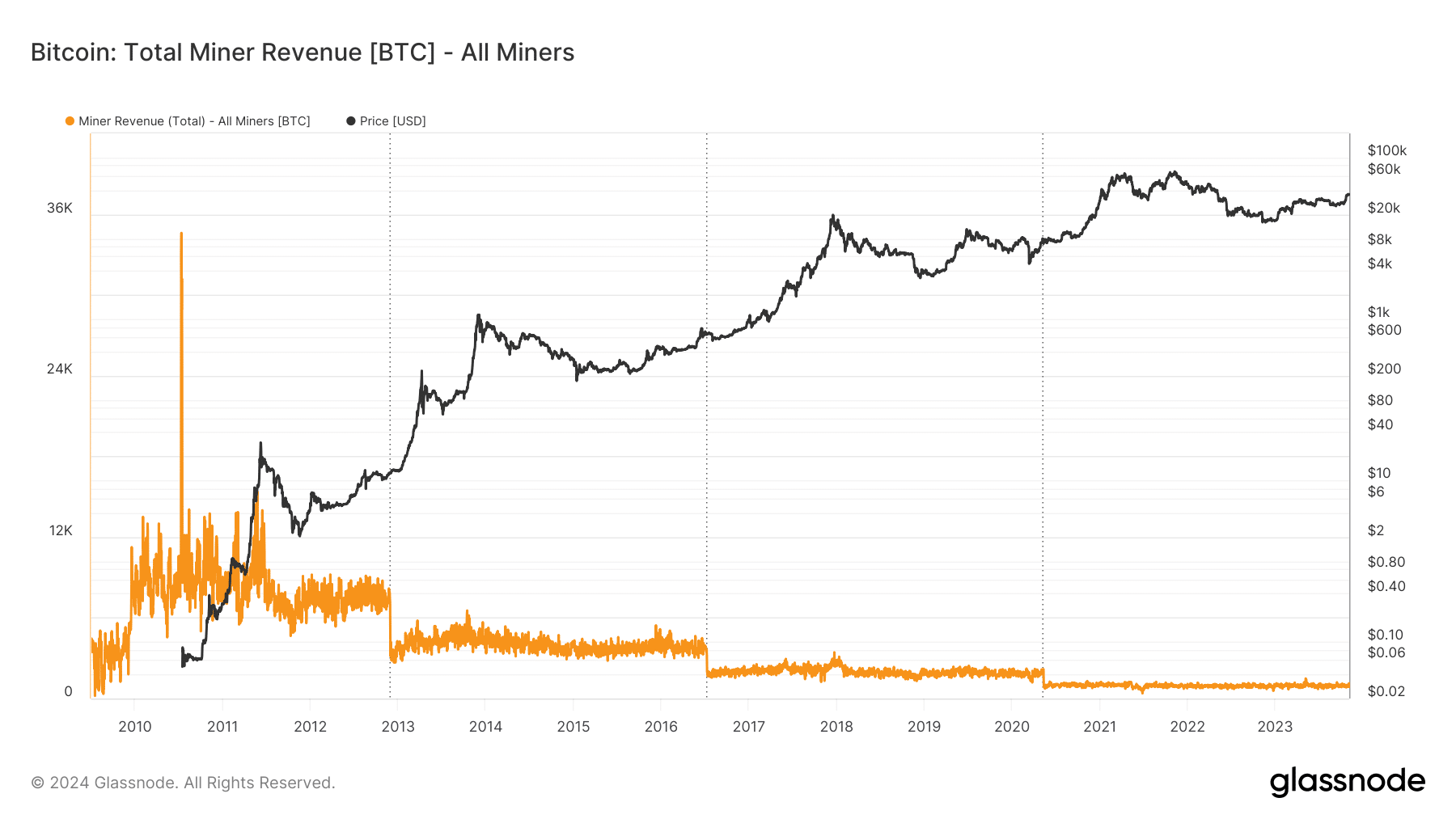

Halvings assault the very important element of their income – block rewards. Every of the 4 such occasions in Bitcoin’s quick historical past have slashed rewards by half, with the newest one lowering it from 6.25 BTC to three.125 BTC. The progressive drop was examined by AMBCrypto utilizing Glassnode’s information.

