- Shares of Bitcoin miners noticed a rise not too long ago.

- BTC has fallen under its help line.

The market cap of US-listed Bitcoin [BTC] miners has climbed to a major excessive, in keeping with a latest report. Regardless of the rising inventory costs of those miners, their income and reserves have been on a decline in the previous few days.

Bitcoin mining inventory surges in capitalization

Based on analysts at JPMorgan, the market capitalization of bitcoin miners listed on U.S. exchanges hit an all-time excessive of $22.8 billion as of fifteenth June.

Within the first half of June, the 14 U.S.-listed Bitcoin mining shares surged, with Core Scientific, TeraWulf, and IREN main the cost with features of 117%, 80%, and 70%, respectively, as famous by JPMorgan analysts Reginald Smith and Charles Pearce.

Bitcoin miners see a decline in reserve and income

Glassnode’s evaluation signifies that the Bitcoin miner steadiness has been steadily lowering over the previous few weeks. At present, the reserve stands at roughly 1.8 million BTC, a stage final noticed in 2021, marking a low not seen in over three years.

This decline means that the quantity of BTC held by miner addresses is shrinking, indicating an ongoing sell-off from these addresses.

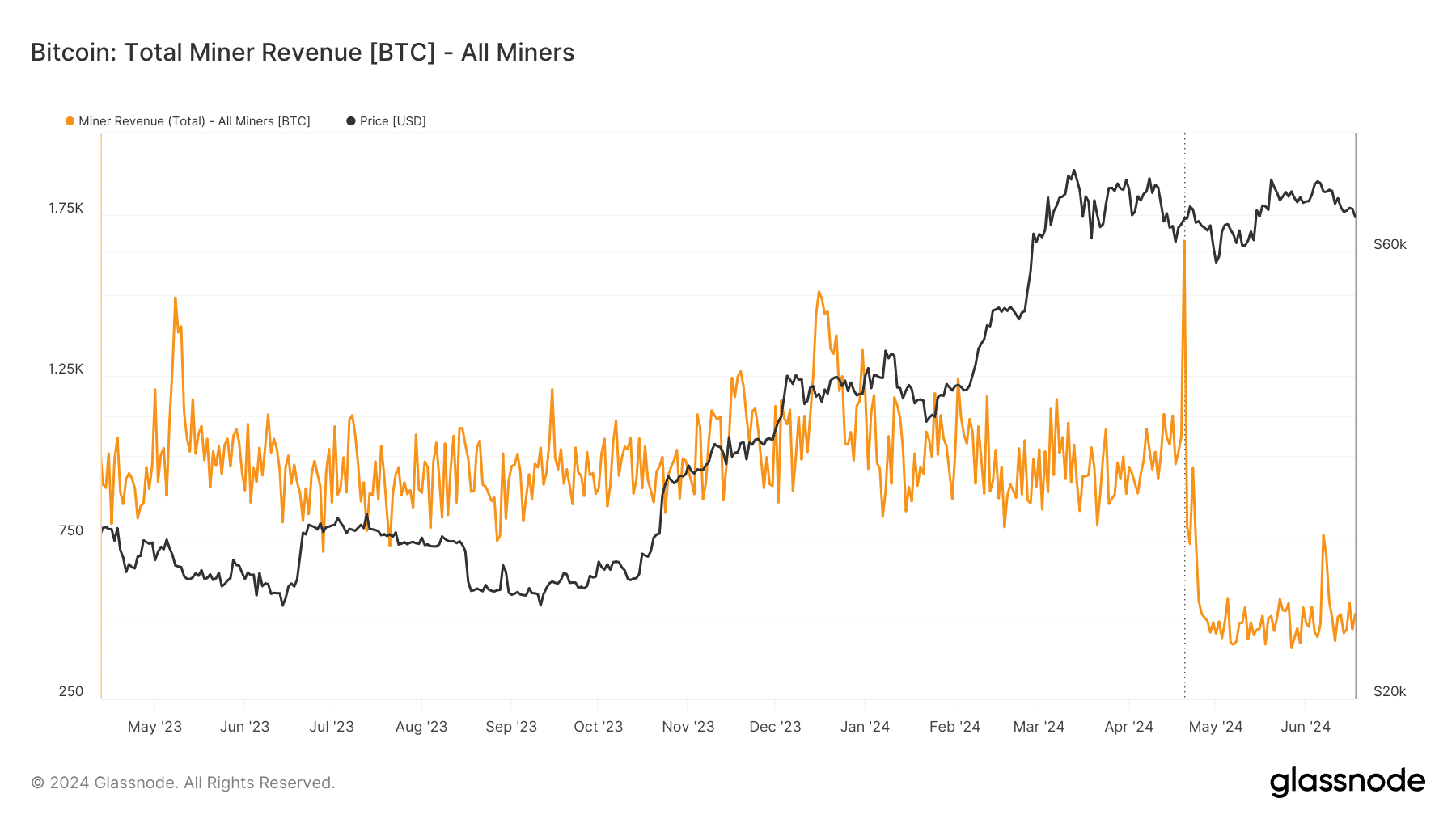

Moreover, an evaluation of BTC miner income signifies a downward pattern in latest weeks.

At present, income stands at roughly 512 BTC, a major drop from the over 1,000 BTC noticed earlier within the yr.

While the latest halving occasion has contributed to this decline, there has additionally been a common lower in income total.

Bitcoin falls off help

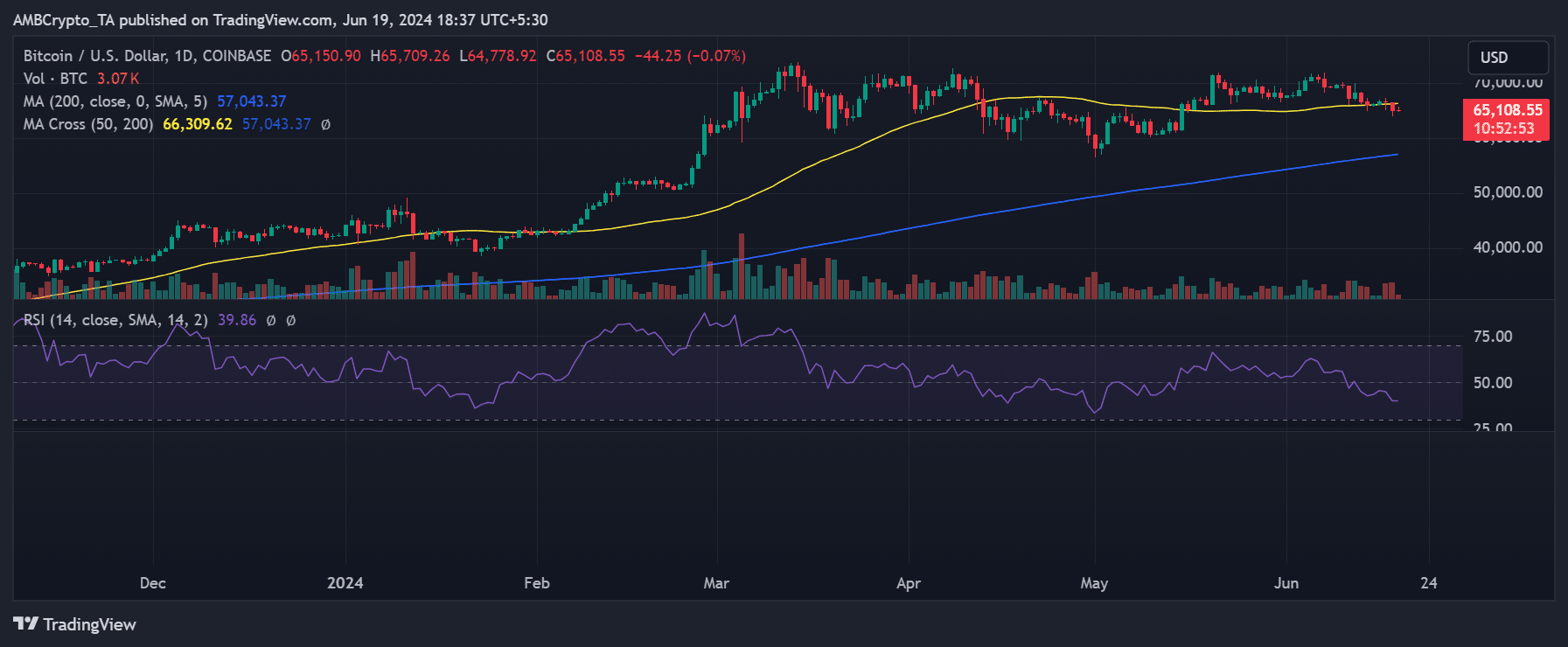

An evaluation of Bitcoin on a day by day time-frame chart revealed a 2% drop on 18th June, bringing its value to roughly $65,152.

Initially, the help stage, indicated by the quick transferring common (yellow line), was round $66,000. Nonetheless, the value decline pushed it under this help stage, which has now become resistance.

Learn Bitcoin (BTC) Value Prediction 2024-25

On the time of writing, Bitcoin was buying and selling at roughly $65,121 and has been unable to interrupt by means of the brand new resistance stage. The stochastic indicator corroborates the present unfavourable pattern, persevering with its downward trajectory.

Moreover, a more in-depth examination of the indicator suggests the opportunity of one other important value shift quickly.