Equally, rewards would drop to 1.5625 cash per block after subsequent halving, and as soon as all of the Bitcoins have been mined, estimated to be round 2140, miners will earn earnings solely from transaction charges.

This meant that miners must double their mining investments to attain the identical output after halving, in different phrases to interrupt even.

So the place does the answer lie?

The importance of transaction charges

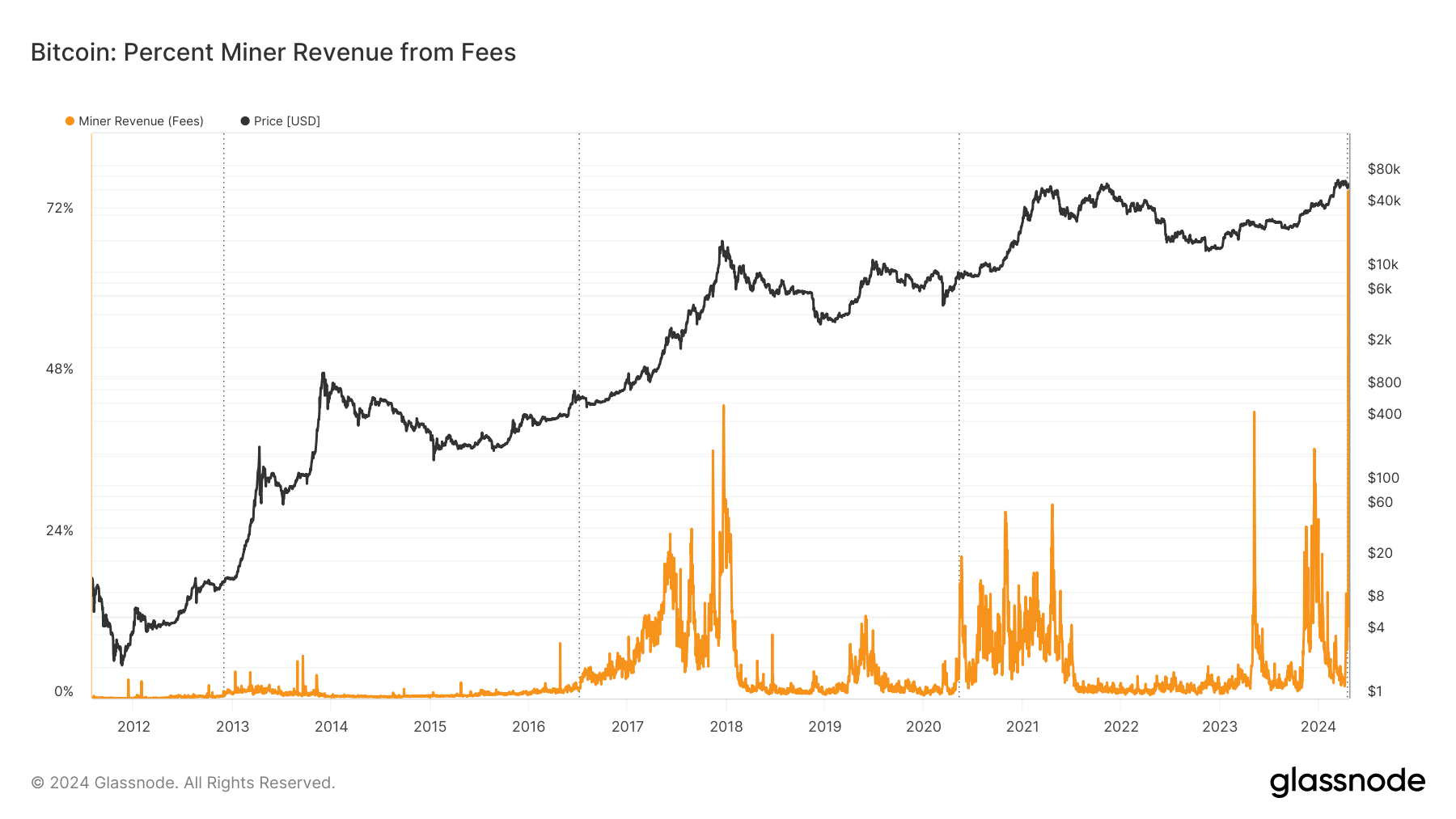

As talked about earlier, transaction charges paid by customers was rising as a robust income stream for miners with every halving. This meant there was a robust case to search for avenues which may improve Bitcoin community utilization and generate extra charges for the miners.

In comes modern token protocols like Ordinals and Runes.

We not too long ago noticed Rune protocol going reside with the halving block – 840,000. Developed by Casey Rodmarmor who additionally launched the Ordinals idea final yr, Runes additionally permits customers to mint tokens on the Bitcoin chain.

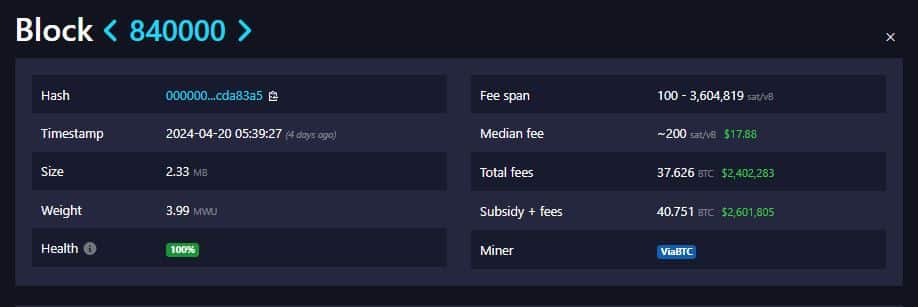

The outcomes had been speedy. The halving block noticed a whopping 37.62 BTCs in charges collected by miners, value almost $2.4 million at prevailing market costs.

Mixed with the slashed block subsidy of three.12 BTCs, miners earned greater than $2.6 million from the block, AMBCrypto noticed utilizing Mempool information.

The truth is, the share of miner income derived from charges hit an all-time excessive (ATH) of 75% on the halving day. Curiously, the earlier spikes in transaction charges was throughout the Ordinals frenzy in December and Might of final yr.

The best way ahead

Although the frenzy has subsided for the reason that halving day, there’s no disputing that protocols like Runes and Ordinals gas speculative exercise to create new cash, significantly amongst crypto degens.

This has helped in unlocking a brand new use case for the primary technology community. Up till 2023, Bitcoin’s status was restricted to being a peer-to-peer (P2P) funds community with not a lot real-world utility.

Nevertheless, with Ordinals and Runes, it has began to place itself like different typical layer-1 blockchains, enabling minting of NFTs and different fungible tokens.

All of this works nicely in Bitcoin miners’ favor. The extra the blockchain is used for the aforementioned actions, the extra money they’d make, and offset the losses from halvening.

Hash price continues to extend

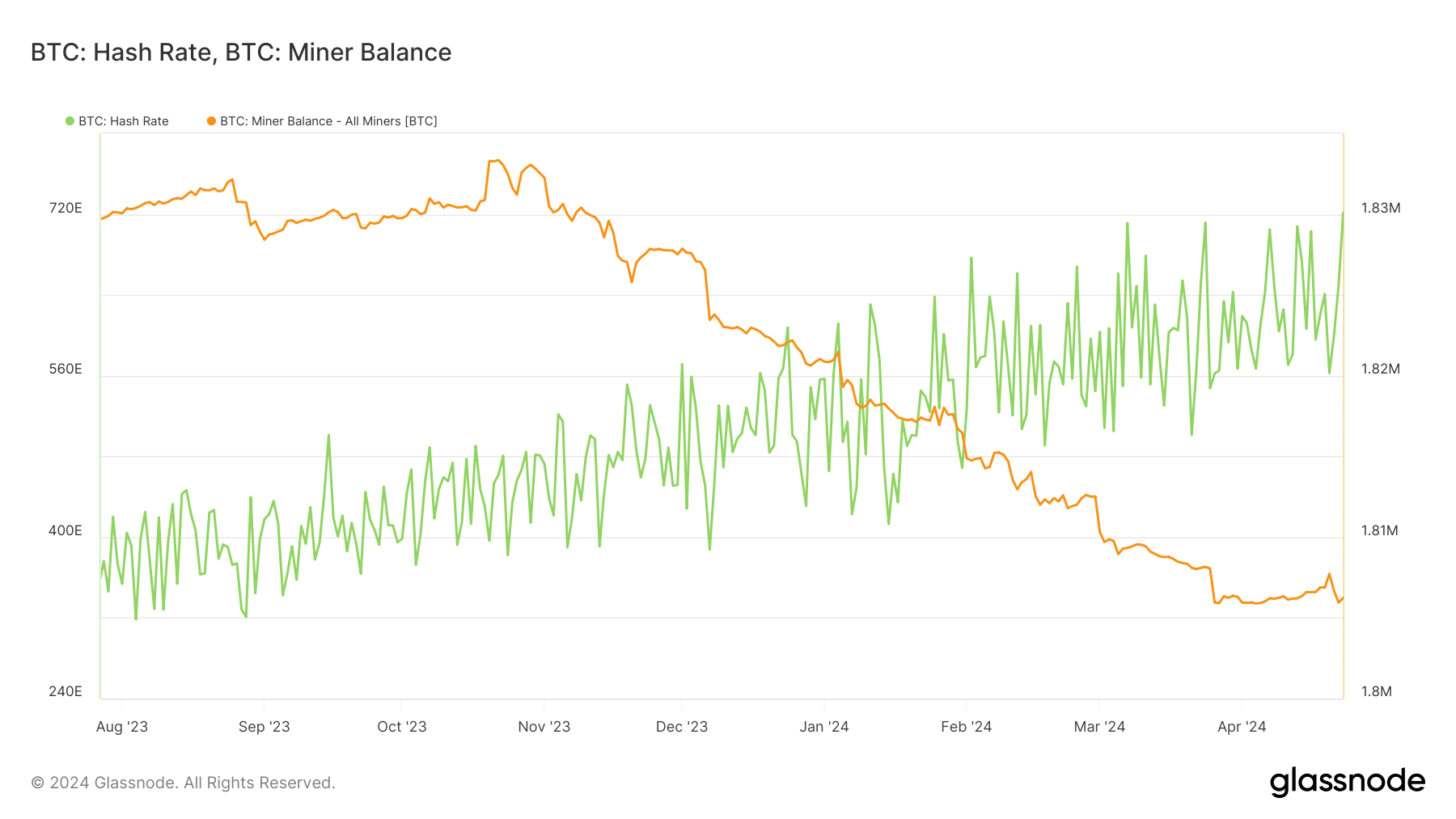

The hash price, or the computational energy devoted by miners, has been on an ascending curve through the years.

With the prospect of extra gamers coming into the trade, and issue rising, there was a better have to search for environment friendly Bitcoin mining machines that generate extra hash price per unit of electrical energy consumed.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

Curiously, after HODLing for greater than a month, miners instantly offloaded their baggage on the halving day. This elevated earnings as a result of charge spike may need motivated them to dump.

The proceeds from these gross sales could be doubtless used to make investments in cheaper equipments.